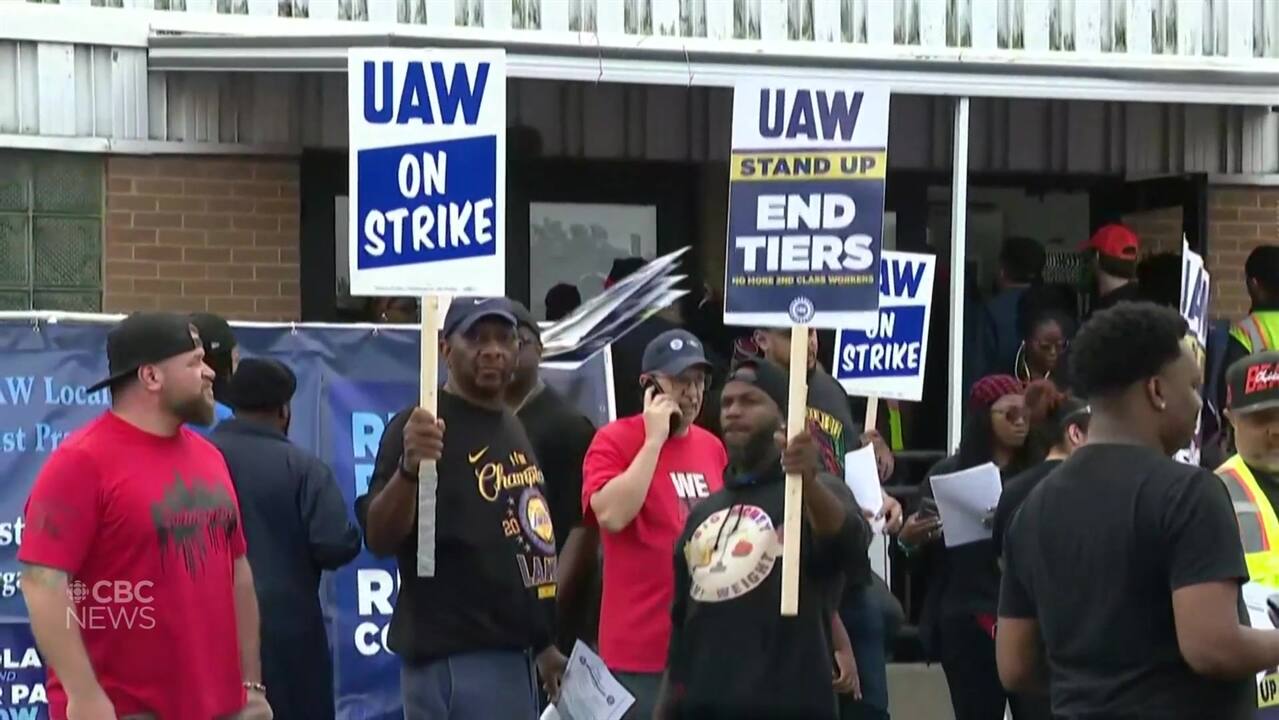

The United Auto Workers union significantly escalated its walkout against Detroit’s Big Three automakers, shutting down Ford’s largest factory and threatening Jeep maker Stellantis.

In a surprise move Wednesday night, 8,700 members left their jobs at Ford’s Kentucky truck plant in Louisville.

On Thursday morning, union president Shawn Fain hinted at further action against Stellantis.

“Here’s to hoping talks at Stellantis today are more productive than Ford yesterday,” Fain wrote on X, formerly Twitter, without saying what might happen.

Ford’s truck plant makes heavy-duty F-Series pickup trucks and large Ford and Lincoln SUVs. The vehicles made at the plant generate $25 billion US per year in revenue, the company said in a statement.

Fain said in a statement that the union has waited long enough “but Ford hasn’t gotten the message” to bargain for a fair contract. “If they can’t understand that after four weeks, the 8,700 workers shutting down this extremely profitable plant will help them understand it,” he said.

The strike came nearly four weeks after the union began its walkouts against General Motors, Ford and Stellantis on Sept. 15, with one assembly plant from each company.

Ford called the strike expansion “grossly irresponsible” and said it has made strong wage and benefit offers to the union. It said the move puts about a dozen other Ford facilities at risk, as well as parts supply plants that together employ more than 100,000 people.

A Ford executive, who spoke on condition of anonymity, said the union called a meeting at the company’s Dearborn, Mich., headquarters Wednesday afternoon, where Fain asked if the company had another offer.

UAW strike impact ‘not massive’ but another week will be ‘painful’: analyst

Automotive analyst Laurie Harbour is a consultant for manufactuinrng companies who recently led a workshop for automotive suppliers to prepare for the ripples of United Auto Workers strike, which is now in its second week and targeting 5 assembly plants in the United States.

High-ranking Ford executives responded that they are working on possibly bringing electric vehicle battery plants into the UAW national contract, like GM did, essentially making them unionized. But they didn’t have a significantly different economic offer, the executive said.

Fain was told Ford put a strong offer on the table, but there wasn’t a lot of room to increase it and keep it affordable for the business, the executive said.

The executive said Fain responded by saying, if that’s the company’s best offer, “You just lost Kentucky Truck Plant.” The meeting only lasted about 15 minutes, the executive said.

In a video, Fain said the union moved because Ford didn’t change its offer.

“We’ve been very patient working with the company on this,” he said. “They have not met expectations, they’re not even coming to the table on it.”

Hugely profitable vehicles now impacted

The escalation against Ford shows that Fain is trying to increase pressure on the company, said Marick Masters, a business professor at Wayne State University who follows labour issues.

But Ford and the other automakers have made concessions and raised wage offers, he said. The companies, he said, “may have reached their resistance points to varying degrees.” Executives, he said, have bottom-line positions they can’t cross in terms of staying competitive with other automakers.

Masters said Fain is likely testing how far he needs to push Ford before going “full throttle” and taking all 57,000 Ford members out on strike.

The union’s move doesn’t leave Masters optimistic for a quick end to the strikes.

“I think the issues that remain on the table are quite thorny,” he said, pointing to union demands that all workers get defined benefit pensions and health insurance when they retire.

The UAW expanded its strikes on Sept. 22, adding 38 GM and Stellantis parts warehouses. Assembly plants from Ford and GM were added the week after that. The Kentucky strike brings to 33,700 the number of workers on strike against the three automakers.

More layoffs likely

Since the start of the strike, the three Detroit automakers have laid off roughly 4,800 workers at factories that are not among the plants that have been hit by the UAW strikes.

The companies say the strikes have forced them to impose those layoffs. They note the job cuts have occurred mainly at factories that make parts for assembly plants that were closed by strikes.

The UAW rejects that argument. It contends that the layoffs are unjustified and were imposed as part of the companies’ pressure campaign to persuade UAW members to accept less in negotiations with automakers. The factories affected by layoffs are in six states: Michigan, Ohio, Illinois, Kansas, Indiana and New York.

Sam Fiorani, an analyst with AutoForecast Solutions, a consulting firm, said he thinks the layoffs reflect a simple reality: The automakers are losing money because of the strikes. By slowing or idling factories that are running below their capacities because of strike-related parts shortages, Fiorani said, the companies can mitigate further losses.

“It doesn’t make sense to keep running at 30 per cent or 40 per cent of capacity when it normally runs at 100 per cent,” he said.