Economy

The US Economy is Now Breaking in Plain Sight

You wouldn’t know it by the headlines. But the US economy is breaking in plain sight. Only the savings cushion of the richest 20% are keeping it afloat. And if interest rates keep rising nearly every day, even that won’t be enough.

Troubling undercurrents for the US economy

The beginning of the quarter has gotten off to a torrid start with long-term Treasury yields rising above 4.75% in the first day and a half of trading through Tuesday morning. It’s a continuation of the end-of-quarter trend, when almost every day we hit new multi-year highs across the longer maturity end of the Treasury curve.

Sure, yields can go higher without a recession, as last week’s column attested. After all, job openings remain plentiful judging by Tuesday morning’s data. But the pace of the recent yield rise is so unrelenting that eventually something will break — either the march higher in yields or the US economy.

The tone has changed, too. Last quarter, the drive higher in real and nominal yields seemed driven by soft-landing bets. Now the dynamic seems less based on such an optimistic outcome, with former bond bulls switching sides and chasing yields higher amid a glut of Treasury supply. That’s having broad implications by pulling up the US dollar and elevating rates across the world financial system, from mortgages to high-yield bonds and beyond.

The combination of higher yields, a higher US dollar and higher oil prices is a toxic brew for corporate earnings. This should be apparent in the forward-looking statements in earnings calls later this month. The result will likely be that the earnings recession continues into this quarter, bringing equities down with bonds. The US real economy may not be far behind.

Why soft landing calls doom themselves

Last week, I spoke of how the view that the economy could prosper even in the face of an historic rise in short-term interest rates was itself causing longer-term rates to rise, dooming those very predictions. That was a view focused narrowly on this business cycle and on market-driven outcomes.

This week, my colleagues economists Tom Orlik and Anna Wong have weighed in with a more expansive view across cycles. And their conclusion is similar:

With alarming regularity, soft landing calls peak before hard landings hit.

Why do economists find it so difficult to anticipate recessions? One reason is simply the way forecasting works. It typically assumes that what happens next in the economy will be some kind of extension of what’s already happened — a linear process, in the jargon. But recessions are non-linear events. The human mind isn’t good at thinking about them.

Linear thinking means extrapolating the existing situation forward without incorporating the lagged impact of rate hikes on household and corporate borrowing. We saw in March, for example, how that thinking was flawed when Silicon Valley Bank and a couple other regional banks failed. Behind the scenes late in 2022 and early in 2023, the stresses in the banking system from deeply diminished asset prices were taking their toll. Then it seemed like almost without warning, we were in a mini banking crisis. That’s the kind of non-linearity Orlik and Wong are talking about.

We’re running out of extra savings

But let’s think about this in real day-to-day terms. Through the pandemic and into this year, the shot in the arm from government transfers has been a huge cushion for the private sector. But the San Francisco Fed has recently calculated that excess savings from the pandemic will be all gone by September.

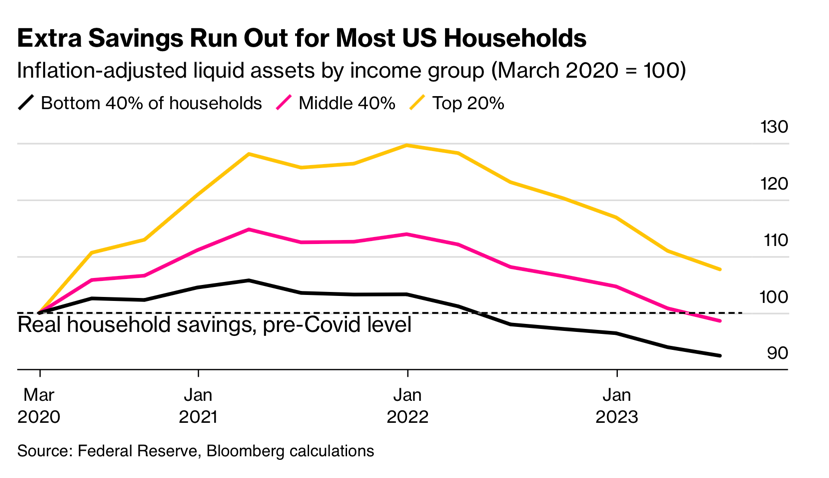

And in fact, Bloomberg Economics calculates that the least wealthy 80% of workers now collectively have less cash on hand than they did when the pandemic started.

As inflation, rising rent costs and higher interest rates hit early in 2022, the money had already run out for the bottom 40% of households. But this year the same has happened for the middle 40%, with extra pandemic savings for the top 20% on a downward trajectory close behind. Since the higher-income households tend to save more anyway, it seems like the support for consumer spending has already more or less disappeared.

By the numbers

-

3.9%

– The personal savings rate for US households in August 2023

Will we dip into our savings to tough this out?

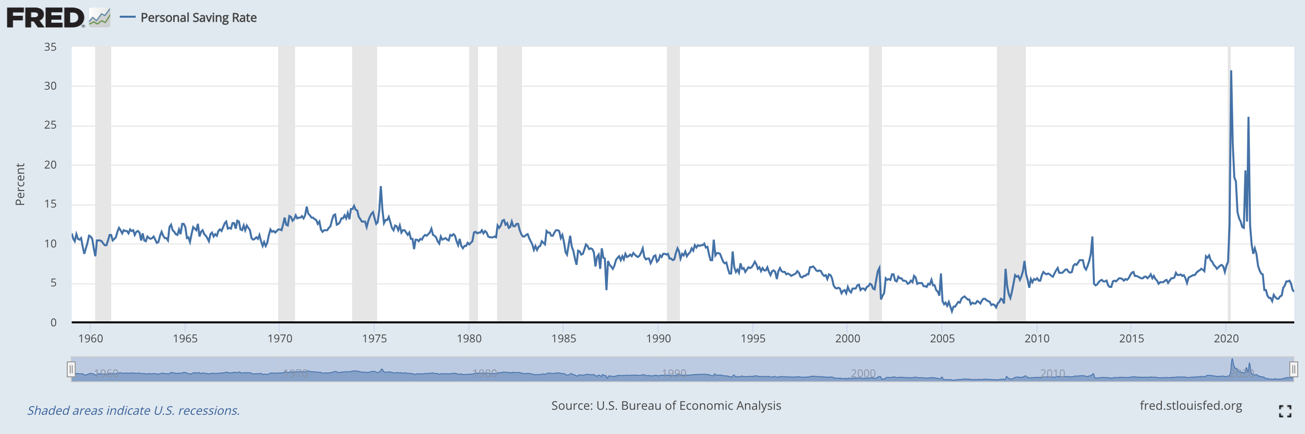

Figuring out how this business cycle progresses depends on what happens next with the personal savings rate. In August, US households got down to 3.9% of disposable income being saved. To put that in context, take a look at the historical comparisons in the chart below.

As with many things, the real outlier in the chart is the pandemic, since the savings rate topped out at a massive 32% when the US was in a country-wide lockdown. But you can see that we are near the low end of the range already. Taking a simple average of each month from 1959 to today shows US households saving about 8.5% of disposable income every month for the last six decades. That figure is 9.4% if you count all monthly data from 1991 forward.

We should consider 3.9% savings a low figure, then. We get figures that low usually during bubbles like the period after 2004 as the housing bubble formed or under recessionary stress as in 2008. The late 1990s was another example, when a low savings rate, driven by stock market wealth effects, lasted through the bubble and into 2001, the beginning of the bust.

If personal savings rates increase enough as the top 20% of households deplete their pandemic savings, that will drive the US economy into a recession.

The banking sector is also a key vector

The economy is not only about the spending habits of households but the investment decisions of businesses and the availability of credit. The SVB collapse was a blow on that front but not a fatal one, as credit only mildly tightened.

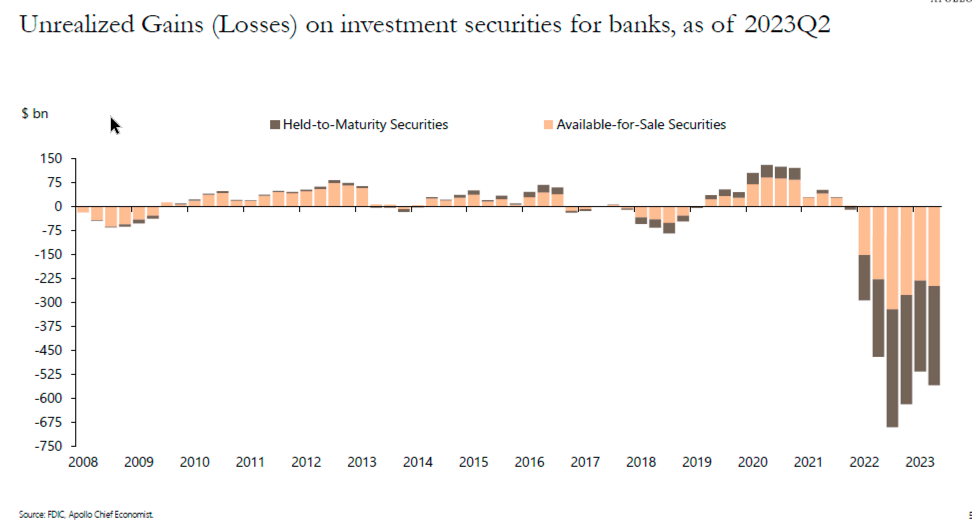

Nevertheless the paper losses by regional banks due to interest rates increasing will restrict credit further. A slide from a recent presentation by Apollo Global’s Chief Economist Torsten Slok shows you that after a couple of quarters of those losses diminishing, they are now increasing again. And they will increase even more as long-term interest rates rise.

I expect two countervailing outcomes as long as yields remain high, keeping balance sheets under stress. First, because the Bank Term Funding Program started in March allows Treasuries to be loaned to the Fed at par, institutions won’t be forced into a fire-sale as interest rates rise. That means marking assets to market on sale is not a lethal threat for most financial institutions. However, since they still face funding pressure due to low deposit rates, their incentive to reach for yield by taking on risky bets increases. Just as in the 1980s, the last time we had this problem with rising rates, high-yield bond issuers could actually benefit.

The desire to reach for yield by banks can help the economy through tougher times as we hit maturity walls for low-grade corporate borrowers then. Of course, in the 1980s, regulatory forbearance for insolvent Savings & Loans eventually led to a wide-scale problem. So such an outcome cannot be discounted this time.

The other reaction to the losses — and the more prudent one — is to rein in credit availability, helping to transmit the Fed’s tightening to the economy through the credit channel. This is what the Fed has wanted to see happen and expects to happen with a lag. But the 1980s S&L crisis experience tells you that even after a recession, lingering balance sheet issues can lead to perverse outcomes due to misaligned incentives.

I expect the yield drama to break

We cannot expect linear outcomes with yields, the dollar and oil prices all rising in tandem. Eventually there will be a torrent of equity selling and a much greater risk of recession as spending slows and precautionary savings grows.

But the move higher in yields has become so extended that I expect a reprieve soon, especially if the economic data start to slow. That will allow for more glide-path outcomes, including even a soft landing. My base case is still a recession, starting as soon as December. The risks outlined above tell you why.

What’s your view?

By the way, having said all that, I’d love to get your take. This week’s MLIV Pulse survey is about the rise in yields and its impact on the stock market. Where do you expect 10-year yields to end this year? How will that impact stocks? Share your views here.

Quote of the Week

Things on my radar

- Surging bond yields aren’t breaking anything quite yet.

- JPMorgan Chase’s CEO thinks AI will end in a 3 1/2-day workweek.

- The last MLIV survey says investors expect a severe commercial real estate crash.

- The student loan restart is an under-appreciated economic headwind.

- The last weekly Mortgage Bankers Association numbers had mortgage rates at a 22-year high.

Economy

Canada’s unemployment rate holds steady at 6.5% in October, economy adds 15,000 jobs

OTTAWA – Canada’s unemployment rate held steady at 6.5 per cent last month as hiring remained weak across the economy.

Statistics Canada’s labour force survey on Friday said employment rose by a modest 15,000 jobs in October.

Business, building and support services saw the largest gain in employment.

Meanwhile, finance, insurance, real estate, rental and leasing experienced the largest decline.

Many economists see weakness in the job market continuing in the short term, before the Bank of Canada’s interest rate cuts spark a rebound in economic growth next year.

Despite ongoing softness in the labour market, however, strong wage growth has raged on in Canada. Average hourly wages in October grew 4.9 per cent from a year ago, reaching $35.76.

Friday’s report also shed some light on the financial health of households.

According to the agency, 28.8 per cent of Canadians aged 15 or older were living in a household that had difficulty meeting financial needs – like food and housing – in the previous four weeks.

That was down from 33.1 per cent in October 2023 and 35.5 per cent in October 2022, but still above the 20.4 per cent figure recorded in October 2020.

People living in a rented home were more likely to report difficulty meeting financial needs, with nearly four in 10 reporting that was the case.

That compares with just under a quarter of those living in an owned home by a household member.

Immigrants were also more likely to report facing financial strain last month, with about four out of 10 immigrants who landed in the last year doing so.

That compares with about three in 10 more established immigrants and one in four of people born in Canada.

This report by The Canadian Press was first published Nov. 8, 2024.

The Canadian Press. All rights reserved.

Economy

Health-care spending expected to outpace economy and reach $372 billion in 2024: CIHI

The Canadian Institute for Health Information says health-care spending in Canada is projected to reach a new high in 2024.

The annual report released Thursday says total health spending is expected to hit $372 billion, or $9,054 per Canadian.

CIHI’s national analysis predicts expenditures will rise by 5.7 per cent in 2024, compared to 4.5 per cent in 2023 and 1.7 per cent in 2022.

This year’s health spending is estimated to represent 12.4 per cent of Canada’s gross domestic product. Excluding two years of the pandemic, it would be the highest ratio in the country’s history.

While it’s not unusual for health expenditures to outpace economic growth, the report says this could be the case for the next several years due to Canada’s growing population and its aging demographic.

Canada’s per capita spending on health care in 2022 was among the highest in the world, but still less than countries such as the United States and Sweden.

The report notes that the Canadian dental and pharmacare plans could push health-care spending even further as more people who previously couldn’t afford these services start using them.

This report by The Canadian Press was first published Nov. 7, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.

The Canadian Press. All rights reserved.

Economy

Trump’s victory sparks concerns over ripple effect on Canadian economy

As Canadians wake up to news that Donald Trump will return to the White House, the president-elect’s protectionist stance is casting a spotlight on what effect his second term will have on Canada-U.S. economic ties.

Some Canadian business leaders have expressed worry over Trump’s promise to introduce a universal 10 per cent tariff on all American imports.

A Canadian Chamber of Commerce report released last month suggested those tariffs would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

More than 77 per cent of Canadian exports go to the U.S.

Canada’s manufacturing sector faces the biggest risk should Trump push forward on imposing broad tariffs, said Canadian Manufacturers and Exporters president and CEO Dennis Darby. He said the sector is the “most trade-exposed” within Canada.

“It’s in the U.S.’s best interest, it’s in our best interest, but most importantly for consumers across North America, that we’re able to trade goods, materials, ingredients, as we have under the trade agreements,” Darby said in an interview.

“It’s a more complex or complicated outcome than it would have been with the Democrats, but we’ve had to deal with this before and we’re going to do our best to deal with it again.”

American economists have also warned Trump’s plan could cause inflation and possibly a recession, which could have ripple effects in Canada.

It’s consumers who will ultimately feel the burden of any inflationary effect caused by broad tariffs, said Darby.

“A tariff tends to raise costs, and it ultimately raises prices, so that’s something that we have to be prepared for,” he said.

“It could tilt production mandates. A tariff makes goods more expensive, but on the same token, it also will make inputs for the U.S. more expensive.”

A report last month by TD economist Marc Ercolao said research shows a full-scale implementation of Trump’s tariff plan could lead to a near-five per cent reduction in Canadian export volumes to the U.S. by early-2027, relative to current baseline forecasts.

Retaliation by Canada would also increase costs for domestic producers, and push import volumes lower in the process.

“Slowing import activity mitigates some of the negative net trade impact on total GDP enough to avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026,” Ercolao said.

Since the Canada-United States-Mexico Agreement came into effect in 2020, trade between Canada and the U.S. has surged by 46 per cent, according to the Toronto Region Board of Trade.

With that deal is up for review in 2026, Canadian Chamber of Commerce president and CEO Candace Laing said the Canadian government “must collaborate effectively with the Trump administration to preserve and strengthen our bilateral economic partnership.”

“With an impressive $3.6 billion in daily trade, Canada and the United States are each other’s closest international partners. The secure and efficient flow of goods and people across our border … remains essential for the economies of both countries,” she said in a statement.

“By resisting tariffs and trade barriers that will only raise prices and hurt consumers in both countries, Canada and the United States can strengthen resilient cross-border supply chains that enhance our shared economic security.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

-

News21 hours ago

News21 hours agoIn the news today: Justin Trudeau and Canada criticized by Donald Trump’s appointees

-

News21 hours ago

News21 hours agoEA Sports video game NHL 25 to include PWHL teams

-

News21 hours ago

News21 hours agoWhat do you do when a goose dies in your backyard, amid concerns about avian flu?

-

News21 hours ago

News21 hours ago‘No yellow brick road’: Atwood weighs in on U.S. election at Calgary forum

-

News19 hours ago

News19 hours agoVia Rail seeks judicial review on CN’s speed restrictions

-

News19 hours ago

News19 hours agoJapanese owner of 7-Eleven receives another offer to rival Couche-Tard bid

-

News21 hours ago

News21 hours agoNova Scotia NDP releases election platform focused on affordability, housing, health

-

News21 hours ago

News21 hours agoSuncor to return all excess cash to shareholders after hitting debt target early