Business

Qualified Candidates Are Not Hired for a Variety of Reasons

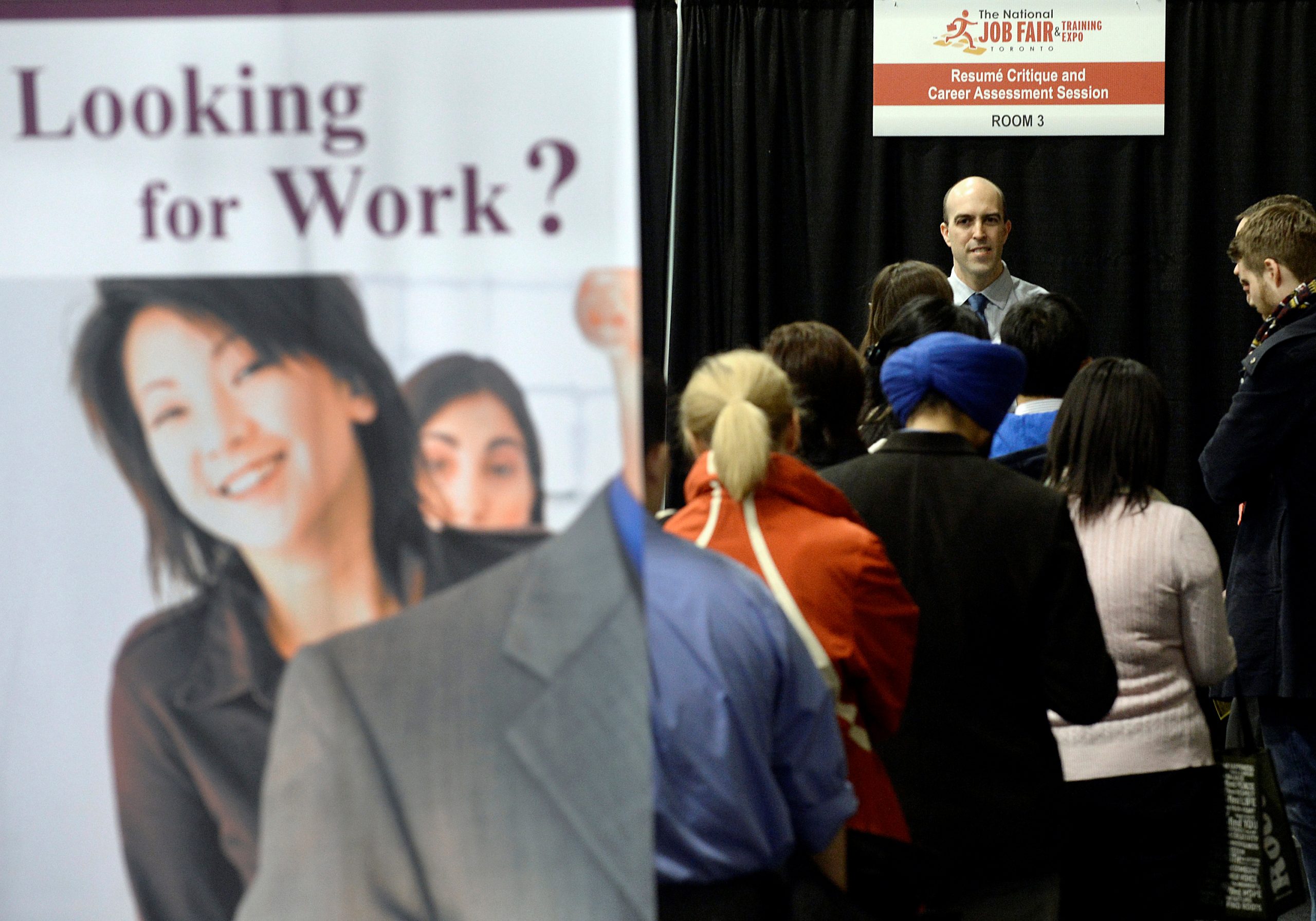

“Why didn’t I get the job?” is the most universal question job seekers ask.

You will seldom know the real reason.

Wishful thinkers sell themselves the false narrative that the most qualified candidate gets hired. This is simply not true. Of all business activities, hiring is the most bias. A candidate’s charisma (Being likeable supersedes your skills and experience.) plays a significant part in getting hired, as does being a referral. (The power of networking.) However, often candidates—qualified as they may be—destroy their chances of getting hired.

Regardless of how many letters you have after your name, your years of experience, or your reputation within your industry/field, there are many reasons an employer aren’t saying “Yes!” to you, the most common being:

Your social media is a turnoff.

Without a doubt, employers will Google you, dissect your social media activities, and review your LinkedIn profile to decide if you’re interview-worthy. If you’re applying to jobs, you’re well qualified for and not getting responses, consider your digital footprint. Meticulously go through your social media accounts. Delete anything unflattering that reflects poorly on you being a mature individual who makes good decisions.

TIP: Before you post anything on social media, ask yourself:

- Am I boasting? (Trying to impress.)

- Will this enhance or diminish my reputation? (Personal brand)

- Is it kind?

- Is it true?

You’ve got a negative attitude.

I’ve lost count of how many candidates I’ve met who complained about their former or current boss and sometimes their coworkers during an interview. They probably think this will show why they’re looking to make a change. Actually, it shows they’re a complainer and probably not a team player, which is someone I don’t hire.

Sage advice when to come to interviews: If you have nothing nice to say, then say nothing at all.

You didn’t do any research.

Even in the age of Google, I still get asked, “What does this company do?” If you don’t know what the company does, how it’s doing, what market it serves, or who its clients are, then you can’t tell me, let alone convince me, how you can add value to the company.

You smell bad.

Are you a smoker? Most people today don’t smoke. Since your interviewer is likely to be a non-smoker, they will smell your cigarette smoke, which will turn them off. Moreover, your interviewer will be asking themselves how many smoke breaks you will be taking throughout the workday.

The same goes for heavy cologne or perfume use. You never know who has allergies or has fragrance sensitivity. So play it safe, go to your interview clean and fresh.

You’re desperate.

Have you ever done an interview while employed? If yes, I bet you were less nervous. You already had a job, so the pressure to find a job to pay your bills wasn’t there—you weren’t desperate!

Coming across as being desperate is a turnoff. So, play it cool, but not too cool; you don’t want to seem indifferent to whether or not you get hired.

You don’t look the part. (Image is everything!)

How you look when you are walking into an interview or greeting an interviewer in the reception area cannot be overstated.

How you dress is how you’ll be judged if:

- You’re serious about being hired.

- You’re “one of them.” (You’ll be a fit.)

- You have respect for yourself and those around you.

Your salary expectations are unrealistic.

The value to an employer many job seekers have of themselves is often questionable. It’s not uncommon for me to immediately end the interview if the candidate is looking for more money, benefits and perks than the position is worth paying.

Research the salary range the job you’re applying for pays in your area and be ready to negotiate a compensation package you’ll be satisfied with. Although start-ups and small family businesses probably cannot offer you the compensation and benefits that large companies can, they may provide advantages worthwhile considering (e.g., fewer office politics, greater flexibility, more hands-on experience).

The good news is that all of the above issues can be fixed. (Yes, even a digital footprint that turns off employers can be corrected.) It’s just a matter of being honest with yourself, not playing the “I’m a victim!” game that some “ism” is why you aren’t getting hired, and question how you present yourself in interviews.

______________________________________________________________

Nick Kossovan, a well-seasoned veteran of the corporate landscape, offers advice on searching for a job. You can send him your questions at artoffindingwork@gmail.com.

Business

All Magic Spells (TM) : Top Converting Magic Spell eCommerce Store

Product Name: All Magic Spells (TM) : Top Converting Magic Spell eCommerce Store

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

All Magic Spells (TM) : Top Converting Magic Spell eCommerce Store is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Business

Turn Your Wife Into Your Personal Sex Kitten

Product Name: Turn Your Wife Into Your Personal Sex Kitten

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Turn Your Wife Into Your Personal Sex Kitten is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Business

CPC Practice Exam

Product Name: CPC Practice Exam

Click here to get CPC Practice Exam at discounted price while it’s still available…

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

CPC Practice Exam is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

-

News21 hours ago

News21 hours agoDefying Convention to Deepen Connections: Booking.com’s 8 Travel Predictions for 2025

-

Sports8 hours ago

Sports8 hours agoIn The Rings: Curling Canada still looking for Canadian Curling Trials title sponsor

-

News7 hours ago

News7 hours agoAfter hurricane, with no running water, residents organize to meet a basic need

-

Politics8 hours ago

Politics8 hours agoN.B. election debate: Tory leader forced to defend record on gender policy, housing

-

News8 hours ago

News8 hours agoAlberta government shifts continuing care from Health to Seniors Ministry

-

News8 hours ago

News8 hours agoBuhai, Green and Shin lead in South Korea after 8-under 64s in first round

-

News8 hours ago

News8 hours agoManitoba government halts school building plan, says other methods will be found

-

News8 hours ago

News8 hours ago‘Significant overreach’: Ontario municipalities slam province over bike lane rules