(Bloomberg) — Skyrocketing demand, limited supply, price gouging and monopoly accusations. And a customer willing to pay almost anything.

Economy

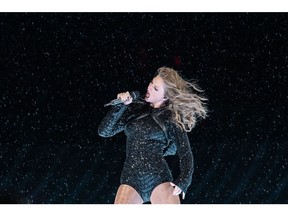

What Taylor Swift Reveals About the US Economy

Swifties, as the popstar’s fans are known, aren’t necessarily your average American, but they capture the current moment in the post-Covid economy. Even as recession looms, many consumers are willing to splurge on what they missed at the height of the pandemic — whether it’s travel or live entertainment.

Swift’s fans represent an extreme version of that turbocharged consumer: millions of mostly Millennials and Gen Zs who waited at least four years to see the superstar live again and emerged from the pandemic with historically high rates of savings.

Read More: Here’s The Real Reason You Can’t Buy Taylor Swift Tickets

Right now, Swift’s “The Eras Tour” tickets are available only on the secondary market and they’re anything but cheap. About 2.4 million were sold last week before Ticketmaster suspended the official pre-sale. The ticketing company’s site crashed under the pressure of some 14 million people trying to get seats.

Among them was Melissa Kearney, an economics professor at the University of Maryland who is now experiencing first-hand the basic laws of supply and demand. The mother of two Swifties, ages 12 and 15, is determined to spend whatever it takes after failing to score tickets.

Gustavo Coutinho, who’s never seen Swift play live, came up with a $2,000 budget after 10 months of savings. The 25-year-old consultant in Boston ended up spending about $1,500 to attend two concerts. “I would pay $3,000 if I had to,” he said.

In the early 2000s, the late economist Alan Krueger came up with the concept of “Rockonomics” to explain the economy through the lens of the music industry. Krueger often used Swift, who released her debut album in 2006 at the age of 16, as an example of someone who played with strategies that boosted concert and product sales, calling her “an economic genius.”

Other artists, including Bruce Springsteen, have proved fans are ready to pay sky-high prices for mega post-Covid live events — recession be damned.

Meanwhile, Swiftonomics is a crash course on another concept: monopoly. Politicians and attorneys general seized on the moment to renew their criticism of Ticketmaster, a dominant player in the live-music industry.

Even before last week, Ticketmaster and parent company Live Nation Entertainment Inc. were at the center of an antitrust investigation by the Department of Justice over whether the platform is abusing its power, according to people familiar with the probe.

Supply Mastermind

Ultimately, the singer is the mastermind behind the supply. She has chosen to play at high-capacity stadiums, and has added new concerts. Still, there’s frenzy around her tours. “Very often you have the sense that scarcity increases demand,” said Pascal Courty, an economist at the University of Victoria in Canada who researches resale markets for tickets.

One of the biggest questions in the broader economy is whether consumers will continue to spend as interest rates and joblessness increase.

Swiftonomics probably won’t help answer. It’s its own economic microcosm, and fans just shake it off.

“I hesitate to read too much into people’s willingness to pay exorbitant amounts for Taylor Swift tickets in terms of what that says about the health of the US economy,” said Kearney, the Swiftie-parent economist. “I’m more inclined to read into it that for the die-hard Taylor Swift fans — of which there are many — the demand for tickets is nearly inelastic.”

—With assistance from Ashley Carman and Reade Pickert.

Economy

PBO projects deficit exceeded Liberals’ $40B pledge, economy to rebound in 2025

OTTAWA – The parliamentary budget officer says the federal government likely failed to keep its deficit below its promised $40 billion cap in the last fiscal year.

However the PBO also projects in its latest economic and fiscal outlook today that weak economic growth this year will begin to rebound in 2025.

The budget watchdog estimates in its report that the federal government posted a $46.8 billion deficit for the 2023-24 fiscal year.

Finance Minister Chrystia Freeland pledged a year ago to keep the deficit capped at $40 billion and in her spring budget said the deficit for 2023-24 stayed in line with that promise.

The final tally of the last year’s deficit will be confirmed when the government publishes its annual public accounts report this fall.

The PBO says economic growth will remain tepid this year but will rebound in 2025 as the Bank of Canada’s interest rate cuts stimulate spending and business investment.

This report by The Canadian Press was first published Oct. 17, 2024.

The Canadian Press. All rights reserved.

Economy

Statistics Canada says levels of food insecurity rose in 2022

OTTAWA – Statistics Canada says the level of food insecurity increased in 2022 as inflation hit peak levels.

In a report using data from the Canadian community health survey, the agency says 15.6 per cent of households experienced some level of food insecurity in 2022 after being relatively stable from 2017 to 2021.

The reading was up from 9.6 per cent in 2017 and 11.6 per cent in 2018.

Statistics Canada says the prevalence of household food insecurity was slightly lower and stable during the pandemic years as it fell to 8.5 per cent in the fall of 2020 and 9.1 per cent in 2021.

In addition to an increase in the prevalence of food insecurity in 2022, the agency says there was an increase in the severity as more households reported moderate or severe food insecurity.

It also noted an increase in the number of Canadians living in moderately or severely food insecure households was also seen in the Canadian income survey data collected in the first half of 2023.

This report by The Canadian Press was first published Oct 16, 2024.

The Canadian Press. All rights reserved.

Economy

Statistics Canada says manufacturing sales fell 1.3% to $69.4B in August

OTTAWA – Statistics Canada says manufacturing sales in August fell to their lowest level since January 2022 as sales in the primary metal and petroleum and coal product subsectors fell.

The agency says manufacturing sales fell 1.3 per cent to $69.4 billion in August, after rising 1.1 per cent in July.

The drop came as sales in the primary metal subsector dropped 6.4 per cent to $5.3 billion in August, on lower prices and lower volumes.

Sales in the petroleum and coal product subsector fell 3.7 per cent to $7.8 billion in August on lower prices.

Meanwhile, sales of aerospace products and parts rose 7.3 per cent to $2.7 billion in August and wood product sales increased 3.8 per cent to $3.1 billion.

Overall manufacturing sales in constant dollars fell 0.8 per cent in August.

This report by The Canadian Press was first published Oct. 16, 2024.

The Canadian Press. All rights reserved.

-

Politics18 hours ago

Politics18 hours agoBad weather forecast for B.C. election day as record numbers vote in advance polls

-

News21 hours ago

Champlain CBP Officers Recover Stolen Vehicle

-

Business18 hours ago

Business18 hours agoNetflix’s subscriber growth slows as gains from password-sharing crackdown subside

-

Politics18 hours ago

Politics18 hours agoPromise tracker: What the Saskatchewan Party and NDP pledge to do if they win Oct. 28

-

News12 hours ago

News12 hours agoTobacco giants would pay out $32.5B to provinces, smokers in ‘historic’ proposed deal

-

News12 hours ago

News12 hours agoHere are the key numbers in the deal proposed by three tobacco giants

-

News19 hours ago

News19 hours agoToronto FC promises change at the club after missing out on the playoffs yet again

-

Business20 hours ago

CB Series – Front Office Pro Series Trade Floor Business Analysis