Liam Payne’s voice is the first one heard in the culture-shifting boy band One Direction’s debut single: “What Makes You Beautiful” launches into a bouncy guitar riff, a cheeky and borderline gratuitous cowbell and then, Payne.

“You’re insecure, don’t know what for / You’re turning heads when you walk through the door,” he sings, in a few words assuring a cross-section of generations that he’s got your back, girl, and you should like yourself a little bit more.

Payne, who died Wednesday after falling from a hotel balcony in Buenos Aires, Argentina, at just 31, was also the last solo voice on the band’s final single, “History” — effectively opening and closing the monolithic run of one of the biggest boy bands of all time.

While the exact circumstances of his death remain unclear — Buenos Aires police said in a statement that Payne “had jumped from the balcony of his room,” although they didn’t offer details on how they established that or whether it was intentional — in life, Payne was a critical part of the internet’s first boy band, one that secured an indelible place in the hearts of millennial and Gen Z fans.

How One Direction became the internet’s first boy band

Before One Direction became One Direction, its members auditioned for the U.K.’s “The X Factor” separately. The judges decided to put five promising, but not yet excellent, boys into a group. They were Harry Styles, Niall Horan, Louis Tomlinson, Zayn Malik and Payne, who together finished third in the 2010 competition.

As Rolling Stone contributing editor Rob Sheffield points out, it was an “unprecedented” way for a boy band to get their start.

“They were sort of assigned to be together. And you don’t expect longevity out of that situation. Honestly, you don’t even expect one good pop record to come out of that situation,” he says. And yet, not only did it work, but One Direction essentially created “a new template for pop stardom, really.”

The show allowed Day 1 fans to follow their career before their official 2011 launch with “What Makes You Beautiful.” Nascent fans could use rising social media platforms like Twitter and Tumblr to find community, draw attention to the group and, in the earliest days, speak directly to the members.

“I honestly made a Twitter so that I could keep up with One Direction, and that’s how I made so many different friends,” says Gabrielle Kopera, 28, a fan from California who remembers the band hosting livestreams and chats. “Sometimes they would say something back and it was so much fun. I feel like that fan interaction doesn’t even happen anymore.”

That feeling of accessibility reinforced the group’s personality and relationship with fans, says Maura Johnston, a freelance music writer and Boston College adjunct instructor.

“The fact that they came up on this British TV show and they became this worldwide phenomenon, I don’t think that would have happened as acutely and as quickly and as immersive without social media, without Twitter or without people being able to mobilize around the globe,” she says.

One Direction and their fans

Millennial and Gen Z audiences practically grew up with One Direction, but the band was truly ubiquitous. That, Johnston says, is at least partially attributable to arriving in a very different media environment from today’s.

“It was a lot more focused,” she says of the early 2010s. “Algorithmic sorting of stuff hadn’t really taken hold. So, there was this broader, mass approach. … They were one of the last gasps of that mass phenomenon, that anyone of any age, even if they weren’t a fan, had to take notice to.”

But it takes more than omnipresence to cultivate a loyal fanbase. And there were myriad reasons why listeners were attracted to One Direction.

“They were five very different musical personalities, along with five very different personalities,” says Sheffield.

They broke the rules associated with traditional boy bands, too: “They co-wrote many of their songs. They didn’t do, you know, corny, choreographed steps on stage,” he said.

After the news of Payne’s death, Kopera says she “got so many messages from people I haven’t talked to in years reaching out because I think everyone kind of realized that it does feel like we just lost a family member.”

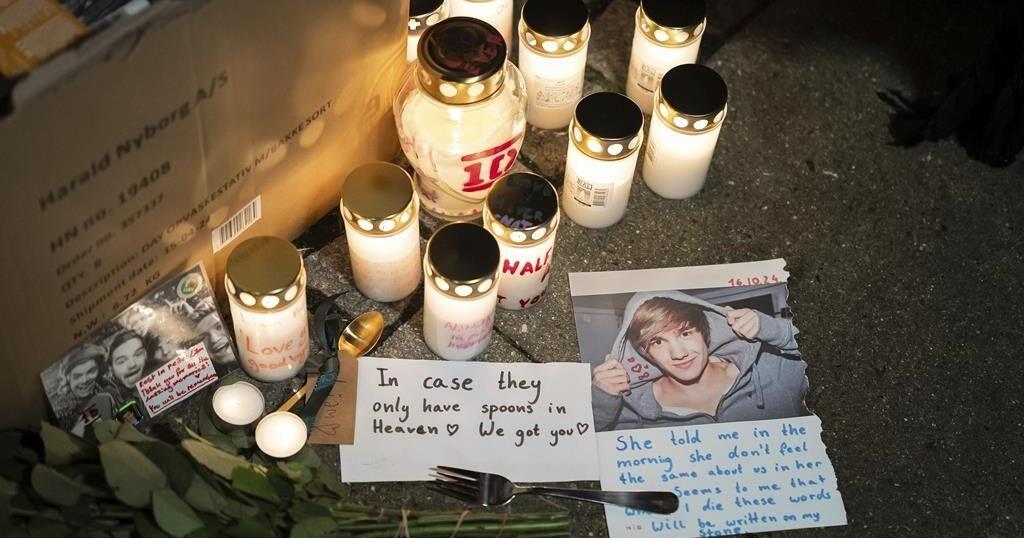

That sentiment was mirrored in the masses of fans who gathered Wednesday outside Buenos Aires’ Casa Sur Hotel, feeding a burgeoning makeshift memorial of flowers, candles and notes as police stood guard.

“I’ve always loved One Direction since I was little,” said Juana Relh, 18, outside Payne’s hotel. “To see that he died and that there will never be another reunion of the boys is unbelievable, it kills me.”

Liam Payne’s place in the band, and its legacy

Payne was a “brooding” older brother-type in One Direction, says Johnston. He also co-wrote many songs, especially in their later career — like the Fleetwood Mac-channeling “What A Feeling” and “Fireproof.”

“He was this grounding force in the band,” Johnston says.

In an Instagram tribute, Tomlinson called Payne “the most vital part of One Direction.”

“His experience from a young age, his perfect pitch, his stage presence, his gift for writing. The list goes on. Thank you for shaping us Liam,” he wrote.

“I always remember that he was the responsible and the sensible one of the group, and I feel like he wore his heart on his sleeve,” Kopera says.

Payne had recently been vocal about struggling with alcoholism, posting a YouTube video in July 2023 where he said he had been sober for six months after receiving treatment. Buenos Aires police said they found clonazepam — a central nervous system depressant — and other over-the-counter drugs in Payne’s hotel room, along with a whiskey bottle in the courtyard where he was found.

“Looking at what happened to Liam, it just makes you feel even more sad, that it just feels like he needed help,” Kopera says. “And it’s so scary to think about how the entertainment industry can just, like, eat up artists.”

After One Direction disbanded in 2016, Payne’s solo career — a single R&B-pop album in 2019, “LP1,” and a number of singles here and there — never took off the same way as some of his bandmates. He was “the least successful,” Sheffield says. “It’s safe to say that on the terms that he was going for, he didn’t really find what he wanted to do.”

“It’s hard, transitioning from being a boy bander to be a pop star,” Johnston says.

At Payne’s solo shows, Sheffield explains, “He would show a little montage of One Direction performing, which is the kind of thing you don’t do when you’re starting out as a solo artist. But fans took that in the spirit it was offered, which is a very generous statement that he’s like, ‘Yep, you’re here because of this history that we share, and I’m here because of that same history.’”

Despite Payne’s struggles and the tragedy of his death, Kopera is confident “his legacy is going to always point back to One Direction.”

For fans, the same is true.

“When I look back on One Direction, I’m like, that was my girlhood. One Direction was the soundtrack to growing up, and I’m so thankful for it,” she says. “They really were just a group of normal boys.”

____

AP journalist Brooke Lefferts contributed to this report.