One week into a new year, here are three decisive questions to ponder about the state of the economy.

In the face of increasing geopolitical tensions affecting the energy sector, what is the outlook for oil markets in 2020?

Given rising unemployment levels, will the job situation improve in Alberta?

And after a slide in home prices, when will the local real-estate market return to equilibrium?

In a series of interviews, some top analysts have weighed in with their expectations for these key areas of the economy.

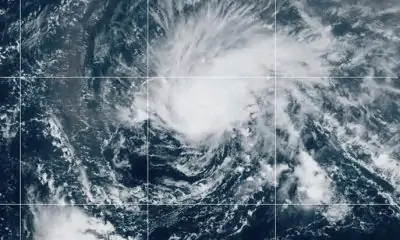

Tension in the Middle East has pushed crude oil prices higher.

Postmedia Archives

What will happen with oil markets and the energy sector?

The year is already starting out with a sudden jolt for oil markets, with prices driven higher by increased geopolitical concerns in the Middle East.

A U.S. drone strike last week killed prominent Iranian general Qassem Soleimani and the fallout pushed global crude prices higher on Friday and Monday.

West Texas Intermediate (WTI) oil has risen more than $2 since his death, closing Monday at US$63.27 a barrel on the New York Mercantile Exchange, its highest point since last spring.

This surge comes on the heels of prices climbing more than 10 per cent between the end of November and New Year’s Day.

“There are more fundamental reasons in the last month that support oil prices than what we have seen in the last year,” said analyst Jeremy McCrea of Raymond James.

Analysts point to the increased risk of conflict in the Middle East as one factor driving prices higher. (An expected drop in spending on U.S. shale oil developments and the potential resolution of the China-U.S. trade dispute could also push markets up.)

Ian Nieboer, managing director of RS Energy Group, said the situation in the Middle East reduces the likelihood of a resolution that would see more Iranian oil barrels come on to the global market in 2020.

He remains cautious about the industry outlook this year and expects companies will stay disciplined in their approach to spending.

“I don’t expect a massive ramp in activity,” Nieboer said.

A new report by consultancy Deloitte forecasts WTI oil prices will average US$58 a barrel in 2020, although it could move higher depending on how geopolitical issues unfold in the coming weeks, said Andrew Botterill, Deloitte’s national oil and gas leader.

However, the world still has access to plenty of oil, he noted.

“All in all, we are going to see producers get a little more confident, see higher prices in the first half of the year and…then we might see producers start to spend a little more capital,” Botterill added.

Alberta’s economy is expected to expand in 2020, but new jobs will be scarce.

Jacques Boissinot / The Canadian Press

What is happening on the employment front?

Albertans looking for work faced a tough market in the second half of last year, as more than 18,000 positions disappeared in November and the unemployment rate climbed above seven per cent — a full percentage point higher than a year earlier.

The economy is expected to regain some momentum this year, but will companies invest more money and create more jobs?

Alicia Macdonald of the Conference Board of Canada said Alberta’s economy will likely expand by about 2.5 per cent this year, as some increased investment occurs in the province.

But she doesn’t see that translating into a flood of new jobs.

“Unfortunately in 2020, we don’t see a significant rebound in the cards,” said Macdonald. “We will see job cuts in the public administration sector and will see unemployment increase throughout the year and won’t peak until the end of 2021.”

The Conference Board expects the unemployment rate will average 7.8 per cent this year. Overall employment is projected to increase, but Alberta will also see more people searching for jobs.

However, some economists see better prospects ahead.

“To the extent that we expect to see some improvement in economic growth and investment in the province in 2020, that will feed into higher job numbers and that should drive the unemployment rate down a little bit,” said Mike Holden, chief economist of the Business Council of Alberta.

Growth should come from energy sector activity, construction and the impact of Alberta reducing its corporate tax rate, he said.

What will happen in the housing market?

The real estate market has been on a bumpy ride in recent years.

Calgary’s property assessment data released last week shows the typical home has dropped in value by four per cent for the new year. (Assessment data is based on property valuations as of July 2019.)

According to the Calgary Real Estate Board, benchmark home prices fell in 2019 (to $418,500 in December), although sales increased by about one per cent.

CREB chief economist Ann-Marie Lurie said some modest increases in local employment and a slight easing in mortgage rates encouraged more home sales last year.

“Our market is oversupplied but we are starting to see signs of stabilization in prices,” she said.

Canada Mortgage and Housing Corp. senior analyst Taylor Pardy expects housing starts will increase slightly this year and improve in 2021, driven by factors such as population growth.

The average price for a home in Calgary will move up by about one per cent this year, according to CMHC.

Calgary still has a large number of existing homes on the market and new houses that have been built but not yet sold, giving potential buyers more bargaining room on price.

“As those inventory levels get absorbed into the market, we are anticipating more balanced market conditions to emerge and as a result, perhaps some slight price increases by the end of 2020,” Pardy said.

So there you have it.

The energy market is starting the year on an upward trajectory, the labour market remains on uncertain footing and the housing market appears to be stabilizing.

It’s not a return to the glory days of a decade ago, but it does look more promising than the tepid beginning of 2019.

BY

Chris Varcoe