Economy

Refreshing Canada's definition of the blue economy – Corporate Knights Magazine

In Canada and around the world, “building back better” has become the overarching focus of COVID-19 recovery. Eager to be included in this rebuilding process, Canada’s freshwater and ocean sectors have begun to define ambitious visions for the future, linking environmental priorities with job creation and economic growth.

For the ocean community, this vision centres on the “blue economy,” defined in a recent Delphi Group report as referring broadly to economic activities that are both based in and actively good for the ocean. While “blue economy” remains an emerging and somewhat fuzzy concept, the report echoes a growing trend toward viewing a broad range of ocean-related activities – established industries, emerging technologies and environmental challenges – through a single blue-economy lens.

While we applaud this movement toward integrated management of ocean resources, we can’t help but notice that freshwater is missing from the conversation.

From a management perspective, freshwater and oceans have historically been distant cousins – clearly related, occasionally crossing paths, but largely living independent lives. But as our knowledge of planetary systems has evolved, the distance between these two worlds has narrowed considerably, and the number of connections between them has rapidly grown.

Take, for example, desalination technologies. The ocean-based blue-economy definition classifies desalination as an ocean activity (see the World Bank’s 2017 report). But Canadian water technology companies, such as British Columbia–based Saltworks, are successfully developing and applying desalination technologies to a range of industrial wastewater treatment applications.

Or let’s consider the “wicked problem” of plastic. Plastic pollution is a major issue facing the world’s oceans and is increasingly propelling Canada’s international commitments, from its founding role in the Global Plastic Action Partnership to its strong support for the Ocean Plastics Charter. But plastic pollution is not, at its core, an oceans issue. Of the more than eight million tons of plastic that ends up in the world’s oceans every year, most is carried into the ocean by rivers, with 90% of plastic pollution coming from just 10 river systems.

A recent map of Canada’s water-technology ecosystem highlights dozens of similar connections, from hydropower (emerging technologies harnessing both tidal and freshwater currents) to aquaculture (a rapidly growing sector including land- and ocean-based operations). These connections make it clear that there is no magic dividing line between freshwater and oceans, where one rule book ends and another takes over.

What do we stand to gain from bringing these two worlds together under a single blue-economy umbrella? In no uncertain terms: a lot.

Because of Canada’s size and the number of sectors that intersect freshwater, coordination in this space has always been a challenge. Freshwater simultaneously fits into a range of sectors, from mining and energy to agriculture and municipal services, and lives nowhere, with no dedicated agency advocating for its interests (the current conversation around the creation of a Canada Water Agency is a promising one, which we’re following with interest).

By extension, freshwater infrastructure and innovation, including around drinking water, wastewater, stormwater and environmental protection, does not attract attention or investment at the same scale as the ocean economy.

How, then, can we leverage the strengths of Canada’s ocean community to advance the interests of “all waters”? We can start by learning from and building on the successes of institutions such as Canada’s Ocean Supercluster, a multi-sectoral organization created by the federal government to support ocean innovation, which has provided a hub to coordinate activity around ocean technologies and solutions. An equivalent entity for freshwater could play a significant role in accelerating investment and innovation around water challenges.

We can also draw inspiration from the ocean economy to generate new sustainable business models and investment for the freshwater sector. Hosted in 2018, the first global conference on the sustainable blue economy explored how to harness the potential of our oceans to improve the lives of all and leverage research and innovation to build prosperity. Building on this theme, Canada’s emerging Blue Economy Strategy (currently focused exclusively on oceans) aims to align economic growth in the ocean sector with job creation and climate action, as well as greater participation of Indigenous Peoples, women and under-represented groups in the ocean economy.

Building back better requires us to take a holistic view of water systems and understand the numerous and complex interconnections between freshwater and ocean sectors.

The prime minister’s Speech from the Throne in September 2020 recognized that “investing in the Blue Economy will help Canada prosper.” Reframing the blue economy as “economic activities that are based in and actively good for all water systems” will better position Canada to tackle the complex environmental challenges that water systems face and harness emerging economic opportunities at the interface of freshwater and ocean sectors.

Melissa Dick is a program manager with Aqua Forum, a non-profit organization whose flagship program is the AquaHacking Challenge.

Alan Shapiro is the director of waterNEXT, Canada’s emerging water-technology ecosystem, and principal at Shapiro & Company.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Economy

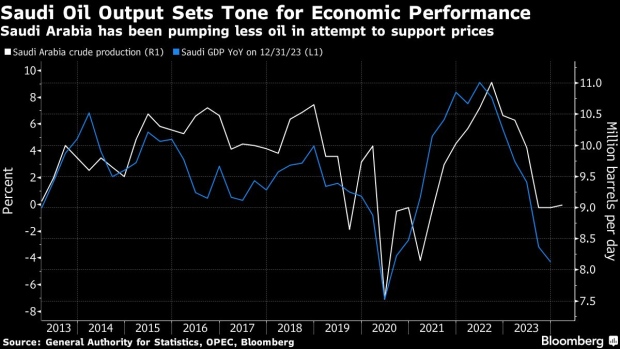

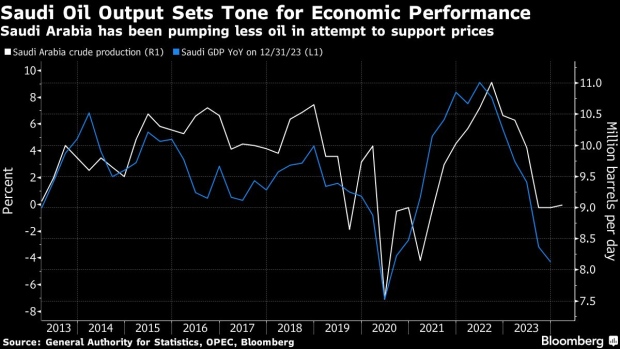

IMF Sees OPEC+ Oil Output Lift From July in Saudi Economic Boost – BNN Bloomberg

(Bloomberg) — The International Monetary Fund expects OPEC and its partners to start increasing oil output gradually from July, a transition that’s set to catapult Saudi Arabia back into the ranks of the world’s fastest-growing economies next year.

“We are assuming the full reversal of cuts is happening at the beginning of 2025,” Amine Mati, the lender’s mission chief to the kingdom, said in an interview in Washington, where the IMF and the World Bank are holding their spring meetings.

The view explains why the IMF is turning more upbeat on Saudi Arabia, whose economy contracted last year as it led the OPEC+ alliance alongside Russia in production cuts that squeezed supplies and pushed up crude prices. In 2022, record crude output propelled Saudi Arabia to the fastest expansion in the Group of 20.

Under the latest outlook unveiled this week, the IMF improved next year’s growth estimate for the world’s biggest crude exporter from 5.5% to 6% — second only to India among major economies in an upswing that would be among the kingdom’s fastest spurts over the past decade.

The fund projects Saudi oil output will reach 10 million barrels per day in early 2025, from what’s now a near three-year low of 9 million barrels. Saudi Arabia says its production capacity is around 12 million barrels a day and it’s rarely pumped as low as today’s levels in the past decade.

Mati said the IMF slightly lowered its forecast for Saudi economic growth this year to 2.6% from 2.7% based on actual figures for 2023 and the extension of production curbs to June. Bloomberg Economics predicts an expansion of 1.1% in 2024 and assumes the output cuts will stay until the end of this year.

Worsening hostilities in the Middle East provide the backdrop to a possible policy shift after oil prices topped $90 a barrel for the first time in months. The Organization of Petroleum Exporting Countries and its allies will gather on June 1 and some analysts expect the group may start to unwind the curbs.

After sacrificing sales volumes to support the oil market, Saudi Arabia may instead opt to pump more as it faces years of fiscal deficits and with crude prices still below what it needs to balance the budget.

Saudi Arabia is spending hundreds of billions of dollars to diversify an economy that still relies on oil and its close derivatives — petrochemicals and plastics — for more than 90% of its exports.

Restrictive US monetary policy won’t necessarily be a drag on Saudi Arabia, which usually moves in lockstep with the Federal Reserve to protect its currency peg to the dollar.

Mati sees a “negligible” impact from potentially slower interest-rate cuts by the Fed, given the structure of the Saudi banks’ balance sheets and the plentiful liquidity in the kingdom thanks to elevated oil prices.

The IMF also expects the “non-oil sector growth momentum to remain strong” for at least the next couple of years, Mati said, driven by the kingdom’s plans to develop industries from manufacturing to logistics.

The kingdom “has undertaken many transformative reforms and is doing a lot of the right actions in terms of the regulatory environment,” Mati said. “But I think it takes time for some of those reforms to materialize.”

©2024 Bloomberg L.P.

Economy

IMF Boss Says ‘All Eyes’ on US Amid Risks to Global Economy – BNN Bloomberg

(Bloomberg) — The head of the International Monetary Fund warned the US that the global economy is closely watching interest rates and industrial policies given the potential spillovers from the world’s biggest economy and reserve currency.

“All eyes are on the US,” Kristalina Georgieva said in an interview on Bloomberg’s Surveillance on Thursday.

The two biggest issues, she said, are “what is going to happen with inflation and interest rates” and “how is the US going to navigate this world of more intrusive government policies.”

The sustained strength of the US dollar is “concerning” for other currencies, particularly the lack of clarity on how long that may last.

“That’s what I hear from countries,” said the leader of the fund, which has about 190 members. “How long will the Fed be stuck with higher interest rates?”

Georgieva was speaking on the sidelines of the IMF and World Bank’s spring meetings in Washington, where policymakers have been debating the impacts of Washington and Beijing’s policies and their geopolitical rivalry.

Read More: A Resilient Global Economy Masks Growing Debt and Inequality

Georgieva said the IMF is optimistic that the conditions will be right for the Federal Reserve to start cutting rates this year.

“The Fed is not yet prepared, and rightly so, to cut,” she said. “How fast? I don’t think we should gear up for a rapid decline in interest rates.”

The IMF chief also repeated her concerns about China devoting too much capital and labor toward export-oriented manufacturing, causing other countries, including the US, to retaliate with protectionist policies.

China Overcapacity

“If China builds overcapacity and pushes exports that create reciprocity of action, then we are in a world of more fragmentation not less, and that ultimately is not good for China,” Georgieva said.

“What I want to see China doing is get serious about reforms, get serious about demand and consumption,” she added.

A number of countries have recently criticized China for what they see as excessive state subsidies for manufacturers, particularly in clean energy sectors, that might flood global markets with cheap goods and threaten competing firms.

US Treasury Secretary Janet Yellen hammered at the theme during a recent trip to China, repeatedly calling on Beijing to shift its economic policy toward stimulating domestic demand.

Chinese officials have acknowledged the risk of overcapacity in some areas, but have largely portrayed the criticism as overblown and hypocritical, coming from countries that are also ramping up clean energy subsidies.

(Updates with additional Georgieva comments from eighth paragraph.)

©2024 Bloomberg L.P.

-

Investment22 hours ago

Investment22 hours agoUK Mulls New Curbs on Outbound Investment Over Security Risks – BNN Bloomberg

-

Media1 hour ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Sports21 hours ago

Sports21 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Business19 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Media3 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Art19 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist

-

Investment19 hours ago

Investment19 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Tech22 hours ago

Tech22 hours agoSave $700 Off This 4K Projector at Amazon While You Still Can – CNET