Engine and alternative power manufacturer Cummins is set to announce a $1 billion investment across their U.S. engine manufacturing network in Indiana, North Carolina and New York, according to the White House.

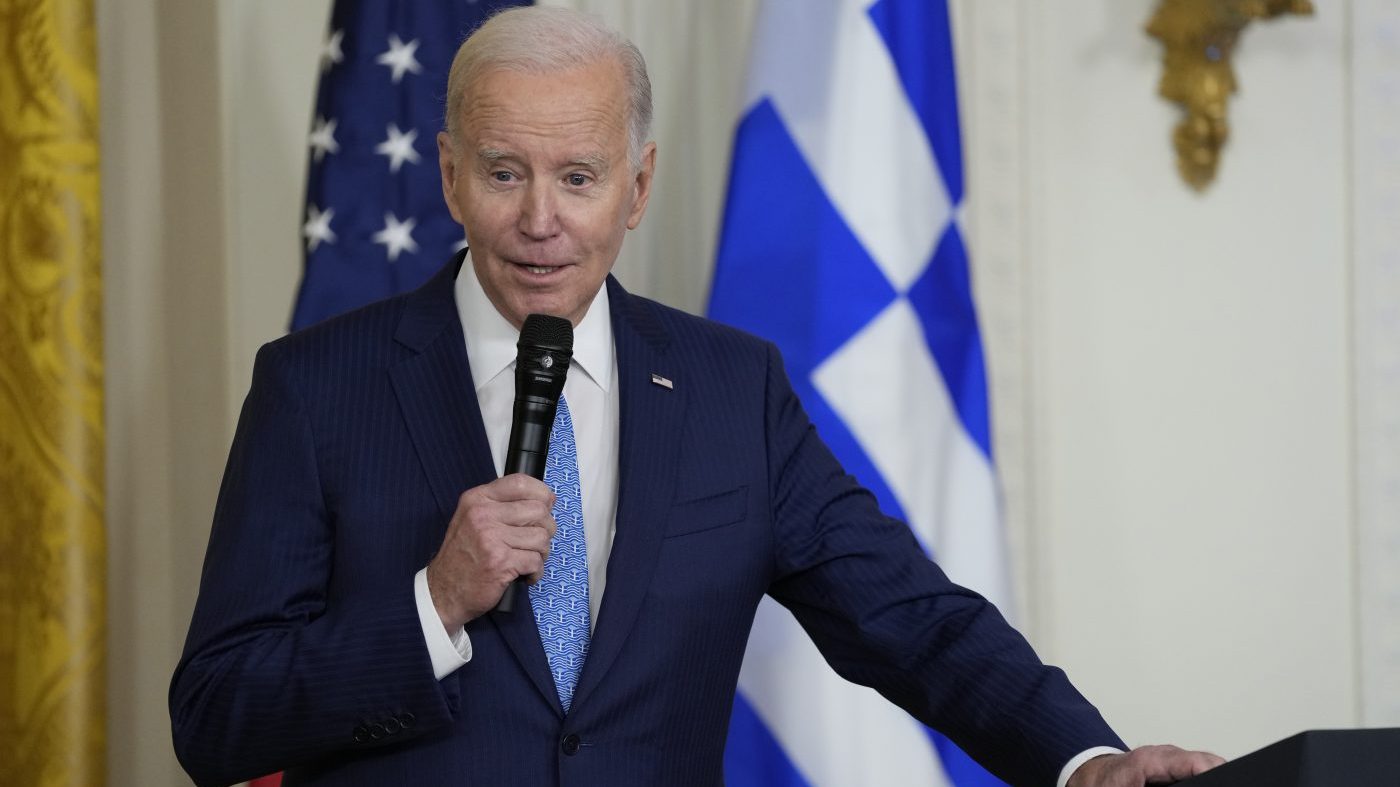

The company’s announcement aligns with President Biden’s visit to the Cummins Power Generation Facility in Fridley, Minn., on Monday, which is part of his “Investing in America tour.”

The investment is set to update facilities “so they can manufacture low- to zero-carbon engines, helping decarbonize the nation’s truck fleets today,” a White House official said. The official added that over half of all medium- and heavy-duty trucks currently on the road in the U.S. use engines manufactured by Cummins.

Cummins said last year, after Biden signed the Inflation Reduction Act, that it would start manufacturing electrolyzers in the U.S. for the first time, all out of its Fridley facility. Electrolyzers are a critical input for clean hydrogen production, which powers hydrogen fuel cell vehicles.

The investment in Minnesota is part of the over $2 billion companies have committed to investing in the North Star State since Biden took office, according to the White House.

The president is set to make remarks after touring the Cummins facility on Monday about how his economic agenda has led to over $435 billion in major private-sector investments.

Biden’s visit to Minnesota is part of a three-week travel blitz the White House has launched to highlight Biden’s economic agenda and investments through legislation passed last year. The “Investing in America tour” started last month at a North Carolina chips manufacturer.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.