The economic squall battering the Canadian tech sector landed squarely in Alberta this week with layoffs at one of the city’s marquee software firms.

Economy

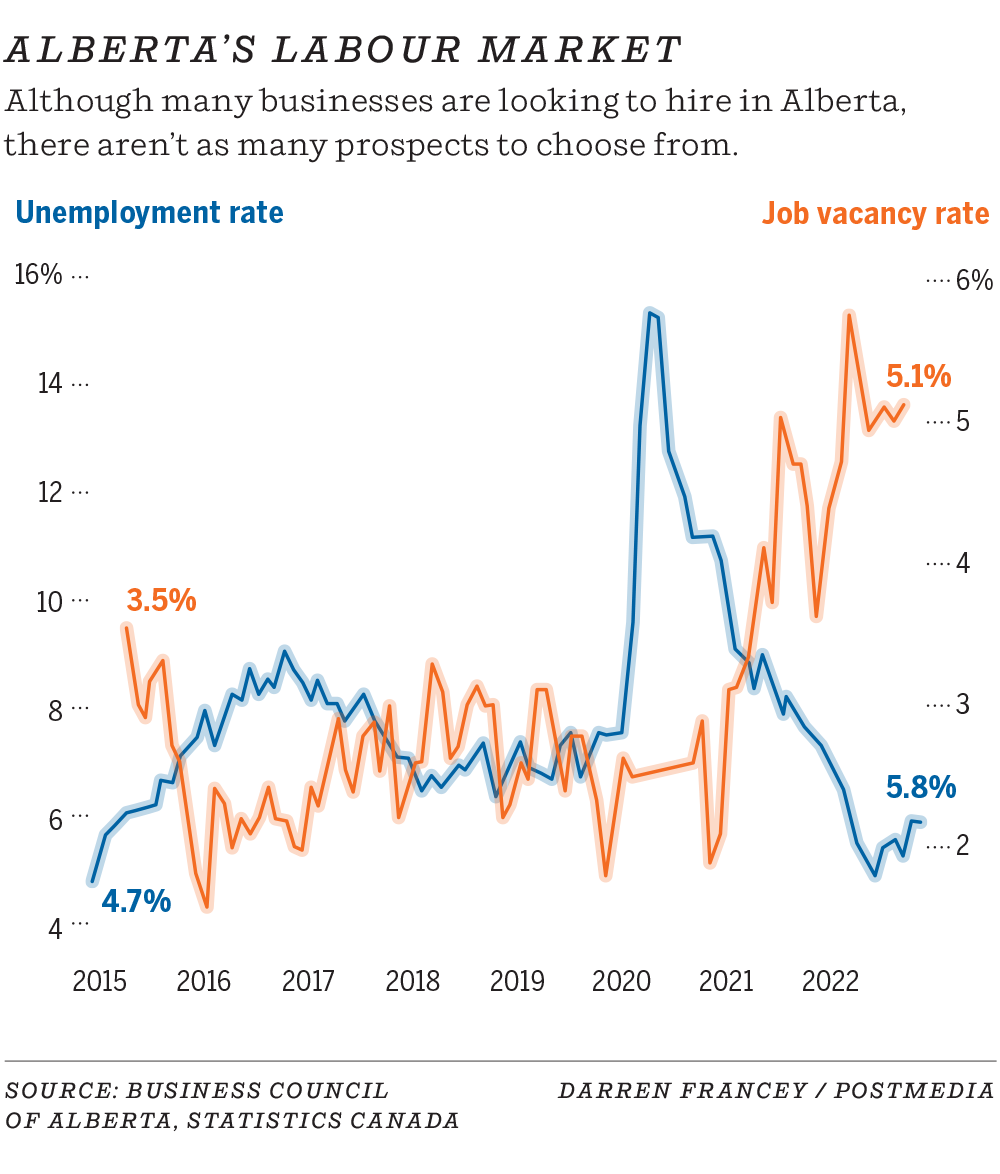

Alberta economy in a ‘state of transition’ as layoffs bump up against labour shortages

Benevity announced it will reduce its staff by 14 per cent, cutting 137 out of almost 1,000 jobs — the first major layoffs in the company’s history — as its CEO cited a dramatic change in broader economic conditions.

The same day, the Calgary Construction Association sounded the alarm about an acute shortage of skilled staff for its sector. It estimates more than 3,000 construction jobs in the region are unfilled as demand for commercial buildings and new homes increases, even with rising interest rates and high inflation.

“As we enter 2023, the Alberta economy is in a state of transition,” the Business Council of Alberta declared in a new report issued Thursday.

The transition means Alberta’s economy will cool off from the “blistering pace” seen in 2022 that was fuelled by surging commodity prices, said council president Adam Legge.

“Alberta is best positioned to weather any downturn or recession globally or domestically in Canada, largely because we have so many of the things the world will continue to need,” Legge said, pointing to energy and agricultural products.

“But we won’t be immune. No place is an island, and that includes Alberta.”

The report noted the labour market is stronger than it has been in years — the jobless rate stood at 5.8 per cent in December — and the recent gap between the provincial and Canadian unemployment levels narrowed over the second half of 2022.

“Alberta’s labour market is the hottest it’s been in years,” it states.

About six in 10 businesses plan on adding staff (according to a survey in November), but with a labour crunch, they will need to attract workers away from existing jobs, the report said.

Staffing shortages are affecting many businesses in industries including hospitality, professional services, and manufacturing. It’s also a challenge for the construction sector as the existing workforce ages and not enough younger people are entering the trades.

Scott White, CEO of Western Electrical Management in Calgary, said as commercial construction increased over the past year, its staffing has increased by 40 per cent.

Large developments in the province are moving ahead, such as the company’s work on the convention centre expansion in Calgary, and construction in the city’s downtown has picked up.

“Since April, we’ve probably hired 140 guys and it’s been very difficult finding people,” White said.

“There are a lot of things coming down the pipe and, to be honest, I’m not sure where they are going to find all the people.”

Other areas of the economy will be affected by a broader slowdown and the squeeze coming from rising interest rates.

One sector already facing challenges across North America is the technology industry, with large-scale layoffs announced at giants such as Microsoft and Amazon, while Canadian firms such as Hootsuite, Clearco, Lightspeed Commerce and Clutch have cut staff.

Nic Beique, CEO of Calgary-based online payment firm Helcim, said the startup is still growing but has slowed some of its hiring plans for the year — it has about 150 staff — and noted the industry is growing more cautious given the economic uncertainty.

“We’re just preparing ourselves that we might see a slowdown; we’re not seeing it yet in the numbers,” he said. “Prudence is the word of 2023 when it comes to tech.”

This past week also saw Calgary-based cleantech firm Summit Nanotech close a $67-million fundraising round as it grows its workforce and expands its business to extract lithium from brine.

Benevity, one of the city’s first startups to gain a billion-dollar valuation, has been a Calgary tech-sector leader, providing customers such as Visa and UPS with employee-engagement software, which enables workplace giving programs and employee volunteering.

The Calgary-based firm, founded in 2008, had 989 employees before this week’s announcement, including 527 in the city.

“All parts of the organization have been impacted, not just those within our Calgary office,” CEO Kelly Schmitt said Thursday in a statement.

“Many companies are tightening budgets in response to the macro-economic environment, but we believe the longer-term appetite for companies to make a social impact is still strong.”

However, its announcement is another signal of the turbulence ahead.

Jim Gibson, a veteran of Calgary’s tech sector and now chief catalyst at the Southern Alberta Institute of Technology (SAIT), said organizations across the industry are responding to investor pressure and shifting away from the “growth-at-all cost” mantra.

“It is part of a shift that’s happening across the world and Calgary is not immune to it,” he said.

“We will feel it, but . . . we weren’t overbuilt, so we won’t see the same level.”

Chris Varcoe is a Calgary Herald columnist.

Economy

Canada’s unemployment rate holds steady at 6.5% in October, economy adds 15,000 jobs

OTTAWA – Canada’s unemployment rate held steady at 6.5 per cent last month as hiring remained weak across the economy.

Statistics Canada’s labour force survey on Friday said employment rose by a modest 15,000 jobs in October.

Business, building and support services saw the largest gain in employment.

Meanwhile, finance, insurance, real estate, rental and leasing experienced the largest decline.

Many economists see weakness in the job market continuing in the short term, before the Bank of Canada’s interest rate cuts spark a rebound in economic growth next year.

Despite ongoing softness in the labour market, however, strong wage growth has raged on in Canada. Average hourly wages in October grew 4.9 per cent from a year ago, reaching $35.76.

Friday’s report also shed some light on the financial health of households.

According to the agency, 28.8 per cent of Canadians aged 15 or older were living in a household that had difficulty meeting financial needs – like food and housing – in the previous four weeks.

That was down from 33.1 per cent in October 2023 and 35.5 per cent in October 2022, but still above the 20.4 per cent figure recorded in October 2020.

People living in a rented home were more likely to report difficulty meeting financial needs, with nearly four in 10 reporting that was the case.

That compares with just under a quarter of those living in an owned home by a household member.

Immigrants were also more likely to report facing financial strain last month, with about four out of 10 immigrants who landed in the last year doing so.

That compares with about three in 10 more established immigrants and one in four of people born in Canada.

This report by The Canadian Press was first published Nov. 8, 2024.

The Canadian Press. All rights reserved.

Economy

Health-care spending expected to outpace economy and reach $372 billion in 2024: CIHI

The Canadian Institute for Health Information says health-care spending in Canada is projected to reach a new high in 2024.

The annual report released Thursday says total health spending is expected to hit $372 billion, or $9,054 per Canadian.

CIHI’s national analysis predicts expenditures will rise by 5.7 per cent in 2024, compared to 4.5 per cent in 2023 and 1.7 per cent in 2022.

This year’s health spending is estimated to represent 12.4 per cent of Canada’s gross domestic product. Excluding two years of the pandemic, it would be the highest ratio in the country’s history.

While it’s not unusual for health expenditures to outpace economic growth, the report says this could be the case for the next several years due to Canada’s growing population and its aging demographic.

Canada’s per capita spending on health care in 2022 was among the highest in the world, but still less than countries such as the United States and Sweden.

The report notes that the Canadian dental and pharmacare plans could push health-care spending even further as more people who previously couldn’t afford these services start using them.

This report by The Canadian Press was first published Nov. 7, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.

The Canadian Press. All rights reserved.

Economy

Trump’s victory sparks concerns over ripple effect on Canadian economy

As Canadians wake up to news that Donald Trump will return to the White House, the president-elect’s protectionist stance is casting a spotlight on what effect his second term will have on Canada-U.S. economic ties.

Some Canadian business leaders have expressed worry over Trump’s promise to introduce a universal 10 per cent tariff on all American imports.

A Canadian Chamber of Commerce report released last month suggested those tariffs would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

More than 77 per cent of Canadian exports go to the U.S.

Canada’s manufacturing sector faces the biggest risk should Trump push forward on imposing broad tariffs, said Canadian Manufacturers and Exporters president and CEO Dennis Darby. He said the sector is the “most trade-exposed” within Canada.

“It’s in the U.S.’s best interest, it’s in our best interest, but most importantly for consumers across North America, that we’re able to trade goods, materials, ingredients, as we have under the trade agreements,” Darby said in an interview.

“It’s a more complex or complicated outcome than it would have been with the Democrats, but we’ve had to deal with this before and we’re going to do our best to deal with it again.”

American economists have also warned Trump’s plan could cause inflation and possibly a recession, which could have ripple effects in Canada.

It’s consumers who will ultimately feel the burden of any inflationary effect caused by broad tariffs, said Darby.

“A tariff tends to raise costs, and it ultimately raises prices, so that’s something that we have to be prepared for,” he said.

“It could tilt production mandates. A tariff makes goods more expensive, but on the same token, it also will make inputs for the U.S. more expensive.”

A report last month by TD economist Marc Ercolao said research shows a full-scale implementation of Trump’s tariff plan could lead to a near-five per cent reduction in Canadian export volumes to the U.S. by early-2027, relative to current baseline forecasts.

Retaliation by Canada would also increase costs for domestic producers, and push import volumes lower in the process.

“Slowing import activity mitigates some of the negative net trade impact on total GDP enough to avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026,” Ercolao said.

Since the Canada-United States-Mexico Agreement came into effect in 2020, trade between Canada and the U.S. has surged by 46 per cent, according to the Toronto Region Board of Trade.

With that deal is up for review in 2026, Canadian Chamber of Commerce president and CEO Candace Laing said the Canadian government “must collaborate effectively with the Trump administration to preserve and strengthen our bilateral economic partnership.”

“With an impressive $3.6 billion in daily trade, Canada and the United States are each other’s closest international partners. The secure and efficient flow of goods and people across our border … remains essential for the economies of both countries,” she said in a statement.

“By resisting tariffs and trade barriers that will only raise prices and hurt consumers in both countries, Canada and the United States can strengthen resilient cross-border supply chains that enhance our shared economic security.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

-

News21 hours ago

News21 hours agoIn the news today: Justin Trudeau and Canada criticized by Donald Trump’s appointees

-

News21 hours ago

News21 hours agoEA Sports video game NHL 25 to include PWHL teams

-

News21 hours ago

News21 hours agoWhat do you do when a goose dies in your backyard, amid concerns about avian flu?

-

News21 hours ago

News21 hours ago‘No yellow brick road’: Atwood weighs in on U.S. election at Calgary forum

-

News19 hours ago

News19 hours agoVia Rail seeks judicial review on CN’s speed restrictions

-

News19 hours ago

News19 hours agoJapanese owner of 7-Eleven receives another offer to rival Couche-Tard bid

-

News21 hours ago

News21 hours agoNova Scotia NDP releases election platform focused on affordability, housing, health

-

News21 hours ago

News21 hours agoSuncor to return all excess cash to shareholders after hitting debt target early