Investment

Rich Chinese step up hunt for foreign investment bets to mitigate risks at home

|

|

HONG KONG, Dec 19 (Reuters) – Wealthy Chinese individuals are paring holdings of local securities and are increasingly looking at assets in the United States and elsewhere overseas – a trend that is set to gather pace in 2023, fund managers and industry sources said.

Hit hard by losses this year, rich Chinese have become more concerned by the uncertain outlook for a domestic economy grappling with COVID disruptions as well as the geopolitical impact of Russia’s invasion of Ukraine on China, they said.

Underlining the bleak return prospects at home, hedge funds with Greater China strategies have lost 12.9% for the year to end-November – on track for their worst year since 2011, according to Eurekahedge data.

Rich Chinese are also fretting about Xi Jinping’s “common prosperity” drive to reduce income inequality, asset managers said, adding that they are looking at overseas private equity and property investment opportunities in countries like the United States and Japan.

Although investing outside of mainland China is not a new development, a significant chunk of that wealth has usually been invested in Chinese assets such as Chinese securities listed in the offshore markets.

“Previously, the wealth creation for these people was not (about) buying American stocks, or buying American real estate…it is starting to change,” said Jason Hsu, founder and chairman of Rayliant Global Advisors.

The Boston-based asset manager has been receiving many queries from Greater China family offices to learn about U.S. economic policies and investment rules, he said.

One Hong Kong-based portfolio manager for a family office that has more than $1 billion in assets told Reuters he slashed his portfolio’s exposure to Chinese assets to a third from the 80% he had at the end of last year and is looking to further trim that exposure.

The portfolio manager, who asked that he and his firm not be identified as the issue is sensitive, has instead increased investment in overseas energy and property sectors – particularly in Japan and the United States – as well as in venture capital.

A managing partner at a separate Chinese family office with more than $1 billion under management said his firm was spending “a significant amount of time” studying money managers and investment opportunities in Japan and the United States, while also keeping an eye out for opportunities tied to China’s reopening.

OFFSHORE EXPOSURE

Underscoring the heightened interest, the U.S. consulate in Hong Kong held two virtual meetings in October and November to connect family offices based in Greater China with U.S. money managers, according to an email reviewed by Reuters and two sources familiar with the matter.

In one of the meetings held last month, Greenlight Capital president David Einhorn, who made his name by shorting Lehman Brothers, and Ken Goldman, who runs the family office of former Google CEO Eric Schmidt, were invited.

The two sources declined to be named as they were not authorised to speak to the media.

The U.S. consulate told Reuters that it frequently explains investment and economic trends in the United States to a wide variety of audiences. Goldman said he attended the session while Einhorn did not respond to Reuters queries.

Wealthy Chinese might have made a lot of money from their home market in the past few years but now they find this does not always work, said Eva Lee, head of Greater China equities at UBS Global Wealth Management Chief Investment Office.

“Investors have learned a lesson this year, they realised diversification is just so important,” she added.

Our Standards: The Thomson Reuters Trust Principles.

Investment

Here's How Much a $1000 Investment in Micron Made 10 Years Ago Would Be Worth Today – Yahoo Finance

How much a stock’s price changes over time is important for most investors, since price performance can both impact your investment portfolio and help you compare investment results across sectors and industries.

The fear of missing out, or FOMO, also plays a factor in investing, especially with particular tech giants, as well as popular consumer-facing stocks.

What if you’d invested in Micron (MU) ten years ago? It may not have been easy to hold on to MU for all that time, but if you did, how much would your investment be worth today?

Micron’s Business In-Depth

With that in mind, let’s take a look at Micron’s main business drivers.

Idaho-based Micron Technology has established itself as one of the leading worldwide providers of semiconductor memory solutions.

Through global brands, namely Micron, Crucial and Ballistix, Micron manufactures and markets high-performance memory and storage technologies including Dynamic Random Access Memory (DRAM), NAND flash memory, NOR Flash, 3D XPoint memory and other technologies. Its solutions are used in leading-edge computing, consumer, networking and mobile products.

A major portion of the revenues is derived from DRAM sales. The company’s mission is to be the most efficient and innovative global provider of semiconductor memory solutions.

Micron reported revenues of $15.54 billion in fiscal 2023. The company has four reportable segments:

Compute and Networking Business Unit (CNBU): The unit comprises of DRAM and NOR Flash products that are sold to the computer, networking, graphics, and cloud server markets, and NAND Flash products which are sold into the networking market. CNBU delivered revenues of $5.71 billion (37% of total revenues) in fiscal 2023.

Mobile Business Unit (MBU): The unit comprises Micron’s discrete DRAM, discrete NAND and managed NAND (including eMMC and universal flash storage (UFS) solutions) products that are sold to smartphone and other mobile-device markets. MBU generated revenues of $3.63 billion (23%) in fiscal 2023.

Storage Business Unit (SBU): The unit accounts for solid state drives (SSDs) and component-level solutions sold into enterprise and cloud, client and consumer storage markets as well as other discrete storage products sold in component and wafer forms to the removable storage markets. SBU’s revenues grossed $2.55 billion (16%) in fiscal 2023.

Embedded Business Unit (EBU): The unit includes Micron’s discrete DRAM, discrete NAND, managed NAND and NOR products, which are sold to the automotive, industrial and consumer markets. EBU’s revenues logged $3.64 billion (24%) in fiscal 2023.

The company struggles with intense competition from Intel, Samsung Electronics, SK Hynix, Toshiba Memory and Western Digital Corporation.

Bottom Line

While anyone can invest, building a lucrative investment portfolio takes research, patience, and a little bit of risk. If you had invested in Micron ten years ago, you’re probably feeling pretty good about your investment today.

According to our calculations, a $1000 investment made in April 2014 would be worth $5,416.81, or a gain of 441.68%, as of April 17, 2024, and this return excludes dividends but includes price increases.

The S&P 500 rose 171.24% and the price of gold increased 76.28% over the same time frame in comparison.

Looking ahead, analysts are expecting more upside for MU.

Micron’s better-than-expected second-quarter performance reflects gains from improved market conditions, strong sales executions and double-digit growth across multiple business units. The positive impact of inventory improvement in the data center, as well as stabilization in other markets, such as automotive, industrial and others, have also contributed to its results. It anticipates the pricing of Dynamic Random Access Memory (DRAM) and NAND chips will keep increasing next year, hence improving its revenues. The pricing benefits will primarily be driven by rising AI server causing a scarcity in the availability of cutting-edge DRAM and NAND supply. The 5G adoption in the Internet of Things devices and wireless infrastructure is likely to spur demand for memory and storage.

Over the past four weeks, shares have rallied 29.54%, and there have been 7 higher earnings estimate revisions in the past two months for fiscal 2024 compared to none lower. The consensus estimate has moved up as well.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Investment

UK Mulls New Curbs on Outbound Investment Over Security Risks – BNN Bloomberg

(Bloomberg) — The UK is considering new curbs on outward investment in emerging technologies such as artificial intelligence and semiconductors, citing the potential security risks of aiding hostile states such as Russia and China.

Britain’s deputy prime minister Oliver Dowden, who oversees the UK’s investment regime, said he’s planning to work with other Group of Seven nations to assess the risks and consider whether to introduce extra restrictions.

The government’s concern is that some outbound investments may be used to “facilitate and support and aid strategic uplift of adversaries,” Dowden said in an interview, citing areas such as semi-conductor manufacturing, cryogenic equipment and facial recognition technology. Nevertheless, “there’s a high bar for the imposition of any form of restrictions,” he said.

The UK’s focus on the issue follows President Joe Biden’s order last year to limit US investment in some Chinese advanced technology companies, as Western nations try to strike a balance between protecting national security while encouraging free trade and innovation. Dowden said he will also review Britain’s approach to export controls and clarify the circumstances in which the government would review inward investment in sensitive sectors like critical minerals and semiconductors.

Read More: UK Weighs Measures to Crimp Investment in China After Biden

“The risk landscape is increasing all the time,” Dowden said, referring to Russia’s invasion of Ukraine, Chinese aggression in the South China Sea and the threat of ransomware attacks. “We are in a state of cyber and economic contestation with an increasing range of state and non-state actors.”

The move by Biden last year regulated US investments in some Chinese semiconductor, quantum computing and AI firms, and the British government said at the time that it would consider its own next steps.

Yet whether the Conservative Party will be in power to see through changes in this area is far from certain, given the opposition Labour Party’s commanding poll lead ahead of a general election that must be called by January 2025 at the latest.

©2024 Bloomberg L.P.

Investment

Sylvia Jones makes announcement in Muncey | CTV News – CTV News London

An investment has been announced to help connect over 23,000 people to primary care teams in the region.

Speaking in Muncey on Thursday, Ontario Health Minister Sylvia Jones said $6.4-million will help people in London, Lambton and Chathamk-Kent.

The money, part of a bigger $110-million investment will support seven new and expanded interprofessional primary care initiatives that will connect over 23,000 Ontarians to primary care teams and provide services.

Services include

- New mobile services for an Indigenous Primary Health Care Organization that will support First Nations, Inuit and Metis community members in Middlesex County.

- A new mobile bus to connect Indigenous people in rural and urban areas of Lambton-Kent-Middlesex with Indigenous led, culturally relevant primary care services in person and virtually.

- A new Family Health Team for London and the surrounding area, that will expand services through additional Community Hub locations throughout the area. By meeting people where they are, and reducing other barriers, this program will help connect people experiencing homelessness or at risk of homelessness with primary care providers that are trauma and violence informed.

- An expanded Family Health Team in Elgin County that will partner with another Family Health Team and Community Health Centre to increase the number of people who can connect to team-based primary care services.

- A new rural site along with expanded capacity at an urban clinic in Lambton County, focused on connecting isolated seniors, socioeconomically disadvantaged and vulnerable people, newcomers, and refugees to primary care.

- New mobile primary care services in Chatham-Kent, including clinics for respiratory and diabetes management, cancer screening and traditional healers to help provide culturally appropriate care.

- Primary care service expansion in Tillsonburg to connect vulnerable and medically complex community members to comprehensive, convenient and connected primary care closer to home.

-

Tech19 hours ago

Tech19 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

News21 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Politics24 hours ago

Politics24 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health15 hours ago

Health15 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech21 hours ago

Tech21 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca

-

Science24 hours ago

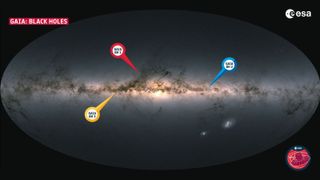

Science24 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

News14 hours ago

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

-

Tech20 hours ago

Nintendo Indie World Showcase April 2024 – Every Announcement, Game Reveal & Trailer – Nintendo Life