Economy

Recession proof? Alberta economy expected to avoid Canadian GDP shrinkage

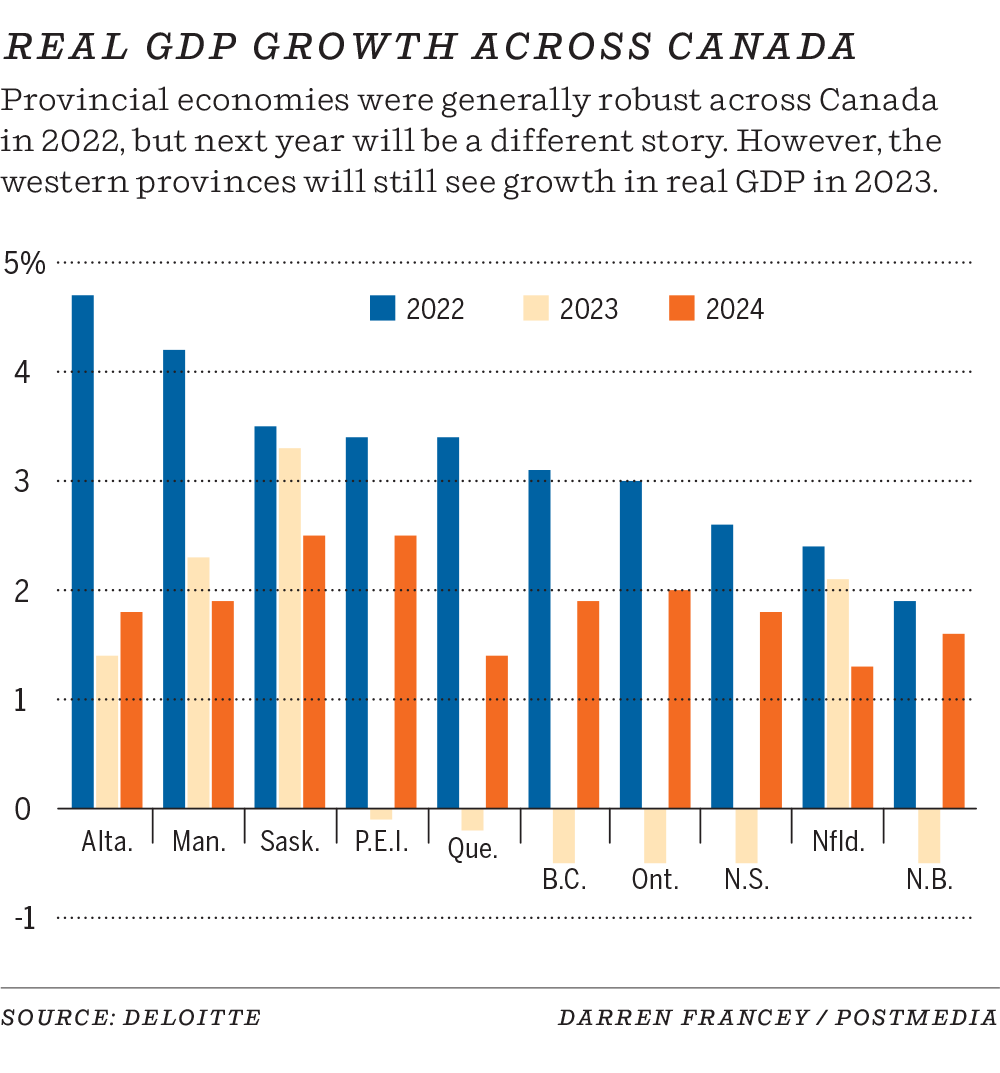

According to Deloitte’s latest economic outlook, Alberta will avoid a recession over the next year, a claim Canada will not be able to make as a whole

“Higher costs for everything have been squeezing household budgets,” said St-Arnaud. “There’s a big decline in purchasing power and consumers will have to do some choices in terms of where and how do they spend. There’s some discretionary spending that won’t happen. Big spending on cars, furniture, appliances, might have to be delayed. Part of the slowdown of the economy is that you’ll see weaker consumer spending as we get into the end of the year.”

But data suggests that higher interest rates are starting to have an effect on cooling inflation, though St-Arnaud said the hikes likely are not done — he agrees with the prognostication of a 50-basis-point bump next month and says there could be an additional 25-point increase before the end of this year.

“We saw some moderation in recent months, but that was mainly due to an easing in gasoline prices,” said St-Arnaud. “(The Bank of Canada) still needs to continue to increase interest rates, but we’re getting to that peak in terms of how much they’ll increase.”

Alberta remains one of the most affordable provinces in the country, which is credited with continued net positive interprovincial migration. In the second quarter of 2022, the total was 9,857 for a fourth-consecutive quarter of positive results. In that time, 23,132 Canadians relocated to Alberta; 15,208 in 2022.

“It’s so important to have people coming in,” she said. “All of these industries, whether they’re the traditional ones or the more growing and emerging ones, are going to need the skilled workers. These positive migration numbers are a great indication that our goal to get these skilled positions filled is going to come to fruition.”

The last time there were four consecutive quarters of net-positive interprovincial migration to Alberta was the third quarter of 2014 to the second quarter of 2015 — also the last time there were four-digit positive gains.

Fir pointed to affordable housing, lower taxes and diversified job opportunities as the draws. Many people are coming to Alberta from Ontario and B.C., where the province has rolled out its Alberta is Calling campaign.

This has been exemplified by recent announcements such as De Havilland announcing plans for a massive manufacturing plant in Wheatland County and Infosys doubling the number of positions for its new office in downtown Calgary to 1,000. There has been further investment in hydrogen production, lithium extraction and agri-sciences.

One positive of the impending slowdown is Deloitte is not expecting employment to bottom out, as it often does in a recession. MacDonald said the current tight labour market will help mitigate some of these pains.

“If you’re looking at laying off staff, you have to ask yourself, ‘how easy is it going to be to get these staff back when demand starts to pick back up?’ ” she said. “We think employers are going to hold on to their employees a lot longer than they normally would during a period of slowdown, just because it’s been so difficult to find the right skills for the jobs that are out there.”

Written by

Twitter: @JoshAldrich03

Economy

September merchandise trade deficit narrows to $1.3 billion: Statistics Canada

OTTAWA – Statistics Canada says the country’s merchandise trade deficit narrowed to $1.3 billion in September as imports fell more than exports.

The result compared with a revised deficit of $1.5 billion for August. The initial estimate for August released last month had shown a deficit of $1.1 billion.

Statistics Canada says the results for September came as total exports edged down 0.1 per cent to $63.9 billion.

Exports of metal and non-metallic mineral products fell 5.4 per cent as exports of unwrought gold, silver, and platinum group metals, and their alloys, decreased 15.4 per cent. Exports of energy products dropped 2.6 per cent as lower prices weighed on crude oil exports.

Meanwhile, imports for September fell 0.4 per cent to $65.1 billion as imports of metal and non-metallic mineral products dropped 12.7 per cent.

In volume terms, total exports rose 1.4 per cent in September while total imports were essentially unchanged in September.

This report by The Canadian Press was first published Nov. 5, 2024.

The Canadian Press. All rights reserved.

Economy

How will the U.S. election impact the Canadian economy? – BNN Bloomberg

[unable to retrieve full-text content]

How will the U.S. election impact the Canadian economy? BNN Bloomberg

Source link

Economy

Trump and Musk promise economic 'hardship' — and voters are noticing – MSNBC

[unable to retrieve full-text content]

Trump and Musk promise economic ‘hardship’ — and voters are noticing MSNBC

Source link

-

News10 hours ago

News10 hours agoJustin Trudeau’s Announcing Cuts to Immigration Could Facilitate a Trump Win

-

News19 hours ago

News19 hours agoOfficer suspended over alleged involvement in protest at Brampton temple: Peel police

-

News10 hours ago

News10 hours ago‘Be ready for both’: Canadians prepare for any outcome as Americans head to the polls

-

Business10 hours ago

Business10 hours agoRestaurant Brands reports US$357M Q3 net income, down from US$364M a year ago

-

News10 hours ago

News10 hours agoNova Scotia election: Tory leader won’t invite Pierre Poilievre to join campaign

-

News22 hours ago

News22 hours agoRustad seeks review as Elections BC says box of 861 votes went uncounted

-

News4 hours ago

News4 hours agoUN refugee chief: Canada cutbacks can avoid anti-immigrant backlash

-

News10 hours ago

News10 hours agoFormer athletes lean on each other to lead Canada’s luge, bobsled teams