(Bloomberg) — The US economy’s recent rebound is looking like a high-water mark for the expansion.

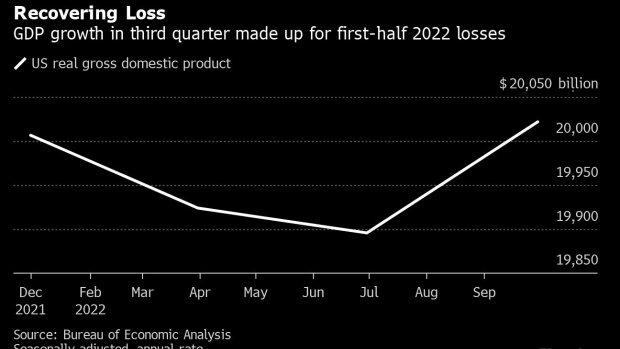

While government data on Thursday revealed US gross domestic product rose 2.6% at an annualized rate in the third quarter, that gain merely made up for the economy’s contraction during the first half of the year.

Total inflation-adjusted GDP in the third quarter was roughly the same as where it was at the end of 2021, and it may soon start deteriorating anew, with the Commerce Department report containing foreboding signs for the economy:

- Investment in residential housing plunged at an annual rate of about 26% — a “monster” decline in the words of Citigroup Inc. economist Nathan Sheets and likely a response to the highest mortgage rates in two decades.

- Consumer spending, the engine of the economy, rose 1.4% from the previous three months, capping the weakest three quarters since the demand destruction of early 2020.

- Stripping trade and inventories out, final sales to domestic buyers showed an annualized growth rate of just 0.5%. That compares with an average of almost 2.6% over the five years before the pandemic.

“It’s very unusual to see that indicator basically stall outside of a recession period — that’s telling,” said Sal Guatieri, a senior economist at BMO Capital Markets, referring to the final-demand indicator. “That means the US economy beneath the surface is losing steam.”

The underlying signs of weakness highlight the difficulty President Joe Biden and Democratic lawmakers have had in crafting a narrative that resonates with voters in the run-up to Nov. 8 congressional elections. While the job market continues to expand, inflation and surging interest rates are taking a toll, as evidenced in Thursday’s report.

Biden himself hailed the release as showing that the economy “is continuing to power forward” and not in recession.

That’s not dissuading many from predicting one. McDonald’s Corp. Chief Executive Officer Chris Kempczinksi said Thursday he expects a mild-to-moderate recession in the US — even though the company itself is doing fine and saw a pick-up in a key metric for sales in the country this month.

What Bloomberg Economics Says…

“A return to economic growth in the third quarter obscures continued signs of a slowdown in components that provide a cleaner signal of momentum… The Fed is likely to view the weaker components as intended consequences of its tighter monetary policy, and not as reasons to back off the tightening cycle just yet.”

— Andrew Husby and Eliza Winger, economists

To read the full note, click here

Inflation-adjusted business investment advanced 3.7%, reflecting a robust increase in outlays for equipment and intellectual property products. At the same time, a separate report Thursday showed orders for non-defense capital goods, excluding aircraft — a proxy for business investment — dropped 0.7% in September, the most in more than a year.

“We expect third-quarter 2022 to mark the peak in quarterly growth, as the cumulative effect of tighter monetary policy begins to push growth below potential,” Morgan Stanley US economists led by Ellen Zentner wrote in a note. They expect fourth-quarter GDP will grow 0.8%.

Thursday’s data did nothing to dissuade traders from expecting Federal Reserve Chair Jerome Powell and his colleagues from boosting interest rates by 75 basis points next week. Futures trading reflects expectations for a half-point increase at the following meeting, in December.

One measure of inflation included in the GDP data, the personal consumption expenditures price index, rose an annualized 4.2% in the third quarter, the slowest pace since the end of 2020. But it likely reflects a decline in trade prices and residential investment, Morgan Stanley’s team of economists said — limiting its implications for the Fed.

Stripping out food and energy, the price index rose 4.5%. Monthly data for September will be released Friday.

How Executives See It

- “The macro-environment indications of a recession are certainly increasing.” — John Greene, chief financial officer of Discover Financial Services, Oct. 25 earnings call

- “Short-term consumer sentiment and consumer demand are clearly reflective of a recessionary environment. While at the same time, input costs, which you would expect to come down in a recessionary environment, are still elevated.” — Marc Bitzer, chief executive officer of Whirlpool Corp., Oct. 21 earnings call

- “We continue to believe that 2023 demand for air travel will be robust. We currently see no signs of demand slowing as we move into the new year.” — Derek Kerr, CFO of American Airlines Group Inc., Oct. 20 earnings call

Source link

Related