Business

Top headlines: Canadian dollar drops after Bank of Canada holds rates — what it means for you – Financial Post

The latest business news as it happens

Advertisement 2

Article content

Article content

5:28 p.m.

Here are Thursday’s top three performers on the TSX

1. StorageVault Canada Inc. ($4.36, +11.79%)

Shares of the Toronto-based company, which owns, develops and leases self-storage units across Canada, rose after RBC Capital Markets said its strong third-quarter earnings “should provide some level of comfort to investors of growth resuming.” Analysts currently have six buys, two holds and no sells on the stock, and an average 12-month price target of $5.77, according to Bloomberg.

2. Allied Properties Real Estate Investment Trust ($16.14, +6.82%)

The Toronto-based owner of class 1 urban office properties bounced off its year-to-date low on Oct. 25 even though it reported earnings that missed analysts’ estimates on funds from operations per unit. Analysts currently have nine buys, two holds and no sells on the stock, and an average 12-month price target of $23.14, according to Bloomberg.

3. Stelco Holdings Inc. ($35.17, 5.02%)

Investors pushed up shares of Hamilton-Ont.-based Stelco, whose subsidiaries produce a variety of steel products, from its year-to-date low on Oct. 25, by the most in 10 weeks. Analysts currently have two buys, five holds and no sells on the stock, and an average 12-month price target of $44.07, according to Bloomberg.

Advertisement 3

Article content

Gigi Suhanic, Financial Post

5 p.m.

Ottawa to double carbon price rebate for rural Canadians

Prime Minister Justin Trudeau has announced that the government will double the carbon price rebate for rural Canadians beginning next April.

Trudeau also says there will be a temporary, three-year pause to carbon pricing measures that are applied to deliveries of heating oil, beginning in two weeks.

A government press release says the change will mean that households that use heating oil would save about $250, on average, at the current rate.

Through a pilot project, low- and median-income households in Atlantic Canada are to receive an upfront payment of $250 if they currently heat their homes with oil but sign up for a heat pump through a joint federal-provincial government program.

The amount of federal funding that eligible homeowners can receive for the installation of a heat pump, which the government says can save households save some $2,500 on their energy bills, is also going up.

Trudeau says it means that lower-income households will be able to get an average heat pump for free.

Article content

Advertisement 4

Article content

The Canadian Press

4:35 p.m.

TSX down as tech stocks fall, U.S. stock markets also lower

Canada’s main stock index moved lower amid weakness in industrials, technology and battery metals, while U.S. markets also fell, led by losses in technology.

The S&P/TSX composite index closed down 72.54 points at 18,875.31.

In New York, the Dow Jones industrial average was down 251.63 points at 32,784.30. The S&P 500 index was down 49.54 points at 4,137.23, while the Nasdaq composite was down 225.62 points at 12,595.61.

The Canadian dollar traded for 72.33 cents U.S. compared with 72.56 cents U.S. on Wednesday.

The December crude oil contract was down US$2.18 at US$83.21 per barrel and the December natural gas contract was up 10 cents at US$3.48 per mmBTU.

The December gold contract was up US$2.50 at US$1,997.40 an ounce and the December copper contract was down a penny at US$3.58 a pound.

The Canadian Press

4:25 p.m.

Panama top court considers lawsuit over First Quantum deal

Panama’s Supreme Court will consider a lawsuit which alleges that the nation’s contract with copper miner First Quantum Minerals Ltd. violates the constitution.

Advertisement 5

Article content

The court said in a statement that it will issue an opinion on the lawsuit within 10 business days. If it then proceeds, it will request written arguments from attorneys representing both sides. From there, it would advance to the magistrates for a ruling, the court said.

Shares of First Quantum fell in Canada trading after the statement, and were down 4.1 per cent at 12.47 a.m. in Toronto.

The mine is First Quantum’s top money-maker and accounts for about 1.5 per cent of global copper output.

Panama’s congress approved a revised contract with the company on Oct. 20 that grants the company the right to mine copper for 20 years, with the option of an additional 20 years. It also includes a minimum annual payment to the government of US$375 million, which President Laurentino Cortizo said will be used to increase pension payments to retirees beginning Nov. 20.

Unions, environmental activists and students say the contract violates the country’s national sovereignty over its minerals and demand a national referendum on the matter. Groups of protesters blocked highways with rocks and burning tires on Thursday demanding the contract be repealed, following a week of street demonstrations against the mine.

Advertisement 6

Article content

First Quantum’s chief executive Tristan Pascall said on a call with investors Wednesday that the company is aware of the protests and will work harder at communicating the benefits that mining can provide to communities in Panama.

Bloomberg

2:52 p.m.

International Energy Agency ‘no longer credible,’ says Alberta premier

Alberta Premier Danielle Smith is calling one of the world’s premier energy research institutions “no longer credible” after it released a report saying fossil fuel demand is likely to peak this decade.

Smith says the International Energy Agency (IEA) no longer does analysis, it points to outcomes it wants and outlines paths to get there.

She says she prefers to get her information from private-sector analysts.

The International Energy Agency has 31 member countries and works with groups such as OPEC, the G20 and the United Nations in researching its reports, which make headlines around the world.

It has conducted research into energy grids, oil markets, technologies and transportation.

Its latest report, released earlier this week, concluded that under current government policies, renewables are likely to generate half the world’s electricity by 2030, with three times as much investment going into wind power than fossil fuel generation.

Advertisement 7

Article content

Smith made the remarks about the IEA at the Edmonton Chamber of Commerce earlier this week.

The Canadian Press

1:53 p.m.

Ontario, Quebec premiers call for speedy end to St. Lawrence Seaway strike

The premiers of Ontario and Quebec are calling on both sides in the St. Lawrence Seaway strike to reach a deal right away, saying the shutdown of the vital trade artery risks significant harm to the region’s economy.

In a joint statement Thursday, Doug Ford and Francois Legault said they were pleased the two parties were set to return to the negotiating table alongside federal mediators Friday, but urged Ottawa to use whatever tools it has on hand to bring about a resolution should an agreement fail to emerge immediately.

The job action by 361 Unifor members at 13 of the 15 locks along the waterway kicked off Sunday, shutting it down immediately. Wages are the key sticking point in the dispute.

Ford and Legault say they cannot have a repeat of the B.C. port workers strike, which halted the flow of goods for 13 days in July.

They warn that businesses and people across the country will soon feel the ripple effects of the current disruption, with tens of millions of dollars in economic activity lost every day.

Advertisement 8

Article content

The seaway, which runs for 300 kilometres between Lake Erie and Montreal, carried $16.7 billion worth of cargo last year, much of it grain, iron ore, stone and road salt.

The Canadian Press

1 p.m.

Shopify signs lease for office space in Manhattan

Shopify Inc. has signed a lease for offices on the far west side of Manhattan, joining a cluster of tech and finance firms expanding in the area.

The Ottawa-based tech company has leased nearly 3,300 square metres (36,000 square feet) of space at Related Cos. and Vornado Realty Trust’s 85 10th Ave., according to a person familiar with the matter. The 11-story building is near Chelsea Market and the High Line, and counts tenants from Alphabet Inc.’s Google to screening company Clear.

Shopify will take over part of the eighth floor, with a rent that’s higher than US$100 a square foot, the person said, asking not to be named citing private details. That’s above the Manhattan third-quarter average of US$75.28 a square foot, according to Colliers data.

Spokespeople for Related and Vornado declined to comment. A representative for Shopify didn’t immediately return a message seeking comment.

Advertisement 9

Article content

Shopify, which has offices in SoHo, is one of a few major tech tenants to have signed a lease in Manhattan this year, although its expansion is relatively small.

Many major tech firms that have grown rapidly over the past few years have since pulled back, due to cost-cutting measures spanning across jobs and real estate. Last year, Meta Platforms Inc. gave up some office space at Hudson Yards as it sought to reduce expenses.

Natalie Wong, Bloomberg

12 p.m.

Midday markets: Stocks slump on weak tech stocks

Weakness in technology stocks helped lead Canada’s main stock index lower in midday trading, while U.S. stock markets also moved lower.

The S&P/TSX composite index was down 52.17 points at 18,895.68.

In New York, the Dow Jones industrial average was down 147.34 points at 32,888.59. The S&P 500 index was down 34.73 points at 4,152.04, while the Nasdaq composite was down 175.32 points at 12,645.90.

The Canadian dollar traded for 72.25 cents U.S. compared with 72.56 cents U.S. on Wednesday.

The Canadian Press

11:41 a.m.

TD Bank predicts homes prices to fall 5% before rebounding next spring on interest rate cut

Advertisement 10

Article content

A new report by TD Economics predicts Canadian home sales and average prices will fall over the coming months but pick up by the second quarter next year.

Economist Rishi Sondhi says the impact of higher interest rates continues to be felt, which will likely push sales and prices lower by 10 and five per cent, respectively, by the end of the first quarter of next year, compared with 2023 third-quarter levels.

The subsequent recovery forecast is based on an assumption the Bank of Canada will cut its key interest rate by next spring as unemployment rises and the core inflation rate inches lower toward the central bank’s two per cent target.

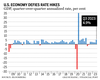

On Wednesday, the Bank of Canada held its key interest rate steady at five per cent but did not rule out future rate hikes amid projections that show inflation remaining higher in the short term.

Sondhi says that would risk adding pressure on overstretched homeowners renewing their mortgages and push supply higher than expected.

The TD report says it will likely take until 2025 for Canadian home sales to sustainably surpass pre-pandemic levels as affordability challenges persist in most provinces.

Advertisement 11

Article content

The Canadian Press

10:44 a.m.

Markets are open: Stocks fall as Meta, UPS disappoint

A slide in big tech weighed on stocks, while Treasury yields fell as economic data reinforced the case for a United States Federal Reserve pause next week — with traders betting the central bank is most likely done with rate hikes.

The Nasdaq 100 dropped almost one per cent as Meta Platforms Inc. sank after dashing investors’ hopes for a long-term advertising recovery. United Parcel Service Inc. — an economic barometer — cut its profit target. Two-year U.S. government yields, which are more sensitive to imminent policy moves, dropped five basis points to 5.06 per cent.

Swap contracts project less than 50 per cent odds for one more Fed hike in the current tightening cycle. The euro remained lower as the European Central Bank kept rates unchanged.

In New York, the S&P 500 was down 0.59 per cent at 4,162.86. The Dow Jones industrial average fell 0.12 per cent to 32,983.06.

In Toronto, the S&P/TSX composite index was down 0.27 per cent at 18,896.29.

Bloomberg

10:14 a.m.

Ford agrees to record 25% wage hike in protracted U.S. autoworkers’ strike

Advertisement 12

Article content

The United Auto Workers (UAW) reached a tentative labour agreement with Ford Motor Co., putting pressure on the carmaker’s two chief rivals to end a protracted strike that has cost the industry billions of dollars.

Ford agreed to a record 25 per cent hourly wage hike over the life of the contract, which exceeds four years. With cost-of-living allowances, the top wage rate is expected to increase by 33 per cent. The top pay will be over US$40 an hour, the union said.

Ford, which has the largest UAW workforce among Detroit’s three legacy automakers, was the first company to offer a counter-proposal to the union and now is the first carmaker to settle. UAW leadership will vote on the deal Oct. 29. It then must be ratified by Ford’s 57,000 U.S. hourly workers, a process that could take weeks.

“While members have occasionally rejected previous contracts, we expect enthusiastic support for this year’s agreement given significant union wins,” Ryan Brinkman, an analyst at JPMorgan Chase & Co. with an “overweight” rating on Ford’s stock, wrote in a research note Thursday. He estimated the deal will likely add US$1.5 billion in annual costs to the automaker for the life of the contract, though details remain unclear.

Advertisement 13

Article content

Ford shares rose 2.3 per cent to US$11.80 as of 9:35 a.m. in New York. The stock is up about 7% this year.

Chief executive Jim Farley is expected to discuss the provisional accord with the UAW in a call with analysts Thursday after the company reports third quarter earnings following the close of regular trading.

Bloomberg

9:24 a.m.

U.S. third-quarter GDP comes in at robust 4.9%

The nation’s economy expanded at a robust 4.9 per cent annual rate from July through September as Americans defied higher prices, rising interest rates and widespread forecasts of a recession to spend at a brisk pace.

The United States Commerce Department said the economy expanded last quarter at the fastest pace in more than two years — and more than twice the 2.1 per cent annual rate of the previous quarter.

Thursday’s report on the nation’s gross domestic product — the economy’s total output of goods and services — showed that consumers drove the acceleration, ramping up their spending on everything from cars to restaurant meals. Even though the painful inflation of the past two years has soured many people’s view of the economy, millions have remained willing to splurge on vacations, concert tickets and sports events.

Advertisement 14

Article content

Last quarter’s robust growth, though, may prove to be a high-water mark for the economy before a steady slowdown begins in the current October-December quarter and extends into 2024.

The breakneck pace is expected to ease as higher long-term borrowing rates, on top of the U.S. Federal Reserve’s short-term rate hikes, cool spending by businesses and consumers.

The economy managed to accelerate despite the Fed’s strenuous efforts to slow growth and inflation by raising its benchmark short-term interest rate to about 5.4 per cent, its highest level in 22 years.

Several Fed officials acknowledged in speeches last week that the most recent economic data showed growth picking up by more than they had expected. Still, most of the policymakers signalled that they will likely keep their key rate, which affects many consumer and business loans, unchanged when they meet next week.

The Associated Press

8:14 a.m.

Precision Drilling reports $19.8M Q3 profit, down from $30.7M a year ago

Precision Drilling Corp. reported a third-quarter profit of $19.8 million, down from $30.7 million a year earlier, as its revenue edged higher.

Advertisement 15

Article content

The company says the profit amounted to $1.45 per diluted share for the quarter ended Sept. 30, down from $2.03 per diluted share in the same quarter last year.

Revenue for the quarter totalled $446.8 million, up from $429.3 million a year earlier.

Precision Drilling says the 4.1 per cent increase in revenue compared with a year ago was due to further strengthening of drilling and service revenue rates, partially offset by lower activity.

Drilling rig utilization days in Canada were down 2.7 per cent compared with a year ago, while its U.S. operations saw a 27.8 per cent drop. International drilling rig utilization days were up 0.4 per cent compared with last year.

The company says its service rig operating hours for the quarter were down 10.4 per cent from a year ago.

The Canadian Press

7:30 a.m.

Canadian dollar drops to 7-month low: Here’s what it means for you

The Canadian dollar fell to its lowest level in seven months after the Bank of Canada kept interest rates unchanged for a second straight meeting yesterday, but left the door open to more tightening even as they forecast weaker economic growth.

Advertisement 16

Article content

Markets reacted to the dimmer outlook. Shortly after the announcement, the loonie fell as low as 72.55 cents to the U.S. dollar and short-term bonds rallied. The Canada two-year benchmark note was at 4.711 per cent at 12:19 p.m. Wednesday, down about six basis points from its level before the rate decision.

The loonie fell further to trade at 72.40 cents U.S. this morning.

As recently as July, the Canadian dollar was trading above 75 cents U.S. It also traded in the 72-cent range last October, and dipped below 69 cents U.S. in March 2020 in the early days of the pandemic. It traded above 82 cents U.S. in May 2021.

Here’s a look at how the price of the dollar affects Canadians:

Who does it help?

A lower Canadian dollar can boost industries like tourism, where the weaker dollar increases visitors from abroad, especially from the U.S., as their money goes further here. It can also mean bigger profits for Canadian businesses that export, like the oil and gas industry, forestry and manufacturing.

Where does it hurt?

A lower loonie means travelling abroad can be more expensive for Canadians, including those planning to travel south for the winter. It also means imports are more expensive. In an editorial last year, former Bank of Canada governor Stephen Poloz noted that a slide from around 80 cents U.S. to 73 to 74 cents boosts the prices of imports by eight per cent to nine per cent.

Advertisement 17

Article content

He also said a weaker dollar is a symptom of wider issues, notably weak business investment that will mean even weaker productivity and economic growth in the future.

What does it mean for inflation?

With the lower dollar boosting import prices, there is a concern that it could increase inflation.

The effects are limited though, argued Royal Bank of Canada earlier this year, noting that services dominate Canadian spending. Even with imports, about a third of the cost comes from domestic services like shipping and retail.

Canada has also been diversifying imports away from the U.S., and the loonie has been doing better against some other currencies like the Chinese yuan, which further lowers the impact on inflation, RBC said.

It did however note that a lower loonie can still mean a boost to prices, including for the roughly 20 per cent of food that’s imported. Categories like fresh fruits, nuts and vegetables, of which 81 per cent are imported, for example, could see prices rise.

Bloomberg, The Canadian Press

Before the opening bell: Stocks sink as earnings misses get punished

Advertisement 18

Article content

Stocks tumbled, with Nasdaq index futures losing about one per cent as investors punished companies reporting weaker-than-expected earnings.

Facebook parent Meta Platforms Inc. sank as much as four per cent in United States pre-market trading after saying it’s at the whim of an uncertain economic environment. Google’s owner Alphabet Inc. lost 1.8 per cent, extending a sell-off on Wednesday on disappointing cloud figures. Amazon.com Inc., which reports results after the bell, slid 1.2 per cent.

The bearish mood carried over to other markets, with European and Asian equities also recording steep losses. The greenback strengthened, gold added 0.6 per cent and Treasury yields edged closer to five per cent. The yen slumped back past 150 per dollar again, fuelling speculation about government intervention in the currency market.

“Earnings season has left much to be desired as typically economically sensitive stocks, that have held up well against a difficult backdrop, begin to creak under the pressure,” said Geir Lode, head of global equities at Federated Hermes Ltd. “Good results are no longer enough for these economically sensitive stocks to gain traction as investors are concerned about a weaker macroeconomic backdrop.”

Advertisement 19

Article content

In Canada, the S&P/TSX composite index closed down 38.64 points at 18,947.85.

Bloomberg

What to watch today

Statistics Canada will release data on the net monthly change in payroll hours this morning.

The Alberta Climate Summit is on today in Edmonton. The event brings thought leaders from industry, government, civil society groups, Indigenous governments and rural communities together to learn from success stories, identify opportunities and challenges, and explore solutions related to Alberta’s clean energy future. Premier Danielle Smith will participate in a fireside chat.

Amazon.com Inc. and Ford Motor Co. are among companies reporting earnings.

Need a refresher on yesterday’s top headlines? Get caught up here.

Related Stories

Additional reporting by The Canadian Press, Associated Press and Bloomberg.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Business

Japan’s SoftBank returns to profit after gains at Vision Fund and other investments

TOKYO (AP) — Japanese technology group SoftBank swung back to profitability in the July-September quarter, boosted by positive results in its Vision Fund investments.

Tokyo-based SoftBank Group Corp. reported Tuesday a fiscal second quarter profit of nearly 1.18 trillion yen ($7.7 billion), compared with a 931 billion yen loss in the year-earlier period.

Quarterly sales edged up about 6% to nearly 1.77 trillion yen ($11.5 billion).

SoftBank credited income from royalties and licensing related to its holdings in Arm, a computer chip-designing company, whose business spans smartphones, data centers, networking equipment, automotive, consumer electronic devices, and AI applications.

The results were also helped by the absence of losses related to SoftBank’s investment in office-space sharing venture WeWork, which hit the previous fiscal year.

WeWork, which filed for Chapter 11 bankruptcy protection in 2023, emerged from Chapter 11 in June.

SoftBank has benefitted in recent months from rising share prices in some investment, such as U.S.-based e-commerce company Coupang, Chinese mobility provider DiDi Global and Bytedance, the Chinese developer of TikTok.

SoftBank’s financial results tend to swing wildly, partly because of its sprawling investment portfolio that includes search engine Yahoo, Chinese retailer Alibaba, and artificial intelligence company Nvidia.

SoftBank makes investments in a variety of companies that it groups together in a series of Vision Funds.

The company’s founder, Masayoshi Son, is a pioneer in technology investment in Japan. SoftBank Group does not give earnings forecasts.

___

Yuri Kageyama is on X:

The Canadian Press. All rights reserved.

Business

Trump campaign promises unlikely to harm entrepreneurship: Shopify CFO

Shopify Inc. executives brushed off concerns that incoming U.S. President Donald Trump will be a major detriment to many of the company’s merchants.

“There’s nothing in what we’ve heard from Trump, nor would there have been anything from (Democratic candidate) Kamala (Harris), which we think impacts the overall state of new business formation and entrepreneurship,” Shopify’s chief financial officer Jeff Hoffmeister told analysts on a call Tuesday.

“We still feel really good about all the merchants out there, all the entrepreneurs that want to start new businesses and that’s obviously not going to change with the administration.”

Hoffmeister’s comments come a week after Trump, a Republican businessman, trounced Harris in an election that will soon return him to the Oval Office.

On the campaign trail, he threatened to impose tariffs of 60 per cent on imports from China and roughly 10 per cent to 20 per cent on goods from all other countries.

If the president-elect makes good on the promise, many worry the cost of operating will soar for companies, including customers of Shopify, which sells e-commerce software to small businesses but also brands as big as Kylie Cosmetics and Victoria’s Secret.

These merchants may feel they have no choice but to pass on the increases to customers, perhaps sparking more inflation.

If Trump’s tariffs do come to fruition, Shopify’s president Harley Finkelstein pointed out China is “not a huge area” for Shopify.

However, “we can’t anticipate what every presidential administration is going to do,” he cautioned.

He likened the uncertainty facing the business community to the COVID-19 pandemic where Shopify had to help companies migrate online.

“Our job is no matter what comes the way of our merchants, we provide them with tools and service and support for them to navigate it really well,” he said.

Finkelstein was questioned about the forthcoming U.S. leadership change on a call meant to delve into Shopify’s latest earnings, which sent shares soaring 27 per cent to $158.63 shortly after Tuesday’s market open.

The Ottawa-based company, which keeps its books in U.S. dollars, reported US$828 million in net income for its third quarter, up from US$718 million in the same quarter last year, as its revenue rose 26 per cent.

Revenue for the period ended Sept. 30 totalled US$2.16 billion, up from US$1.71 billion a year earlier.

Subscription solutions revenue reached US$610 million, up from US$486 million in the same quarter last year.

Merchant solutions revenue amounted to US$1.55 billion, up from US$1.23 billion.

Shopify’s net income excluding the impact of equity investments totalled US$344 million for the quarter, up from US$173 million in the same quarter last year.

Daniel Chan, a TD Cowen analyst, said the results show Shopify has a leadership position in the e-commerce world and “a continued ability to gain market share.”

In its outlook for its fourth quarter of 2024, the company said it expects revenue to grow at a mid-to-high-twenties percentage rate on a year-over-year basis.

“Q4 guidance suggests Shopify will finish the year strong, with better-than-expected revenue growth and operating margin,” Chan pointed out in a note to investors.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:SHOP)

The Canadian Press. All rights reserved.

Business

RioCan cuts nearly 10 per cent staff in efficiency push as condo market slows

TORONTO – RioCan Real Estate Investment Trust says it has cut almost 10 per cent of its staff as it deals with a slowdown in the condo market and overall pushes for greater efficiency.

The company says the cuts, which amount to around 60 employees based on its last annual filing, will mean about $9 million in restructuring charges and should translate to about $8 million in annualized cash savings.

The job cuts come as RioCan and others scale back condo development plans as the market softens, but chief executive Jonathan Gitlin says the reductions were from a companywide efficiency effort.

RioCan says it doesn’t plan to start any new construction of mixed-use properties this year and well into 2025 as it adjusts to the shifting market demand.

The company reported a net income of $96.9 million in the third quarter, up from a loss of $73.5 million last year, as it saw a $159 million boost from a favourable change in the fair value of investment properties.

RioCan reported what it says is a record-breaking 97.8 per cent occupancy rate in the quarter including retail committed occupancy of 98.6 per cent.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:REI.UN)

The Canadian Press. All rights reserved.

-

News20 hours ago

News20 hours ago‘I get goosebumps’: Canadians across the country mark Remembrance Day

-

News20 hours ago

News20 hours agoSurrey police transition deal still in works, less than three weeks before handover

-

News19 hours ago

News19 hours agoFrom transmission to symptoms, what to know about avian flu after B.C. case

-

News19 hours ago

News19 hours agoBitcoin has topped $87,000 for a new record high. What to know about crypto’s post-election rally

-

News19 hours ago

News19 hours agoWisconsin Supreme Court grapples with whether state’s 175-year-old abortion ban is valid

-

News20 hours ago

News20 hours agoTwin port shutdowns risk more damage to Canadian economy: business groups

-

News9 hours ago

News9 hours agoCanadanewsmedia news November 12, 2024: Union serves strike notice to Canada Post

-

News9 hours ago

News9 hours agoAs Toronto enters its Taylor Swift era, experts say crowd safety depends on planning

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.