Investment

Saudi Arabian Public Investment Fund says assets surpasses 2.23 trillion riyals in 2022 – Reuters

DUBAI, Aug 6 (Reuters) – Saudi Arabia’s Public Investment Fund on Sunday released its annual report for 2022, which said its assets under management (AUM) surpassed 2.23 trillion riyals ($594.43 billion).

The kingdom’s sovereign wealth fund reported an AUM of 1.98 trillion riyals for 2021.

The PIF said it generated a total shareholders’ return of 8% and established 25 companies in 2022, and locally deployed 120 billion riyals in that year in strategic sectors.

The PIF said 23% of its AUM were international investments, while 68% were local investments and the remainder were treasury.

The fund said 17% of its assets were externally managed, while 83% were internally managed.

PIF is the chosen vehicle of Crown Prince Mohammed bin Salman, the kingdom’s de facto ruler, to drive an economic agenda aimed at cutting reliance on oil.

PIF said the ongoing expansion of its three subsidiary offices in London, New York and Hong Kong would support the fund’s continued growth and “positioning PIF as the partner of choice for global investors”.

Its sources of funding come from retained earnings from investments, capital injections from the government, government assets transferred to the fund and loans and debt instruments.

The fund raised $5.5 billion in February from a green bond sale, following its inaugural green bond that raised $3 billion in October.

In addition, it obtained a $17 billion loan in November from a group of 25 banks that will partly refinance a loan it took out in 2018.

The crown prince in February last year announced the transfer of 4% of shares in Saudi Aramco, worth $80 billion, to the PIF.

In April, there was a second transfer of 4% in Aramco shares, valued also around $80 billion, to PIF’s subsidiary Sanabil Investments.

($1 = 3.7515 riyals)

Our Standards: The Thomson Reuters Trust Principles.

Investment

The Advantages of Using Bitcoin for Online Casino Betting: Faster, Cheaper, Safer

With increased adoption of cryptocurrencies and proliferation in the online gaming industry, Bitcoin casinos are becoming increasingly common. Bitcoin, being one of the alternative currencies, may offer immense advantages in security, anonymity, and speed of every transaction, from appealing to new and seasoned players. The following article will outline the main benefits of using Bitcoin for online casino betting and will describe in detail how this cryptocurrency enhances gaming.

For those interested in exploring the benefits of Bitcoin gaming, theonlinecasinos offers a carefully curated list of reliable Bitcoin casinos. Their guide helps players find the best options available, ensuring a seamless, secure, and rewarding gaming experience.

1. Speed of Transaction

The main benefit linked to the use of Bitcoin in online casino betting is that it possesses high transaction speed. Unlike the bank transfers and card payments, which take several hours or even days, Bitcoin transactions take just minutes.

Why does this matter?

Fast transactions equal the ability for players to fund their accounts straight away with no need for confirmation. Since some gamers just want to get started immediately, or just simply cash out and go, this can come pretty in handy. While most bank transfers involve verification by means of a financial intermediary that is likely to be slow, Bitcoin involves a decentralized network of computers handling processing without any interference from an intermediary.

2. Savings on Fees

Deposits and withdrawals have made it possible for players to cut down or totally eliminate fees imposed by financial institutions through Bitcoin. Banks, credit organizations, and networks of all kinds impose a fee on any transaction, but especially international ones. Due to the fact that this is a network where users make transactions directly, the network fees for Bitcoin are minimal.

How Does This Affect Players?

The lower fees translate to savings that the player will make every time a transfer is made. There are some online casinos that absorb even this negligible Bitcoin network fee; thus, this makes deposits and withdrawals absolutely free for players. To players usually performing lots of transactions or large quantities, this difference in fees may prove critical.

3. Improved Security and Data Protection

Bitcoin uses blockchain technology, one of the most secure and transparent systems in the world. All the transactions involved in blockchain are encrypted; hence, fraud and hacking have almost nil chances of being performed. Furthermore, there is no necessity for sharing personal data while using Bitcoin for online betting as your card number or bank details will not come into play.

Anonymity and Privacy Protection

In the case of Bitcoin, players can preserve anonymity, since for a transaction, one needs only a Bitcoin address. Hence, Bitcoin casinos are true Catch-22 for those who value privacy in financial operations and want to avoid unnecessary checks from banks and other institutions.

4. Fewer Restrictions and Regulations

A lot of countries ban gambling or strictly regulate any operations including online casino transactions. This may raise serious barriers for players to access their favorite platforms or even to get accounts suspended. Bitcoin transactions do not go through the banking system and therefore are not regulated like traditional money. This means greater freedom for users.

Benefits to International Players

For players whose countries have restricted gambling, Bitcoin is an easy way around any legal restrictions. For people in countries with unfinished developed banking or those, due to which one can’t access every type of payment, Bitcoin casinos are a great way to access different kinds of bets.

5. Bonuses and Special Offers for Bitcoin Users

Most online casinos welcome the use of Bitcoin by giving bonuses for cryptocurrency choices. In many cases, higher welcome bonuses, cashback on deposits, free spins within the slot machines, and others are common.

How Does This Benefit Players?

The Bitcoin bonus can increase the player’s budget very much and bring extra value to players. Online casinos are happy to see this cryptocurrency, as it cuts some transaction processing costs for them, either. Because of that, promotion activities targeting depositors and withdrawers of Bitcoins can be regularly found.

6. Bitcoin for Gaming Bankroll Management

Being a cryptocurrency, Bitcoin allows players to have flexible banking of their bankroll. Many users keep their winnings in the form of Bitcoins, since it can surge in price. This adds the opportunity to earn extra income from its volatility when Bitcoin prices surge upwards.

Example of Bankroll Management

Using Bitcoin Many players keep their winnings in Bitcoin, due to the fact that its price might go up. In this case, casino winnings create passive income. But one should keep in mind that Bitcoin’s price also goes down, so this strategy is to be used with care.

Investment

Trade-X reviews: peculiarities of transactions on trading platform

Financial independence is an important component of success. To avoid wasting everything, you need to be able to save and invest. Thanks to this, it will be possible to create a financial cushion. You can get additional income with the help of brokers. Every adult can register on the Trade-X website and start trading activity. The latter is based on the conclusion of transactions for the purchase and sale of material values, currency, contacts and shares of well-known companies. As reviews show, the broker sets a minimum commission and charges the trader a certain amount after a successful profit. With the right approach and the ability to analyze data, the trader receives a tangible profit from his deals.

Let’s consider what the trader’s work is and read the real comments of Trade-X clients.

Recommendations and reviews about Trade-X

Choosing a source of income, many people monitor websites and look for what they write about the broker in reviews. After all, safety on the Internet, especially when entering your personal data and bank cards is very important. Newcomers who are just entering the market are especially concerned. It is known that the Trade-X company is officially registered in London and acts according to the legislation. It carries out work with an exchange expert and a hedge fund, has more than 200 assets. Trading conditions, including commissions and spreads, are transparent, which does not allow the broker to change them in its favor.

Participants of Medium, Linkedin, Reddit platforms often write good reviews that no fraudulent schemes were observed on the sites, and the support service always responded quickly to questions and any difficulties, if they arose. The broker company has an arsenal of trading tools, signals and training materials, where everyone can understand the nuances of the profession for free. The reviews also say that the terminals work well without delays, price movements are displayed on the charts. By the way, you can monitor the status of the launched order both from your computer and from your phone by installing the Trade-X broker application.

Features of cooperation with the provider of trading platforms

The provider offers trading platforms with access to many financial instruments. It is a kind of analytical center with access points to currencies.

The following are the features of operations:

- Ease of management of the personal account and the site as a whole for novice depositors and professionals.

- Analysis tools: different timeframes, indicators and analytical tools, which simplifies predicting and planning transactions.

- Minimal costs. Trade-X brokers provide competitive spreads on major assets, as well as no commissions for certain types of accounts, which can be beneficial for traders with frequent trades.

- 24/7 market access: support for 24/7 trading, especially for cryptocurrencies and some international markets.

- Margin trading and leverage: Trade-X offers leverage to help increase trade volume, although it also increases risk.

- Automation and trading robots: integration with trading robots and algorithmic systems is supported, allowing for automated trades.

- Security: state-of-the-art technology to protect funds and data, such as encryption and two-factor authentication.

- Training and support: video tutorials, personalized mentoring, group webinars, literature.

Access to the platforms is open to adults who have completed the registration and document verification process. The minimum deposit is 500 dollars. After depositing this amount, you can start investing in any asset. You can follow the course of events by connecting to mobile Internet from anywhere in the city and even in the country. They write in the reviews that it is very convenient. The international resource Trade-X operates in 197 countries, so entry is free for those wishing to invest in the most popular resources. In case of difficulties with authorization, you can use the site mirror or connect VPN services.

What to trade on Trade-X site

More than 200 assets are presented on the site. It is easy to get confused when choosing from such an arsenal. However, experienced participants of the investment market recommend choosing currency pairs. In any case, it is necessary to be aware of possible rate drops or growth. You can learn this from the news, the current chart and your observations.

The most common trading options on the Trade-X website:

- Currency pairs, which are the ratio of the prices of two currencies.

- Resources: gas, oil, ores, metals.

- Stocks: a share of ownership in a company.

- Futures: a contract on future purchase.

Trading on the stock exchange for beginners most often starts with currency pairs – they seem more familiar, clear and predictable. It is not difficult to calculate the dynamics of quotations with the large availability of tools and comprehensive assistance from the administration. Visual representation of price movements is significant for a trader, and the latest news in the world economy provides an additional stimulus for correct calculation of ask and bid.

Trade-X services have long been considered the gold standard of the industry. Since its foundation, the online broker has not stopped its development even for a day or an hour. Its services are becoming more and more technological and interesting for users. This allows to get a significant increase in the client base. Positive reviews allowed the company to stand out among other trading platforms, and assigning a personal manager to you will allow you to feel more confident if you are just at the start of trading.

Investment

Tesla shares soar more than 14% as Trump win is seen boosting Elon Musk’s electric vehicle company

NEW YORK (AP) — Shares of Tesla soared Wednesday as investors bet that the electric vehicle maker and its CEO Elon Musk will benefit from Donald Trump’s return to the White House.

Tesla stands to make significant gains under a Trump administration with the threat of diminished subsidies for alternative energy and electric vehicles doing the most harm to smaller competitors. Trump’s plans for extensive tariffs on Chinese imports make it less likely that Chinese EVs will be sold in bulk in the U.S. anytime soon.

“Tesla has the scale and scope that is unmatched,” said Wedbush analyst Dan Ives, in a note to investors. “This dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players.”

Tesla shares jumped 14.8% Wednesday while shares of rival electric vehicle makers tumbled. Nio, based in Shanghai, fell 5.3%. Shares of electric truck maker Rivian dropped 8.3% and Lucid Group fell 5.3%.

Tesla dominates sales of electric vehicles in the U.S, with 48.9% in market share through the middle of 2024, according to the U.S. Energy Information Administration.

Subsidies for clean energy are part of the Inflation Reduction Act, signed into law by President Joe Biden in 2022. It included tax credits for manufacturing, along with tax credits for consumers of electric vehicles.

Musk was one of Trump’s biggest donors, spending at least $119 million mobilizing Trump’s supporters to back the Republican nominee. He also pledged to give away $1 million a day to voters signing a petition for his political action committee.

In some ways, it has been a rocky year for Tesla, with sales and profit declining through the first half of the year. Profit did rise 17.3% in the third quarter.

The U.S. opened an investigation into the company’s “Full Self-Driving” system after reports of crashes in low-visibility conditions, including one that killed a pedestrian. The investigation covers roughly 2.4 million Teslas from the 2016 through 2024 model years.

And investors sent company shares tumbling last month after Tesla unveiled its long-awaited robotaxi at a Hollywood studio Thursday night, seeing not much progress at Tesla on autonomous vehicles while other companies have been making notable progress.

Tesla began selling the software, which is called “Full Self-Driving,” nine years ago. But there are doubts about its reliability.

The stock is now showing a 16.1% gain for the year after rising the past two days.

The Canadian Press. All rights reserved.

-

News18 hours ago

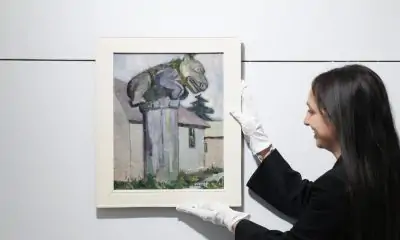

News18 hours agoEstate sale Emily Carr painting bought for US$50 nets C$290,000 at Toronto auction

-

News18 hours ago

News18 hours agoClass action lawsuit on AI-related discrimination reaches final settlement

-

News18 hours ago

News18 hours agoCanada’s Hadwin enters RSM Classic to try new swing before end of PGA Tour season

-

News19 hours ago

News19 hours agoAll premiers aligned on push for Canada to have bilateral trade deal with U.S.: Ford

-

News18 hours ago

News18 hours agoTrump nominates former congressman Pete Hoekstra as ambassador to Canada

-

News18 hours ago

News18 hours agoFormer PM Stephen Harper appointed to oversee Alberta’s $160B AIMCo fund manager

-

News18 hours ago

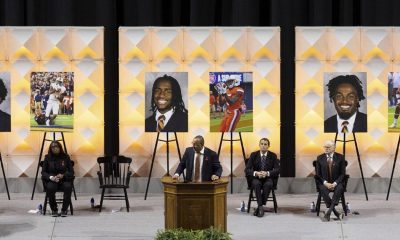

News18 hours agoEx-student pleads guilty to fatally shooting 3 University of Virginia football players in 2022

-

News18 hours ago

News18 hours agoComcast to spin off cable networks that were once the entertainment giant’s star performers