Article content

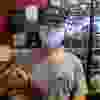

The owner of a diner that’s been serving breakfast to Kitsilano with a smile for 30 years says a sudden increase in rent is now forcing him to close.

“Things happen beyond our control and people bigger than us can crush dreams. Come say goodbye and we will try not to cry.” — Nelson Ma

The owner of a diner that’s been serving breakfast to Kitsilano with a smile for 30 years says a sudden increase in rent is now forcing him to close.

Business representatives for the community say they are witnessing a similar trend happening along the West 4th Avenue strip. Other mom-and-pop shops are folding under the growing weight of commercial market costs.

“Things happen beyond our control and people bigger than us can crush dreams,” Nelson Ma, 68, said to his customers in a Facebook post, announcing his plans to close the diner at the end of July.

“Come say goodbye and we will try not to cry.”

Located east of Arbutus Street, Nelly’s Grill is a popular spot among locals, known for combining two brunch favourites in a fried chicken eggs Benedict.

After its building was bought last September, restaurant manager Joyce Yee, said the new landlord — Novena Land Property — told them their plans to increase the rent once Ma’s lease ended in 18 months.

“He’s been paying close to $9,000 a month in rent and property taxes but to renew he’d have to pay more than double that,” said Yee, who has worked at the diner for 17 years.

“All of us employees have been grieving. We’ve watched customers’ families grow up and get bigger throughout the years,” Yee said.

Though Ma has tried finding other leasing options, inflated rent costs across the city are keeping him from being able to relocate the diner, Yee said. Trying to sell the business also proved tricky.

“The new owner said ‘no’ to the one offer we got. He has the final say and has even started renovations upstairs during food service. We feel we have no choice but to leave.”

Lauren Angelucci, a Kitsilano resident of 20 years, said she’s saddened to hear news of the restaurant’s closing.

“I’m so sad to see the place go. Our baby’s first meal was there when he was just a week old.”

The restaurant wasn’t the first along the strip to feel pushed out by rising rent costs proposed after a change in ownership. In December, a realtor who came into Bishop’s restaurant told the owner the building had been sold and a rent hike was coming.

“The realtor told us that rent alone would be costing $100 per square foot,” said John Bishop, who opened the fine-dining establishment in 1986 when the cost of rent and property taxes were around $2,000 per month.

By the start of 2022, costs had risen to 10 times that much.

“We simply couldn’t afford to stay open,” Bishop said. “After 37 years in business, paying rent and taxes, I thought being a good tenant may have mattered but we weren’t offered any chance of negotiating rent.”

A business that used to operate two doors down from Nelly’s, Peak Golf, told Postmedia it made the move to a less-costly West 4th storefront once new landlords took over in September.

When contacted by phone, Novena Land’s managing director told Postmedia he did not wish to comment on Nelly’s Grill decision to shutter.

Jane McFadden, executive director of the Kitsilano Business Association, said she’s seen various shops and eateries along the thoroughfare go out of business because they are priced out of the commercial market.

“It’s unfortunate to see long-standing businesses like Nelly’s, ones that contain a lot of memories, go out of business. However, these new landlords are often just rising rental prices, many that have stayed the same for years under the old landlord, up to current market value.”

McFadden said the West 4th business district continues to thrive.

“In the past six months, 11 new small businesses have opened up brick-and-mortar business locations along the strip.”

While commercial rents dropped in the early months of the COVID-19 pandemic, according to Statistics Canada’s commercial rent prices index, they began to climb back up and by early 2022, had rebounded to pre-pandemic levels even though sales had not bounced back to the same degree.

In Vancouver, the average asking net commercial rent was up 27 per cent year-over-year in the first quarter of 2022, according to Canadian real estate giant Colliers.

TOKYO (AP) — Japanese technology group SoftBank swung back to profitability in the July-September quarter, boosted by positive results in its Vision Fund investments.

Tokyo-based SoftBank Group Corp. reported Tuesday a fiscal second quarter profit of nearly 1.18 trillion yen ($7.7 billion), compared with a 931 billion yen loss in the year-earlier period.

Quarterly sales edged up about 6% to nearly 1.77 trillion yen ($11.5 billion).

SoftBank credited income from royalties and licensing related to its holdings in Arm, a computer chip-designing company, whose business spans smartphones, data centers, networking equipment, automotive, consumer electronic devices, and AI applications.

The results were also helped by the absence of losses related to SoftBank’s investment in office-space sharing venture WeWork, which hit the previous fiscal year.

WeWork, which filed for Chapter 11 bankruptcy protection in 2023, emerged from Chapter 11 in June.

SoftBank has benefitted in recent months from rising share prices in some investment, such as U.S.-based e-commerce company Coupang, Chinese mobility provider DiDi Global and Bytedance, the Chinese developer of TikTok.

SoftBank’s financial results tend to swing wildly, partly because of its sprawling investment portfolio that includes search engine Yahoo, Chinese retailer Alibaba, and artificial intelligence company Nvidia.

SoftBank makes investments in a variety of companies that it groups together in a series of Vision Funds.

The company’s founder, Masayoshi Son, is a pioneer in technology investment in Japan. SoftBank Group does not give earnings forecasts.

___

Yuri Kageyama is on X:

The Canadian Press. All rights reserved.

Shopify Inc. executives brushed off concerns that incoming U.S. President Donald Trump will be a major detriment to many of the company’s merchants.

“There’s nothing in what we’ve heard from Trump, nor would there have been anything from (Democratic candidate) Kamala (Harris), which we think impacts the overall state of new business formation and entrepreneurship,” Shopify’s chief financial officer Jeff Hoffmeister told analysts on a call Tuesday.

“We still feel really good about all the merchants out there, all the entrepreneurs that want to start new businesses and that’s obviously not going to change with the administration.”

Hoffmeister’s comments come a week after Trump, a Republican businessman, trounced Harris in an election that will soon return him to the Oval Office.

On the campaign trail, he threatened to impose tariffs of 60 per cent on imports from China and roughly 10 per cent to 20 per cent on goods from all other countries.

If the president-elect makes good on the promise, many worry the cost of operating will soar for companies, including customers of Shopify, which sells e-commerce software to small businesses but also brands as big as Kylie Cosmetics and Victoria’s Secret.

These merchants may feel they have no choice but to pass on the increases to customers, perhaps sparking more inflation.

If Trump’s tariffs do come to fruition, Shopify’s president Harley Finkelstein pointed out China is “not a huge area” for Shopify.

However, “we can’t anticipate what every presidential administration is going to do,” he cautioned.

He likened the uncertainty facing the business community to the COVID-19 pandemic where Shopify had to help companies migrate online.

“Our job is no matter what comes the way of our merchants, we provide them with tools and service and support for them to navigate it really well,” he said.

Finkelstein was questioned about the forthcoming U.S. leadership change on a call meant to delve into Shopify’s latest earnings, which sent shares soaring 27 per cent to $158.63 shortly after Tuesday’s market open.

The Ottawa-based company, which keeps its books in U.S. dollars, reported US$828 million in net income for its third quarter, up from US$718 million in the same quarter last year, as its revenue rose 26 per cent.

Revenue for the period ended Sept. 30 totalled US$2.16 billion, up from US$1.71 billion a year earlier.

Subscription solutions revenue reached US$610 million, up from US$486 million in the same quarter last year.

Merchant solutions revenue amounted to US$1.55 billion, up from US$1.23 billion.

Shopify’s net income excluding the impact of equity investments totalled US$344 million for the quarter, up from US$173 million in the same quarter last year.

Daniel Chan, a TD Cowen analyst, said the results show Shopify has a leadership position in the e-commerce world and “a continued ability to gain market share.”

In its outlook for its fourth quarter of 2024, the company said it expects revenue to grow at a mid-to-high-twenties percentage rate on a year-over-year basis.

“Q4 guidance suggests Shopify will finish the year strong, with better-than-expected revenue growth and operating margin,” Chan pointed out in a note to investors.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:SHOP)

The Canadian Press. All rights reserved.

TORONTO – RioCan Real Estate Investment Trust says it has cut almost 10 per cent of its staff as it deals with a slowdown in the condo market and overall pushes for greater efficiency.

The company says the cuts, which amount to around 60 employees based on its last annual filing, will mean about $9 million in restructuring charges and should translate to about $8 million in annualized cash savings.

The job cuts come as RioCan and others scale back condo development plans as the market softens, but chief executive Jonathan Gitlin says the reductions were from a companywide efficiency effort.

RioCan says it doesn’t plan to start any new construction of mixed-use properties this year and well into 2025 as it adjusts to the shifting market demand.

The company reported a net income of $96.9 million in the third quarter, up from a loss of $73.5 million last year, as it saw a $159 million boost from a favourable change in the fair value of investment properties.

RioCan reported what it says is a record-breaking 97.8 per cent occupancy rate in the quarter including retail committed occupancy of 98.6 per cent.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:REI.UN)

The Canadian Press. All rights reserved.

‘I get goosebumps’: Canadians across the country mark Remembrance Day

Surrey police transition deal still in works, less than three weeks before handover

From transmission to symptoms, what to know about avian flu after B.C. case

Bitcoin has topped $87,000 for a new record high. What to know about crypto’s post-election rally

Wisconsin Supreme Court grapples with whether state’s 175-year-old abortion ban is valid

Twin port shutdowns risk more damage to Canadian economy: business groups

Canadanewsmedia news November 12, 2024: Union serves strike notice to Canada Post

As Toronto enters its Taylor Swift era, experts say crowd safety depends on planning