TORONTO — Canadian households and the overall economy have proven surprisingly resilient in the face of rising interest rates, said senior economists from the big banks, which could complicate the fight against inflation.

Economy

Resilient economy may muddle inflation fight, recession still expected: economists

|

|

Porter said however that history shows a recession has been unavoidable after rates rise this fast, and that the resilience could make for a tougher fight ahead against inflation.

“The reality is if the economy remains too strong, then rates will go even higher.”

While there is the risk of needing higher rates to cool the economy, there is the potential for the resilience shown so far to lead to the gentle cooling that policymakers are attempting, said Scotiabank chief economist Jean-Francois Perrault.

“We have about 100,000 job losses occurring this year, which will not be mild or that 100,000 and their family, if it occurs. However, that is a third of what would normally occur in a recession.”

There’s still a lot of pain to come

Craig Wright

RBC chief economist Craig Wright said the bank is sticking to its forecast of a recession that it’s been predicting since last July, as a number of long-term tailwinds including free trade, cheap credit and low-cost labour, reverse.

Wright however expects the slowdown, purposefully imposed through interest rates, will do its job and have inflation back to the Bank of Canada’s target range of one to three per cent by the end of the year.

Others aren’t so confident inflation will be able to come down so quickly, with Porter noting that underlying inflation, which strips out some volatile prices like energy, looks to be settling in at around five per cent and it will be tough to get that down as expectations shift.

Overall, it will be some time before economists know how well the sharp rise in interest rates are working, and how it will play out in households and the overall economy.

“Monetary policy takes a long time to have an impact,” said Perrault. “You increase it a lot, and then you got to wait to see if it works or not. And that’s the challenge that we have, and they have.”

Economy

Nigeria’s Economy, Once Africa’s Biggest, Slips to Fourth Place – BNN Bloomberg

(Bloomberg) — Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Africa’s most industrialized nation will remain the continent’s largest economy until Egypt reclaims the mantle in 2027, while Nigeria is expected to remain in fourth place for years to come, the data released this week shows.

Nigeria and Egypt’s fortunes have dimmed as they deal with high inflation and a plunge in their currencies.

Bola Tinubu has announced significant policy reforms since he became Nigeria’s president at the end of May 2023, including allowing the currency to float more freely, scrapping costly energy and gasoline subsidies and taking steps to address dollar shortages. Despite a recent rebound, the naira is still 50% weaker against the greenback than what it was prior to him taking office after two currency devaluations.

Read More: Why Nigeria’s Currency Rebounded and What It Means: QuickTake

Egypt, one of the emerging world’s most-indebted countries and the IMF’s second-biggest borrower after Argentina, has also allowed its currency to float, triggering an almost 40% plunge in the pound’s value against the dollar last month to attract investment.

The IMF had been calling for a flexible currency regime for many months and the multilateral lender rewarded Egypt’s government by almost tripling the size of a loan program first approved in 2022 to $8 billion. This was a catalyst for a further influx of around $14 billion in financial support from the European Union and the World Bank.

Read More: Egypt Avoided an Economic Meltdown. What Next?: QuickTake

Unlike Nigeria’s naira and Egypt’s pound, the value of South Africa’s rand has long been set in the financial markets and it has lost about 4% of its value against the dollar this year. Its economy is expected to benefit from improvements to its energy supply and plans to tackle logistic bottlenecks.

Algeria, an OPEC+ member has been benefiting from high oil and gas prices caused first by Russia’s invasion of Ukraine and now tensions in the Middle East. It stepped in to ease some of Europe’s gas woes after Russia curtailed supplies amid its war in Ukraine.

©2024 Bloomberg L.P.

Economy

Limiting Global Warming to 1.5C Would Avoid Two-Thirds of Economic Toll – Bloomberg

Climate inaction will depress the world’s economy more than previously estimated, according to a new study that takes into account the impacts of weather extremes and variability such as temperature spikes and intense rainfall.

A scenario in which global temperatures rise 3C on average will reduce the world’s gross domestic product by about 10%, doctoral researcher Paul Waidelich of ETH Zurich and colleagues write, with less developed countries paying the worst toll. By comparison, limiting global warming by 2050 to 1.5C — as sought by the Paris Agreement — will reduce that impact by about two-thirds.

Economy

PM: Millennials and Gen Z drive Canadian economy – CTV News Montreal

[unable to retrieve full-text content]

- PM: Millennials and Gen Z drive Canadian economy CTV News Montreal

- Canada’s budget 2024 and what it means for the economy Financial Post

- Federal budget is about ensuring fair economy for ‘everyone’: Trudeau Global News

-

Tech18 hours ago

Tech18 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Science23 hours ago

Science23 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

Investment23 hours ago

Investment23 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth

-

News19 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Science22 hours ago

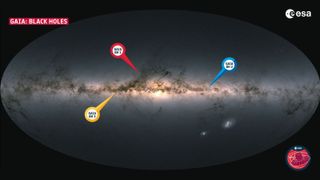

Science22 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Politics22 hours ago

Politics22 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health13 hours ago

Health13 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech20 hours ago

Tech20 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca