Real eState

The quick rise and public fall of Vancouver’s Coromandel Properties

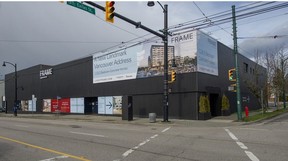

But now, Coromandel finds itself under scrutiny and the talk of the town. Its recent petition to B.C. Supreme Court seeking creditor protection reveals a pattern of high levels of leverage and repeated borrowing to hold onto properties while failing to develop them quickly enough.

The company has declared it is in financial trouble with $700 million in outstanding debts on 16 prime Vancouver properties, most of which are potential development sites. It is seeking relief under the Companies’ Creditors Arrangement Act, seeking time for the company to be restructured.

Coromandel’s creditor protection application was delayed in a B.C. Supreme Court hearing on Thursday, around the same time hundreds of real estate industry professionals were gathered three blocks away in a hotel ballroom to hear Vancouver Mayor Ken Sim speak at an event hosted by the Urban Development Institute (UDI).

It’s a fall from grace for a company that grew relatively quickly to amass a portfolio of 16 prime Vancouver properties. Coromandel’s petition pegs the combined appraised value of those sites, based on their existing use or Coromandel’s plans for them, at more than $1 billion.

Coromandel Properties began as CM Bay Properties. In 2014, the company paid $15.8 million for a former gas station site near Oakridge Centre that was notable for a proposal to build a mixed-use condo and retail complex in what media reports at the time described as a record-setting per buildable-square-foot price.

In 2015, it moved into offices on the 18th floor of a building on West Georgia Street in downtown Vancouver and announced it would be known as Coromandel Properties, putting forth Jerry Zhong, also known as Zhen Yu Zhong, as its principal.

The company now leases 12,000 square feet of space in the Georgia Street office tower for $19,892 a month, according to a list of assets and liabilities included in the court petition.

In the following years, Coromandel continued to add to its portfolio. The petition outlines the company’s vision for several of these sites, including tall towers combining hotels, offices, condos and apartments. But figures in the development industry say the company has, to date, completed a limited number of relatively modest projects.

Earlier this month, Coromandel’s website listed nine “future development” projects, four in various stages of development, and only two completed projects.

“I would call them a small developer with unusually large land holdings. They’re a small developer, both in terms of their past track record and overall amount of property under development,” said Jon Stovell, who has been in the Metro Vancouver real estate development industry for more than 25 years and is chair of the UDI and president of Reliance Properties.

“It’s fair to say it’s a significant event. Everybody is keeping an eye on to see how it sorts itself out. It’s primarily a function of a very, very, very rapid increase in interest rates … and not surprising that some developer, maybe, is caught on the wrong side of that, just the way that their capital is structured,” said Stovell.

Ronn Rapp, CEO of the Homebuilders Association Vancouver, put it this way: “Everyone has to start somewhere, but the order of magnitude in this case is unusual.”

Typically, developers want to sequence their projects “to drive a more evenly balanced cash flow position,” Rapp said, with some projects in early stages while others are under construction and others are completed and driving revenue.

In July 2015, Zhong explained in a news release that his company’s new name, Coromandel, was “derived from the valuable screens that were created in China and shipped all over the world via the Coromandel Coast of southern India. We chose (the name) to honour the heritage of our company’s principals who travelled from China to make Canada their home.”

But there were also much smaller companies, backed by a mix of money from B.C., other Canadian provinces and overseas that were jumping into the market to assemble residential land and buy commercial sites in various part of Metro Vancouver.

Coromandel was one of several of these. Some local developers were critical of the way these newer companies seemed to be buying prime lots at top dollar with no pressing plans to develop them. Academics and observers said it wasn’t the first time inflated real estate prices were being blamed on investors and immigrants from Asia, pointing back to the 1980s and 1990s-era exodus of people and money from Hong Kong to Vancouver.

Instead, the company threw its support behind popular events like the Vancouver Cherry Blossom Festival and charitable causes such as the Vancouver Sun’s Adopt-A-School program. At the Vancouver Art Gallery, it joined some of the city’s high profile entrepreneurs, such as Artizia founder Brian Hill, as well as big corporate names, such as BMO and TD, in being a lead sponsor and backer of major exhibits, including Claude Monet’s Secret Garden and Takashi Murakami’s The Octopus Eats Its Own Leg.

In one of the few public photos of Zhong, he is pictured at the opening of the Murakami exhibit standing with a big cheerful smile next to the Japanese pop artist.

Like many other more established developers, Coromandel and Zhong also threw money into political contributions. Elections B.C. records show that in 2017 alone, Coromandel donated $20,000 to the B.C. NDP and $35,000 to Vision Vancouver. Ahead of the 2018 election, Zhong also donated to Vision and independent candidate Kennedy Stewart.

Zhong attended events and parties, but kept a low-profile in the media.

Stovell said he does not personally know Zhong, but knows Louie from his time on city council, saying “he was a great councillor and did a lot for the city.”

Louie grew up in East Vancouver and his career took him from bundling Vancouver Sun and Province newspapers in the viewless basement of the old Pacific Press building, where he was a union rep, to a key player in Vancouver’s city council chamber, to Coromandel’s board rooms.

Louie was first elected to Vancouver council in 2002 representing COPE, as the left-leaning, union-backed party swept to power. He was part of the split from COPE which produced the more centrist Vision Vancouver, the party with which he was re-elected to council in 2005, 2008, 2011 and 2014.

Coromandel didn’t make Louie and Zhong available for an interview, and declined to answer questions by email.

John Nicola, CEO of Nicola Wealth, said his company bought Coromandel out of a joint venture earlier this year to build two apartment towers on a site near Oakridge.

“They, at the time, needed a liquidity event,” Nicola said. “They had obviously, in hindsight, pressure from these other projects, and we were committed to going ahead, so therefore we said: ‘OK fine, we are going to continue on our own.’”

— With research from Carolyn Soltau

Real eState

Here are some facts about British Columbia’s housing market

Housing affordability is a key issue in the provincial election campaign in British Columbia, particularly in major centres.

Here are some statistics about housing in B.C. from the Canada Mortgage and Housing Corporation’s 2024 Rental Market Report, issued in January, and the B.C. Real Estate Association’s August 2024 report.

Average residential home price in B.C.: $938,500

Average price in greater Vancouver (2024 year to date): $1,304,438

Average price in greater Victoria (2024 year to date): $979,103

Average price in the Okanagan (2024 year to date): $748,015

Average two-bedroom purpose-built rental in Vancouver: $2,181

Average two-bedroom purpose-built rental in Victoria: $1,839

Average two-bedroom purpose-built rental in Canada: $1,359

Rental vacancy rate in Vancouver: 0.9 per cent

How much more do new renters in Vancouver pay compared with renters who have occupied their home for at least a year: 27 per cent

This report by The Canadian Press was first published Oct. 17, 2024.

The Canadian Press. All rights reserved.

Real eState

B.C. voters face atmospheric river with heavy rain, high winds on election day

VANCOUVER – Voters along the south coast of British Columbia who have not cast their ballots yet will have to contend with heavy rain and high winds from an incoming atmospheric river weather system on election day.

Environment Canada says the weather system will bring prolonged heavy rain to Metro Vancouver, the Sunshine Coast, Fraser Valley, Howe Sound, Whistler and Vancouver Island starting Friday.

The agency says strong winds with gusts up to 80 kilometres an hour will also develop on Saturday — the day thousands are expected to go to the polls across B.C. — in parts of Vancouver Island and Metro Vancouver.

Wednesday was the last day for advance voting, which started on Oct. 10.

More than 180,000 voters cast their votes Wednesday — the most ever on an advance voting day in B.C., beating the record set just days earlier on Oct. 10 of more than 170,000 votes.

Environment Canada says voters in the area of the atmospheric river can expect around 70 millimetres of precipitation generally and up to 100 millimetres along the coastal mountains, while parts of Vancouver Island could see as much as 200 millimetres of rainfall for the weekend.

An atmospheric river system in November 2021 created severe flooding and landslides that at one point severed most rail links between Vancouver’s port and the rest of Canada while inundating communities in the Fraser Valley and B.C. Interior.

This report by The Canadian Press was first published Oct. 17, 2024.

The Canadian Press. All rights reserved.

News

No shortage when it comes to B.C. housing policies, as Eby, Rustad offer clear choice

British Columbia voters face no shortage of policies when it comes to tackling the province’s housing woes in the run-up to Saturday’s election, with a clear choice for the next government’s approach.

David Eby’s New Democrats say the housing market on its own will not deliver the homes people need, while B.C. Conservative Leader John Rustad saysgovernment is part of the problem and B.C. needs to “unleash” the potential of the private sector.

But Andy Yan, director of the City Program at Simon Fraser University, said the “punchline” was that neither would have a hand in regulating interest rates, the “giant X-factor” in housing affordability.

“The one policy that controls it all just happens to be a policy that the province, whoever wins, has absolutely no control over,” said Yan, who made a name for himself scrutinizing B.C.’s chronic affordability problems.

Some metrics have shown those problems easing, with Eby pointing to what he said was a seven per cent drop in rent prices in Vancouver.

But Statistics Canada says 2021 census data shows that 25.5 per cent of B.C. households were paying at least 30 per cent of their income on shelter costs, the worst for any province or territory.

Yan said government had “access to a few levers” aimed at boosting housing affordability, and Eby has been pulling several.

Yet a host of other factors are at play, rates in particular, Yan said.

“This is what makes housing so frustrating, right? It takes time. It takes decades through which solutions and policies play out,” Yan said.

Rustad, meanwhile, is running on a “deregulation” platform.

He has pledged to scrap key NDP housing initiatives, including the speculation and vacancy tax, restrictions on short-term rentals,and legislation aimed at boosting small-scale density in single-family neighbourhoods.

Green Leader Sonia Furstenau, meanwhile, says “commodification” of housing by large investors is a major factor driving up costs, and her party would prioritize people most vulnerable in the housing market.

Yan said it was too soon to fully assess the impact of the NDP government’s housing measures, but there was a risk housing challenges could get worse if certain safeguards were removed, such as policies that preserve existing rental homes.

If interest rates were to drop, spurring a surge of redevelopment, Yan said the new homes with higher rents could wipe the older, cheaper units off the map.

“There is this element of change and redevelopment that needs to occur as a city grows, yet the loss of that stock is part of really, the ongoing challenges,” Yan said.

Given the external forces buffeting the housing market, Yan said the question before voters this month was more about “narrative” than numbers.

“Who do you believe will deliver a better tomorrow?”

Yan said the market has limits, and governments play an important role in providing safeguards for those most vulnerable.

The market “won’t by itself deal with their housing needs,” Yan said, especially given what he described as B.C.’s “30-year deficit of non-market housing.”

IS HOUSING THE ‘GOVERNMENT’S JOB’?

Craig Jones, associate director of the Housing Research Collaborative at the University of British Columbia, echoed Yan, saying people are in “housing distress” and in urgent need of help in the form of social or non-market housing.

“The amount of housing that it’s going to take through straight-up supply to arrive at affordability, it’s more than the system can actually produce,” he said.

Among the three leaders, Yan said it was Furstenau who had focused on the role of the “financialization” of housing, or large investors using housing for profit.

“It really squeezes renters,” he said of the trend. “It captures those units that would ordinarily become affordable and moves (them) into an investment product.”

The Greens’ platform includes a pledge to advocate for federal legislation banning the sale of residential units toreal estate investment trusts, known as REITs.

The party has also proposed a two per cent tax on homes valued at $3 million or higher, while committing $1.5 billion to build 26,000 non-market units each year.

Eby’s NDP government has enacted a suite of policies aimed at speeding up the development and availability of middle-income housing and affordable rentals.

They include the Rental Protection Fund, which Jones described as a “cutting-edge” policy. The $500-million fund enables non-profit organizations to purchase and manage existing rental buildings with the goal of preserving their affordability.

Another flagship NDP housing initiative, dubbed BC Builds, uses $2 billion in government financingto offer low-interest loans for the development of rental buildings on low-cost, underutilized land. Under the program, operators must offer at least 20 per cent of their units at 20 per cent below the market value.

Ravi Kahlon, the NDP candidate for Delta North who serves as Eby’s housing minister,said BC Builds was designed to navigate “huge headwinds” in housing development, including high interest rates, global inflation and the cost of land.

Boosting supply is one piece of the larger housing puzzle, Kahlon said in an interview before the start of the election campaign.

“We also need governments to invest and … come up with innovative programs to be able to get more affordability than the market can deliver,” he said.

The NDP is also pledging to help more middle-class, first-time buyers into the housing market with a plan to finance 40 per cent of the price on certain projects, with the money repayable as a loan and carrying an interest rate of 1.5 per cent. The government’s contribution would have to be repaid upon resale, plus 40 per cent of any increase in value.

The Canadian Press reached out several times requesting a housing-focused interview with Rustad or another Conservative representative, but received no followup.

At a press conference officially launching the Conservatives’ campaign, Rustad said Eby “seems to think that (housing) is government’s job.”

A key element of the Conservatives’ housing plans is a provincial tax exemption dubbed the “Rustad Rebate.” It would start in 2026 with residents able to deduct up to $1,500 per month for rent and mortgage costs, increasing to $3,000 in 2029.

Rustad also wants Ottawa to reintroduce a 1970s federal program that offered tax incentives to spur multi-unit residential building construction.

“It’s critical to bring that back and get the rental stock that we need built,” Rustad said of the so-called MURB program during the recent televised leaders’ debate.

Rustad also wants to axe B.C.’s speculation and vacancy tax, which Eby says has added 20,000 units to the long-term rental market, and repeal rules restricting short-term rentals on platforms such as Airbnb and Vrbo to an operator’s principal residence or one secondary suite.

“(First) of all it was foreigners, and then it was speculators, and then it was vacant properties, and then it was Airbnbs, instead of pointing at the real problem, which is government, and government is getting in the way,” Rustad said during the televised leaders’ debate.

Rustad has also promised to speed up approvals for rezoning and development applications, and to step in if a city fails to meet the six-month target.

Eby’s approach to clearing zoning and regulatory hurdles includes legislation passed last fall that requires municipalities with more than 5,000 residents to allow small-scale, multi-unit housing on lots previously zoned for single family homes.

The New Democrats have also recently announced a series of free, standardized building designs and a plan to fast-track prefabricated homes in the province.

A statement from B.C.’s Housing Ministry said more than 90 per cent of 188 local governments had adopted the New Democrats’ small-scale, multi-unit housing legislation as of last month, while 21 had received extensions allowing more time.

Rustad has pledged to repeal that law too, describing Eby’s approach as “authoritarian.”

The Greens are meanwhile pledging to spend $650 million in annual infrastructure funding for communities, increase subsidies for elderly renters, and bring in vacancy control measures to prevent landlords from drastically raising rents for new tenants.

Yan likened the Oct. 19 election to a “referendum about the course that David Eby has set” for housing, with Rustad “offering a completely different direction.”

Regardless of which party and leader emerges victorious, Yan said B.C.’s next government will be working against the clock, as well as cost pressures.

Yan said failing to deliver affordable homes for everyone, particularly people living on B.C. streets and young, working families, came at a cost to the whole province.

“It diminishes us as a society, but then also as an economy.”

This report by The Canadian Press was first published Oct. 17, 2024.

-

News16 hours ago

News16 hours agoCanadanewsmedia news October 18, 2024: Testy B.C. election campaign reaches final day

-

News16 hours ago

News16 hours agoUS to probe Tesla’s ‘Full Self-Driving’ system after pedestrian killed in low visibility conditions

-

News16 hours ago

News16 hours agoAdvocates urge Ontario to change funding for breast prostheses, ostomy supplies

-

News16 hours ago

News16 hours agoMore details expected on proposed deal that would see tobacco giants pay billions

-

News16 hours ago

News16 hours ago‘Kindness’ influencers on TikTok give money to strangers. Why is that controversial?

-

News16 hours ago

News16 hours agoHousing, health, and plastic straws: Here’s how B.C. politicians are wooing voters

-

News16 hours ago

News16 hours agoTesty B.C. election campaign sees leaders attacking each other more than policy

-

News16 hours ago

News16 hours agoRwanda shrugs off ‘sportswashing’ criticism in pursuit of a winning development formula