Investment

Takeaways from our 2021 investment outlook: Legacy of the lockdowns – Investors' Corner BNP Paribas

Here we summarise the big picture for investors at the end of 2020. This constitutes the starting point for our 2021 investment outlook.

- Since the 2008 global financial crisis, the global economy has been mired in anaemic growth and weak demand, tempered by consistently rising asset prices.

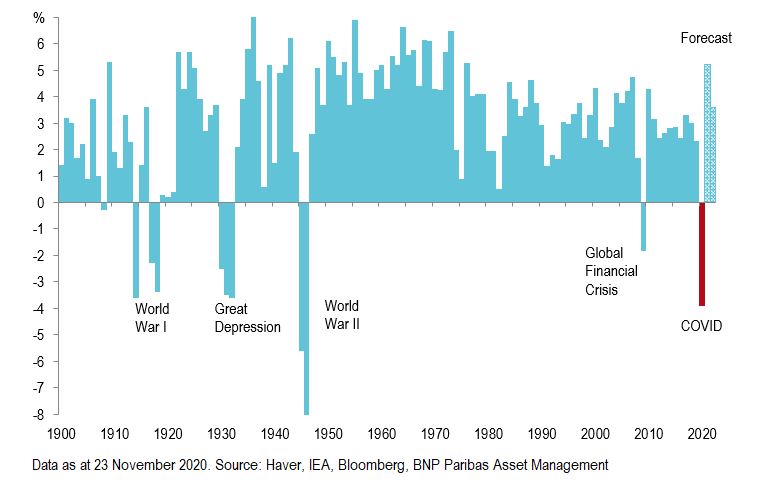

- In 2020 the global economy faced a crisis of unprecedented magnitude (see Exhibit 1 below) after the pandemic lockdowns. After a contraction of 4.4% in 2020 the IMF forecasts global growth of 5.4% in 2021. Overall, this would leave 2021 GDP some 6.5% lower than in the pre-COVID-19 projections of January 2020. The adverse impact on low-income households is particularly acute, imperilling the significant progress made in reducing extreme poverty over the last 30 years. Countering inequality is a key challenge to be met in 2021 and beyond.

Exhibit 1: Largest decline since WWII – graph shows change in world gross domestic product (inflation-adjusted, in %)

Source: BNP Paribas Asset Management, as of 26/11/2020

- Under the best-case scenario, one or more vaccines for COVID-19 become widely available by the second half of 2021. Otherwise, the disease remains a longer-term threat requiring us to ‘live with’ the virus – repeated lockdowns will not be a sustainable long-term strategy.

- In 2020, advanced economies loosened the monetary and fiscal reins most spectacularly. Debt-to-GDP ratios soared, rising for many countries by more than they did in the years after the Global Financial Crisis (GFC). Major central banks have largely financed the increase in budget deficits, monetising an expanding national debt, much as Japan has done.

- One way to understand the weakness in aggregate economic demand is to study real interest rates (the ‘price’ of money in the economy). In 2006, the real yield of the 10-year inflation-protected US Treasury bond was between 2% and 3%. Since 2010, its yield has mostly been below 1%, including a spell in negative territory both in 2012 and again in 2020. Negative real yields are now common to the G3 economies (see Exhibit 2 below) and beyond. In 60% of the global economy — including 97% of advanced economies — central banks have pushed policy interest rates to below 1%. In one-fifth of the world, policy rates are negative.

Exhibit 2: Real yields are now negative for G3 sovereign debt – graph shows changes in real yields for US, Japanese and eurozone government debt between 1997 and 16/11/2020.

Source: BNP Paribas Asset Management, as of 26/11/2020

- In 2020, these meagre interest rates, along with cheap, low-risk liquidity from central banks, led asset prices higher. Risk premia for risky assets shrank. Companies whose revenues have plummeted — cruise lines, airlines, cinemas — were able to borrow money in 2020 to survive. Investors had few higher-yield options. Will central banks continue to supply such liquidity in 2021?

- And how is all this debt to be paid for? The appropriate historical parallel is perhaps the post-World War II period, when central banks capped bond yields at levels well below the trend GDP growth rate to gradually reduce the national debt as a proportion of GDP.

- Alternatively, instead of financial repression and inflation (as post WW2), the extraordinarily low real interest rates we have seen over the past decade could help achieve fiscal sustainability. It would, however, be imprudent to count on it. No policymaker should expect real interest rates to remain persistently below the growth rate of real GDP. Indeed, forecast imbalances in planned global savings and investment could drive real interest rates higher (ageing societies save a lot, but old societies do not).

- Another risk is that improved real trend growth does not come to the rescue. Lower global growth after the pandemic accompanied by inadequate fiscal stimulus would leave marginal sections of the economy vulnerable to collapse. Such an outcome would test the paradigm of modest growth, low inflation and supportive central bank policy that has supported asset prices since 2008.

Today we face three interconnected crises – health, economic and climate. The instability provoked by the pandemic presents a window of opportunity to pivot in a new direction. Long-term environmental viability, equality and inclusive growth are essential pre-conditions to a sustainable economy. By taking a holistic, systemic, long-term view, we are less likely to be surprised by crises and better able to manage them.

For in-depth insights into what’s next for the global economy and markets, read our 2021 investment outlook, ‘Legacy of the lockdowns’

Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. The views expressed in this podcast do not in any way constitute investment advice.

The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions).

Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.

Source link

Investment

MOF: Govt to establish high-level facilitation platform to oversee potential, approved strategic investments

|

|

KUALA LUMPUR: A meeting with 70 financial fund investors and corporate members at the recently concluded Joint Investors Meeting in London has touched on the MADANI government’s immediate action to stimulate strategic investment in important technologies, according to the Ministry of Finance (MoF).

In a statement today, it said that the government is serious about making investments a national agenda through the establishment of a high-level investment facilitation platform to ensure the implementation of potential and approved strategic investments through a “Whole of Government” approach.

Minister of Finance II Datuk Seri Amir Hamzah Azizan (pix), who led the Malaysian delegation to the Joint Investors Meeting from April 20 to 22, said that the National Investment Council (MPN) chaired by the Prime Minister is an integrated action that reflects how serious the government is in making Malaysia an investment hub in the region.

Among the immediate actions taken by the government is establishing the National Semiconductor Strategic Committee (NSSTF) to facilitate cooperation between the government, industry players, universities, and relevant stakeholders to place the Malaysian semiconductor industry at the forefront and ensure the continued growth of the electronics & electrical industry, especially the semiconductor sector, as a major contributor to the Malaysian economy.

The government also aims to empower Malaysia as a preferred green investment destination as well as remove barriers and bureaucracy in the provision and accessibility to renewable energy, especially for the new technology industry, including data centres, said Amir Hamzah.

He also said that the country’s investment prospects have reached an extraordinary level, with approved investments surging to RM329.5 billion in 2023 from RM268 billion in 2022.

He said about 74 per cent of manufacturing projects approved between 2021 and 2023 have been completed or are in process.

In addition, Amir Hamzah said the greater initial stage construction work completed in 2023 (RM31.5 billion) and 2022 (RM26.3 billion) shows a positive trend for future investment opportunities.

“From a total of 5,101 investment projects approved in 2023, as many as 81.2 per cent or 4,143 projects are in the services sector, 883 projects in the manufacturing sector, and 75 projects in other related sectors,” he said.

Before this, Amir Hamzah met with international investors in New York and Washington to clarify the direction of the implementation of the MADANI Economic framework to improve investors’ confidence in Malaysia’s economic level and strengthen the perception and investment sentiment of foreign investors towards the country.

Investment

Want $1 Million in Retirement? Invest $15000 in These 3 Stocks

|

|

Compound interest is a thing of magic. It’s also one of your best bets if you’re looking to retire rich.

It might take time and patience but there’s not a whole lot of heavy lifting when it comes to a buy-and-hold investment strategy. What matters most is having decades of time in front of you, which will allow you to maximize the benefits of compounded returns. And, of course, choosing the right investments is equally important.

The magic of compound interest

With a decent return, building a million-dollar portfolio might not be as hard as you think. An initial investment of $15,000, returning 15% annually, would be worth just shy of $1 million in 30 years.

First off, 30 years is a long time, which means you’ll need to be planning your retirement far in advance. However, all it takes is one initial investment of $15,000 and the right stocks to build a $1 million portfolio.

Additionally, it’s important to remain realistic and acknowledge that a stock returning 15% annually is not exactly common. That being said, the TSX certainly has its share of dependable companies with track records of returning far more than just 15% per year.

I’ve put together a list of three Canadian stocks that are perfect for hands-off investors who are looking to retire rich.

Constellation Software

It will require a steep initial investment, but Constellation Software (TSX:CSU) is well worth its nearly $4,000-a-share price tag. When it comes to market-crushing returns, the tech stock has been in a league of its own over the past two decades.

Even as the company is now valued at a massive market cap of close to $80 billion, the impressive returns have continued. Shares are up more than 200% over the past five years. That’s good enough for a compound annual growth rate (CAGR) of 25%.

At a 25% annual return, a $15,000 investment would be worth a whopping $12 million in 30 years.

Descartes Systems

Descartes Systems (TSX:DSG) is another tech stock that’s no stranger to delivering market-beating returns. The company is also only valued at a market cap of $10 billion, leaving plenty of room for growth in the coming decades.

There’s a reason why Descartes Systems is one of the few tech stocks trading near all-time highs today. This stock is a proven winner, with lots of growth left in the tank.

Over the past five years, the stock has had a CAGR just shy of 20%.

goeasy

The last pick on my list is a beaten-down growth stock that’s trading at a serious discount.

The consumer-facing financial services provider has been hit by short-term headwinds from sky-high interest rates. With potential rate cuts around the corner though, now could be an excellent time to be loading up on goeasy (TSX:GSY).

Even with shares down 25% from all-time highs, the stock is still nearing a return of 300% over the past five years.

goeasy was crushing the market’s returns before the recent spike in interest rates, and there’s no reason to believe why the company won’t continue to do so for years to come.

Investment

FLAGSHIP COMMUNITIES REAL ESTATE INVESTMENT TRUST ANNOUNCES CLOSING OF APPROXIMATELY US

|

|

TORONTO, April 24, 2024 /CNW/ – Flagship Communities Real Estate Investment Trust (the “REIT” or “Flagship“) (TSX: MHC.U) (TSX: MHC.UN) announced today that it has completed its previously announced public offering (the “Offering“) of 3,910,000 trust units (the “Units“) on a bought deal basis at a price of US$15.35 per Unit for total gross proceeds to the REIT of approximately US$60 million.

The Offering was completed through a syndicate of underwriters co-led by BMO Capital Markets and Canaccord Genuity Corp.

The REIT intends to use the net proceeds from the Offering to fund a portion of the approximately US$93 million aggregate purchase price for the REIT’s previously announced acquisition of seven manufactured housing communities comprising 1,253 lots (the “Acquisitions“) and for general business purposes. In the event the REIT is unable to consummate one or both of the Acquisitions, the REIT intends to use the net proceeds of the Offering to fund future acquisitions and for general business purposes.

The REIT has also granted the underwriters an over-allotment option to purchase up to an additional 586,500 Units on the same terms and conditions, exercisable at any time, in whole or in part, up to 30 days after the date hereof.

About Flagship Communities Real Estate Investment Trust

Flagship Communities Real Estate Investment Trust is a leading operator of affordable residential Manufactured Housing Communities primarily serving working families seeking affordable home ownership. The REIT owns and operates exceptional residential living experiences and investment opportunities in family-oriented communities in Kentucky, Indiana, Ohio, Tennessee, Arkansas, Missouri, and Illinois. To learn more about Flagship, visit www.flagshipcommunities.com.

Forward-Looking Statements

This press release contains statements that include forward-looking information (within the meaning of applicable Canadian securities laws). Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “can”, “could”, “would”, “must”, “estimate”, “target”, “objective”, and other similar expressions, or negative versions thereof, and include statements herein concerning the use of the net proceeds of the Offering.

These forward-looking statements are based on the REIT’s expectations, estimates, forecasts and projections, as well as assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies that could cause actual results to differ materially from those that are disclosed in such forward-looking statements. While considered reasonable by management of the REIT as at the date of this news release, any of these expectations, estimates, forecasts, projections, or assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those expectations, estimates, forecasts, projections, or assumptions could be incorrect. Material factors and assumptions used by management of the REIT to develop the forward-looking information in this news release include, but are not limited to, that the conditions to closing of the Acquisitions will be met or waived in a timely manner and that both of the Acquisitions will be completed on the current agreed upon terms.

When relying on forward-looking statements to make decisions, the REIT cautions readers not to place undue reliance on these statements, as they are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors, many of which are beyond the REIT’s control, could cause actual results to differ materially from the results discussed in the forward-looking statements, such as the risks identified in the REIT’s management’s discussion and analysis for the year ended December 31, 2023 available on the REIT’s profile on SEDAR+ at www.sedarplus.com, including, but not limited to, the factors discussed under the heading “Risks and Uncertainties” therein and the risk of the REIT’s plans with respect to debt bridge financing for the Acquisitions not being achieved as anticipated. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Forward-looking statements are made as of the date of this press release and, except as expressly required by applicable Canadian securities laws, the REIT assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

-

Health22 hours ago

Health22 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

News19 hours ago

Amid concerns over ‘collateral damage’ Trudeau, Freeland defend capital gains tax change

-

Art23 hours ago

Random: We’re In Awe of Metaphor: ReFantazio’s Box Art

-

Art16 hours ago

The unmissable events taking place during London’s Digital Art Week

-

Politics20 hours ago

Politics20 hours agoHow Michael Cohen and Trump went from friends to foes

-

Science21 hours ago

NASA hears from Voyager 1, the most distant spacecraft from Earth, after months of quiet

-

Tech23 hours ago

Surprise Apple Event Hints at First New iPads in Years

-

Media22 hours ago

Vaughn Palmer: B.C. premier gives social media giants another chance