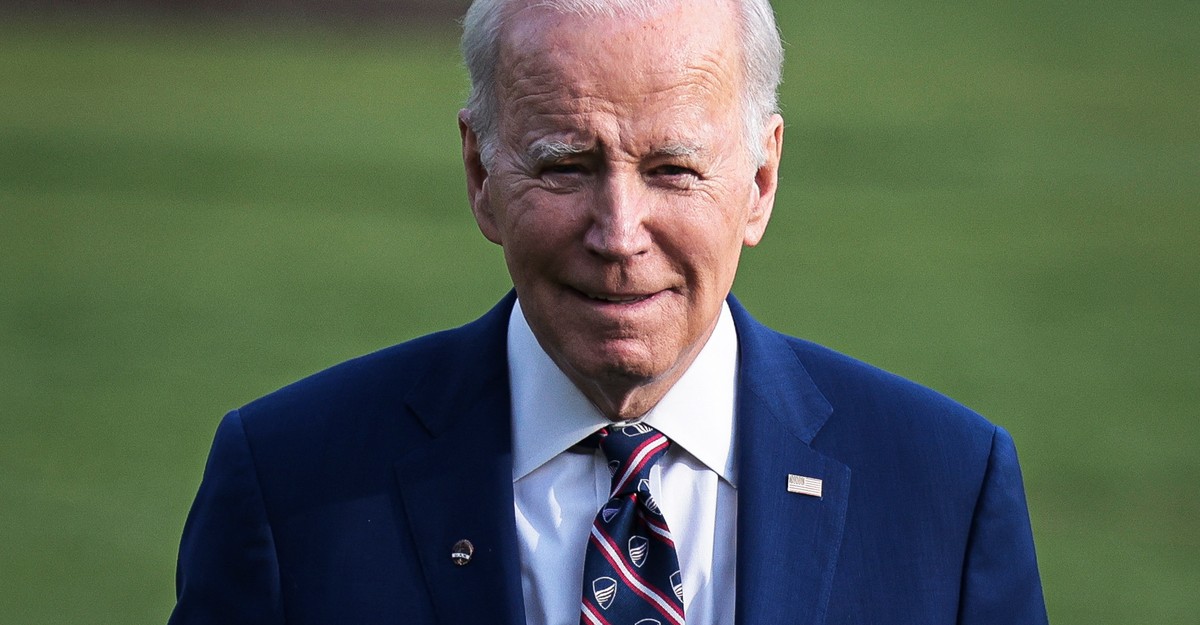

When President Joe Biden visits South Carolina to tout a new solar-energy-manufacturing facility today, he will underscore a striking pattern: Some of the biggest winners from his economic agenda have been Republican-leaning places whose political leaders have consistently opposed his initiatives.

Centered on a trio of bills Biden signed in his first two years, the president’s economic program has triggered what could become the most concentrated burst of public and private investment since the 1960s. The twin bills Biden signed in 2022 to promote more domestic production of clean energy and semiconductors have already helped generate about $500 billion in private investment in new factories and expansion of existing plants, according to the administration’s tally. Simultaneously, the federal government is spending billions more repairing roads, bridges, and other facilities through some 32,000 projects already funded by the bipartisan infrastructure bill approved in 2021. Companies are spending twice as much on constructing new manufacturing facilities as they were as recently as two years ago, a recent Treasury Department analysis found.

“We had high expectations, and we are meeting or exceeding those expectations, particularly on these investments serving as a catalyst for private-sector investment,” White House Chief of Staff Jeff Zients told me in an interview.

This surge of investment could rumble through the economy for years. The reverberations could include reviving domestic manufacturing, opening new facilities in depressed communities that have suffered plant closings and disinvestment since the 1970s, and potentially increasing the nation’s productivity, a key ingredient of sustained growth.

“That data suggests we are in the midst of a big build as a country,” says Joseph Parilla, the director of applied research at the Brookings Metro think tank. “We are in a very important economic moment, particularly for a lot of these regions that have been waiting for this type of private investment, and desperately need it.”

But the political impact of this investment for Biden and other Democrats remains much more uncertain. Polls suggest that for most Americans, the continued pain of inflation, even as it moderates, overshadows the good news of new factory openings. And analyses by Brookings Metro and other groups have found that this private investment is flowing disproportionately into places that didn’t vote for Biden in 2020 and remain highly unlikely to vote for him again in 2024. Many of the communities benefiting most are represented by congressional Republicans who initially voted against the new federal incentives encouraging these investments, and more recently even voted to repeal some of them.

Biden has presented the red tint of the investment patterns as a point of pride, proof that he’s delivering on his promise, after the polarization of Donald Trump’s presidency, to govern in the interest of all Americans. “I promised to be a president for all Americans, whether or not they voted for me or whether or not they voted for these laws,” Biden said last week when announcing a $42 billion plan under the infrastructure bill to extend high-speed internet to all communities by 2030. “These investments will help all Americans. We’re not going to leave anyone behind.”

Many Democrats see that as an important economic commitment and a powerful political argument. But portions of the party are grumbling that the administration is not showing enough concern as companies steer so much of the investment triggered by the new federal incentives toward Republican-leaning states and counties.

That concern is rooted partly in the belief that voters in those places are unlikely to credit Biden for promoting new factories and facilities or to punish Republicans who have opposed the incentives that made them possible. An even larger complication may be the fact that many of these new jobs are moving into states where workers have historically received lower wages and benefits than in the more heavily unionized blue states. “They are sending the money to the states with the lowest worker protections, lower worker standards,” Michael Podhorzer, the former longtime political director of the AFL-CIO, told me. “It’s putting pressure on blue-state employers to lower their standards to be competitive.”

The magnitude of the Biden boom in investment could be historic. Three bills are contributing to the upsurge. One is the Inflation Reduction Act, which provides sweeping subsidies for the domestic manufacture and deployment of clean-energy products such as electric vehicles. The second is the CHIPS and Science Act, which allocates billions of dollars to encourage the domestic production of semiconductors, now produced mostly abroad. The third is the bipartisan infrastructure bill, which funds not only traditional infrastructure projects such as roads and bridges but also new needs like the broadband program and a nationwide network of electric-vehicle chargers. Biden hopes to turbocharge the effect of these bills with other policies pushing companies to buy American in the materials they use in all of these projects.

“What seems to be emerging is a clearly American industrial strategy,” says Ellen Hughes-Cromwick, a senior fellow in climate and energy at Third Way, a centrist Democratic group. “This is about moving ahead in markets where we can be super competitive.”

In a rough calculation, the administration has forecast that these three bills will generate about $3.5 trillion in investment over the next decade. Public spending, either directly on infrastructure projects or through the tax and grant incentives for semiconductors and clean-energy projects, will account for only about two-fifths of that total, with investment from private companies providing the rest. If these bills inspire that much new public and private investment, it would represent a substantial increase—as much as 7 percent annually—in the level of investment the economy now produces (about $5 trillion annually).

The torrent of spending from companies that these bills are expected to unlock is crucial because it refutes the traditional conservative complaint that public investments simply discourage private investments, Jared Bernstein, the new chair of the Council of Economic Advisers, told me. “The idea that public investment crowds out private investments turns out to be ‘bass-ackwards,’ and that is an important insight of Bidenomics,” Bernstein said.

There’s no guarantee that the bills will generate as much net new investment as the administration hopes. Jason Furman, who served as chair of the Council of Economic Advisers for President Barack Obama, told me that if the surge of investment contributes to “overheating” the economy, that would prompt the Federal Reserve Board to raise interest rates, which would reduce the level of investment elsewhere. “If you get more in these areas, you are going to get less in other areas, and you can’t just think of these as additive,” said Furman, now an economics professor at Harvard.

Bernstein doesn’t entirely reject that possibility, but he told me that more investment will just as likely expand the economy’s capacity to produce more output without inflation. “These are investments in the supply side; they are ways to give yourself a little more room to grow,” Bernstein said. “If you are truly standing up a domestic industry that wasn’t there before, that’s new capacity, and, in the long run, that reduces inflationary pressures.”

Whether or not the Biden agenda generates all the investment the administration now projects, it likely will represent the federal government’s most ambitious effort since the height of the Cold War to upgrade the nation’s physical infrastructure and nurture technologically advanced strategic industries. Economic-development experts such as Parilla say that the closest modern parallel to Biden’s investment agenda may be the intertwined federal initiatives from the mid-1950s to the late ’60s to build the interstate highway system, invigorate higher education and scientific research after the shock of the Soviet Union’s Sputnik-satellite launch, upgrade our nuclear-weapons capabilities, and then win the space race to land on the moon. Those efforts accelerated the development of an array of new technologies, from semiconductors to computers to the internet, that provide the foundation of the 21st-century digital economy.

Biden has indicated that he’s expecting similar long-term economic benefits from his agenda, whose direct public spending in inflation-adjusted dollars is larger than the funds Washington spent combined on the interstate highway system and the Apollo moon-landing program. Some Democrats see Biden’s interlocking policies to increase public and private investment as the party’s most fully fleshed-out alternative to the GOP’s argument, since the Ronald Reagan era, that lower taxes and less regulation are the keys to growth.

But the distribution of this new investment has complicated that political calculus. Parilla and a senior research analyst at Brookings Metro, Glencora Haskins, calculated that half the private-sector investments the White House has cataloged have gone to counties that voted for Trump—far more than the 28 percent of the nation’s total economic output that those places generate. Regionally, the biggest winner from the new investment has been the Republican-leaning South, attracting more than two-fifths of the new dollars, considerably more than its share of the total GDP (about a third). The Midwest (about a fifth) and West (about a fourth) have each attracted a share of new investment that roughly matches its portion of the GDP, while the big loser has been the staunchly Democratic Northeast, which is drawing only about an eighth of the new spending.

Some key swing states are among the biggest beneficiaries. Arizona, Georgia, and Michigan—each of which flipped from Trump in 2016 to Biden in 2020—rank in the top six states receiving the most investments, according to unpublished data provided by Brookings Metro to The Atlantic.

But nine of the 15 states receiving the most private investment backed Trump in 2020—including Texas, Ohio, Idaho, Kentucky, Tennessee, Indiana, Utah, North Carolina and South Carolina. And of those nine, North Carolina is the only one that Biden realistically can hope to contest in 2024. Meanwhile, several blue-leaning but still competitive states that Biden likely must hold to win next year have attracted much less investment, including Wisconsin (24th), Pennsylvania (26th), Minnesota (34th), and New Hampshire (44th).

Administration officials are adamant that they are not trying to channel the investment in any way. “The president ran as being president for the American people, for communities all across the country, and that is what he is doing,” Zients told me. “This implementation is not a political exercise.” Instead, Zients said, “the money is flowing into all communities” where there is either, in his words, a “need” to upgrade infrastructure or an “opportunity” to locate manufacturing facilities.

Hughes-Cromwick correctly notes that if Biden in any way said, “‘This money needs to go to blue states,’ the reaction” from Republicans “would be fierce.” But critics are also correct that the administration’s hands-off approach to the investment flow could threaten its broader economic and political goals.

The administration hopes “that in red and purple states, workers will credit Biden and Democrats for the new investment and jobs, which will make Democrats competitive in the region,” Podhorzer, the former AFL-CIO political director, told me. “That is just not going to be the case. History tells us that if any politicians are credited, it’s much more likely they will be local ones.” Georgia’s Republican governor, Brian Kemp, last week demonstrated the problem when he denounced Biden’s program and credited local efforts at the opening of an electric-vehicle-battery plant in the state that has received tax breaks under the Inflation Reduction Act.

The issue is not just who gets political credit for the new jobs. To achieve its full impact, Biden’s investment agenda will need durable support over time from a congressional majority willing to defend its central provisions. The early evidence suggests that investment in red places is not helping this cause: Even though four-fifths of all the clean-energy investments announced have gone to districts held by Republicans in the House of Representatives, every one of them voted this spring to repeal the Inflation Reduction Act incentives that have encouraged those investments.

The White House, in a fact sheet for Biden’s visit to South Carolina, pointedly noted that Republican Representative Joe Wilson (who famously yelled “You lie” at Obama during one of the president’s State of the Union speeches) was among those who voted to repeal the incentives, although they helped finance the expansion of solar manufacturing in his district that Biden visited to celebrate today. Zients said that Biden plans to aggressively “call out” Republicans who are not just “showing up at the ribbon cuttings for a bill they didn’t support, [but] are actively trying to take that money away from their communities.”

The biggest challenge in the red-state-investment tilt may be whether it impedes Biden’s overarching goal of creating more well-paying jobs for workers without a college degree. As Podhorzer pointed out, average wages in many industries, including manufacturing, are much lower in red states than in blue.

Almost all the projects funded under the infrastructure bill require contractors to pay higher “prevailing wages,” so that legislation has proved immensely popular with unions representing construction workers. But the UAW union has repeatedly complained that the auto companies receiving massive federal subsidies under the Inflation Reduction Act are seeking to reduce wages and benefits by producing EV batteries and other components in new facilities that are not subject to the union’s national contract. “Why is Joe Biden’s administration facilitating this corporate greed with taxpayer money?” UAW President Shawn Fain complained in a statement late last month after the Energy Department approved a $9.2 billion loan to Ford to construct three new EV-battery plants in Kentucky and Tennessee.

Compounding the union’s concern is that, as the EV share of the overall market grows, the auto companies will inevitably reduce employment at the unionized plants now producing the batteries for internal-combustion vehicles as they gear up production at their EV-battery plants. Given the locations of most of those EV plants, that change will also likely shift jobs from Rust Belt states that Democrats must win, like Michigan, to states such as Kentucky, Tennessee, and South Carolina, where their prospects are dim. “If I am a Democratic Party adviser, why are we giving $9 billion to replace 7,500 Rust Belt jobs with half-the-wage Kentucky and Tennessee jobs?” one UAW source, who asked for anonymity while discussing union strategy, told me. “What’s the political calculus there?”

Biden lost his most powerful tool to promote unionization in the EV transition when Senator Joe Manchin insisted on the removal of a provision in the inflation-reduction bill that would have given consumers a substantial tax break for purchasing electric vehicles built with union labor.

But critics in the party believe that the administration should be more aggressive about challenging companies to provide good wages with the tools they still have, such as the conditions they can attach to the sort of loan Ford received. “We definitely don’t want to be stimulating a race-to-the-bottom dynamic that will be undermining our own goals of ensuring decent livelihoods for workers,” Isabel Estevez, the deputy director of industrial policy and trade at the Roosevelt Institute, a liberal think tank, told me.

Biden has identified with unions more overtly than any Democratic president in decades, so he will likely seek some way to soothe the discontent at the UAW. But he probably won’t veer from his larger course of celebrating how much of the new investment is flowing into red-leaning blue-collar places, even if many of those are communities he is unlikely to win or in states he cannot seriously contest.

Because Bidenomics aims to revive “investments in places that have long been left behind, then it is inevitable” that some of that funding will benefit distressed communities that have turned away from Democrats and embraced Trump, Bernstein told me. For Biden, aides say, that’s not a bug in his plan, but a benefit. “President Biden often says, ‘Whether you voted for me or not, I will be your president,’” Bernstein said. “Now he can stand at the podium and hold up the graphics that show that it’s true.”