With the oil price war between Saudi Arabia and Russia showing no signs of relenting, some analysts are now warning that the standoff could extend much longer. Saudi policy now appears to revolve around inflicting pain on both OPEC and non-OPEC producers over the short term, with a long-term view to returning to its former role as the swing producer and price setter.

With the Arab nation recently claiming that it’s ‘very comfortable’ with $30 oil, it might make good on its threat to maintain a 12 million bpd output clip for a whole year with minimal increase in spending by drawing upon its considerable reserves.

Given this backdrop, some pundits are now beginning to seriously consider the specter of a collapse by the decades-old petrodollar system. With Saudi Arabia–a key U.S. ally upon which the petrodollar was founded–having thrown the gauntlet on the U.S., a collapse by the petrodollar system could mean mass devaluations across major oil-producing regions.

But what are the odds that this could become a reality any time soon?

Short Overview of the Petrodollar

Defined simply, petrodollars are dollars paid to oil-producing countries in exchange for their oil. Being a global currency, most international transactions, including energy products, are priced in U.S. dollars. The petrodollar system traces its roots back to the early 1970s when it replaced yet another monetary system–the gold standard.

In the final days of World War II, a meeting between all 44 Allied nations member states was held in Bretton Woods, New Hampshire, where a relatively young and economically nimble United States emerged as the leader in the new global economic order, replacing the former hegemon: a war-torn and debt-ridden Great Britain.

The historic meeting also created an international gold-backed monetary system–the U.S. held most of the world’s gold supply and agreed to redeem any dollar, for its value in gold, any currency that was pegged to the dollar.

The system worked well at first; however, it was not long before its shortcomings became apparent. After all, the global gold supply grows only slowly, which means being on the gold standard curtailed government spending and inflation.

The system also put the U.S. under undue pressure regarding the balance of payments–in 1971, stagflation in the U.S. prompted many nations, including the United Kingdom, to redeem most of their U.S. dollars for gold. On August 15, 1971, President Richard M. Nixon shocked the world when he officially ended the international convertibility from U.S. dollars into gold, effectively bringing an end to the gold standard.

Worried about the resultant trade deficit by having to pay vast amounts for necessary imports, the U.S. and Saudi Arabia soon returned to the negotiating table. The petrodollar system was created in 1973, whereby the United States and Saudi Arabia struck a deal that would see every barrel of oil purchased from Saudi Arabia denominated in U.S. dollars.

Related: Saudi Arabia And The U.S. Could Form The World’s Newest Oil Cartel Under this new arrangement, any country that bought Saudi oil could only do so using USD. In exchange, the U.S. offered weapons and military protection for Saudi oil fields from neighboring nations. By 1975, all OPEC nations had agreed to U.S. deals identical to Saudi’s– pricing their own oil supplies in U.S. dollars in exchange for weapons and military protection.

Thus, the petrodollar system was born, which created an immediate artificial demand for U.S. dollars across the globe. As global oil demand increased, so did the demand for U.S. dollars.

Petrodollar Recycling

The petrodollar system was escalated in 1979 when the United States and Saudi Arabia negotiated the United States-Saudi Arabian Joint Commission on Economic Cooperation, wherein the two nations agreed to use only U.S. dollars for oil contracts. In effect, the U.S. dollars would be recycled back to America by doing business with U.S. companies in a system known as petrodollar recycling.

Since then, most oil-exporting countries started recycling their petrodollars through sovereign wealth funds. Through these funds, these nations invest in non-oil related businesses that lower their dependence on oil. The largest petrodollar recyclers ranked by assets are:

- Norway Government Pension Fund Global $1.186 trillion

- China Investment Corporation $940. 604 billion

- Abu Dhabi Investment Authority $696.660 billion

- Kuwait Investment Authority $592.000 billion

- Hong Kong Monetary Authority Investment Portfolio $539.865 billion

- GIC Private Limited $440.000 billion

- SAFE Investment Company $417.844 billion

- Temasek Holdings $375.383 billion

- Qatar Investment Authority $328.000 billion

- National Council for Social Security Fund $324.996 billion

Data Source: Sovereign Wealth Fund Institute

These oil-producing countries use these funds to provide a cushion to fall back on during hard times and can help lower volatility in their own economies as well as the global economy.

There’s a dark side to it, though.

According to the Bureau of International Settlements, up to 70% of OPEC’s investable reserve funds could be unaccounted for. Mind you, BIS only reports on OPEC members, so non-OPEC funds are fully unaccounted for.

The U.S. Treasury suspects that the unaccounted-for funds are invested in regional stock markets, construction loans, regional stock markets, hedge funds, and private equity funds. Some could also be finding their way into the U.S. market where they are invested through foreign intermediaries, which are untraceable.

These hidden petrodollars can increase global volatility due to their sheer size. For instance, dumping of U.S. Treasuries by a large holder can trigger a significant decline by the dollar–as was feared during the U.S.-China trade war.

Collapse of the Petrodollar?

RT Keiser Report believes that Russia’s got the upper hand in the current geopolitical oil game while U.S. shale and the American dollar are going to suffer greatly.

“Today is the end of the petrodollar. We are going to see the rise of the ruble-dollar or the Chinese-Russian oil-based dollar.”

Keiser contends that “…the era of the U.S. holding the world’s reserve currency is finished”.

There’s no doubt in anyone’s mind that U.S. shale producers could be among the first victims of the ongoing oil price war (Chevron Corp. recently cut its Permian Shale production by 20%); but neither Saudi Arabia nor Russia will come out unscathed, either.

The Saudi government has already announced a raft of austerity measures, including a 5% cut to its 2020 budget. Meanwhile, although Russia seems to be in a better patch due to its low debt levels and ample sovereign wealth reserves clocking in at over $100 billion, it’s still likely to end up with a deficit this year due to the effects of the oil price war– not counting those by the coronavirus pandemic.

Related: US Oil Turns Its Back On The Permian As Prices Crash

But more importantly, reports about the impending collapse of the petrodollar are greatly exaggerated.

The United States has repeatedly used the power of petrodollars to enforce its foreign policy but is largely none the worse for wear because of it.

In 2014, Russia and Iran signed a five-year trade deal with each other worth $20 billion which involves the sale of Iranian oil and is not priced in dollars.

Iran and Venezuela have inked oil contracts in their own currencies instead of petrodollars in defiance due to Washington sanctions.

China and Russia have repeatedly called for a replacement of the U.S. dollar as a global currency, with China launching yuan-denominated oil futures in 2018.

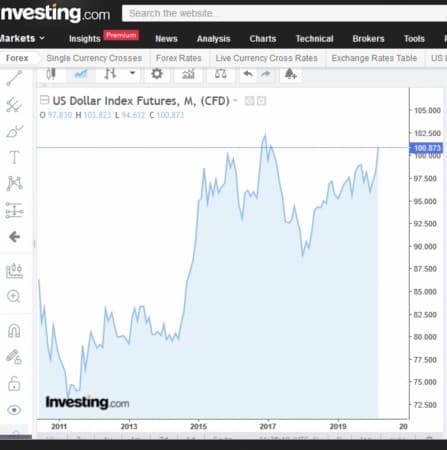

These rogue nations have not exactly caused a dollar collapse; on the contrary, the dollar index has been routinely taking out multi-year highs in recent years.

Dollar Index 10-Year Change

Source: Investing.com

There appears to be some profound misconceptions about the importance of oil as a commodity; that oil somehow underwrites the global financial system and is directly responsible for the dollar’s hegemony. But the truth is that since the 1980s, the dollar has become the global reserve currency mainly because of the strength and dynamism of the U.S. economy.

Exporters sometimes accept payment in other mediums — planes, tanks, construction services, etc. — but their central banks nearly always demand dollars for reasons entirely unconnected to oil because the U.S. dollar is underwritten by the U.S. taxpayer, founded upon decades of broadly consistent macro-economic policy management and easily exchangeable.

In fact, a bigger threat to the petrodollar’s dominance is the rapid shift to renewable energy. Europe appears to be largely winning in the rush to clean energy with the United States lagging behind the E.U. and China. Less fossil fuel consumption might weaken demand for the dollar, but probably not cause its collapse until a suitable substitute is found.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com: