Article content

There was a sense the tide had turned when Swiss National Bank surprised markets and cut its interest rate on Thursday — the first of the central banks in the developed world to do so.

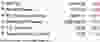

Canadians second only to Australians in the share of their income spent servicing debt

There was a sense the tide had turned when Swiss National Bank surprised markets and cut its interest rate on Thursday — the first of the central banks in the developed world to do so.

Article content

It put a big question out there — who’s next?

The stage is being set for other central banks to follow the Swiss, says Avery Shenfeld, chief economist of CIBC Capital Markets — but when isn’t the only question — it’s also by how much.

Advertisement 2

Article content

“Once inflation looks sufficiently tamed, the dosage will come down to just how much of an economic squeeze the existing level of rates has applied,” he said in his weekly note Friday.

Canadians, he argues, could use a bigger dose of rate relief than most in the world.

Higher interest rates have clearly had a big impact on Canadians, especially in comparison to their neighbours to the south. Canada’s per capita consumption is falling, but American consumers, up until recently, have kept up their spending, helping the U.S. economy avoid the slowdowns seen here, and in the United Kingdom and much of Europe, said Shenfeld.

How mortgages work in different countries has a lot to do with that impact. Americans largely have 30-year mortgages, while mortgages in Canada, the U.K. and Australia reset about every five years. Germans often lock in for 10 years or more, but the U.S. is the only place where a 30-year fixed rate is the norm, he said.

But even compared to countries who share shorter mortgage terms, Canadians are worse off. The ratio of home prices to incomes in Canada has risen 40 per cent since 2015, according to Organisation for Economic Co-operation and Development data, “far eclipsing what’s been seen in other countries where mortgage borrowers are also exposed to rising rates,” said Shenfeld. Countries with older populations like Japan and some EU nations also have fewer outstanding mortgages.

Article content

Advertisement 3

Article content

As CIBC’s chart shows Canadians are second only to Australians among seven major economies in the share of their income spent on interest and principal, thanks to the sharp increase in home prices and a collective rise in debt service costs.

“Put it all together, and Canada’s household sector was set up to be among the most vulnerable to rising mortgage rates,” Shenfeld said.

As a result, Canada could need bigger interest rate cuts to get the economy moving again. That is reinforced, he said, by the fact that about half of all mortgages still face renewal under considerably higher rates. Those coming due in 2025 will be facing an adjustment up from when rates were near zero in 2020.

“Whether Canada will be next after the Swiss, or wait a bit longer, there’s a good reason to expect that rate cuts will have to be deeper here than in countries with lower household debt burdens, cheaper houses, or locked-in mortgages,” said Shenfeld.

How deep then is the question, and to that there may be no easy answer. Much will depend on whether data to come shows the economy holding its own or tanking.

Advertisement 4

Article content

Most economists expect the Bank of Canada to start cutting its interest rate in June, but predictions on by how much vary.

Economists at Bank of Montreal and the Royal Bank of Canada expect 100 basis points of cuts this year and 100 the next, bringing the interest rate to 3 per cent by the end of 2025.

CIBC is forecasting a slightly deeper reduction, with the central bank cutting the rate by 25 bps in June, followed by a 50 bps cut in September and another 50 in December, to end the year at 3.75 per cent. By the end of 2025, they forecast the overnight rate will be down to 2.75 per cent.

Toronto Dominion Bank’s forecast goes even further, predicting interest rates will be cut to 2.25 per cent by the end of 2025.

Sign up here to get Posthaste delivered straight to your inbox.

Looking back 40 years, Canadians can take some comfort that this isn’t the worst housing affordability crisis the country has been through.

Today’s chart from BMO Economics senior economist Sal Guatieri shows that the “first and worst” hit in 1981, when mortgage rates were at 21 per cent and payments and utilities ate up 65 per cent of disposable income. Nine years later in a “speculative bubble,” mortgage rates were at 14 per cent, taking up 55 per cent of income. And that brings us to today.

Advertisement 5

Article content

Guatieri says affordability probably improved somewhat early this year as mortgage rates eased and home prices fell further, “but buyers shouldn’t expect meaningful relief until the BoC brings down policy rates.”

Today’s Data: U.S. new home sales

The contribution limit for your tax-free savings account this year is $7,000, meaning you have as much as $95,000 in room if you’ve never contributed before. But some taxpayers still exceed their limits and then claim they didn’t know the rules when the taxman comes calling. Tax expert Jamie Golombek says that’s a defence that won’t win. Find out more

Recommended from Editorial

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Advertisement 6

Article content

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

TOKYO (AP) — Japanese technology group SoftBank swung back to profitability in the July-September quarter, boosted by positive results in its Vision Fund investments.

Tokyo-based SoftBank Group Corp. reported Tuesday a fiscal second quarter profit of nearly 1.18 trillion yen ($7.7 billion), compared with a 931 billion yen loss in the year-earlier period.

Quarterly sales edged up about 6% to nearly 1.77 trillion yen ($11.5 billion).

SoftBank credited income from royalties and licensing related to its holdings in Arm, a computer chip-designing company, whose business spans smartphones, data centers, networking equipment, automotive, consumer electronic devices, and AI applications.

The results were also helped by the absence of losses related to SoftBank’s investment in office-space sharing venture WeWork, which hit the previous fiscal year.

WeWork, which filed for Chapter 11 bankruptcy protection in 2023, emerged from Chapter 11 in June.

SoftBank has benefitted in recent months from rising share prices in some investment, such as U.S.-based e-commerce company Coupang, Chinese mobility provider DiDi Global and Bytedance, the Chinese developer of TikTok.

SoftBank’s financial results tend to swing wildly, partly because of its sprawling investment portfolio that includes search engine Yahoo, Chinese retailer Alibaba, and artificial intelligence company Nvidia.

SoftBank makes investments in a variety of companies that it groups together in a series of Vision Funds.

The company’s founder, Masayoshi Son, is a pioneer in technology investment in Japan. SoftBank Group does not give earnings forecasts.

___

Yuri Kageyama is on X:

The Canadian Press. All rights reserved.

Shopify Inc. executives brushed off concerns that incoming U.S. President Donald Trump will be a major detriment to many of the company’s merchants.

“There’s nothing in what we’ve heard from Trump, nor would there have been anything from (Democratic candidate) Kamala (Harris), which we think impacts the overall state of new business formation and entrepreneurship,” Shopify’s chief financial officer Jeff Hoffmeister told analysts on a call Tuesday.

“We still feel really good about all the merchants out there, all the entrepreneurs that want to start new businesses and that’s obviously not going to change with the administration.”

Hoffmeister’s comments come a week after Trump, a Republican businessman, trounced Harris in an election that will soon return him to the Oval Office.

On the campaign trail, he threatened to impose tariffs of 60 per cent on imports from China and roughly 10 per cent to 20 per cent on goods from all other countries.

If the president-elect makes good on the promise, many worry the cost of operating will soar for companies, including customers of Shopify, which sells e-commerce software to small businesses but also brands as big as Kylie Cosmetics and Victoria’s Secret.

These merchants may feel they have no choice but to pass on the increases to customers, perhaps sparking more inflation.

If Trump’s tariffs do come to fruition, Shopify’s president Harley Finkelstein pointed out China is “not a huge area” for Shopify.

However, “we can’t anticipate what every presidential administration is going to do,” he cautioned.

He likened the uncertainty facing the business community to the COVID-19 pandemic where Shopify had to help companies migrate online.

“Our job is no matter what comes the way of our merchants, we provide them with tools and service and support for them to navigate it really well,” he said.

Finkelstein was questioned about the forthcoming U.S. leadership change on a call meant to delve into Shopify’s latest earnings, which sent shares soaring 27 per cent to $158.63 shortly after Tuesday’s market open.

The Ottawa-based company, which keeps its books in U.S. dollars, reported US$828 million in net income for its third quarter, up from US$718 million in the same quarter last year, as its revenue rose 26 per cent.

Revenue for the period ended Sept. 30 totalled US$2.16 billion, up from US$1.71 billion a year earlier.

Subscription solutions revenue reached US$610 million, up from US$486 million in the same quarter last year.

Merchant solutions revenue amounted to US$1.55 billion, up from US$1.23 billion.

Shopify’s net income excluding the impact of equity investments totalled US$344 million for the quarter, up from US$173 million in the same quarter last year.

Daniel Chan, a TD Cowen analyst, said the results show Shopify has a leadership position in the e-commerce world and “a continued ability to gain market share.”

In its outlook for its fourth quarter of 2024, the company said it expects revenue to grow at a mid-to-high-twenties percentage rate on a year-over-year basis.

“Q4 guidance suggests Shopify will finish the year strong, with better-than-expected revenue growth and operating margin,” Chan pointed out in a note to investors.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:SHOP)

The Canadian Press. All rights reserved.

TORONTO – RioCan Real Estate Investment Trust says it has cut almost 10 per cent of its staff as it deals with a slowdown in the condo market and overall pushes for greater efficiency.

The company says the cuts, which amount to around 60 employees based on its last annual filing, will mean about $9 million in restructuring charges and should translate to about $8 million in annualized cash savings.

The job cuts come as RioCan and others scale back condo development plans as the market softens, but chief executive Jonathan Gitlin says the reductions were from a companywide efficiency effort.

RioCan says it doesn’t plan to start any new construction of mixed-use properties this year and well into 2025 as it adjusts to the shifting market demand.

The company reported a net income of $96.9 million in the third quarter, up from a loss of $73.5 million last year, as it saw a $159 million boost from a favourable change in the fair value of investment properties.

RioCan reported what it says is a record-breaking 97.8 per cent occupancy rate in the quarter including retail committed occupancy of 98.6 per cent.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:REI.UN)

The Canadian Press. All rights reserved.

Chrystia Freeland says carbon rebate for small businesses will be tax-free

FACT FOCUS: Election officials knock down Starlink vote rigging conspiracy theories

Nova Scotia election promise tracker: What has been promised by three main parties?

Former B.C. premier John Horgan, who connected with people, dies at 65

Suncor Energy earnings rise to $2.02 billion in third quarter

Swearing-in ceremonies at B.C. legislature mark start of new political season

New Brunswick premier confirms her Liberal government will draft carbon pricing plan

B.C. teen with bird flu is in critical care, infection source unknown: health officer

Comments