Real eState

Vancouver real estate: unlivable home previously auctioned by city hall sells over asking price for $2.5 million – Straight.com

A derelict home with a bit of history with the City of Vancouver recently changed hands.

A buyer purchased 3469 Arbutus Street for $2.5 million, which was over the property’s listing price of $2,395,000.

The listing by Sutton Group-West Coast Realty describes the 2,385-square-foot residence as “not livable”.

An online search produced a report to city council by Marina Marzin, collector of taxes with the City of Vancouver.

Marzin’s report recalled that the city auctioned the property as part of its annual tax sale on November 13, 2019.

“The owner of the Property (the “Owner”) inherited the Property in 1985, and it is mortgage free,” Marzin wrote.

The assessed value of the property in 2019 was $2,154,700.

“The Owner has not paid any City taxes on the Property since 2016,” Marzin related. “The Property appears to be abandoned. The Owner does not reside at the Property.”

Moreover, “The City has attempted to deliver various notices and messages to the Owner, both leading up to and after the tax sale in November 2019, but has no confirmation that it has succeeded.”

According to Marzin, the City has had “no confirmed communication with the Owner in 4 years”.

“The Owner is unresponsive to other tax matters as well,” the tax collector related.

The property has been subject to the city’s empty homes tax, and B.C.’s speculation and vacancy tax.

At the 2019 city auction, a “tax sale purchaser bid the minimum upset price, $4,373.74, plus $1,400,000.00”.

Marzin explained that following a tax sale, “there is a one–year period when the owner of a property can redeem the taxes owing and the tax sale purchaser will not obtain title to the property”.

As a result, city council then declares a manifest error, refunds the buyer, and cancels the tax sale.

In circumstances that were not totally clear, Marzin wrote in the October 27, 2020 report that city staff recommend that council makes a declaration of manifest error “because staff has no confirmation that the Owner received any Tax Notices or notices of the tax sale leading up to the tax sale”.

Marzin’s report was included in the November 4, 2020 agenda of council.

Minutes show that the report was subsequently withdrawn by staff.

It was not immediately known if the tax sale was either maintained or cancelled.

The run-down home sits on a 6,250-square-foot lot with a frontage of 50 feet.

The two-storey home with basement was built in 1928.

According to B.C. Assessment, the property’s 2021 value as of July 1, 2020 was $2,013,700.

The lot is valued at $1,980,000, and the run-down house, $33,700.

Sutton Group-West Coast Realty listed the property on January 30, 2021 for $2,395,000.

After 12 days, a buyer came forward and picked up the property for $2.5 million on February 11.

The transaction was tracked by real-estate site fisherly.com.

Real eState

Celebrity real estate agent Mauricio Umansky explains when housing prices will come down – Fox Business

Real eState

Real Estate Stocks Fall As Mortgage Rates Rise To 4-Month Highs: 'Inflation Is Proving Tougher To Bring D – Benzinga

Real estate stocks slid at Wednesday’s market open, weighed down by the latest disappointing data on housing starts and a spike in mortgage rates, darkening the outlook for the sector.

By 9:00 a.m. EST, the Real Estate Select Sector SPDR Fund XLRE had dropped by 0.3%. This marked its fourth consecutive day of losses and set a course for its lowest close since the end of November 2023.

The fund has also slipped below its 200-day moving average, a critical long-term benchmark, signaling that investor sentiment has turned negative.

The average interest rate for 30-year fixed-rate mortgages with loan balances up to $766,550 climbed by 12 basis points to 7.13% for the week ending Apr. 12, 2024, according to the latest figures from the Mortgage Bankers Association. This rate is the highest recorded since early December.

On Wednesday, the yield on a 30-year Treasury bond, a key benchmark for long-term mortgage rates, traded at 4.75%, at the highest since mid-November 2023, as Fed Chair Powell admitted that there has been a lack of progress in the disinflation trend.

Chart: Real Estate Stocks Fall Below Key Long-Term Moving Average As Inflation Bites Again

Weaknesses In Multifamily Segment Continue

Joel Kan, MBA’s Vice President and Deputy Chief Economist, explained the rise in rates, stating, “Rates increased for the second consecutive week, driven by incoming data indicating that the economy remains strong and inflation is proving tougher to bring down.”

Despite the uptick in mortgage rates, there was a 3.3% week-over-week increase in the Market Composite Index, which measures mortgage loan application volume.

Kan further noted, “Application activity picked up, possibly as some borrowers decided to act in case rates continue to rise. Purchase applications were the primary driver of this increase, although they are still about 10% lower than last year’s levels. There was a slight uptick in refinance applications, mainly due to a 3% rise in conventional applications.”

Chart: US 30-Year Mortgage Rates Rose To The Highest Level Since Late November

The real estate market’s challenges are linked to affordability and a shrinking availability as the supply of new homes falls.

Andrew Foran, an economist at Toronto Dominion Securities, commented on the trend in home building, “Homebuilding activity moderated in March as weakness in the multifamily segment persisted and the single-family segment gave back most of its considerable gain from the prior month.”

Data revealed a 14.7% month-over-month decline in housing starts in March, with the figures dropping to 1.32 million annualized units, significantly below the anticipated 1.49 million.

Both the single-family and multifamily sectors experienced declines, with single-family starts down by 12.4% (or 145,000 units) and multifamily starts plummeting by 21.7% (or 83,000 units). This retreat in multifamily starts marked the lowest level since April 2020.

Additionally, residential permits decreased more than expected in March, falling by 4.3% month-over-month to 1.46 million annualized units. This included a 5.7% drop in single-family permits—the first decline in fifteen months—and a 1.2% reduction in multifamily permits.

Rising & Falling

The weakest performers among real estate stocks with a market cap of at least $1 billion on Wednesday were:

| Name | 1-day %chg |

|---|---|

| Prologis, Inc. PLD | -6.55% |

| First Industrial Realty Trust, Inc. FR | -3.33% |

| STAG Industrial, Inc. STAG | -2.89% |

| EastGroup Properties, Inc. EGP | -2.89% |

| Rexford Industrial Realty, Inc. REXR | -2.35% |

Those showing the highest gains were:

| Name | 1-day %chg |

|---|---|

| SL Green Realty Corp. SLG | 3.18% |

| Opendoor Technologies Inc. OPEN | 2.55% |

| Medical Properties Trust, Inc. MPW | 2.49% |

| eXp World Holdings, Inc. EXPI | 2.32% |

| Vornado Realty Trust VNO | 2.25% |

Now Read: Best REITs to Buy in April

Image: Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Real eState

Toronto real estate agent puts comical spin on promoting burnt-down house – NOW Toronto

A Toronto real estate agent posted a picture of a $799,000 house that appears to be burnt down on TikTok saying it’s perfect for first-time homebuyers on a budget.

The agent, Ruthie Miller, was half joking.

Miller’s real estate career has run parallel to being a stand-up comedian. She found the run-down house as she was trying to look for a place to invest in herself.

Though she wasn’t the seller of the house, she thought posting the entertaining video on TikTok would attract more buyers to it.

The Yorkdale-Glen neighbourhood home is placed on a 25 x 130 ft. lot and the listing includes pictures of burnt down areas in the home.

Miller posted the video a week ago, but now the price is currently over $1 million on Realtor.ca.

“This house did have a fire and probably needs a lot of work. If you’re anything like me and you think to yourself, ‘Oh, I can fix him. All he needs is a little bit of TLC. He’s just had some bad relationships in the past,’ then you might be into this one,” Miller said in the video.

Some viewers were confused and wondered if the video was a parody.

“LOL genuinely can’t tell if this is a joke or not … a budget? Your gonna need another 200k to fix it it’s not even livable,” one person commented.

When asked if she thought her comedic approach to real estate could mislead people, Miller said, “I don’t know.”

Miller told Now Toronto that she was joking about some parts, especially about the house being suitable for a first-time homebuyer because of the structural issues.

Miller believes she’s bringing attention to real estate regardless of the method and people are going to look at the listing and request more information if they want to.

“I’m a comedian also, so why not mesh the two? It’s a clever way of doing it,” Miller challenged.

Miller believes Toronto’s real estate market always has room for humour.

“I personally like it. I hope I’m not breaking any rules with my professionalism. I like blending comedy with real estate. It’s easy to make fun of realtors because they’re usually advertising multi-million dollar properties when most of the city can’t afford rent.”

-

News22 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Investment21 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

Business21 hours ago

Rupture on TC Energy's NGTL gas pipeline sparks wildfire in Alberta – The Globe and Mail

-

Art21 hours ago

Squatters at Gordon Ramsay's Pub Have 'Left the Building' After Turning It Into an Art Café – PEOPLE

-

Tech14 hours ago

Tech14 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Politics20 hours ago

Politics20 hours agoThe Earthquake Shaking BC Politics

-

Sports24 hours ago

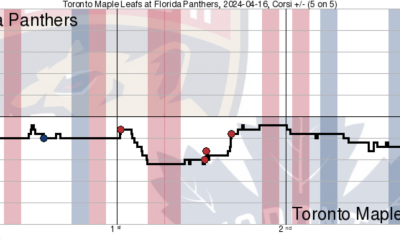

Sports24 hours agoGame in 10: Maple Leafs squander multi-goal lead to Florida, draw the Boston Bruins in the first round – Maple Leafs Hot Stove

-

Investment20 hours ago

Investment20 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth