Business

Today's news: Trending business stories for November 10, 2023 – Financial Post

The latest business news as it happens

Advertisement 2

Article content

Article content

5:05 p.m.

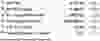

Here are the top 3 performers on the TSX this week

Nuvei Corp. ($25.64, 21.75 per cent)

Investors in the global payments technology business boosted shares of the Montreal based company after it raised its full-year and fourth-quarter revenue guidance and Citi Group lifted its price target to US$20 from US$17. Analysts have 12 buys, six holds and no sells on the stock and a 12-month price target of $39.20, according to Bloomberg.

Stella Jones Inc. ($83.03, 11.32 per cent)

Shares of the maker of utility poles and other wood products such as railway ties continue to rise after the Montreal-based company reported earnings that beat estimates and CIBC World Markets raised its price target to $83 from $74. Analysts have six buys, one hold and no sells on the stock and a 12-month price target of $91, according to Bloomberg.

Stelco Holdings Inc. ($42.45, 10.06 per cent)

Investors pushed up shares of Hamilton, Ont., based Stelco 12 per cent on Thursday after it reported earnings that beat estimates, leading investment banking firm Stifel to raise its price target for the steelmaker to $41 from $37. Analysts have two buys, five holds and no sells on the stock and a 12-month price target of $46.43, according to Bloomberg.

Advertisement 3

Article content

Gigi Suhanic

4:39 p.m.

Market close: TSX posts small gain boosted by energy, while U.S. markets rally

Canada’s main stock index rose to make a small gain today, buoyed by strength in energy stocks, while U.S. markets rallied to end the week, led by a two-per-cent gain on the Nasdaq.

The S&P/TSX composite index closed up 67.06 points at 19,654.47.

In New York, the Dow Jones industrial average was up 391.16 points at 34,283.10. The S&P 500 index was up 67.89 points at 4,415.24, while the Nasdaq composite was up 276.66 points at 13,798.11.

The Canadian dollar traded for 72.36 cents U.S. compared with 72.56 cents U.S. on Thursday.

The December crude oil contract was up US$1.43 at US$77.17 per barrel and the December natural gas contract was down almost a penny at US$3.03 per mmBTU.

The December gold contract was down US$32.10 at US$1,937.70 an ounce and the December copper contract was down five cents at US$3.59 a pound.

The Canadian Press

2:15 p.m.

S&P 500 on track for 7-week high

U.S. stocks rebounded as Treasury volatility abated, with traders looking past a disappointing reading on consumer sentiment and the United States Federal Reserve’s efforts to downplay the market’s dovish bid.

Article content

Advertisement 4

Article content

The S&P 500 hit the key 4,400 technical mark and was on track for a seven-week high. Tech giants led gains, with the Nasdaq 100 up almost two per cent. Microsoft Corp. climbed toward a record and Nvidia Corp. rallied for an eighth straight day. Two-year yields traded above five per cent, while those on 30-year bonds fell after a surge triggered by a weak government sale and Fed chair Jerome Powell’s remarks that officials won’t hesitate to tighten if needed.

“Calm in the Treasury market” is what a sustained market rally would require, said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter. “Short, sharp declines are no more beneficial for stocks than short, sharp rises.”

Wall Street continued to keep an eye on the latest remarks from U.S. officials, with Fed Bank of Atlanta president Raphael Bostic saying policymakers can return inflation to their goal without the need to hike further. Data showed consumer long-term inflation expectations hit a 12-year high, while economic concerns weighed on sentiment.

The caution that pervaded equity markets in the past three months has now switched to “year-end greed” on expectations of a decline in US bond yields, according to Bank of America Corp.’s Michael Hartnett.

Advertisement 5

Article content

Bloomberg

1:41 p.m.

Desmarais family member to invest in $3-billion green hydrogen project in Quebec

The Canadian arm of Tree Energy Solutions GmbH will invest about US$3 billion to build a green hydrogen plant in Quebec.

The project is being financed privately — 60 per cent by Belgium-based Tree Energy and 40 per cent by a fund controlled by France Chretien-Desmarais, a member of the billionaire Desmarais family and the daughter of former Canadian Prime Minister Jean Chretien.

The project is expected to produce 70,000 metric tons of hydrogen a year from a site in Shawinigan, about 100 miles north of Montreal, starting in 2028. It will be mostly powered by wind and solar farms to be built nearby.

“The economic spinoffs will be significant for Shawinigan and the Mauricie region, and will position Québec as a leader in decarbonization,” Eric Gauthier, general manager of TES Canada, said in a news release. Gauthier is a former executive at Power Corp. of Canada, the Desmarais family’s publicly traded holding company.

About one-third of the hydrogen will be used for long-haul transportation in Quebec, while the rest will be used to produce so-called “electric renewable natural gas,” or e-NG.

Advertisement 6

Article content

Launched in 2019, Tree Energy Solutions has HSBC Holdings PLC and UniCredit SpA among its investors. It’s also looking at other large-scale projects around the world, including one announced in May in partnership with TotalEnergies SE in the U.S.

Bloomberg

Noon

Midday markets: Losses in utility, base metal stocks weigh on TSX, while U.S. stocks up

Canada’s main stock index was down in late-morning trading, weighed down by losses in the utility and base metal stocks, while U.S. stock markets moved higher.

The S&P/TSX composite index was down 13.80 points at 19,573.61.

In New York, the Dow Jones industrial average was up 142.79 points at 34,034.73. The S&P 500 index was up 29.25 points at 4,376.60, while the Nasdaq composite was up 145.65 points at 13,667.10.

The Canadian dollar traded for 72.29 cents U.S. compared with 72.56 cents U.S. on Thursday.

The December crude oil contract was up US$1.31 at US$77.05 per barrel and the December natural gas contract was down a penny at US$3.03 per mmBTU.

The December gold contract was down US$22.70 at US$1,947.10 an ounce and the December copper contract was down five cents at US$3.59 a pound.

Advertisement 7

Article content

The Canadian Press

10:44 a.m.

Top 1% of tax filers saw incomes rise by almost 10% in 2021: Statistics Canada

Statistics Canada says the country’s top one per cent of tax filers saw their incomes rise by almost 10 per cent in 2021, while those in the bottom half saw their average income decline.

The agency says the incomes of the top earnings group, excluding capital gains, jumped 9.4 per cent higher to $579,000.

Meanwhile, filers in the top 0.1 per cent saw their average income increase 17.4 per cent to almost $2.1 million and those in the top 0.01 per cent experienced an average income increase of 25.7 per cent, bringing their earnings to about $7.7 million.

At the same time, filers in the bottom half saw their average income fall by $1,400 to $21,100 in 2021 as the government ended many of its pandemic benefit programs.

Statistics Canada adds women made up roughly 26 per cent of the top one per cent of income tax filers, up from 25.4 per cent in 2020 and 11.4 per cent in 1982.

Its research also looked at money made from the sale of a home or other asset, finding 12.2 per cent of tax filers received capital gains, which had an average value of $37,600 in 2021. Average capital gains were $29,300 in 2020.

Advertisement 8

Article content

The Canadian Press

10:09 a.m.

Markets open: Caution switches to ‘year-end greed’

Stocks rose and bond yields fell, with Wall Street traders looking past the United States Federal Reserve’s efforts to downplay the market’s dovish bid ahead of a key reading on consumer sentiment.

The S&P 500 snapped back, following a slide triggered by a Treasury selloff and Jerome Powell’s remarks that officials won’t hesitate to tighten, if needed. While that’s roughly the message that several Fed speakers have been sending over the past few days, it served as a catalyst for a pullback in markets after a solid November rally. Two-year yields dropped below five per cent, while the dollar halted a four-day advance.

On Friday, the S&P 500 was up 0.34 per cent at 4,362.06, while the Dow Jones Industrial Average rose 0.13 per cent to 33,937.42. The Nasdaq composite was up 0.49 per cent at 13,587.35.

“For the market to sustainably rally from here it still needs what it hasn’t received: Calm in the Treasury market,” said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter. “Short, sharp declines are no more beneficial for stocks than short, sharp rises.”

Advertisement 9

Article content

Fed officials are trying to determine if they should keep raising rates after electing to leave the central bank’s benchmark unchanged at their last two policy meetings. It’s currently in a range of 5.25 per cent to 5.5 per cent, the highest level in 22 years. Fed Bank of Atlanta President Raphael Bostic said policymakers can return U.S. inflation to their goal without the need to hike further.

The caution that pervaded equity markets in the past three months has now switched to “year-end greed” on expectations of a decline in U.S. bond yields, according to Bank of America Corp.’s Michael Hartnett.

In Toronto, the S&P/TSX composite was down 0.20 per cent to 19,548.48.

Bloomberg, Financial Post

7:30 a.m.

Trudeau government outlines $500 million in spending cuts

Prime Minister Justin Trudeau’s government has unveiled the details of $500 million in spending cuts, aiming to assure Canadians that fiscal responsibility is a priority amid high interest rates and stubborn inflation.

Still, the cuts represents only about 0.1 per cent of the $490 billion in spending budgeted for the 2023-2024 fiscal year. Treasury Board President Anita Anand put forward the plan for the cuts — which take aim at consulting, professional services and travel across 68 departments and agencies — in the House of Commons on Nov. 9.

Advertisement 10

Article content

The reductions are an initial step in the government’s first spending review since taking power in 2015. In total, the government aims to chop $15.4 billion from spending over five years and $4.5 billion annually after that, and Anand promised to reveal more details in the months to come.

“Not only is this the first time our government’s undertaking a spending review, but we’re also in a time of high inflation and high interest rates,” Anand said. “What we need to do is to ensure that we are spending taxpayer dollars prudently.”

Bloomberg

Before the opening bell: Stock

Global equities retreated after United States Federal Reserve chair Jerome Powell’s warning that interest rates may have to climb further.

The Stoxx 600 shed 0.6 per cent, undermined also by a set of poor corporate announcements. Energy shares outperformed as the WTI crude oil benchmark rose for the second day in a row.

Nasdaq 100 index futures slipped 0.2 per cent, while 10-year Treasury yields held steady around 4.63 per cent, after surging on Thursday on renewed concern about higher interest rates. Earlier, Asian shares fell, tracking Wall Street’s lower close.

Advertisement 11

Article content

In Canada, the S&P/TSX composite index closed up 57.20 points at 19,587.41.

Bloomberg

What to watch today

The United States is observing Veteran’s Day today, so bond markets will be closed. Stock markets are open.

The Bank of Canada’s senior loan officer survey for the third quarter will be released at 10:30 a.m. ET.

In the U.S., the University of Michigan Consumer Sentiment Index will land at 10 a.m.

Sleep Country Canada Holdings Inc. will release its third quarter earnings and hold a conference call at 8 a.m. SNC-Lavalin Group Inc., which recently changed its name to AtkinsRealis, will also release earnings.

Related Stories

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Business

Telus prioritizing ‘most important customers,’ avoiding ‘unprofitable’ offers: CFO

Telus Corp. says it is avoiding offering “unprofitable” discounts as fierce competition in the Canadian telecommunications sector shows no sign of slowing down.

The company said Friday it had fewer net new customers during its third quarter compared with the same time last year, as it copes with increasingly “aggressive marketing and promotional pricing” that is prompting more customers to switch providers.

Telus said it added 347,000 net new customers, down around 14.5 per cent compared with last year. The figure includes 130,000 mobile phone subscribers and 34,000 internet customers, down 30,000 and 3,000, respectively, year-over-year.

The company reported its mobile phone churn rate — a metric measuring subscribers who cancelled their services — was 1.09 per cent in the third quarter, up from 1.03 per cent in the third quarter of 2023. That included a postpaid mobile phone churn rate of 0.90 per cent in its latest quarter.

Telus said its focus is on customer retention through its “industry-leading service and network quality, along with successful promotions and bundled offerings.”

“The customers we have are the most important customers we can get,” said chief financial officer Doug French in an interview.

“We’ve, again, just continued to focus on what matters most to our customers, from a product and customer service perspective, while not loading unprofitable customers.”

Meanwhile, Telus reported its net income attributable to common shares more than doubled during its third quarter.

The telecommunications company said it earned $280 million, up 105.9 per cent from the same three-month period in 2023. Earnings per diluted share for the quarter ended Sept. 30 was 19 cents compared with nine cents a year earlier.

It reported adjusted net income was $413 million, up 10.7 per cent year-over-year from $373 million in the same quarter last year. Operating revenue and other income for the quarter was $5.1 billion, up 1.8 per cent from the previous year.

Mobile phone average revenue per user was $58.85 in the third quarter, a decrease of $2.09 or 3.4 per cent from a year ago. Telus said the drop was attributable to customers signing up for base rate plans with lower prices, along with a decline in overage and roaming revenues.

It said customers are increasingly adopting unlimited data and Canada-U.S. plans which provide higher and more stable ARPU on a monthly basis.

“In a tough operating environment and relative to peers, we view Q3 results that were in line to slightly better than forecast as the best of the bunch,” said RBC analyst Drew McReynolds in a note.

Scotiabank analyst Maher Yaghi added that “the telecom industry in Canada remains very challenging for all players, however, Telus has been able to face these pressures” and still deliver growth.

The Big 3 telecom providers — which also include Rogers Communications Inc. and BCE Inc. — have frequently stressed that the market has grown more competitive in recent years, especially after the closing of Quebecor Inc.’s purchase of Freedom Mobile in April 2023.

Hailed as a fourth national carrier, Quebecor has invested in enhancements to Freedom’s network while offering more affordable plans as part of a set of commitments it was mandated by Ottawa to agree to.

The cost of telephone services in September was down eight per cent compared with a year earlier, according to Statistics Canada’s most recent inflation report last month.

“I think competition has been and continues to be, I’d say, quite intense in Canada, and we’ve obviously had to just manage our business the way we see fit,” said French.

Asked how long that environment could last, he said that’s out of Telus’ hands.

“What I can control, though, is how we go to market and how we lead with our products,” he said.

“I think the conditions within the market will have to adjust accordingly over time. We’ve continued to focus on digitization, continued to bring our cost structure down to compete, irrespective of the price and the current market conditions.”

Still, Canada’s telecom regulator continues to warn providers about customers facing more charges on their cellphone and internet bills.

On Tuesday, CRTC vice-president of consumer, analytics and strategy Scott Hutton called on providers to ensure they clearly inform their customers of charges such as early cancellation fees.

That followed statements from the regulator in recent weeks cautioning against rising international roaming fees and “surprise” price increases being found on their bills.

Hutton said the CRTC plans to launch public consultations in the coming weeks that will focus “on ensuring that information is clear and consistent, making it easier to compare offers and switch services or providers.”

“The CRTC is concerned with recent trends, which suggest that Canadians may not be benefiting from the full protections of our codes,” he said.

“We will continue to monitor developments and will take further action if our codes are not being followed.”

French said any initiative to boost transparency is a step in the right direction.

“I can’t say we are perfect across the board, but what I can say is we are absolutely taking it under consideration and trying to be the best at communicating with our customers,” he said.

“I think everyone looking in the mirror would say there’s room for improvement.”

This report by The Canadian Press was first published Nov. 8, 2024.

Companies in this story: (TSX:T)

Business

TC Energy cuts cost estimate for Southeast Gateway pipeline project in Mexico

CALGARY – TC Energy Corp. has lowered the estimated cost of its Southeast Gateway pipeline project in Mexico.

It says it now expects the project to cost between US$3.9 billion and US$4.1 billion compared with its original estimate of US$4.5 billion.

The change came as the company reported a third-quarter profit attributable to common shareholders of C$1.46 billion or $1.40 per share compared with a loss of C$197 million or 19 cents per share in the same quarter last year.

Revenue for the quarter ended Sept. 30 totalled C$4.08 billion, up from C$3.94 billion in the third quarter of 2023.

TC Energy says its comparable earnings for its latest quarter amounted to C$1.03 per share compared with C$1.00 per share a year earlier.

The average analyst estimate had been for a profit of 95 cents per share, according to LSEG Data & Analytics.

This report by The Canadian Press was first published Nov. 7, 2024.

Companies in this story: (TSX:TRP)

The Canadian Press. All rights reserved.

Business

BCE reports Q3 loss on asset impairment charge, cuts revenue guidance

BCE Inc. reported a loss in its latest quarter as it recorded $2.11 billion in asset impairment charges, mainly related to Bell Media’s TV and radio properties.

The company says its net loss attributable to common shareholders amounted to $1.24 billion or $1.36 per share for the quarter ended Sept. 30 compared with a profit of $640 million or 70 cents per share a year earlier.

On an adjusted basis, BCE says it earned 75 cents per share in its latest quarter compared with an adjusted profit of 81 cents per share in the same quarter last year.

“Bell’s results for the third quarter demonstrate that we are disciplined in our pursuit of profitable growth in an intensely competitive environment,” BCE chief executive Mirko Bibic said in a statement.

“Our focus this quarter, and throughout 2024, has been to attract higher-margin subscribers and reduce costs to help offset short-term revenue impacts from sustained competitive pricing pressures, slow economic growth and a media advertising market that is in transition.”

Operating revenue for the quarter totalled $5.97 billion, down from $6.08 billion in its third quarter of 2023.

BCE also said it now expects its revenue for 2024 to fall about 1.5 per cent compared with earlier guidance for an increase of zero to four per cent.

The company says the change comes as it faces lower-than-anticipated wireless product revenue and sustained pressure on wireless prices.

BCE added 33,111 net postpaid mobile phone subscribers, down 76.8 per cent from the same period last year, which was the company’s second-best performance on the metric since 2010.

It says the drop was driven by higher customer churn — a measure of subscribers who cancelled their service — amid greater competitive activity and promotional offer intensity. BCE’s monthly churn rate for the category was 1.28 per cent, up from 1.1 per cent during its previous third quarter.

The company also saw 11.6 per cent fewer gross subscriber activations “due to more targeted promotional offers and mobile device discounting compared to last year.”

Bell’s wireless mobile phone average revenue per user was $58.26, down 3.4 per cent from $60.28 in the third quarter of the prior year.

This report by The Canadian Press was first published Nov. 7, 2024.

Companies in this story: (TSX:BCE)

The Canadian Press. All rights reserved.

-

News24 hours ago

News24 hours agoFreeland says she’s ready to deal with Trump |

-

News24 hours ago

News24 hours agoNASA astronauts won’t say which one of them got sick after almost eight months in space

-

News24 hours ago

News24 hours ago43 monkeys remain on the run from South Carolina lab. CEO thinks they’re having an adventure

-

News24 hours ago

News24 hours agoMitch Marner powers Matthews-less Maple Leafs over Red Wings

-

News8 hours ago

News8 hours agoCanada’s Denis Shapovalov wins Belgrade Open for his second ATP Tour title

-

News8 hours ago

News8 hours agoAffordability or bust: Nova Scotia election campaign all about cost of living

-

News24 hours ago

News24 hours agoB.C. police officer stabbed during arrest in stolen vehicles investigation

-

News8 hours ago

News8 hours agoFirst World War airmen from New Brunswick were pioneers of air warfare

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.