Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Real eState

Posthaste: What downturn? Canadians across all generations still bullish on real estate

Dropping home prices and economic uncertainty hasn’t turned Canadians off the housing market, with people across all age groups bullish on real estate, new research suggests.

Members of the baby boomer, generation X, millennial and generation Z cohorts are confident owning a home is a good financial investment, and 49 per cent think a home purchase will produce a similar or better return than other investments over the next 12 months, according to a generational trends report released March 15 from Mustel Group and Sotheby’s International Realty Canada. People are even more bullish about real estate’s performance in the long term, the survey said, and 60 per cent think property will match or exceed other financial investments in the next 10 years.

As a result, Canadians of all ages are eager to get into the housing market, and the survey suggests the pandemic may have helped accelerate homeownership dreams. Across all generations, 35 per cent say they are more likely to buy a house than they were in January 2020. Homeowners are also more eager to sell. One-third say they are more likely to put their house on the market within the next five years than they were before the pandemic started.

Those findings come amid a housing market that has cooled significantly from its peak as elevated inflation and resulting higher interest rates weighed on prices. The average price of a home fell 12 per cent in 2022, and is expected to fall another six per cent this year, according to the Canadian Real Estate Association. The economy is also softening, and many economists predict the country will tip into a recession sometime this year. To add to that, a rising cost of living is boosting every-day expenses, and many people are taking on more debt to help make ends meet. Higher interest rates have also made the prospect of paying down a mortgage much more expensive, putting homeownership out of reach for many.

Still, that’s not enough to put people off wanting to buy real estate, Sotheby’s Canada said.

The pandemic played a key role in stoking the desire to own a home. While lockdowns during the pandemic initially pushed people to seek out more space, fuelling sales and prices, the pandemic also highlighted the value of including property in a financial plan. Stock market volatility during the pandemic made real estate an attractive alternative to traditional investments, Sotheby’s Canada said.

“One of the most transformative and enduring social and economic outcomes of the pandemic is that Canadians now place a heightened importance on primary home ownership,” Kottick said, “not only as an investment in their lifestyle and personal security, but as an investment in their financial future.”

And while a third of Canadians say they’re more likely to buy a house in the next five years than they were pre-pandemic, intentions differ among generations. Baby boomers say they’re 29 per cent more likely to buy a house, but 23 per cent say they’re less likely. Among gen X, 35 per cent are more likely to make a home purchase, with 23 per cent less likely. Millennials are a bit more eager to get in on homeownership, and 36 per cent say they’re now more likely to buy a house. Similarly, gen Z-ers say they’re 40 per cent more likely to become homeowners.

Mustel Group and Sotheby’s Canada polled 2,000 people aged 18-77 living in Vancouver, Calgary, Toronto and Montreal.

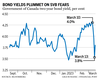

The yield on short-term Canada bonds is falling at the fastest rate in decades, as investors bet the Bank of Canada will cut rates in coming months to counter fallout from the collapse of United States regional banks.

Traders in overnight interest swaps are now pricing in rate cuts from the Bank of Canada by June. Last week, traders were expecting the next move to be a hike.

Real eState

Homelessness: Tiny home village to open next week in Halifax suburb

HALIFAX – A village of tiny homes is set to open next month in a Halifax suburb, the latest project by the provincial government to address homelessness.

Located in Lower Sackville, N.S., the tiny home community will house up to 34 people when the first 26 units open Nov. 4.

Another 35 people are scheduled to move in when construction on another 29 units should be complete in December, under a partnership between the province, the Halifax Regional Municipality, United Way Halifax, The Shaw Group and Dexter Construction.

The province invested $9.4 million to build the village and will contribute $935,000 annually for operating costs.

Residents have been chosen from a list of people experiencing homelessness maintained by the Affordable Housing Association of Nova Scotia.

They will pay rent that is tied to their income for a unit that is fully furnished with a private bathroom, shower and a kitchen equipped with a cooktop, small fridge and microwave.

The Atlantic Community Shelters Society will also provide support to residents, ranging from counselling and mental health supports to employment and educational services.

This report by The Canadian Press was first published Oct. 24, 2024.

The Canadian Press. All rights reserved.

Real eState

Here are some facts about British Columbia’s housing market

Housing affordability is a key issue in the provincial election campaign in British Columbia, particularly in major centres.

Here are some statistics about housing in B.C. from the Canada Mortgage and Housing Corporation’s 2024 Rental Market Report, issued in January, and the B.C. Real Estate Association’s August 2024 report.

Average residential home price in B.C.: $938,500

Average price in greater Vancouver (2024 year to date): $1,304,438

Average price in greater Victoria (2024 year to date): $979,103

Average price in the Okanagan (2024 year to date): $748,015

Average two-bedroom purpose-built rental in Vancouver: $2,181

Average two-bedroom purpose-built rental in Victoria: $1,839

Average two-bedroom purpose-built rental in Canada: $1,359

Rental vacancy rate in Vancouver: 0.9 per cent

How much more do new renters in Vancouver pay compared with renters who have occupied their home for at least a year: 27 per cent

This report by The Canadian Press was first published Oct. 17, 2024.

The Canadian Press. All rights reserved.

Real eState

B.C. voters face atmospheric river with heavy rain, high winds on election day

VANCOUVER – Voters along the south coast of British Columbia who have not cast their ballots yet will have to contend with heavy rain and high winds from an incoming atmospheric river weather system on election day.

Environment Canada says the weather system will bring prolonged heavy rain to Metro Vancouver, the Sunshine Coast, Fraser Valley, Howe Sound, Whistler and Vancouver Island starting Friday.

The agency says strong winds with gusts up to 80 kilometres an hour will also develop on Saturday — the day thousands are expected to go to the polls across B.C. — in parts of Vancouver Island and Metro Vancouver.

Wednesday was the last day for advance voting, which started on Oct. 10.

More than 180,000 voters cast their votes Wednesday — the most ever on an advance voting day in B.C., beating the record set just days earlier on Oct. 10 of more than 170,000 votes.

Environment Canada says voters in the area of the atmospheric river can expect around 70 millimetres of precipitation generally and up to 100 millimetres along the coastal mountains, while parts of Vancouver Island could see as much as 200 millimetres of rainfall for the weekend.

An atmospheric river system in November 2021 created severe flooding and landslides that at one point severed most rail links between Vancouver’s port and the rest of Canada while inundating communities in the Fraser Valley and B.C. Interior.

This report by The Canadian Press was first published Oct. 17, 2024.

The Canadian Press. All rights reserved.

-

News15 hours ago

News15 hours agoJustin Trudeau’s Announcing Cuts to Immigration Could Facilitate a Trump Win

-

News2 hours ago

News2 hours agoAlberta aims to add two seats to legislature, bringing total to 89 for next election

-

News16 hours ago

News16 hours agoNova Scotia election: Tory leader won’t invite Pierre Poilievre to join campaign

-

News16 hours ago

News16 hours ago‘Be ready for both’: Canadians prepare for any outcome as Americans head to the polls

-

Sports16 hours ago

Sports16 hours agoCanada’s Dabrowski and New Zealand’s Routliffe pick up second win at WTA Finals

-

Business16 hours ago

Business16 hours agoRestaurant Brands reports US$357M Q3 net income, down from US$364M a year ago

-

News16 hours ago

News16 hours agoNova Scotia monument honours eight brothers who fought in Second World War

-

News10 hours ago

News10 hours agoUN refugee chief: Canada cutbacks can avoid anti-immigrant backlash