VANCOUVER – Predictions of a close election were holding true in British Columbia on Saturday, with early returns showing the New Democrats and the B.C. Conservatives locked in a tight battle.

Both NDP Leader David Eby and Conservative Leader John Rustad retained their seats, while Green Leader Sonia Furstenau lost to the NDP’s Grace Lore after switching ridings to Victoria-Beacon Hill.

However, the Greens retained their place in the legislature after Rob Botterell won in Saanich North and the Islands, previously occupied by party colleague Adam Olsen, who did not seek re-election.

It was a rain-drenched election day in much of the province.

Voters braved high winds and torrential downpours brought by an atmospheric river weather system that forced closures of several polling stations due to power outages.

Residents faced a choice for the next government that would have seemed unthinkable just a few months ago, between the incumbent New Democrats led by Eby and Rustad’s B.C. Conservatives, who received less than two per cent of the vote last election

Among the winners were the NDP’s Housing Minister Ravi Kahlon in Delta North and Attorney General Niki Sharma in Vancouver-Hastings, as well as the Conservatives Bruce Banman in Abbotsford South and Brent Chapman in Surrey South.

Chapman had been heavily criticized during the campaign for an old social media post that called Palestinian children “inbred” and “time bombs.”

Results came in quickly, as promised by Elections BC, with electronic vote tabulation being used provincewide for the first time.

The election authority expected the count would be “substantially complete” by 9 p.m., one hour after the close of polls.

Six new seats have been added since the last provincial election, and to win a majority, a party must secure 47 seats in the 93-seat legislature.

There had already been a big turnout before election day on Saturday, with more than a million advance votes cast, representing more than 28 per cent of valid voters and smashing the previous record for early polling.

The wild weather on election day was appropriate for such a tumultuous campaign.

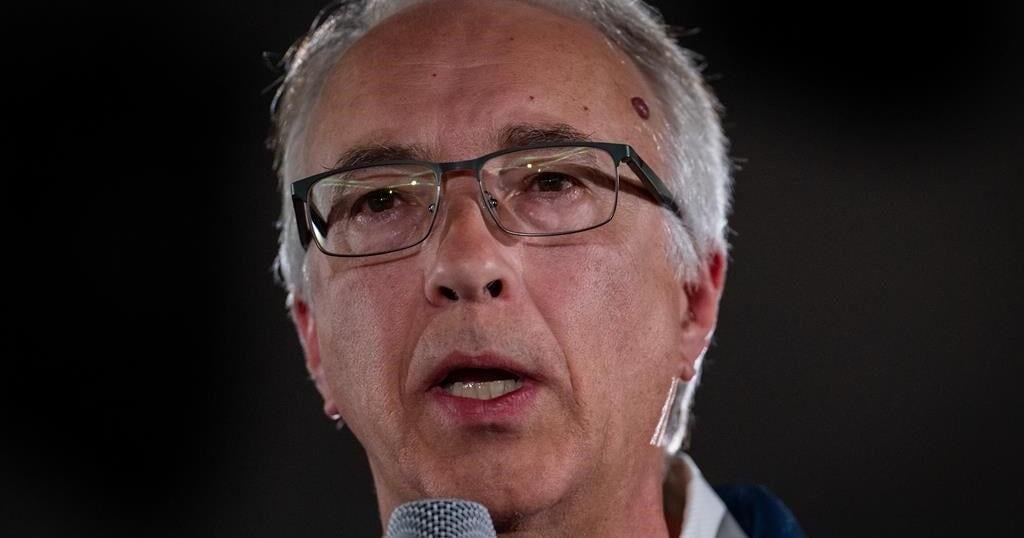

Once considered a fringe player in provincial politics, the B.C. Conservatives stand on the brink of forming government or becoming the official Opposition.

Rustad’s unlikely rise came after he was thrown out of the Opposition, then known as the BC Liberals, joined the Conservatives as leader, and steered them to a level of popularity that led to the collapse of his old party, now called BC United — all in just two years.

Rustad shared a photo on social media Saturday showing himself smiling and walking with his wife at a voting station, with a message saying, “This is the first time Kim and I have voted for the Conservative Party of BC!”

Eby, who voted earlier in the week, posted a message on social media Saturday telling voters to “grab an umbrella and stay safe.”

Two voting sites in Cariboo-Chilcotin in the B.C. Interior and one in Maple Ridge in the Lower Mainland were closed due to power cuts, Elections BC said, while several sites in Kamloops, Langley and Port Moody, as well as on Hornby, Denman and Mayne islands, were temporarily shut but reopened by mid-afternoon.

Some former BC United MLAs running as Independents were defeated, with Karin Kirkpatrick, Dan Davies, Coralee Oakes and Tom Shypitka all losing to Conservatives.

Kirkpatrick had said in a statement before the results came in that her campaign had been in touch with Elections BC about the risk of weather-related disruptions, and was told that voting tabulation machines have battery power for four hours in the event of an outage.

— With files from Brenna Owen

This report by The Canadian Press was first published Oct. 19, 2024.