Business

US economy turns in record Q3 growth, but crisis is not over – Al Jazeera English

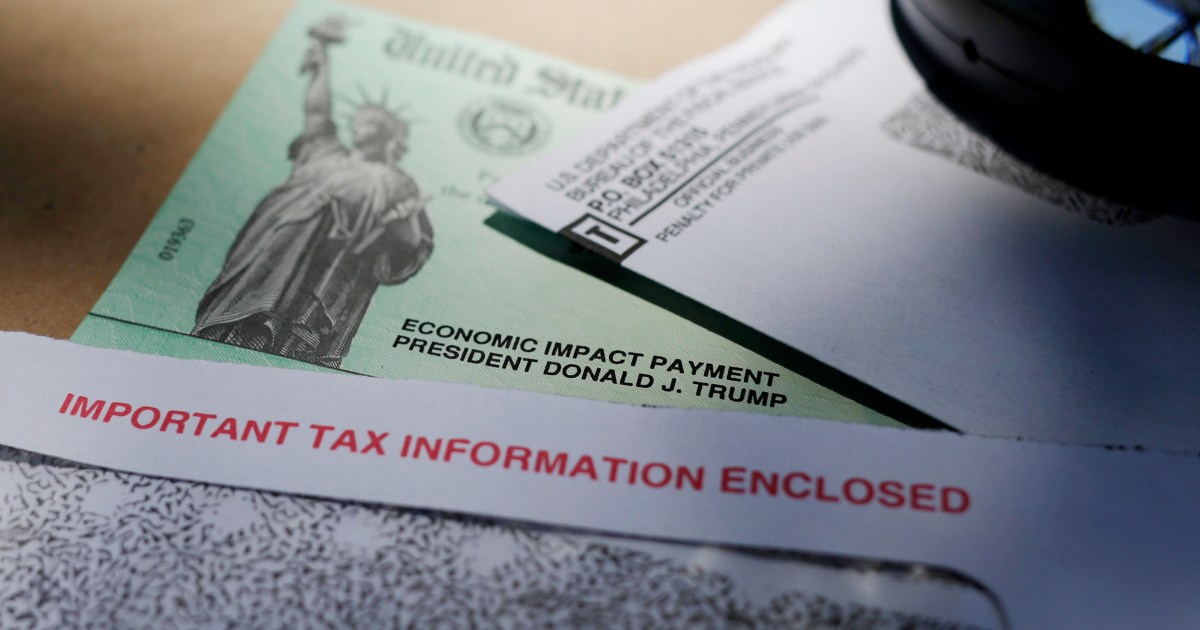

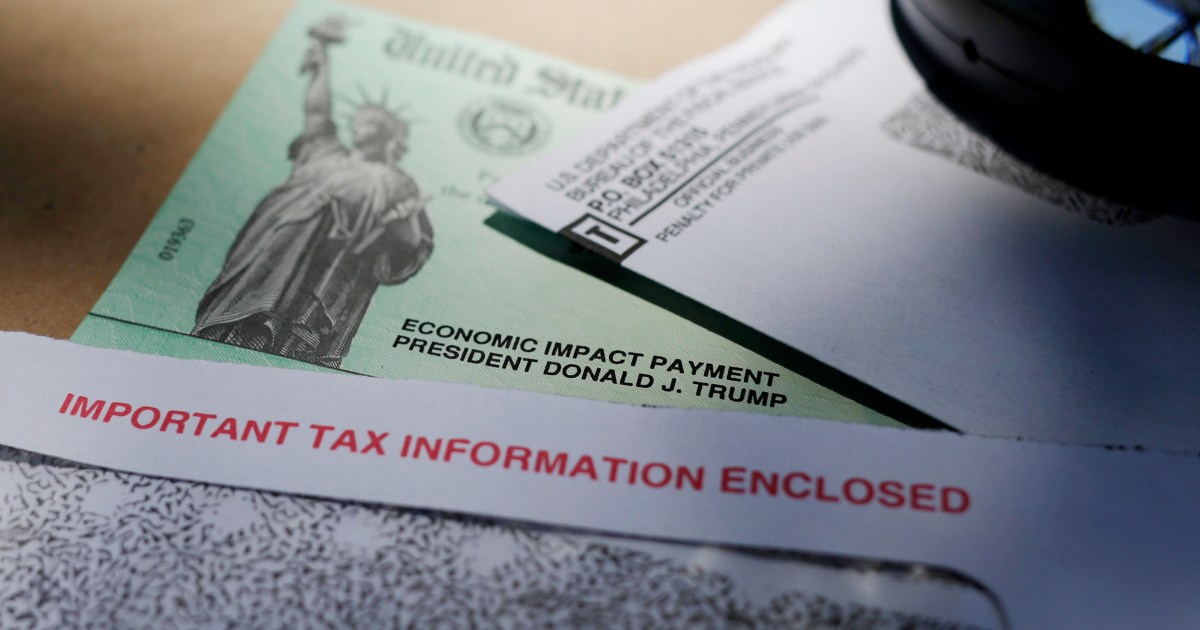

The United States economy grew at its fastest pace on record in the third quarter, rebounding at an annual rate of 33.1 percent, the Bureau of Economic Analysis said on Thursday.

The blockbuster reading follows on from a record-shattering 31.4 percent contraction in the second quarter- and a negative 5 percent hit in the first quarter – when the economy officially entered recession in February.

The balance signals that though the economy is crawling out of the deep hole dug by COVID-19 it still has a way to go to recapture its pre-pandemic strength.

Put simply, the economic crisis is not over.

Moreover, some sectors of the economy are recovering faster than others and those disparities are rippling through the fabric of American society in the form of deepening inequalities.

Those with a job and assets like stock portfolios and homes are doing well, while those who are jobless or own a business ravaged by virus restrictions are falling further behind. Racial wealth and income disparities are widening. Women are dropping out of the workforce at an alarming rate as the demands of jobs and looking after children learning remotely force tough choices on parents.

Thursday’s report on gross domestic product (GDP) is the last major economic data release before the November 3 US presidential election.

Though the headline number may be seized upon as a bragging point for President Donald Trump, it is unlikely to dramatically influence his reelection prospects, given more than 75 million Americans have already voted, according to the US Elections Project.

But there is a world of uncertainty that lies ahead – both for the election and the economy.

If the results of the election are contested, it could lead to further hold-ups with a new round of virus relief aid as the White House and Democrats in Congress fail to find common ground.

The stakes could not be higher. Aid from the federal government such as enhanced employment benefits, lifelines for small businesses, and one-off cash payments to households helped the economy bounce back in the third quarter. But those stimulus effects are fading.

There is a mounting body of data that points to a downshifting recovery in the fourth quarter. Federal Reserve Chairman Jerome Powell has warned that more government spending is needed to keep the recovery on track.

Now surging COVID-19 infections are raising the spectre of more business-sapping restrictions.

An unprecedented recession, a slowing recovery

The COVID-19 recession is a far different beast from previous post-war contractions.

The Great Recession of 2008-2009 was triggered by a massive build-up of debt, mostly due to the housing bubble. When it burst, loans soured, house prices crashed, credit markets seized, wealth was wiped out, unemployment skyrocketed and demand for finished goods and services – what economists call “aggregate demand” – suffered a massive blow.

That devastated industries like construction and manufacturing and sent the Federal Reserve scrambling to create new tools to pull the US and global economies back from the brink of collapse. Congress dithered and eventually stepped up with a $787bn stimulus package in 2009.

But subsequent rounds of federal spending were not forthcoming, leaving the Fed to carry to recovery ball with the blunt tool of monetary policy. Many economists believe this led to a more protracted recovery.

The COVID-19 recession by contrast was triggered by lockdowns designed to contain the spread of the disease. Entire sectors of the economy ground to a halt virtually overnight, delivering an unprecedented supply shock that quickly turned into a demand shock as 22 million people were thrown out of work in March and April.

Customer-facing service industries, like restaurants, that employ a disproportionate number of low wage workers, as well as minorities and women, were gutted.

This time around, the Fed acted much faster with bold and decisive action, such as slashing interest rates to near zero, resuming bond buying to keep borrowing costs at rock bottom and making trillions of dollars of lending available to keep credit markets from freaking out.

Congress also moved far more quickly on the spending front, approving some $3 trillion in virus relief aid to help small businesses keep workers on payrolls, laid-off workers remain afloat and state and local governments cope with the public health crisis.

The combined efforts of the Fed and Congress helped power the economy in the third quarter – putting money in people’s pockets to help unleash pent-up demand as lockdown restrictions were rolled back.

That is clear from Thursday’s numbers. Consumer spending – which drives roughly two-thirds of US economic growth – was indeed the hero of third-quarter GDP.

Businesses, such as car dealers building up inventories, exports and a red hot housing market were also key drivers.

But federal stimulus programmes including the lifeline to small businesses and the $600 federal weekly top-up to state unemployment benefits expired at the end of July – and that waning stimulus is manifesting in metrics that signal the recovery is now shifting into low gear.

In August, personal income in the US declined 2.7 percent – a fall the US Department of Commerce said was “more than accounted for” by the expiration of the federal weekly jobless benefit supplement.

Disparities are also widening. Again – monetary policy is a blunt instrument.

While basement level borrowing costs helped keep credit flowing to businesses and households – essential for keeping the economy healthy – they have also rewarded asset owners.

Record-low mortgage rates for example, helped drive sales of previously owned homes to a 14-year high in September, while investors chasing bigger returns from risker assets helped US stock indexes recover from the COVID crash earlier this year. The S&P 500 hit a new all-time high at the start of September.

That means many Americans who own their own home and are invested in the stock market and who still have a job are not only doing well, many of them are more well off than before the pandemic.

Meanwhile, those who are out of work and who don’t own appreciating assets are struggling.

Nearly one in three renters in the US did not pay their rent fully on time in the first week of October, while one in 10 started the month owing back rent, according to a housing payments survey by Apartment List.

Layoffs remain widespread. Some 751,000 Americans filed for state unemployment benefits last week. That is 40,000 fewer than the previous week, but still far above February’s average of just over 200,000 initial weekly jobless claims.

And though the nation’s unemployment rate fell to 7.9 percent in September – a little less than half of its pandemic high in April – it is still miles off of February’s unemployment rate of 3.5 percent.

Only 11.4 million of the 22 million jobs lost during lockdowns have been recovered. Many temporary layoffs are turning into permanent job losses.

Federal Reserve chiefs aren’t exactly known for their plain-talking ways, but Powell was pretty blunt when he laid out the case earlier this month for more fiscal stimulus from Congress: “Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses,” he said.

But more relief hinges on Congress and the White House overcoming their differences to pass another aid package.

Looming over this backdrop of partisan political acrimony is the ever-present threat of COVID-19.

Infections are surging in parts of the US, raising the spectre of more growth-sapping containment measures. In Europe, where cases are spiraling, France and Germany have ordered partial lockdowns.

The course of the virus, the outcome of the election, and plateauing recovery are launching the US down an uncertain path. One that could lead to longer economic recovery.

Business

Gildan replacing five directors ahead of AGM, will back two Browning West nominees

|

|

MONTREAL — Gildan Activewear Inc. is making changes to its board of directors in an attempt to head off a move by an activist shareholder looking to replace a majority of the board at its annual meeting next month.

U.S. investment firm Browning West wants to replace eight of Gildan’s 12 directors with its own nominees in a move to bring back founder Glenn Chamandy as chief executive.

Gildan, which announced late last year that Chamandy would be replaced by Vince Tyra, said Monday it will replace five members of its board of directors ahead of its annual meeting set for May 28.

It also says current board members Luc Jobin and Chris Shackelton will not run for re-election and that it will recommend shareholders vote for Karen Stuckey and J.P. Towner, who are two of Browning West’s eight nominees.

The new directors who will join the Gildan board on May 1 are Tim Hodgson, Lee Bird, Jane Craighead, Lynn Loewen and Les Viner. They will replace Donald Berg, Maryse Bertrand, Shirley Cunningham, Charles Herington and Craig Leavitt.

Hodgson, who served as chief executive of Goldman Sachs Canada from 2005 to 2010, is expected to replace Berg as chair.

“I look forward to working with this highly qualified board and management team to realize the full benefits of Vince’s ambitious yet realistic plan to drive growth by enhancing the Gildan sustainable growth strategy,” Hodgson said in a statement.

“The refreshed board and I fully believe in Vince and his talented team as well as Gildan’s leading market position and growth prospects.”

Gildan has been embroiled in controversy ever since it announced Chamandy was being replaced by Tyra.

The company has said Chamandy had no credible long-term strategy and had lost the board’s confidence. But several of Gildan’s investors have criticized the company for the move and called for his return.

Those investors include the company’s largest shareholder, Jarislowsky Fraser, as well as Browning West and Turtle Creek Asset Management.

In announcing the board changes, Gildan said it met with shareholders including those who Browning West has counted as supportive.

“Our slate strikes a balance between ensuring the board retains historical continuity during a period of transition and provides fresh perspectives to ensure it continues to serve its important oversight function on behalf of all shareholders,” the company said.

Gildan said last month that it has formed a special committee of independent directors to consider a “non-binding expression of interest” from an unnamed potential purchaser and contact other potential bidders.

But Browning West and Turtle Creek have said the current board cannot be trusted to oversee a sale of the company.

The company said Monday that there continues to be external interest in acquiring the company and the process is ongoing.

This report by The Canadian Press was first published April 22, 2024.

Companies in this story: (TSX:GIL)

The Canadian Press

Business

Ottawa puts up $50M in federal budget to hedge against job-stealing AI – CP24

Anja Karadeglija, The Canadian Press

Published Sunday, April 21, 2024 4:02PM EDT

Last Updated Sunday, April 21, 2024 4:04PM EDT

Worried artificial intelligence is coming for your job? So is the federal government — enough, at least, to set aside $50 million for skills retraining for workers.

One of the centrepiece promises in the federal budget released Tuesday was $2.3 billion in investments aiming to boost adoption of the technology and the artificial intelligence industry in Canada.

But tucked alongside that was a promise to invest $50 million over four years “to support workers who may be impacted by AI.” Workers in “potentially disrupted sectors and communities” will receive new skills training through the Sectoral Workforce Solutions Program.

“There is a significant transformation of the economy and society on the horizon around artificial intelligence,” said Joel Blit, an associate professor of economics at the University of Waterloo.

Some jobs will be lost, others will be created, “but there’s going to be a transition period that could be somewhat chaotic.”

While jokes about robots coming to take jobs predate the emergence of generative AI systems in late 2022, the widespread availability of systems like ChatGPT made those fears real for many, even as workers across industries began integrating the technology into their workday.

In June 2023, a briefing note for Finance Minister Chrystia Freeland warned the impact of generative AI “will be felt across all industries and around 40 per cent of all working hours could be impacted.”

“Banking, insurance and energy appear to have higher potential for automation compared to other sectors,” says the note, obtained through access to information and citing information from Accenture.

“This could have substantial impacts on jobs and skills requirements.”

The budget only singles out “creative industries” as an affected sector that will be covered by the program. In February, the Canadian TV, film, and music industries asked MPs for protection against AI, saying the tech threatens their livelihood and reputations.

Finance Canada did not respond to questions asking what other sectors or types of jobs would be covered under the program.

“The creative industries was used as an illustrative example, and not intended as an exclusion of other affected areas,” deputy Finance spokesperson Caroline Thériault said in a statement.

In an interview earlier this year, Bea Bruske, president of the Canadian Labour Congress, said unions representing actors and directors have been very worried about how their likenesses or their work could be used by AI systems. But the “reality is that we have to look at the implication of AI in all jobs,” she said.

Blit explained large language models and other generative AI can write, come up with new ideas and then test those ideas, analyze data, as well as generate computer programming code, music, images, and video.

Those set to be affected are individuals in white-collar professions, like people working in marketing, health care, law and accounting.

In the longer run, “it’s actually quite hard to predict who is going to be impacted,” he said. “What’s going to happen is that entire industries, entire processes are going to be reimagined around this new technology.”

AI is an issue “across sectors, but certainly clerical and customer service jobs are more vulnerable,” Hugh Pouliot, a spokesperson for the Canadian Union of Public Employees, said in an email.

The federal government has used AI in nearly 300 projects and initiatives, new research published earlier this month revealed.

According to Viet Vu, manager of economic research at Toronto Metropolitan University’s the Dais, the impact of AI on workers in a sector like the creative industry doesn’t have to be negative.

“That’s only the case if you adopt it irresponsibly,” he said, pointing out creative professionals have been adopting new digital tools in their work for years.

He noted only four per cent of Canadian businesses are using any kind of artificial intelligence or machine learning. “And so we’re really not there yet for these frontier models and frontier technologies” to be making an impact.

When it comes to the question of how AI will affect the labour market, it’s more useful to think about what types of tasks technology can do better, as opposed to whether it will replace entire jobs, Vu said.

“A job is composed of so many different tasks that sometimes even if a new technology comes along and 20, 30 per cent of your job can be done using AI, you still have that 60, 70 per cent left,” he said.

“So it’s rare that (an) entire occupation is actually sort of erased out of existence because of technology.”

Finance Canada also did not respond to questions about what new skills the workers would be learning.

Vu said there are two types of skills it makes sense to focus on in retraining — computational thinking, or understanding how computers operate and make decisions, and skills dealing with data.

There is no AI system in the world that does not use data, he said. “And so being able to actually understand how data is curated, how data is used, even some basic data analytics skills, will go a really long way.”

But given the scope of the change the AI technology is set to trigger, critics say a lot more than $50 million will be necessary.

Blit said the money is a good first step but won’t be “close to enough” when it comes to the scale of the coming transformation, which will be comparable to globalization or the adoption of computers.

Valerio De Stefano, Canada research chair in innovation law and society at York University, agreed more resources will be necessary.

“Jobs may be reduced to an extent that reskilling may be insufficient,” and the government should look at “forms of unconditional income support such as basic income,” he said.

The government should also consider demanding AI companies “contribute directly to pay for any social initiative that takes care of people who lose their jobs to technology” and asking “employers who reduce payrolls and increase profits thanks to AI to do the same.”

“Otherwise, society will end up subsidizing tech businesses and other companies as they increase profit without giving back enough for technology to benefit us all.”

Business

Honda to build electric vehicles and battery plant in Ontario, sources say – Global News

Honda Canada is set to build an electric vehicle battery plant near its auto manufacturing facility in Alliston, Ont., where it also plans to produce fully electric vehicles, The Canadian Press has learned.

Senior sources with information on the project confirmed the federal and Ontario governments will make the announcement this week, but were not yet able to give any dollar figures.

However, comments Monday from Ontario Premier Doug Ford and Economic Development Minister Vic Fedeli suggest it is a project worth around $14 billion or $15 billion.

Ford told a First Nations conference that there will be an announcement this week about a new deal he said will be double the size of a Volkswagen deal announced last year. That EV battery plant set to be built in St. Thomas, Ont., comes with a $7-billion capital price tag.

Fedeli would not confirm if Ford was referencing Honda, but spoke coyly after question period Monday about the amount of electric vehicle investment in the province.

“We went from zero to $28 billion in three years and if the premier, if his comments are correct, then next week, we’ll be announcing $43 billion … in and around there,” he said.

More on Canada

The Honda facility will be the third electric vehicle battery plant in Ontario, following in the footsteps of Volkswagen and a Stellantis LG plant in Windsor, and while those two deals involved billions of dollars in production subsidies as a way of competing with the United States’ Inflation Reduction Act subsidies, Honda’s is expected to involve capital commitments and tax credits.

Federal Finance Minister Chrystia Freeland’s recent budget announced a 10-per-cent Electric Vehicle Supply Chain investment tax credit on the cost of buildings related to EV production as long as the business invests in assembly, battery production and cathode active material production in Canada.

That’s on top of an existing 30-per-cent Clean Technology Manufacturing investment tax credit on the cost of investments in new machinery and equipment.

Honda’s deal also involves two key parts suppliers for their batteries — cathodes and separators — with the locations of those facilities elsewhere in Ontario set to be announced at a later date.

The deal comes after years of meetings and discussions between Honda executives and the Ontario government, the sources said.

Prime Minister Justin Trudeau, Premier Doug Ford and Honda executives were on hand in March 2022 in Alliston when the Japanese automaker announced hybrid production at the facility, with $131.6 million in assistance from each of the two levels of government.

Around the time of that announcement, conversations began about a larger potential investment into electric vehicles, the sources said, and negotiations began that summer.

Fedeli travelled to Japan that fall, the first of three visits to meet with Honda Motor executives about the project. Senior officials from the company in Japan also travelled to Toronto three times to meet with government officials, including twice with Ford.

During a trip by the Honda executives to Toronto in March 2023, Ontario officials including Fedeli pitched the province as a prime destination for electric vehicle and battery investments, part of a strong push from the government to make Ford’s vision of an end-to-end electric vehicle supply chain in the province a reality.

Negotiations took a major step forward that July, when Ontario sent a formal letter to Honda Canada, signalling its willingness to offer incentives for a battery plant and EV production. Honda Canada executives then met with Ford in November and December.

The latter meeting sealed the deal, the sources said.

Honda approached the federal government a few months ago, a senior government official said, and Freeland led her government’s negotiations with the company.

The project is expected to involve the construction of several plants, according to the source.

— With files from Nojoud Al Mallees in Ottawa.

© 2024 The Canadian Press

-

Health10 hours ago

Health10 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art16 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Science24 hours ago

Science24 hours ago"Hi, It's Me": NASA's Voyager 1 Phones Home From 15 Billion Miles Away – NDTV

-

Health14 hours ago

Health14 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

News22 hours ago

Some Canadians will be digging out of 25+ cm of snow by Friday – The Weather Network

-

Media21 hours ago

Jon Stewart Slams the Media for Coverage of Trump Trial – The New York Times

-

Investment14 hours ago

Investment14 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

News15 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News