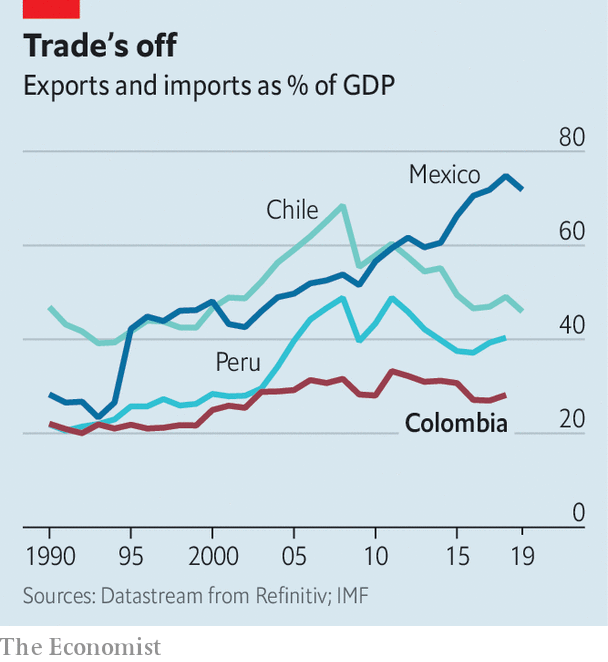

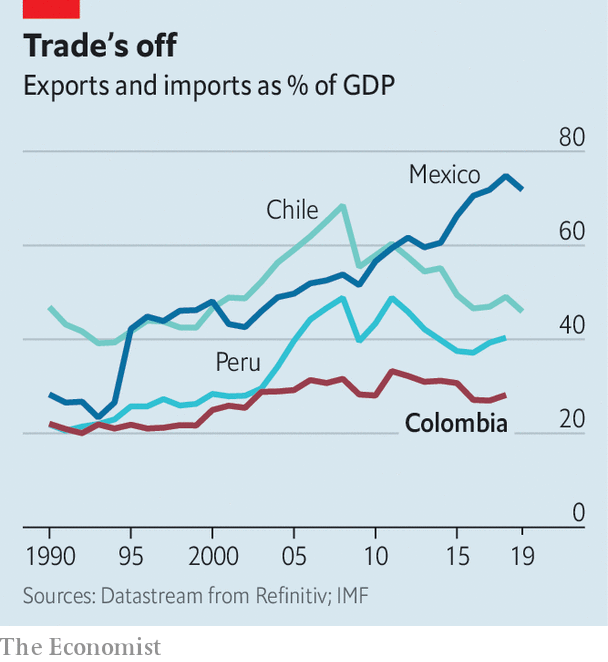

Colombia is now as closed as it was in the 1990s, according to a new book*. Total trade has increased fivefold, but the ratio of trade to GDP has not risen much (see chart). Non-tariff measures affect nearly four-fifths of imports, up from 27% in 1992, says the UN Conference on Trade and Development. The government has created new trade-related agencies, and has given existing bodies more power to meddle.

Economy

The costs of Colombia’s closed economy

|

|

COLOMBIANS PAY more for wine than most Latin Americans. The price shoots up as soon as a case reaches shore. Each time a shipment arrives, importers must submit at least eight forms to as many agencies. Officials can take up to 15 days to clear it. In the meantime, importers store their bottles in climate-controlled warehouses. When a permit finally comes, bad roads and high trucking charges mean that merchants pay among the highest freight bills in the world to ship the wine to Bogotá, the capital, where most customers are. By the time it reaches a dinner table a bottle of wine costs eight times more than in its country of origin. Its costly journey is the rule, not the exception, for products imported by Colombia.

It used to be easier. The government liberalised the economy in the early 1990s after decades of protectionism. At that time Colombia depended on exports of coffee, the price of which was plummeting. In an effort to diversify the economy and make it more productive, the government reduced tariffs and eliminated lists of items whose import was prohibited.

That openness lasted just a few years. Owners of factories and sugar mills, dairy farmers, rice growers and regional governments, which own distillers of aguardiente, a local tipple, were hurt by competition. They lobbied to restore protection. The government could not reimpose tariffs, in part because of its commitments as a member of the World Trade Organisation. So it put up lots of non-tariff barriers.

The coddling of domestic producers is one reason why productivity has barely grown since the 1990s. In 2012 farms produced less by value in real terms than they did in 1990. Peru and Chile, which have less variety in their growing conditions but more open economies, have doubled their output over the same period. Pricey imports raise exporters’ costs, making them less competitive.

Ports are suffering. Ships arrive in Buenaventura, the biggest port on the Pacific coast, loaded with containers, but they leave with nothing. Cartagena, on the Caribbean coast, makes its living as a transshipment port, shuffling goods from one ship to another. But that is less profitable than handling exports and imports. Colombia’s “main export is air”, says Anibal Ochoa, the port’s commercial director.

Until now, governments have ignored the costs of Colombia’s closed shop. That is partly because their priority was to defeat the FARC, a guerrilla group that waged a 50-year war against the state. From the early 2000s Colombia earned a decent living from oil and gas, which replaced coffee as the main export. They account for nearly 60% of goods exports.

Now pressure is building to liberalise. A peace agreement in 2016 ended the war. Oil prices fell in 2014 and have yet to recover fully. Reserves are running low. Trade could become the economy’s new engine, says Jorge García, one of the book’s editors.

So far, though, the push to open up has had little support from the top. The government has made some permits easier to apply for, but did not reduce their number or cost. For now, it seems, only rich Colombians will be able to afford wine. Others will drown their sorrows in aguardiente.■

*“Comercio Exterior en Colombia: Política, Instituciones, Costos y Resultados”, edited by Jorge García García, Enrique Montes Uribe, Iader Giraldo Salazar. Banco de la República.

This article appeared in the The Americas section of the print edition under the headline “The costs of Colombia’s closed economy”

Economy

China economy grows faster than expected in first quarter – BBC.com

China’s economy made a stronger-than-expected start to the year, even as the crisis in its property sector deepened.

According to official data, gross domestic product (GDP) expanded by 5.3% in the first three months of 2024, compared to a year earlier.

That beat expectations the world’s second largest economy could see growth slow to 4.6% in the first quarter.

Last month, Beijing set an ambitious annual growth target for world’s second largest economy of “around 5%”.

Data from the National Bureau of Statistics (NBS) also showed first quarter retail sales growth, a key gauge of China’s consumer confidence, fell to 3.1%.

“You cannot manufacture growth forever so we really need to see households come to the party if China wants to hit that around 5% growth target,” Harry Murphy Cruise from Moody’s Analytics told the BBC.

In the same period property investment fell 9.5%, highlighting the challenges faced by China’s real estate firms.

The figures came as China continues to struggle with an ongoing property market crisis. According to the International Monetary Fund (IMF), the sector accounts for around 20% of the economy.

The latest data also showed new home prices fell at the fastest pace for more than eight years in March.

The real estate industry crisis has been highlighted in January when property giant Evergrande was ordered to liquidate by a court in Hong Kong.

Rival developers Country Garden and Shimao have also been hit with a winding-up petitions in the city.

Last week, credit ratings agency Fitch cut its outlook for China, citing increasing risks to the country’s finances as it faces economic challenges.

At the annual gathering of China’s leaders in March officials said the economy grew by 5.2% in 2023.

For decades the Chinese economy expanded at a stellar rate, with official figures putting its GDP growing at an average of close to 10% a year.

Economy

Stumbling Toward a Deal — as the Economy Surges – AGF Perspectives

Insights and Market Perspectives

CONGRESS IS STUMBLING TOWARD PASSAGE of legislation late this week that would provide enormous aid to Ukraine, Israel and Taiwan. It’s a VERY messy process — typically — that has obscured the major development for financial markets: red hot economic growth, far exceeding expectations.

WE’LL GET TO THE CONGRESSIONAL BRAWL in a second, but first — dramatic economic growth is having a major impact on interest rates, with the Atlanta Fed GDP Now predicting economic growth at 2.8%, after yesterday’s blowout retail sales report.

EVEN CHINA, considered a basket case a few months ago, is blasting off — with Beijing reporting 5.3% first quarter economic growth.

WITH THE U.S. TEN YEAR BOND YIELD now above 4.5%, this has to be a shock for the Federal Reserve, which may be frozen for months to come — unable to cut rates as long as the economy is growing above trend with inflation not falling to the Fed’s 2% goal.

THERE SURELY WON’T BE ANY FISCAL RESTRAINT, as Congress moves awkwardly toward passage of a nearly $100 billion spending package for allies.

THIS IS A VERY FLUID fluid environment — even a Tik-Tok ban is included — with House Speaker Mike Johnson preparing four separate bills in a dizzying process that may require support from Democrats — which could cost Johnson his job.

BOTTOM LINE: This is sausage-making at its ultimate, as Democrats prepare to bail out Johnson, as angry right wingers demand provisions to protect the border, and as aid seems increasingly likely — surely for Israel, probably for Ukraine. It’s only Tuesday, there’s a long way to go; details won’t come into focus for a few more days.

IN THE MEANTIME, THE ECONOMY CONTINUES TO ROAR — it’s too strong, in our opinion, to be sustainable.

THESE DRAMATIC STORIES MAY HAVE TO TAKE A BACK SEAT as the gleeful media is obsessed with the Donald Trump trial. The buzz after the first day was whether Trump dozed off yesterday during the jury selection process, Our advice to Trump — get some espresso, the last thing you want is opponents calling you “sleepy Don.”

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

The views expressed in this blog are provided as a general source of information based on information available as of the date of publication and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Speculation or stated believes about future events, such as market or economic conditions, company or security performance, or other projections represent the beliefs of the author and do not necessarily represent the view of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and AGF accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. Any financial projections are based on the opinions of the author and should not be considered as a forecast. The forward looking statements and opinions may be affected by changing economic circumstances and are subject to a number of uncertainties that may cause actual results to differ materially from those contemplated in the forward looking statements. The information contained in this commentary is designed to provide you with general information related to the political and economic environment in the United States. It is not intended to be comprehensive investment advice applicable to the circumstances of the individual.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is a registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

©2024 AGF Management Limited. All rights reserved.

Economy

China’s economy beats expectations, growing 5.3 percent in first quarter – Al Jazeera English

Statistics agency says economy has made ‘good start’ to the year under the leadership of Chinese President Xi Jinping.

China’s economy grew faster than expected in the first three months of the year, a boost for policymakers grappling with a property-sector crisis, weak consumer demand and mounting government debt.

Gross domestic product (GDP) grew by 5.3 percent in the first quarter, data released by the National Bureau of Statistics (NBS) showed on Tuesday, comfortably above forecasts and up from a 5.2 percent expansion in the previous quarter.

By sector, industrial production and agriculture grew by 6.1 percent and 3.8 percent, respectively, while services grew by 5 percent, according to NBS data.

The NBS said in a statement that the economy had made a “good start” under “the strong leadership” of the Central Committee of the Communist Party of China and President Xi Jinping.

“As a result, the policies continued to take effect, production and demands maintained stable and witnessed an increase, employment and prices were generally stable, market confidence continued to boost, and high-quality development made new progress,” the statistics agency said.

The stronger-than-expected figures came days after China reported that exports and imports declined 7.5 percent and 1.9 percent, respectively, in March, missing expectations.

The world’s second-largest economy has struggled to sustain a recovery from the COVID-19 pandemic amid a range of longstanding structural challenges, including a hugely indebted real estate sector and a shrinking population.

Fitch Ratings earlier this month downgraded China’s sovereign credit outlook to negative, citing “increasing risks to China’s public finance outlook” as Beijing attempts to move away from real estate-led growth.

Beijing last month set a 5 percent growth target for 2024, a rate that would beat most developed economies but be among the country’s slowest expansions since 1990.

Officials have unveiled a number of fiscal and monetary policy measures to boost the economy, including $1.8 trillion in spending on major construction and infrastructure projects.

-

Media23 hours ago

DJT Stock Plunges After Trump Media Files to Issue Shares

-

Business22 hours ago

FFAW, ASP Pleased With Resumption of Crab Fishery – VOCM

-

Media22 hours ago

Marjorie Taylor Greene won’t say what happened to her Trump Media stock

-

Business23 hours ago

Javier Blas 10 Things Oil Traders Need to Know About Iran's Attack on Israel – OilPrice.com

-

Politics23 hours ago

Politics23 hours agoIn cutting out politics, A24 movie 'Civil War' fails viewers – Los Angeles Times

-

Art24 hours ago

It’s Time to Remove Father Rupnik’s Art – National Catholic Register

-

Business21 hours ago

Tesla May Be Headed For Massive Layoffs As Woes Mount: Reports – InsideEVs

-

Investment24 hours ago

A Once-in-a-Generation Investment Opportunity: 1 Top Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April … – Yahoo Finance