QUEBEC — Following up on those pre-Christmas cheques for millions of Quebecers, the Legault government now is coming to the aid of seniors struggling with the cost of living.

Economy

Quebec looking at $8-billion contingency fund ‘for economic risks’

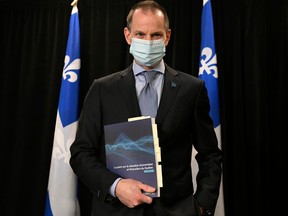

Tabling his fall economic update Thursday, Finance Minister Eric Girard confirmed previously announced plans to increase the maximum amount of the refundable senior assistance tax credit from $411 a year to $2,000, beginning this year.

The measure applies to those 70 and older who already receive this tax credit, and adds to the list of eligible recipients, Girard said. The news means an additional 398,500 seniors will have access to the credit, for a total of 1.1 million people.

If you add all the previous measures announced for 2022, the total relief for eligible seniors living alone will be $3,100. For a couple, the amount is $2,200.

Girard has also announced a plan to index the income tax system and social assistance programs to reflect increases in the prices of goods and services, to the level of 6.44 per cent. That indexation kicks in Jan. 1 and represents an additional $2.3 billion in relief.

But one day before the National Assembly recesses for Christmas, Girard’s update confirmed what he has been saying for weeks: Quebec’s economy is slowing down at an alarming rate, with little relief in sight in the short term.

“The economic outlook for Quebec and Canada has deteriorated quickly,” the update states. “A high degree of uncertainty hangs over the economic and financial forecast.”

The document spells things out bluntly: Quebec’s economic growth is expected to slow from 3.1 per cent in 2022 to 0.7 per cent in 2023. In his March budget, Girard had predicted two per cent growth for 2023.

And while Girard says he believes inflation peaked at eight per cent in June, the full effects of the slowdown and increases in lending rates by the central bank have yet to be felt.

As a precaution, he included the alternative scenario featuring an $8-billion contingency fund over five years.

“We believe the recession is, more or less, within a 50 per cent probability,” Girard told reporters at a news conference. “It’s good policy to have provisions for contingencies, whether they are pandemic- or economic-related.”

Under the recession scenario, economic activity would decline by one per cent in 2023 before increasing by 1.2 per cent in 2024. The overall negative impact on Quebec’s finances would be a whopping $5 billion in 2023, which would lead to a $4.1-billion deficit in 2023-24.

“For individuals, we have suggested if the economy slows down, it is the appropriate time for a fiscal stimulus,” Girard noted. “The fiscal stimulus we have highlighted as possible would be an income tax reduction.”

In the last election, the CAQ pledged an income tax cut — a promise restated by Premier François Legault in his interview with the Montreal Gazette last month.

For now, Girard’s budgetary deficit projection for 2022-23 remains lower than he said it would be in the March budget. That’s because that same high inflation rate has driven up Quebec’s own source revenues by about $14 billion.

Girard is also able to lower a projected $6.5-billion deficit for 2022-23 to $5.2 billion, including a mandatory contribution to the debt-reducing Generations Fund. Quebec is still on track to balance its books by 2027-28, Girard said.

The update represents a followup to a series of other measures promised by the CAQ during the election campaign to help Quebecers deal with inflation.

Up first were cheques of $400 to $600 for citizens who earned less than $100,000 in 2021. A Revenue Quebec spokesperson told the Montreal Gazette Thursday that more than half of the payments — in the form of direct deposit or paper cheques — have already been sent.

Two promised cost-of-living bills have also been tabled by the CAQ and should be adopted before the legislature recesses Friday. Bill 1 slaps a three per cent ceiling on government fee increases, while Bill 2 imposes the same ceiling on hydro rates.

The opposition parties were not impressed, with Québec solidaire saying the update does not include enough specific relief measures for citizens. QS wanted Quebec to immediately increase the minimum wage from $14.25 to $18 an hour and freeze all government fees.

“It’s not generous enough, it’s not targeted enough,” added Liberal finance critic Frédéric Beauchemin. He noted seniors will have to wait until they do their income taxes in order to get the CAQ tax credit, when they need the money now.

Economy

Canada’s unemployment rate holds steady at 6.5% in October, economy adds 15,000 jobs

OTTAWA – Canada’s unemployment rate held steady at 6.5 per cent last month as hiring remained weak across the economy.

Statistics Canada’s labour force survey on Friday said employment rose by a modest 15,000 jobs in October.

Business, building and support services saw the largest gain in employment.

Meanwhile, finance, insurance, real estate, rental and leasing experienced the largest decline.

Many economists see weakness in the job market continuing in the short term, before the Bank of Canada’s interest rate cuts spark a rebound in economic growth next year.

Despite ongoing softness in the labour market, however, strong wage growth has raged on in Canada. Average hourly wages in October grew 4.9 per cent from a year ago, reaching $35.76.

Friday’s report also shed some light on the financial health of households.

According to the agency, 28.8 per cent of Canadians aged 15 or older were living in a household that had difficulty meeting financial needs – like food and housing – in the previous four weeks.

That was down from 33.1 per cent in October 2023 and 35.5 per cent in October 2022, but still above the 20.4 per cent figure recorded in October 2020.

People living in a rented home were more likely to report difficulty meeting financial needs, with nearly four in 10 reporting that was the case.

That compares with just under a quarter of those living in an owned home by a household member.

Immigrants were also more likely to report facing financial strain last month, with about four out of 10 immigrants who landed in the last year doing so.

That compares with about three in 10 more established immigrants and one in four of people born in Canada.

This report by The Canadian Press was first published Nov. 8, 2024.

The Canadian Press. All rights reserved.

Economy

Health-care spending expected to outpace economy and reach $372 billion in 2024: CIHI

The Canadian Institute for Health Information says health-care spending in Canada is projected to reach a new high in 2024.

The annual report released Thursday says total health spending is expected to hit $372 billion, or $9,054 per Canadian.

CIHI’s national analysis predicts expenditures will rise by 5.7 per cent in 2024, compared to 4.5 per cent in 2023 and 1.7 per cent in 2022.

This year’s health spending is estimated to represent 12.4 per cent of Canada’s gross domestic product. Excluding two years of the pandemic, it would be the highest ratio in the country’s history.

While it’s not unusual for health expenditures to outpace economic growth, the report says this could be the case for the next several years due to Canada’s growing population and its aging demographic.

Canada’s per capita spending on health care in 2022 was among the highest in the world, but still less than countries such as the United States and Sweden.

The report notes that the Canadian dental and pharmacare plans could push health-care spending even further as more people who previously couldn’t afford these services start using them.

This report by The Canadian Press was first published Nov. 7, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.

The Canadian Press. All rights reserved.

Economy

Trump’s victory sparks concerns over ripple effect on Canadian economy

As Canadians wake up to news that Donald Trump will return to the White House, the president-elect’s protectionist stance is casting a spotlight on what effect his second term will have on Canada-U.S. economic ties.

Some Canadian business leaders have expressed worry over Trump’s promise to introduce a universal 10 per cent tariff on all American imports.

A Canadian Chamber of Commerce report released last month suggested those tariffs would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

More than 77 per cent of Canadian exports go to the U.S.

Canada’s manufacturing sector faces the biggest risk should Trump push forward on imposing broad tariffs, said Canadian Manufacturers and Exporters president and CEO Dennis Darby. He said the sector is the “most trade-exposed” within Canada.

“It’s in the U.S.’s best interest, it’s in our best interest, but most importantly for consumers across North America, that we’re able to trade goods, materials, ingredients, as we have under the trade agreements,” Darby said in an interview.

“It’s a more complex or complicated outcome than it would have been with the Democrats, but we’ve had to deal with this before and we’re going to do our best to deal with it again.”

American economists have also warned Trump’s plan could cause inflation and possibly a recession, which could have ripple effects in Canada.

It’s consumers who will ultimately feel the burden of any inflationary effect caused by broad tariffs, said Darby.

“A tariff tends to raise costs, and it ultimately raises prices, so that’s something that we have to be prepared for,” he said.

“It could tilt production mandates. A tariff makes goods more expensive, but on the same token, it also will make inputs for the U.S. more expensive.”

A report last month by TD economist Marc Ercolao said research shows a full-scale implementation of Trump’s tariff plan could lead to a near-five per cent reduction in Canadian export volumes to the U.S. by early-2027, relative to current baseline forecasts.

Retaliation by Canada would also increase costs for domestic producers, and push import volumes lower in the process.

“Slowing import activity mitigates some of the negative net trade impact on total GDP enough to avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026,” Ercolao said.

Since the Canada-United States-Mexico Agreement came into effect in 2020, trade between Canada and the U.S. has surged by 46 per cent, according to the Toronto Region Board of Trade.

With that deal is up for review in 2026, Canadian Chamber of Commerce president and CEO Candace Laing said the Canadian government “must collaborate effectively with the Trump administration to preserve and strengthen our bilateral economic partnership.”

“With an impressive $3.6 billion in daily trade, Canada and the United States are each other’s closest international partners. The secure and efficient flow of goods and people across our border … remains essential for the economies of both countries,” she said in a statement.

“By resisting tariffs and trade barriers that will only raise prices and hurt consumers in both countries, Canada and the United States can strengthen resilient cross-border supply chains that enhance our shared economic security.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

-

News24 hours ago

News24 hours agoChrystia Freeland says carbon rebate for small businesses will be tax-free

-

News23 hours ago

News23 hours agoFACT FOCUS: Election officials knock down Starlink vote rigging conspiracy theories

-

News23 hours ago

News23 hours agoNova Scotia election promise tracker: What has been promised by three main parties?

-

News23 hours ago

News23 hours agoFormer B.C. premier John Horgan, who connected with people, dies at 65

-

News23 hours ago

News23 hours agoSuncor Energy earnings rise to $2.02 billion in third quarter

-

News24 hours ago

News24 hours agoSwearing-in ceremonies at B.C. legislature mark start of new political season

-

News23 hours ago

News23 hours agoNew Brunswick premier confirms her Liberal government will draft carbon pricing plan

-

News23 hours ago

News23 hours agoB.C. teen with bird flu is in critical care, infection source unknown: health officer