Real eState

Real Estate Investors Skip Paying Loans While Raising Billions – BNN

(Bloomberg) — Some of the largest real estate investors are walking away from debt on bad property deals, even as they raise billions of dollars for new opportunities borne of the pandemic.

The willingness of Brookfield Property Partners LP, Starwood Capital Group, Colony Capital Inc. and Blackstone Group Inc. to skip payments on commercial mortgage-backed securities backed by hotels and malls illustrates how the economic fallout from the coronavirus has devalued some real estate while also creating new targets for these cash-loaded investors.

“Just because a prior investment didn’t work out doesn’t necessarily mean that should tarnish the reputation for future endeavors,” said Alan Todd, head of U.S. CMBS research for Bank of America Securities. “It’s not like something was done in bad faith.”

While cutting losers to buy winners is an age-old investment proposition, the Covid-19 pandemic may create even more openings than the past crises that became bonanzas for real estate investors. The mass exodus of Americans from public spaces has hammered already-weak retailers and their landlords, crippled business travel, crushed restaurants unable to fill all of their tables, and sown chaos for office towers whose tenants may never need as much space again.

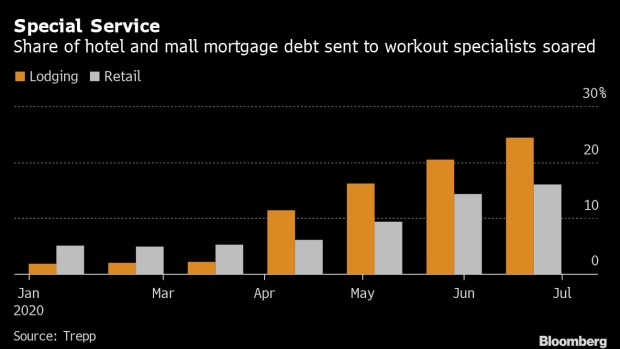

Hotels and malls have been the biggest CMBS losers during the pandemic. Lodging and retail debt turned over to so-called special servicers — workout specialists — is at the highest level since 2010, according to industry tracker Trepp.

Relatively Painless

Missing payments on CMBS debt is relatively painless, because it’s typically non-recourse, meaning borrowers can hand over the keys to a property and lenders won’t be able to come after other assets. Property owners are more likely to walk away when their equity has been wiped out by lower values.

“They know that if they borrow from most lenders, they win if they win and they win if they lose,” said Ethan Penner, an investor who pioneered CMBS deals in the 1990s at Nomura Securities.

Starwood founder Barry Sternlicht and Colony Chairman Tom Barrack got their starts thanks to the 1980s savings and loan crisis, while Blackstone President Jon Gray traded stakes in hotels, offices and single-family homes to generate big returns through the financial crisis.

Now these firms are raising money for their next round of bets, even as they skip debt payments on old obligations.

At least 11 Brookfield malls with more than $2 billion in CMBS debt are delinquent or seeking payment relief because of Covid-19. The company has already repurchased some of its former debt at reduced prices.

“The lenders are willing to sell us their loans or the mortgages back at a discount,” Brookfield Property Chief Executive Officer Brian Kingston said during an Aug. 6 earnings call. “And so in that case we’ve been able to essentially reacquire the asset at an attractive basis.”

Brookfield Asset Management Inc., the parent of the property firm, raised $23 billion from investors in the most recent quarter, including $12 billion in new commitments for a distressed fund. Brookfield spokeswoman Kerrie McHugh declined to comment.

Digital Strategy

Colony has stopped making payments on many of its hotel bonds since the pandemic hit, while focusing on its long-planned “digital” real estate strategy — buying properties like cell towers, data centers and network infrastructure.

It began raising at least $6 billion for a second digital fund shortly before announcing plans in May to evaluate “strategic and financial alternatives” for 245 lodging properties with $3.5 billion in debt. Wells Fargo & Co., trustee of Colony’s Tharaldson hotel portfolio, sued in June in federal court to appoint a receiver to manage those hotels after Colony defaulted on the debt. The portfolio, with $842.7 million in loans, was reappraised in June at $836.7 million, down 36% from $1.3 billion in January 2018.

“We’ve been very careful not to put good money into bad situations,” Colony CEO Marc Ganzi said on a conference call earlier this month.

Blackstone, which ended its second quarter with $46 billion to invest in real estate deals, is delinquent on a $274 million mortgage for four Club Quarters Hotels. Blackstone is considering walking away from those properties, because it would cost too much to make them competitive, Bloomberg reported in June.

Hotels, Retail

Hotel and retail properties represent just 13% of Blackstone’s real estate exposure and the Club Quarters mortgage is its sole delinquent CMBS.

Starwood is said to be raising $11 billion for a new opportunistic investment fund while also falling behind on payments for 17 of its 30 retail properties with almost $2 billion in CMBS debt. Management of three Starwood malls was assigned to a court-appointed receiver in April after it missed payments.

Debt on a four-mall portfolio was downgraded to junk following an appraisal that cut the property value 66% and wiped out Starwood’s equity.

“We remain committed to ensuring the best outcome possible for our investors in what has proven to be a very challenging asset class,” Starwood said in an emailed statement. “The level of uncertainty regarding tenant performance, anchor stability, capital markets and now the impact of the pandemic remains unprecedented and our strategy for these assets is evolving.”

©2020 Bloomberg L.P.

Real eState

Waterdown home listed for $2M offers 'rural-style living' – Hamilton Spectator

/* OOVVUU Targeting */

const path = ‘/business/real-estate’;

const siteName = ‘thespec.com’;

let domain = ‘thestar.com’;

if (siteName === ‘thestar.com’)

domain = ‘thestar.com’;

else if (siteName === ‘niagarafallsreview.ca’)

domain = ‘niagara_falls_review’;

else if (siteName === ‘stcatharinesstandard.ca’)

domain = ‘st_catharines_standard’;

else if (siteName === ‘thepeterboroughexaminer.com’)

domain = ‘the_peterborough_examiner’;

else if (siteName === ‘therecord.com’)

domain = ‘the_record’;

else if (siteName === ‘thespec.com’)

domain = ‘the_spec’;

else if (siteName === ‘wellandtribune.ca’)

domain = ‘welland_tribune’;

else if (siteName === ‘bramptonguardian.com’)

domain = ‘brampton_guardian’;

else if (siteName === ‘caledonenterprise.com’)

domain = ‘caledon_enterprise’;

else if (siteName === ‘cambridgetimes.ca’)

domain = ‘cambridge_times’;

else if (siteName === ‘durhamregion.com’)

domain = ‘durham_region’;

else if (siteName === ‘guelphmercury.com’)

domain = ‘guelph_mercury’;

else if (siteName === ‘insidehalton.com’)

domain = ‘inside_halton’;

else if (siteName === ‘insideottawavalley.com’)

domain = ‘inside_ottawa_valley’;

else if (siteName === ‘mississauga.com’)

domain = ‘mississauga’;

else if (siteName === ‘muskokaregion.com’)

domain = ‘muskoka_region’;

else if (siteName === ‘newhamburgindependent.ca’)

domain = ‘new_hamburg_independent’;

else if (siteName === ‘niagarathisweek.com’)

domain = ‘niagara_this_week’;

else if (siteName === ‘northbaynipissing.com’)

domain = ‘north_bay_nipissing’;

else if (siteName === ‘northumberlandnews.com’)

domain = ‘northumberland_news’;

else if (siteName === ‘orangeville.com’)

domain = ‘orangeville’;

else if (siteName === ‘ourwindsor.ca’)

domain = ‘our_windsor’;

else if (siteName === ‘parrysound.com’)

domain = ‘parrysound’;

else if (siteName === ‘simcoe.com’)

domain = ‘simcoe’;

else if (siteName === ‘theifp.ca’)

domain = ‘the_ifp’;

else if (siteName === ‘waterloochronicle.ca’)

domain = ‘waterloo_chronicle’;

else if (siteName === ‘yorkregion.com’)

domain = ‘york_region’;

let sectionTag = ”;

try

if (domain === ‘thestar.com’ && path.indexOf(‘wires/’) = 0)

sectionTag = ‘/business’;

else if (path.indexOf(‘/autos’) >= 0)

sectionTag = ‘/autos’;

else if (path.indexOf(‘/entertainment’) >= 0)

sectionTag = ‘/entertainment’;

else if (path.indexOf(‘/life’) >= 0)

sectionTag = ‘/life’;

else if (path.indexOf(‘/news’) >= 0)

sectionTag = ‘/news’;

else if (path.indexOf(‘/politics’) >= 0)

sectionTag = ‘/politics’;

else if (path.indexOf(‘/sports’) >= 0)

sectionTag = ‘/sports’;

else if (path.indexOf(‘/opinion’) >= 0)

sectionTag = ‘/opinion’;

} catch (ex)

const descriptionUrl = ‘window.location.href’;

const vid = ‘mediainfo.reference_id’;

const cmsId = ‘2665777’;

let url = `https://pubads.g.doubleclick.net/gampad/ads?iu=/58580620/$domain/video/oovvuu$sectionTag&description_url=$descriptionUrl&vid=$vid&cmsid=$cmsId&tfcd=0&npa=0&sz=640×480&ad_rule=0&gdfp_req=1&output=vast&unviewed_position_start=1&env=vp&impl=s&correlator=`;

url = url.split(‘ ‘).join(”);

window.oovvuuReplacementAdServerURL = url;

#HamOntHouseHunt is a regular feature looking at houses for sale in the Hamilton area market. Have a tip? Email us at fhewitt@torstar.ca.

Price $1,999,900

The fully functional barn located on the property of 694 Centre Rd. in Waterdown.

The kitchen of 694 Centre Rd. in Waterdown.

The primary bedroom of 694 Centre Rd. in Waterdown.

The back deck of 694 Centre Rd. in Waterdown.

Real eState

Former HGTV star slapped with $10 million fine and jail time for real estate fraud – Fortune

Back when mortgage rates and home prices were more reasonable and manageable, homeowners invested in fixer-upper properties and made them their own. Now these types of projects aren’t as popular. But in the early-to-mid-2010s, HGTV shows including Fixer Upper, Love It or List It, and Flip It to Win It were all the rage as viewers binge-watched dilapidated homes transform into dream properties.

But as it turns out, one former HGTV star’s house-flipping show was masking major real estate fraud. On Tuesday, Charles “Todd” Hill, was sentenced to four years in jail and ordered to pay back nearly $10 million to his victims following his conviction. Los Gatos, Calif.–based Hill, 58, was the star of HGTV show Flip It to Win It, which aired in 2013 and featured Hill and his team purchasing dilapidated homes and fixing them up. Hill then sold them for a profit.

“Some see the huge amount of money in Silicon Valley real estate as a business opportunity,” Santa Clara County District Attorney Jeff Rosen said in a statement. “Others, unfortunately, see it as a criminal opportunity—and we will hold those people strictly accountable.”

What did Hill do?

According to the indictment shared with Fortune, the accusations against Hill happened between 2012 and 2014, around the time his show (which lasted just one season) began. The indictment shows 10 counts of grand theft of personal property exceeding $950,000; three counts of embezzlement; and one count of diversion of construction funds. Hill could not be reached by Fortune to comment on the indictment, conviction, or sentencing.

Hill was convicted last year of the multiple fraud schemes, including scams that happened before his show aired. This included a Ponzi scheme with evidence showing that Hill had spent laundered money on a rented apartment in San Francisco, hotels, vacations, and luxury cars, according to a press release from the Santa Clara County District Attorney’s Office. HGTV did not respond to requests for comment from Fortune ahead of publication.

“To hide the theft, he created false balance sheets and got loans using fraudulent information,” according to the district attorney’s office. In another case, Hill diverted construction money for personal use. But one of the strangest accounts came from an investor who had poured $250,000 into a property he wanted Hill to remodel.

Instead, during a tour of the home, the investor “found it to be a burnt-down shell with no work done on it.”

After the district attorney’s investigation, Hill was indicted in November 2019 and in September 2023 admitted his guilt and was convicted by plea of grand theft against all of his victims. He’ll have to pay restitution of more than $9.4 million and serve 10 years on probation.

Victims who spoke at Tuesday’s hearing said they’re still reeling from the financial and professional damages from the fraud, according to the district attorney’s office.

Real eState

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

A Winnipeg man’s registration as a real estate salesman has been cancelled after a family vacated their home on a tight deadline for a sale that never went through, then changed brokerages and, months later, got $60,000 less for their house than what they expected when they moved out.

A Manitoba Securities Commission panel found Reginald Wayne Kehler engaged in professional misconduct and conduct unbecoming a registrant when he signed a document on behalf of sellers without their knowledge, reduced the listing price of a home without their approval, and didn’t tell them for nearly a month that a potential buyer hadn’t paid a promised $100,000 deposit.

The sellers, identified as D.R. and P.R. in the panel decision released Wednesday, were awarded $10,394 from the real estate reimbursement fund. Kehler was ordered to pay $12,075 to cover costs of the investigation and hearing.

The sellers were a military family who had to move in 2020 after the husband was posted to Ottawa.

They chose Kehler as their listing agent, because he had helped them find the home when they moved to Winnipeg in 2018, and they had a good relationship with him, the panel’s decision says.

They listed their house in May and on June 15, 2020, accepted an offer of $570,000 with possession on July 15. A deposit of $100,000 was to be paid within 72 hours of acceptance of the offer.

Kehler was the salesperson for both the buyer and the sellers — but the sellers say he never told them that.

A form that indicated the sellers knew he was also representing the buyer, dated June 15, 2020, was filed.

While it appeared to be signed with the sellers’ names, they said they didn’t see it until March 2021. One of the two wasn’t even in Winnipeg on June 15.

“Kehler, in his interview with commission staff, acknowledges that the sellers never signed this document — we note that the purported signatures on the form look nothing like the actual signatures of the sellers on other documents,” the decision says.

Kehler told commission staff he’d been authorized to sign on the sellers’ behalf, which they denied. The panel found them more believable.

Once the deal was made, the sellers, believing they had just a month before the buyer would take possession of their home, quickly packed up and prepared to move with their two young children.

Buyer never made deposit

Meanwhile, the buyer hadn’t made the $100,000 deposit before the deadline — but Kehler didn’t tell the sellers.

Kehler told commission staff that was because he thought the deposit was still coming, and he didn’t want to cause more stress for the sellers.

On July 10, just five days before the buyer was to take possession and the day before the family was leaving Winnipeg, the sellers spoke to Kehler — but he still didn’t tell them the deposit hadn’t been paid.

Kehler “said everything was fine,” according to the decision.

It wasn’t until the evening of July 13, when the family arrived in Toronto on their way to Ottawa and just 36 hours before the scheduled closing, that Kehler told them he’d never received the deposit.

Eventually, they received $4,000 of the deposit, but the sale of the house never closed. The sellers scrambled to extend the insurance on their old home and make sure they continued to pay the utility bills, the decision says.

Home relisted

Kehler then recommended they relist the home, and it went back on the market at $574,900.

On Aug. 10, 2020, Kehler recommended the price be reduced to $569,900. Instead, the seller said he should reduce the price to $567,900.

But when the seller looked at the online listing on Aug. 22, it was listed at $564,900.

The sellers also asked Kehler about maintaining the property, since they were no longer in Winnipeg. He agreed he would, but friends ended up going and mowing the lawn, the decision says.

The sellers asked Kehler and his brokerage about what could be done to “make things right,” the decision says, but they never received any responses.

On Sept. 5, they hired a new brokerage to sell the home. Under the new real estate salesman, they accepted an offer on Dec. 13, and closed the deal Jan. 2, 2021, receiving $507,500 for the home.

Kehler’s actions were “contrary to the best interests of the public” and undermined “public confidence in the real estate industry,” the decision says.

-

Media22 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media24 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment22 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Real eState14 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

News20 hours ago

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

-

Business22 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Business14 hours ago

Dow Jones Rises But S&P, Nasdaq Fall; Nvidia, SMCI Flash Sell Signals As Bitcoin's Fourth Halving Arrives – Investor's Business Daily

-

Politics23 hours ago

Politics23 hours agoIran news: Canada, G7 urge de-escalation after Israel strike – CTV News