Economy

What's Happening in the World Economy: A Tough Winter Lies Ahead – Bloomberg

Hello. Today we look at the challenges facing the world economy, this week’s U.S. employment report and how a Chinese slowdown may impact other countries.

Feeling the Chill

The world economy is running into many headwinds as the year enters its final stretch and the northern hemisphere’s winter beckons:

- The delta variant abounds, limiting activity

- Supply chains are straining and ports are congested

- China is being rocked by a power crunch, regulatory crackdown and turmoil at Evergrande

- Food and commodity prices are surging, propelling inflation

- There are labor shortages in certain industries

- U.S. lawmakers are at odds over spending and the federal debt limit

- Central banks are starting to withdraw stimulus

Put them all together and these different forces suggest the recovery from the pandemic recession is going to be challenged in coming months, as Enda Curran writes in this rundown of all the potential spoilers.

“Expectations of a swift exit from the pandemic were always misplaced,” said Frederic Neumann, co-head of Asian economic research at HSBC in Hong Kong. “Full recovery will be measured in years, not quarters.”

This makes for a difficult job for central bankers as they juggle when best to slow or reverse supportive monetary policies. They could add to the economic weakness by acting prematurely, or alternatively they could let inflation run out of control by acting too late.

It could get even worse. Bank of America analysts told clients on Friday that oil could reach $100 a barrel for the first time since 2014 and spur an economic crisis.

“We may just be one storm away from the next macro hurricane,” analysts including Francisco Blanch wrote.

Perhaps among those faring worst is the U.K. economy.

In Bloomberg’s Big Take today, Joe Mayes, Lizzy Burden and Isis Almeida detail how Brexit is leaving the country even more isolated as it runs short of workers and faces a winter potentially tougher than any since the 1970s.

The Week Ahead

Employers in the U.S. probably stepped up their hiring in September after lackluster jobs growth a month earlier, illustrating gradual yet choppy progress toward filling a record number of vacancies.

Friday’s report from the Labor Department is predicted to show payrolls increased by about half a million last month, almost twice as much as in August, according to the median projection in a Bloomberg survey of economists. Unemployment is forecast to have fallen to 5.1% from 5.2%.

Elsewhere, global negotiators meeting to agree on a new landscape for corporate taxation will try to keep their ground-breaking deal alive in a crucial Oct. 8 gathering.

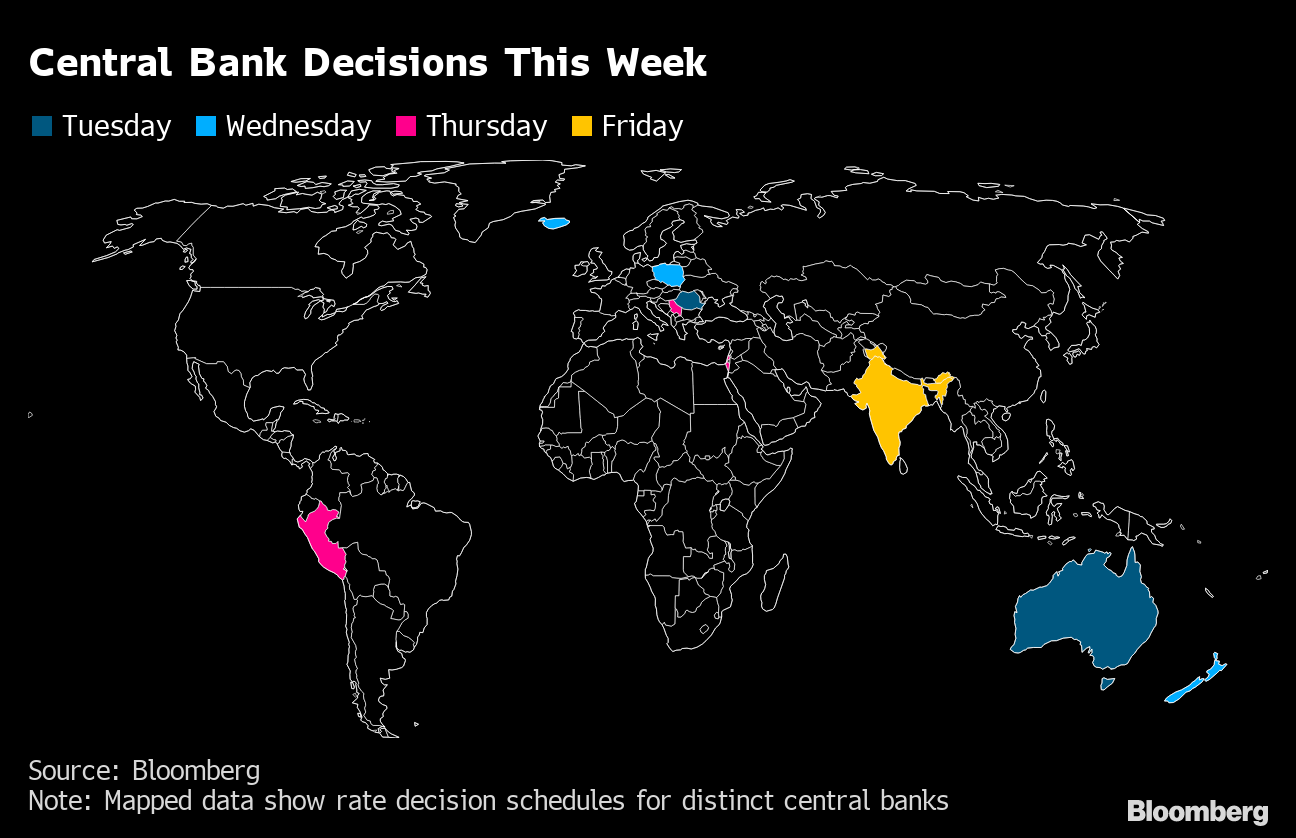

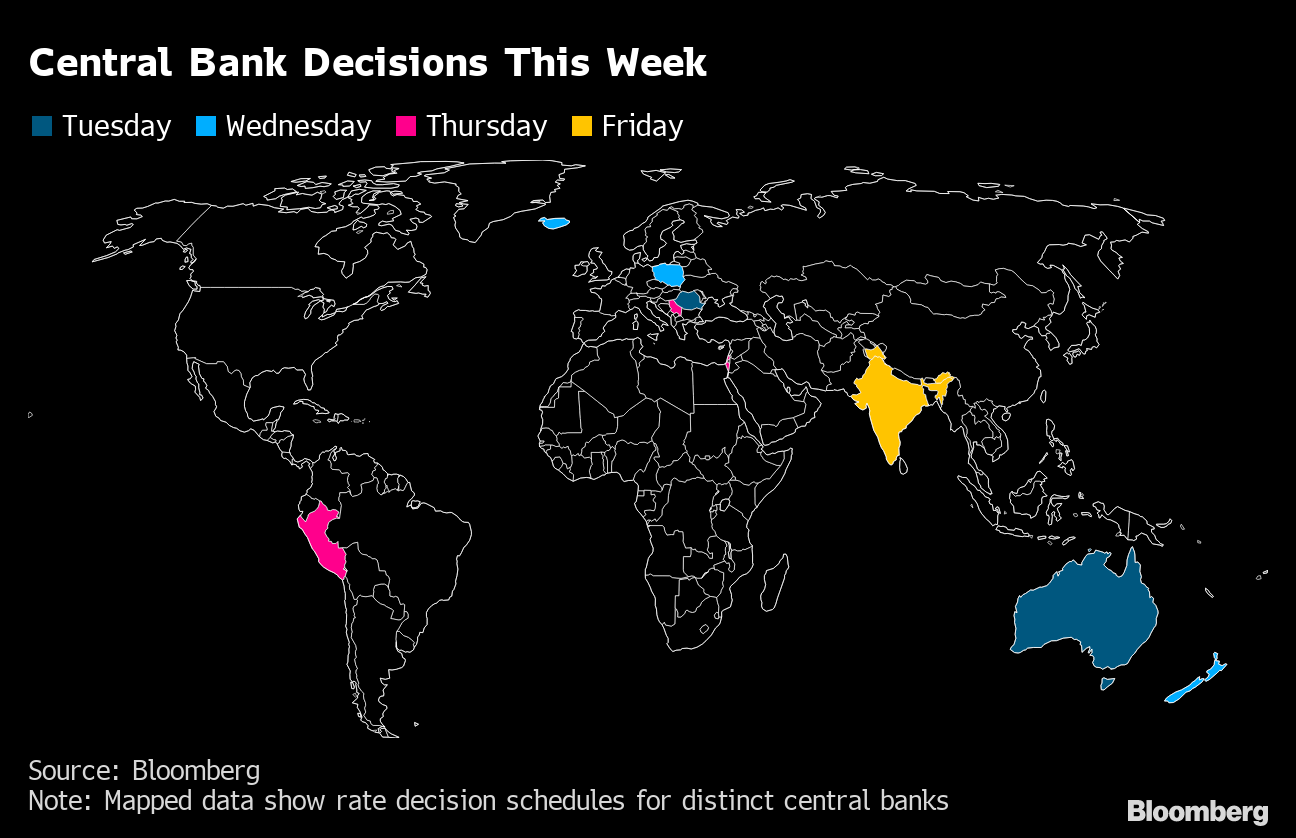

Central Bank Decisions This Week

Source: Bloomberg

Note: Mapped data show rate decision schedules for distinct central banks

.chart-js display: none;

Meanwhile, central banks in New Zealand, Iceland and Peru are among those likely to raise interest rates among several decisions due, and Japan may get a new finance minister.

Check out the world economy’s full diary here.

Today’s Must Reads

- Biden on China | The U.S. administration will directly engage with Beijing in the coming days to enforce commitments in their trade deal and start a new process to exclude certain products from U.S. tariffs.

- Debt drama | U.S. politicians are locked in a huge fight over the size of the national debt, even though investors, economists and officials are much more focused on what it costs.

- Fed trading | Federal Reserve Vice Chair Richard Clarida traded between $1 million and $5 million out of a bond fund into stock funds one day before Chair Jerome Powell flagged possible policy action as the pandemic worsened, his 2020 financial disclosures show.

- European real estate | A boom in the region’s property prices is widening the gulf between the haves and have nots, feeding anger about inequality and accusations that property markets are broken and unfair.

- American restaurants | The fragile recovery in U.S. food hospitality is sputtering. A survey found that 51% of small restaurants in the country couldn’t pay their rent in September, up from 40% in July.

- New Japanese finance chief | Former Olympics Minister Shunichi Suzuki on Monday became Japan’s first new finance minister in nearly nine years, replacing Taro Aso as the ruling party reboots its cabinet in the run-up to a general election.

- Rich pickings | Nordic countries are placing themselves in the vanguard of economies trying to get wealthy people to fund public finances more in the aftermath of the ordeal.

- Christmas at risk | Supply chain strains mean retailers are already in various forms of panic that usually don’t take hold until the weeks before the holidays hit.

Need-to-Know Research

China’s slowdown is a potential challenge for global growth.

At Citigroup, a vulnerability index indicates that exporters of manufacturers and commodities are particularly at risk to a weakening Chinese economy.

Neighbors like Taiwan and Korea are sensitive to a slowdown as are metal exporters such as Australia and Chile. Key trading partners such as Germany are also somewhat exposed.

On #EconTwitter

Read more reactions on Twitter

Enjoy reading the New Economy Daily?

- Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world’s most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here.

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Media9 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media11 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment10 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Media23 hours ago

DJT Stock Jumps. The Truth Social Owner Is Showing Stockholders How to Block Short Sellers. – Barron's

-

Health24 hours ago

Health24 hours agoType 2 diabetes is not one-size-fits-all: Subtypes affect complications and treatment options – The Conversation

-

Business23 hours ago

Tofino, Pemberton among communities opting in to B.C.'s new short-term rental restrictions – Vancouver Sun

-

Business22 hours ago

A sunken boat dream has left a bad taste in this Tim Hortons customer's mouth – CBC.ca

-

News21 hours ago

Best in Canada: Jets Beat Canucks to Finish Season as Top Canadian Club – The Hockey News