Real eState

Toronto woman says she was sexually harassed by real estate agent while looking for an apartment – CP24 Toronto's Breaking News

A Toronto woman is sharing her story after she says she was sexually harassed by a real estate agent while looking for a rental apartment in the city.

Originally from Belleville, Ont., Alyssa Graham made the move to downtown Toronto in 2014 and has been living there ever since.

Graham said she started searching for a new place in mid-January, with plans to move in on Feb. 1.

“This certain property that I wanted was listed on Zolo.ca. So I just reached out to them and asked them if it was still available,” Graham told CTV News Toronto.

From there, Graham said she was paired up with a real estate agent who was “very confident” he could find her a place by her desired move-in date.

And while her first pick for a rental property fell through, Graham said she agreed to work with the agent on a go-forward basis.

That’s when things started to get weird, she said.

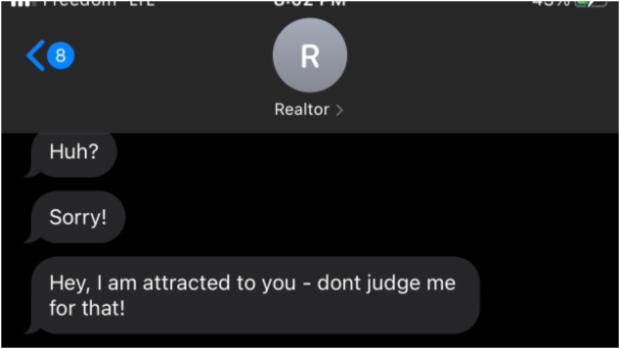

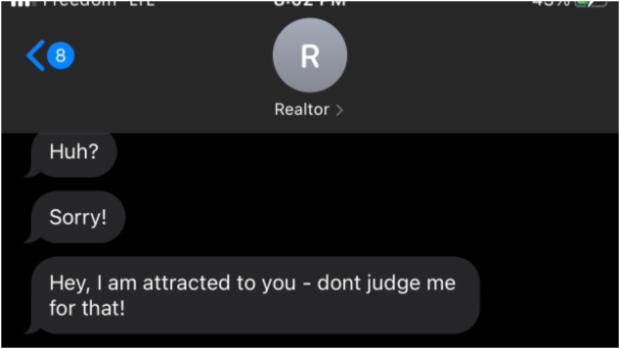

Graham said she noticed that some of the texts and phone conversations with the agent were “rather flirty.”

“I answered the phone and I said ‘hello’ and he said ‘you sound so sexy when you answer the phone.’”

Nonetheless, Graham said she agreed to meet the agent for a showing at another unit as she was desperate for housing, chalking up his unorthodox approach to being part of his “spiel.”

“This was our first time meeting. He kept calling it a date, he kept asking when we were going to make out, he offered to pay $500 a month in rent for me.”

“When we were leaving the unit, he shut all the lights off and the door was locked. We’re in a pitch-black apartment, I can’t even see my hand in front of me. I’m trying to find a door to get out, but I can’t see anything.”

When the real estate agent eventually did turn the lights back on, Graham said she was eager to remove herself from the situation, but that he continued his advances.

Graham explained that following the showing, the agent was insistent on driving her home and that he would “not take no for an answer.”

She said she apprehensively accepted the offer and was dropped off at a nearby hotel, where she had been staying while in between apartments.

“He dropped me off and was like ‘so can I get a kiss?’” she said. Graham quickly refused and then made her way into the hotel.

The agent then called her asking if he should come up to her room and offered to “get a place for the night” if she was interested, Graham alleges.

After a number of unanswered texts and phone calls from the agent later — where Graham says he claimed that he couldn’t help being attracted to his client — Graham said she decided to report the incident to his employer, Zolo.

“I told them everything that happened, that I don’t think he submitted any offers for me, that he wasted a month of time, cost me money, scared me, made me incredibly uncomfortable, etc.” Graham said.

Graham admits that she was originally nervous to submit the complaint as it would likely result in his termination and that the agent was aware of where she was living.

She said she was assured by the company that she “should be fine” because Zolo has “screenings for things like that.”

“We would have caught that,” she said she was told.

In a statement issued to CTV News Toronto on Thursday , Zolo president Mustafa Abbasi said the company acted quickly to address the issue.

“In January 2021, Zolo received a complaint from a customer regarding their interaction with an agent. We acted swiftly and in accordance with our zero-tolerance policy, terminating the agent effective immediately, within 24 hours of receiving the complaint,” the statement reads.

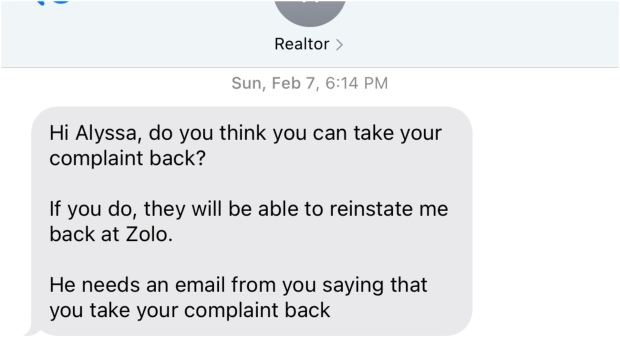

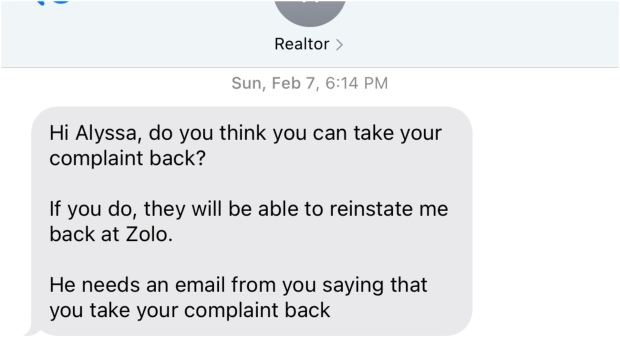

But Graham said that weeks later, the agent reached back out to her asking for her to retract her complaint so that he could be reinstated.

She refused, but agreed to speak with his boss in exchange for compensation for the money paid to cover her hotel expenses.

“We signed a contract for this, which was also sent to his boss, and I spoke with his boss, and they reinstated him.”

Graham said the agent agreed to pay her $1,500 to cover those expenses, of which he has paid $150.

“I’ve contacted him about the payments countless times, which I don’t like doing as this man made me feel very uncomfortable in the past, he’s now claiming he’s not paying me and has blocked my emails and texts,” she said.

However, in a follow up statement to CTV News Toronto, Abbasi claimed that the agent was not reinstated following his termination adding that he is “no longer affiliated with Zolo in any way.”

With relief, Graham said she was finally able to find an apartment with a female real estate agent and is set to move out of the hotel on March 1. But she says that the “nightmare” experience has left its mark.

“With COVID-19, it’s been hard for everyone, but I’ve had some pretty rough days and he [the real estate agent] knows about those too and he was still giving me the runaround and I guess, just saw me as a piece of ass.”

“I thought I was talking to someone who was genuinely trying to help me, and it turned out not to be the case whatsoever.”

Real eState

Proposed Toronto condo complex seeks gargantuan height increase – blogTO

A large condo complex proposed in the increasingly condo-packed Yonge and Eglinton neighbourhood is planning to go much taller.

Developer Madison Group has filed plans to increase the height of its planned two-tower condo complex at 50 Eglinton Ave. W., from previously approved heights of 33 and 35 storeys, respectively, to a significantly taller plan calling for 46- and 58-storey towers.

The dual skyscrapers will rise from a podium featuring restored facades of a heritage-designed Toronto Hydro substation building.

As of 2024, plans for high-rise development at this site have been evolving for over a dozen years, first as two separate projects before being folded into one. The height sought for this site has almost doubled in the years since first proposed, and it shouldn’t come as a huge surprise for anyone tracking development in this part of the city.

Early 2024 design for 50 Eglinton West before current height increase request.

Building on a 2023 approval for towers of 33 and 35 storeys, the developer filed an updated application at the start of 2024 seeking a slight height increase to 35 and 37 storeys.

Only a few months later, the latest update submitted with city planners this April reflects the changing landscape in the surrounding midtown area, where tower heights and density allotments have skyrocketed in recent years in advance of the Eglinton Crosstown LRT.

April 2024 vision for 50 Eglinton Avenue West.

The current design from Audax Architecture is a vertical extrusion of the previous plan that maintains all details, including stepbacks and material details.

That updated design introduced in January responds to an agreement that allows the developer to incorporate office space replacement required under the neighbourhood plan to a nearby development site at 90-110 Eglinton East.

According to a letter filed with the City, “As a result of the removal of the on-site office replacement, which altered the design and size of the podium, and to improve the heritage preservation approach to the former Toronto Hydro substation building… Madison engaged Audax Architecture and Turner Fleischer Architects to reimagine the architectural style and expression of the project.”

A total of 1,206 condominium units are proposed in the current version of the plan, with over 98 per cent of the total floor space allocated to residential space. Of that total, 553 units are planned for the shorter west tower, with 653 in the taller east tower.

A sizeable retail component of over 1,300 square metres would animate the base of the complex at Duplex and Eglinton.

The complex would be served by a three-level underground parking garage housing 216 spots for residents and visitors. Most residents would be expected to make use of the Eglinton Line 1 and future Line 5 stations across the street to the southeast for longer-haul commutes.

Audax Architecture/Turner Fleischer Architects

Real eState

Luxury real estate prices just hit an all-time record – CNBC

Real estate is increasingly a tale of two markets — a luxury sector that is booming, and the rest of the market that continues to struggle with higher rates and low inventory.

Overall real estate sales fell 4% nationwide in the first quarter, according to Redfin. Yet, luxury real estate sales increased more than 2%, posting their best year-over-year gains in three years, according to Redfin.

Real estate experts and brokers chalk up the divergence to interest rates and supply. With mortgage rates now above 7% for a 30-year fixed loan, most homebuyers are finding prices out of reach. Affluent and wealthy buyers, however, are snapping up homes with cash, making them less vulnerable to high rates.

Nearly half of all luxury homes, defined by Redfin as homes in the top 5% of their metro area by value, were bought with all cash in the quarter, according to Redfin. That is the highest share in at least a decade. In Manhattan, all-cash deals hit a record 68% of all sales, according to Miller Samuel.

The flood of cash is also driving up prices at the top. Median luxury-home prices soared nearly 9% in the quarter, roughly twice the increase seen in the broader market, according to Redfin. The median price of luxury homes hit an all-time record of $1,225,000 during the period.

“People with the means to buy high-end homes are jumping in now because they feel confident prices will continue to rise,” said David Palmer, a Redfin agent in Seattle, where the median-priced luxury home sells for $2.7 million. “They’re ready to buy with more optimism and less apprehension.”

The luxury market is also benefiting from more supply of homes for sale. Since wealthy sellers are more likely to buy with cash, they are not as worried about trading out of a low-rate mortgage like most homeowners. That has freed up the upper end of listings, creating more inventory and driving more sales.

The number of luxury homes for sale jumped 13% in the first quarter, compared to a 3% decline for the rest of the housing market, according to Redfin. While overall luxury inventory remains “well below” pre-pandemic levels, the number of luxury listings that came online during the first quarter jumped 19%, the report said.

“Prices continue to increase for high-end homes, so homeowners feel it’s a good time to cash in on their equity,” Palmer said.

Still, not all luxury markets are booming, and the strongest price growth is in areas not typically known for luxury homes. According to Redfin, the market with the fastest luxury price growth was Providence, Rhode Island, with prices up 16%, followed by New Brunswick, New Jersey, where prices were up 15%. New York City saw the biggest price decline, down 10%.

When it comes to overall sales of luxury homes, Seattle posted the strongest growth of any metro area, with sales up 37%. Austin, Texas ranked second with sales up 26%, followed by San Francisco with a 24% increase.

Luxury homes sold the fastest in Seattle, with a median days on the market of nine days, followed by Oakland, California, and San Jose, California.

Subscribe to CNBC’s Inside Wealth newsletter with Robert Frank.

Real eState

New condo market in Toronto hits 15-year low: 'It is dead' – The Globe and Mail

Condo construction is shown in Ajax, Ont., on Nov. 30, 2023.Christopher Katsarov/The Canadian Press

New condo sales in the Toronto region dropped to their lowest level since the 2009 financial crisis, with investors balking at lofty purchase prices and higher borrowing costs.

The slowdown has imperilled the construction of homes at a time when governments are desperately trying to spur more building in a bid to make housing more affordable. The cost of housing is out of reach for many Canadian residents with the average monthly rent around $2,000 and the typical home selling for more than $700,000. The pace of home building needs to accelerate to meet demand of a growing population. But the staggering drop in new condo sales will lead to less investment in housing.

There were 1,461 new condo sales in the Greater Toronto and Hamilton Area in the first quarter of the year, according to industry research firm Urbanation Inc. That marked the lowest quarterly amount since early 2009, when the world was reeling from the U.S. housing meltdown and global recession.

“It is dead. I would never use words like this, but I am because it is true,” said Simeon Papailias, managing partner with real estate brokerage REC Canada, whose firm sells new condos, also known as preconstruction condos because they have not been built yet.

Mr. Papailias said his firm used to handle an average of 300 preconstruction sales a day. So far this year, there has been an average of 500 preconstruction sales per month.

The preconstruction condo market started to falter in 2022 as the Bank of Canada raised interest rates to cool inflation. Preconstruction buyers do not take out a mortgage until their condo unit is built and that process can take several years. However, they still need to show developers up front that they can qualify for a loan when the condo building has been completed.

And it’s not just the high borrowing costs. New condo prices have been climbing as developers face higher construction costs. Although prices declined incrementally from the fourth quarter of 2023 to the first quarter of this year, some downtown Toronto projects have been selling for a minimum of $1,800 per square foot. That means a 500 square foot studio would cost $900,000. That is unattractive for prospective homeowners who plan to live in their condo, as well as for investors, who make up the bulk of the preconstruction purchases.

Buyers can find cheaper and larger condos that have already been built. “Existing square footage is so much cheaper. The builders and their future pricing is a huge issue,” said Tuli Parubets, a mortgage agent with Mortgage Scout who works with homebuyers in the Toronto region.

Investors would have to charge more than the going market rental rate to cover their mortgage and other condo-related costs. “It’s very difficult for investors to make the numbers work on buying new condos, given their record high price premium over resales and steeply negative cash flow on rentals,” said Urbanation president Shaun Hildebrand.

Pierre Carapetian, who has sold real estate in the Toronto region for 18 years, said he has steered his clients away from preconstruction homes into the resale market because resale homes are cheaper.

“In the last two years, I have not recommended a single project,” said Mr. Carapetian, who runs his own real estate brokerage. “I could not in good conscience recommend anything at this juncture because it makes no logical sense.”

As a result, demand has crumbled and developers have put projects on hold. Urbanation said since the market started slowing in 2022, it has counted five dozen projects have been put on hold indefinitely. That accounts for 21,505 condo units.

For projects that have been launched, the weak pace of sales is affecting their ability to get financing to start construction. During the first quarter, projects in the preconstruction phase were only 50 per cent sold, on average. That compared to an average of 61 per cent in the first quarter of 2023, and an average of 85 per cent in 2022.

Lenders typically require developers to sell 70 per cent of their units for construction financing. The longer it takes to sell preconstruction condos, the longer it will take to get financing and start construction. That will eventually lead to fewer homes being built.

“No launches, no sales and no starts,” said Mr. Papailias. “It’s absolutely the most vicious cycle.”

The slowdown is occurring as governments try to make it easier for real estate developers to build. The federal government recently announced that it will allow first-time homebuyers to take out a 30-year mortgage for a preconstruction home if they make a deposit that is less than 20 per cent of the home’s purchase price and they pay for mortgage insurance. The old mortgage rules did not allow insured-mortgage borrowers to take out a loan longer than 25 years.

However, given that Toronto region developers typically require a 20 per cent deposit, the longer amortization is not expected to make a big difference in the new home market.

-

Business12 hours ago

Honda to build electric vehicles and battery plant in Ontario, sources say – Global News

-

Science13 hours ago

Science13 hours agoWill We Know if TRAPPIST-1e has Life? – Universe Today

-

Investment16 hours ago

Down 80%, Is Carnival Stock a Once-in-a-Generation Investment Opportunity?

-

Health12 hours ago

Health12 hours agoSimcoe-Muskoka health unit urges residents to get immunized

-

News17 hours ago

Honda expected to announce multi-billion dollar deal to assemble EVs in Ontario

-

Sports22 hours ago

Sports22 hours agoJets score 7, hold off Avalanche in Game 1 of West 1st Round – NHL.com

-

Art22 hours ago

‘Luminous’ truck strap artwork wins prestigious Biennale prize in first for New Zealand – The Guardian

-

Tech16 hours ago

Tech16 hours agoIndigenous Craft and Vendors Market a success in Halifax