Investment

Weak U.S. core capital goods orders point to deepening business investment downturn – Kitco NEWS

WASHINGTON (Reuters) – New orders for key U.S.-made capital goods fell sharply in February as demand for machinery and other products slumped, suggesting a deepening contraction in business investment that analysts said signaled the economy was already in recession.

The coronavirus pandemic has further darkened the outlook for business investment as measures to contain the highly contagious virus have brought the country to a sudden stop. The Federal Reserve has taken extraordinary steps to soften the hit on the economy. U.S. senators were set to vote on Wednesday on a record $2 trillion fiscal stimulus package.

“Business investment is the key swing factor in every recession and right now the pendulum is swinging the wrong way with declining orders likely to drag the economy over the cliff and down into recession in March,” said Chris Rupkey, chief economist at MUFG in New York.

Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, dropped 0.8% in February after rising by a slightly downwardly revised 1.0% in January, the Commerce Department said on Wednesday.

These so-called core capital goods orders were previously reported to have increased 1.1% in January.

Economists polled by Reuters had forecast core capital goods orders dropping 0.4% in February. There were decreases in orders for machinery, primary metals and computers and electronics products last month. But demand for electrical equipment, appliances and components increased 1.3% last month.

Shipments of core capital goods fell 0.7% last month. Core capital goods shipments are used to calculate equipment spending in the government’s gross domestic product measurement.

They increased 1.1% in January. Business investment has contracted for three straight quarters, the longest such stretch since 2009. Economists have blamed the business investment rot on the Trump Administration’s 20-month-old trade war with China. The weakness in business investment comes at a time when corporate profits are weakening.

“Given that profits are likely now declining, financial market conditions have tightened and the economy contracting, business investment will take it on the chin,” said Ryan Sweet, a senior economist at Moody’s Analytics in West Chester, Pennsylvania. “Business investment in equipment will drop sharply in the second quarter.”

Stocks on Wall Street extended their massive rally from Tuesday, with investors comforted by the huge stimulus package. The dollar fell against a basket of currencies, while U.S. Treasury prices rose.

ABRUPT HALT

The coronavirus, which causes a respiratory illness called COVID-19, has brought the economy to a abrupt halt, with governors in at least 18 states, accounting for nearly half the country’s population, ordering residents to stay mostly indoors.

“Non-essential” businesses have also been ordered closed, leading to massive unemployment and a rush to apply for jobless benefits. A survey by data firm IHS Markit on Tuesday showed its gauge of U.S. business activity dropped to a record low in March. Analysts say the economy slipped into recession in March.

Recessions in the United States are called by the National Bureau of Economic Research. The NBER’s business cycle dating committee does not define a recession as two consecutive quarters of decline in real gross domestic product, as is the rule of thumb in many countries.

Instead, it looks for a drop in economic activity, spread across the economy and lasting more than a few months. Measures taken by the Fed to stem the slide include slashing interest rates to zero, promising bottomless dollar funding and implementing an array of programs to help keep companies afloat.

Overall orders for durable goods, items ranging from toasters to aircraft that are meant to last three years or more, accelerated 1.2% last month after gaining 0.1% in January. They were boosted by a 4.6% rebound in orders for transportation equipment, which followed a 0.9% decline in January.

Orders for civilian aircraft slipped 0.3% last month after soaring 356.7% in January. Motor vehicles and parts orders accelerated 1.8% in February after falling 0.5%.

But orders for transportation equipment are set to weaken. Boeing (BA.N) has temporarily closed some its plants in Washington State, one the regions hardest hit by the coronavirus, and auto makers have shuttered factories to protect their workers from COVID-19.

Reporting by Lucia Mutikani; Editing by Andrea Ricci

Investment

Canada Pension Plan investment board to host public meeting in Calgary – CTV News Calgary

The Canada Pension Plan (CPP) investment board will be hosting a public meeting from 6 to 8 p.m. on April 16 at the BMO Centre.

Registration for the public is closed, but organizers say there is room for some walk-ins.

The board hosts public meetings across Canada every two years to update people on the fund’s performance, governance and investment approach.

The pension plan has been a hot topic in Alberta over the last year, after the provincial government released a commissioned report exploring the possibility of an Alberta Pension Plan (APP).

According to the report, if Alberta gave the required three-year notice to quit the CPP, it would be entitled to $334 billion, or about 53 per cent of the fund by 2027.

However, critics say that is an overestimation.

Premier Danielle Smith has said she will not call a referendum on the topic until the Office of the Chief Actuary releases an updated number.

More information on the public meetings can be found on the CPP Investments’ website.

Investment

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April – Yahoo Finance

The artificial intelligence (AI) space is red-hot right now. Companies across every industry are looking to capitalize on the technology, and are investing heavily to gain an edge over the competition. That’s true in the social media space, where advertisers are keen to get in front of the right audience for them.

While the social media landscape is jam-packed with competition, one company is separating itself from the pack. Meta Platforms (NASDAQ: META) is making strides across various aspects of the AI realm, and its performance over the competition shows.

Let’s dig in to why now is a lucrative opportunity to invest in Meta as the long-term AI narrative plays out.

The profit machine is up and running

One of the most appealing aspects of Meta is how efficiently management runs the business. In 2023, Meta grew revenue 16% year over year to $135 billion. However, the company increased income from operations by a whopping 62% year over year to $46.7 billion.

By expanding its operating margin, Meta recognized significant growth on the bottom line as well. Last year, the company generated $43 billion in free cash flow. With such a robust financial profile, Meta is well-positioned to invest profits back into the business as well as reward shareholders.

Investing for the future

During Meta’s fourth-quarter earnings call in February, investors learned how the company is deploying its cash heap. For starters, it has increased its share repurchase program by $50 billion. This is encouraging to see as it could imply that management views Meta stock as a good value.

But perhaps more exciting was the announcement of a quarterly dividend. Many high-growth tech companies are not in a financial position to pay a dividend — or instead choose to reinvest profits into research and development or marketing strategies. Meta’s new dividend certainly sets the company apart from many of its peers, and is a nice sweetener for long-term shareholders.

Another way Meta is using its cash flow is in the realm of artificial intelligence. Like many enterprises, Meta relies heavily on sophisticated graphics processing units (GPUs) from Nvidia. However, Meta has been hinting for a while that the company is investing in its own hardware. Earlier this month, Meta announced that an updated version of its training and inference chips, called MTIA, is now available.

This is important for a couple of reasons. Namely, in-house chips will allow Meta to “control the whole stack” and scale back its reliance on semiconductors from third parties. Additionally, given the company’s knowledge base of data that it collects from social media platforms Facebook, Instagram, and WhatsApp, these new chips put Meta in a position to improve its targeted recommendation models and ad campaigns through the power of generative AI.

A compelling valuation

Meta competes with a number of players in the social media landscape. Alphabet is one of the company’s top competitors given that it operates the world’s top-two most visited websites: YouTube and Google. However, in 2023 Alphabet only grew its core advertising business by 6% year over year. By contrast, Meta’s advertising segment increased 16%.

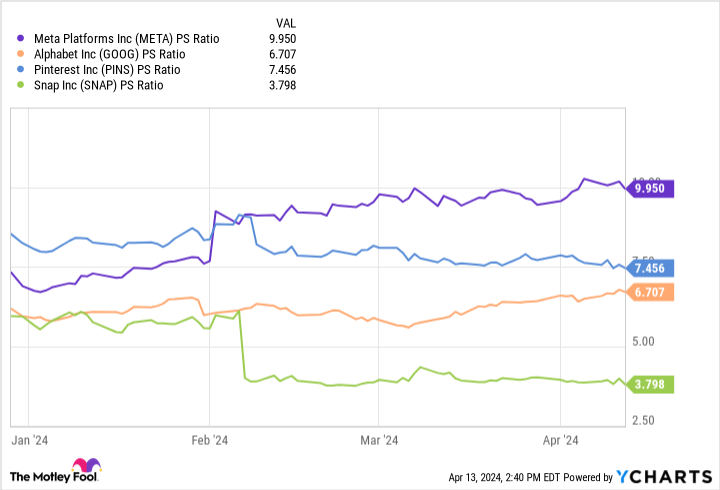

While Meta’s price-to-sales (P/S) ratio of 10 is higher than many of its social media peers, the company’s growth in the highly competitive and cyclical advertising landscape may warrant the premium.

Additionally, considering Meta’s price-to-free-cash-flow ratio of about 31 is actually trading relatively in line with its 10-year average of 32, the stock might not be as expensive as it appears.

Overall, I am optimistic about Meta’s aggressive ambitions in artificial intelligence — an investment that is yet to play out. The AI narrative is going to be a long-term story. But I see Meta as extremely well-equipped to take advantage of secular themes fueling AI, and benefiting across its entire business.

The combination of a dividend, share buybacks, consistent cash flow, and a compelling AI play make Meta stick out in a highly contested AI landscape. I think now is a great opportunity to scoop up shares in Meta and prepare to hold for the long term.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Pinterest. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April was originally published by The Motley Fool

Investment

Goldman Sachs Backs AI in Hospitals With $47.5 Million Kontakt.io Investment – BNN Bloomberg

(Bloomberg) — The growth equity unit of Goldman Sachs Group Inc. has invested $47.5 million in Kontakt.io, a startup that helps hospital managers make decisions about patients, beds and equipment.

It’s the 39th investment in health care from the bank’s growth equity division and the deal is “a good example of what is coming down the pipe” for its portfolio, according to Christian Resch, the UK-based the Goldman partner who led the financing and will sit on Kontakt.io’s board.

Kontakt.io, formed in Poland in 2014, makes small bluetooth-connected devices that stick on hospital equipment and software for managing the data collected by the sensors. The idea is to track practically everything inside a hospital — from patient beds to ultrasound machines — to help managers make decisions about capacity and replacement. The startup wants to build out an AI system that can offer suggestions to managers. It bills for the entire tracking system, rather than solo sensors.

Philipp von Gilsa, Kontakt.io’s chief executive officer, said his business helps health-care operators curb inefficiencies and manage pressures like crippling nursing shortages. “Hospitals are extremely, extremely wasteful in how they treat their resources,” he said. “We help them address that and, at the end of the day, save money.”

Health-care and life sciences IT spend is expected to continue rising, growing 8.3% in 2023 to $245.8 billion, according to Gartner estimates. But that money hasn’t always found its way to startups, which have struggled to compete with entrenched medical suppliers and navigate byzantine health-care networks. While many startups offer tools for managing health records or apps for patient use, Kontakt.io is focused on operations. The company pointed to a 2019 study that found roughly a quarter of US health spending was wasted due to issues like fraud and administrative hassles.

Kontakt.io has largely grown without major outside capital. It first marketed to a range of sectors interested in tracking indoor data, but has since homed in on health care, which now provides 80% of its sales, according to von Gilsa.

The startup has “roughly 500” enterprise customers, he said, including HCA Healthcare Inc. and the UK’s National Health Service. Von Gilsa declined to share revenue but said 2022 sales exceeded the $7.5 million his company raised before Goldman’s funding, and revenues tripled in the last twelve months. Kontakt.io, he said, has been profitable for the last four years.

With the financing, which came solely from Goldman, von Gilsa plans to hire more engineers to build an automated system for hospital staff using artificial intelligence. Machines will offer recommendations for daily decisions like how to stock certain machines or when to move patients into surgery.

Some 4 million devices in circulation give the startup an edge in building this AI, according to von Gilsa, who said the large quantities of data gathered by Kontakt.io sensors can help train its models.

Larger rivals, like GE HealthCare Technologies Inc., have also touted recent AI features designed to streamline hospital operations. Goldman’s Resch said Kontakt.io’s integration of sensors and software gave the bank confidence in its prospects.

©2024 Bloomberg L.P.

-

Media16 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Tech21 hours ago

Tech21 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Real eState20 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Sports19 hours ago

Sports19 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Science20 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Art23 hours ago

Art Bites: The Movement to Remove Renoir From Museums

-

Investment17 hours ago

Investment17 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

News22 hours ago

Montrealers conduct a sit-in to demand that Scotiabank divest from Elbit Systems