The Democrat-controlled House, which is expected to take up the legislation on Friday, August 12, must approve the bill before Biden can sign it into law.

It would raise over $700 billion in government revenue over 10 years and spend over $430 billion to reduce carbon emissions and extend subsidies for health insurance under the Affordable Care Act and use the rest of the new revenue to reduce the deficit.

Senate Democrats, with a narrow 50-seat majority, stayed unified to pass the legislation, using a special, filibuster-proof process to approve the measure without Republican votes. Final passage came after a marathon series of contentious amendment votes

known as a “vote-a-rama” that stretched nearly 16 hours from late Saturday night until Sunday afternoon.

West Virginia Democratic Sen. Joe Manchin told CNN that the legislation he helped write is “a good balanced bill.”

“I think we’ll all benefit from it; the country will,” Manchin told CNN. “We have energy security, that’s what we were looking for. And we have the ability to invest in the energy of the future.”

Biden praised the Senate for passing the bill in a statement Sunday, thanking Democrats in the chamber and touting the legislation’s climate investments and health care provisions.

“Today, Senate Democrats sided with American families over special interests, voting to lower the cost of prescription drugs, health insurance, and everyday energy costs and reduce the deficit, while making the wealthiest corporations finally pay their fair share,” Biden said.

How Senate Democrats passed the bill on a party-line vote

Senate Democrats have long hoped to pass a signature legislative package that would incorporate major agenda items for the party, but struggled for months to reach a deal that gained full support of their caucus.

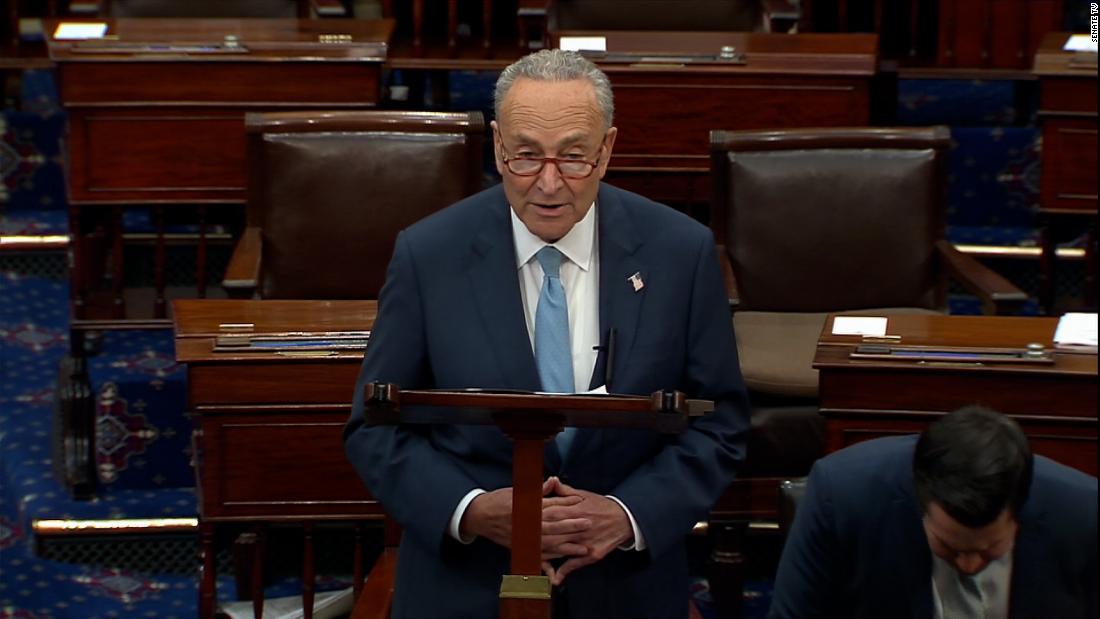

Manchin played a key role in shaping the legislation — which only moved forward after the West Virginia Democrat and Senate Majority Leader Chuck Schumer announced a deal at the end of July, a major breakthrough for Democrats after earlier negotiations had stalled out.

Arizona Sen. Kyrsten Sinema on Thursday night offered critical support after party leaders agreed to change new tax proposals, indicating she would “move forward” on the sweeping economic package.

But Sinema, Manchin and other senators worked through the weekend making crucial alterations on the bill.

To avoid a last-minute collapse of the bill on Sunday, Democrats created a plan to win over Sinema, who was concerned over the 15% corporate minimum tax’s impact on subsidiaries owned by private equity. Senate Democrats accepted a narrower tax proposal, but instead of paying for it through a change to the state and local tax (SALT) deduction, as Senate GOP Whip John Thune of South Dakota suggested, they instead extended the limitation on the amount of losses that businesses can deduct for another two years.

The change was intended to prevent House Democrats primarily from coastal districts, who have campaigned on repealing limits on the SALT deduction, from breaking from the bill, when they vote on it later this week.

After the bill’s passage in the Senate, Sinema said in a statement it would “help Arizonans build better lives for themselves and their families by lowering prices, making health care more affordable and accessible, and securing Arizona’s water and energy future,” while also “boosting innovation and spurring job creation.”

In a good sign for the bill becoming law, key House Democrats signaled later Sunday that they’ll vote for it despite previous demands over SALT.

Rep. Josh Gottheimer of New Jersey had been part of the “No SALT, no deal” caucus. But he said the bill passes his test because it doesn’t raise individual income tax rates.

Rep. Mikie Sherrill of New Jersey, another member of that caucus, echoed his sentiment: “I will also remain steadfast in my commitment to ensuring that any discussion of reforms to the 2017 tax law begins with addressing SALT. Because this legislation does not raise taxes on families in my district, but in fact significantly lowers their costs, I will be voting for it.”

Republicans used the weekend “vote-a-rama” to put Democrats on the spot and force politically tough votes. They were also successful in removing a key insulin provision to cap the price of insulin to $35 per month on the private insurance market, which the Senate parliamentarian ruled was not compliant with the Senate’s reconciliation rules. The $35 insulin cap for Medicare beneficiaries remains in place.

Senate Minority Leader Mitch McConnell said in a statement that the bill included “giant job-killing tax hikes” and amounted to “a war on American fossil fuel.” The Kentucky Republican said Democrats “do not care about middle-class families’ priorities.”

“And their response to the runaway inflation they’ve created is a bill that experts say will not meaningfully cut inflation at all,” said McConnell. “The American people are clear about their priorities. Environmental regulation is a 3% issue. Americans want solutions for inflation, crime, and the border.”

How the bill addresses the climate crisis

While

economists disagree over whether the

package would, in fact, live up to its name and reduce inflation, particularly in the short term, the bill would have a crucial impact on reducing carbon emissions.

The nearly $370 billion clean energy and climate package is the largest climate investment in US history, and the biggest victory for the environmental movement since the landmark Clean Air Act. It also comes at a critical time; this summer has seen punishing heat waves and deadly floods across the country, which scientists say are both linked to a warming planet.

Analysis from Senate Majority Leader Chuck Schumer’s office — as well as multiple independent analyses — suggests the measure would reduce US carbon emissions by up to 40% by 2030. Strong climate regulations from the Biden administration and action from states would be needed to get to President Joe Biden’s goal of cutting emissions 50% by 2030.

The bill also contains many tax incentives meant to bring down the cost of electricity with more renewables, and spur more American consumers to switch to electricity to power their homes and vehicles.

Lawmakers said the bill represents a monumental victory and is also just the start of what’s needed to combat the climate crisis.

“This isn’t about the laws of politics, this is about the laws of physics,” Democratic Sen. Brian Schatz of Hawaii told CNN. “We all knew coming into this effort that we had to do what the science tells us what we need to do.”

Key health care and tax policy in the bill

The bill would empower Medicare to negotiate prices of certain costly medications administered in doctors’ offices or purchased at the pharmacy. The Health and Human Services secretary would negotiate the prices of 10 drugs in 2026, and another 15 drugs in 2027 and again in 2028. The number would rise to 20 drugs a year for 2029 and beyond.

This controversial provision is far more limited than the one House Democratic leaders have backed in the past. But it would open the door to fulfilling a longstanding party goal of allowing Medicare to use its heft to lower drug costs.

Democrats are also planning to extend the enhanced federal premium subsidies for Obamacare coverage through 2025, a year later than lawmakers recently discussed. That way, they wouldn’t expire just after the 2024 presidential election.

To boost revenue, the bill would impose a 15% minimum tax on the income large corporations report to shareholders, known as book income, as opposed to the Internal Revenue Service. The measure, which would raise $258 billion over a decade, would apply to companies with profits over $1 billion.

Concerned about how this provision would affect certain businesses, particularly manufacturers, Sinema has suggested that she won changes to the Democrats’ plan to pare back how companies can deduct depreciated assets from their taxes. The details remain unclear.

However, Sinema nixed her party’s effort to tighten the carried interest loophole, which allows investment managers to treat much of their compensation as capital gains and pay a 20% long-term capital gains tax rate instead of income tax rates of up to 37%.

The provision would have lengthened the amount of time investment managers’ profit interest must be held from three years to five years to take advantage of the lower tax rate. Addressing this loophole, which would have raised $14 billion over a decade, had been a longtime goal of congressional Democrats.

In its place, a 1% excise tax on companies’ stock buybacks was added, raising another $74 billion, according to a Democratic aide.

This story and headline have been updated with additional developments.

CNN’s Ella Nilsen, Tami Luhby, Katie Lobosco, Matt Egan and Kristin Wilson contributed to this report.