Media

Media Beat: April 01, 2020 – FYI Music News

Yeah, it’s April Fool’s Day and Lefsetz sets it up

The live business has already written off 2020. The big acts don’t want to take the risk of cancellation, there are way too many startup costs, to get geared up again for the fall? NO WAY!

So, they’re waiting until 2021.

That’s the dirty little secret of touring today, the costs. That’s why tours have sponsorships, that’s why acts make national touring deals, they need that cash to ramp up, and if they are left high and dry…who is gonna eat those costs?

Certainly not Live Nation. Live Nation is most concerned about its stock price, so it keeps on telling Wall Street that tours are gonna start up again by June or July, the summer is LN’s most profitable season, and all will be hunky-dory and the stock will bounce back. As for AEG? No one knows since it’s privately held by Phil Anschutz. A Republican in Democratic clothing, Phil is worried about being outed as a supporter of Trump and his agenda, certainly his business agenda, so he’s laying low until the virus is gone, like I said, 2021. And who knows? Phil’s 80 years old, a member of COVID-19’s target demo, so now is not the time for him to take big risks.

But 2021 is. Especially if there’s no risk involved.

It’s gonna be Martin Luther King Day weekend. Mark your calendars right now, this is a four-day affair, running from Friday, January 15th to Monday, January 18th.

The first thought was to have it during the Christmas break when everybody is home and can pay attention, but it turns out the acts go on holiday, as does the business, can you say the Four Seasons in Hawaii?

And, with a new year, you get a new start.

And LN and AEG are gonna work together on this. Even Jerry Mickelson. But Seth Hurwitz and IMP are left out, this affair has got to be squeaky clean.

Now it’s a well-known fact that Coachella is the most lucrative festival in the world.

But the only thing more lucrative was Desert Trip. You remember that the biggest acts of the sixties, playing for boomers in the fall?

Well, needless to say, you can’t do this in Palm Springs. The weather is not amenable and it’s the high season for snowbirds, there are no hotel rooms available.

So, for weather, antitrust and tax reasons, the Reunification Concert is happening in Mexico. Cabo, to be exact. Sammy Hagar personally negotiated with the cartels; they’ve agreed to back off for the weekend. However, insiders know they’re taking 10% of the net. Then again, touring always was a crooked business. – You can continue reading Bob once this file hits his archives.

Government of Canada Coronavirus cheat sheet

The portal answers questions, provides real-time statistics and even offers a self-assessment tool for those who think they might have symptoms.

COVID-19: Gov’t of Canada offers monetary relief to the Broadcasting sector

As part of the government’s broader efforts to support the broadcasting sector, the CRTC is waiving the next payment of licence fees that’s worth about $30M to some of the richest cartels in the country. This follows plans to launch a $30M ad campaign tied to the current pandemic.

Bell Media announces anchors for Quibi newscasts

Bell Media has announced programming and host details for the three Daily Essentials programs it is producing for Quibi’s bite-sized news and entertainment content that launch April 6. From Bell Media’s CTV News and TSN, the daily short-form content packages are entitled Newsday by CTV News and hosted by Heather Butts, Newsnight by CTV News (hosted by Rashmi Nair), and Sports AM by TSN featuring hosts Kayla Grey and Lindsay Hamilton. CTV News will produce daily news, available weekday morning and evening shows and mornings for the weekend. TSN will create sports info for Quibi for every day of the week in the morning.

Bell Media has an exclusive agreement with Quibi to prove news and sports in Canada. The video platform is set to launch Monday the 6th for $6.99 per month with ads, and $9.99 without ads.

BC funeral homes offer online streaming memorials

Funeral homes are increasingly promoting live-streamed memorial services for families grieving a loss during the COVID-19 crisis in an effort to curb the spread of the virus.

The province included funeral homes on a list of essential services released this week, but Laura van Sprang, manager of Sands Funeral Chapel Victoria, says video-streaming services give families a chance to honour a loved one without coming together in person. – Roxanne Egan-Elliott, Times Colonist

As Coronavirus escalates, personal privacy plummets

As countries around the world race to contain the pandemic, many are deploying digital surveillance tools as a means to exert social control, even turning security agency technologies on their own civilians. Health and law enforcement authorities are understandably eager to employ every tool at their disposal to try to hinder the virus — even as the surveillance efforts threaten to alter the precarious balance between public safety and personal privacy on a global scale. – Natasha Singer & Choe Sang-Hun, NYT

Nielsen: How marketers should be dealing with the coronavirus

Matt O’Grady, Nielsen global commercial president, has released research, Key Questions All Marketers Should Be Asking, on the rise in TV media consumption and falling advertising volumes.

The paper includes a look at TV viewing time spent across 24 countries and advertising spends across Europe; how the pullback on advertising spend will cut expenses in the short term but will affect a brand’s resilience. – Jenni Gilbert, AdNews

Comcast reports 212 percent surge in voice and video calls

Voice and video calls have more than tripled on Comcast’s network over the past month since people across the US started working from home due to the COVID-19 pandemic. In a blog post this afternoon, Comcast said traffic for that category is up 212 percent in total, with overall peak traffic on its network up by 32 percent. In some cities, like San Francisco and Seattle, Comcast says peak traffic is up closer to 60 percent. – Jacob Kastrenakes, The Verge

Netflix leads in premium streaming contest

Nielsen says the amount of total streaming minutes was up 22% to 156 billion minutes for the week of March 16 week versus the week of March 9 (127.6 billion). This is more than double the growth of the prior week. It is also up from 115 billion streaming minutes for the week of Feb. 24.

Streaming now stands at 23% of all viewing being done on TVs as of the week of March 16 versus 14% for the same week a year ago with Netflix leading with a 29% share. – Wayne Friedman, MediaPost

‘The phone slipped into the bath’: Conference call tales

Even without video, conference calls can be revealing.

“I remember a client was on a call while in the bath, and you could hear splashing and the tap running. He then realised the microphone was on and the phone slipped into the bath. Gurgle gurgle gurgle. He jumped out the bath to get another phone, slid and fell down the stairs,” recalls Neil Henderson from Zurich Insurance. – Katie Prescott, BBC News

Echoes of Depression-era Manhattan: A lockdown letter from New York

As I write, the USNS Comfort has pulled into Pier 92. Footage of the arrival of the immense hospital ship—with its roughly 1,000 beds to help relieve the hospital crisis—is running on the news channels. The governor and the mayor are all present alongside the heads of FEMA. I see New York governor Andrew Cuomo, and in his cadence, I hear a voice from the 1930s. “Forget the politics, we have a national crisis,” he says. “We are not red, we are not blue, we are red, white, and blue.” I see Cuomo, and I imagine an F.D.R. of this moment, a New Yorker who is steering America through a crisis without apparent end. It is Cuomo, these last few weeks, who has been talked about by columnists and cab drivers as a possible president who could lead the nation. This morning, Cuomo even sounds like Roosevelt in 1932: “No one will get evicted for non-payment of rent. If you don’t pay the rent, you can’t be evicted for three months.” And then, as he has said repeatedly, “We are New York. We are tough—but tough in a good way.” – Marie Brenner, Vanity Fair

Celebrity culture is burning

Among the social impacts of the coronavirus is its swift dismantling of the cult of celebrity. The famous are ambassadors of the meritocracy; they represent the American pursuit of wealth through talent, charm and hard work. But the dream of class mobility dissipates when society locks down, the economy stalls, the death count mounts and everyone’s future is frozen inside their own crowded apartment or palatial mansion. The difference between the two has never been more obvious. The #guillotine2020 hashtag is jumping. As grocery aisles turn bare, some have suggested that perhaps they ought to eat the rich. – Amanda Hess, NYT

David Geffen’s Instagram post draws ire from the public

Geffen’s Caribbean excursion is the latest revelation of how the crisis is affecting people unequally across the globe. While the world’s wealthy have fled to vacation homes, specially made bunkers or floating palaces, rank-and-file workers from nurses to supermarket cashiers have been left juggling childcare and risking infection working jobs deemed essential.

And John Mayer probably won’t be invited on the entertainment mogul’s yacht once the pandemic blows over. He’s posted a parody video after seeing Geffen quarantined on a supersized yacht. – Bloomberg & Daily Mail

Anne Murray: A Little Good News

[embedded content]

Over the Rainbow with Eric Clapton and a select group of friends

[embedded content]

Media

Trump could cash out his DJT stock within weeks. Here’s what happens if he sells

Former President Donald Trump is on the brink of a significant financial decision that could have far-reaching implications for both his personal wealth and the future of his fledgling social media company, Trump Media & Technology Group (TMTG). As the lockup period on his shares in TMTG, which owns Truth Social, nears its end, Trump could soon be free to sell his substantial stake in the company. However, the potential payday, which makes up a large portion of his net worth, comes with considerable risks for Trump and his supporters.

Trump’s stake in TMTG comprises nearly 59% of the company, amounting to 114,750,000 shares. As of now, this holding is valued at approximately $2.6 billion. These shares are currently under a lockup agreement, a common feature of initial public offerings (IPOs), designed to prevent company insiders from immediately selling their shares and potentially destabilizing the stock. The lockup, which began after TMTG’s merger with a special purpose acquisition company (SPAC), is set to expire on September 25, though it could end earlier if certain conditions are met.

Should Trump decide to sell his shares after the lockup expires, the market could respond in unpredictable ways. The sale of a substantial number of shares by a major stakeholder like Trump could flood the market, potentially driving down the stock price. Daniel Bradley, a finance professor at the University of South Florida, suggests that the market might react negatively to such a large sale, particularly if there aren’t enough buyers to absorb the supply. This could lead to a sharp decline in the stock’s value, impacting both Trump’s personal wealth and the company’s market standing.

Moreover, Trump’s involvement in Truth Social has been a key driver of investor interest. The platform, marketed as a free speech alternative to mainstream social media, has attracted a loyal user base largely due to Trump’s presence. If Trump were to sell his stake, it might signal a lack of confidence in the company, potentially shaking investor confidence and further depressing the stock price.

Trump’s decision is also influenced by his ongoing legal battles, which have already cost him over $100 million in legal fees. Selling his shares could provide a significant financial boost, helping him cover these mounting expenses. However, this move could also have political ramifications, especially as he continues his bid for the Republican nomination in the 2024 presidential race.

Trump Media’s success is closely tied to Trump’s political fortunes. The company’s stock has shown volatility in response to developments in the presidential race, with Trump’s chances of winning having a direct impact on the stock’s value. If Trump sells his stake, it could be interpreted as a lack of confidence in his own political future, potentially undermining both his campaign and the company’s prospects.

Truth Social, the flagship product of TMTG, has faced challenges in generating traffic and advertising revenue, especially compared to established social media giants like X (formerly Twitter) and Facebook. Despite this, the company’s valuation has remained high, fueled by investor speculation on Trump’s political future. If Trump remains in the race and manages to secure the presidency, the value of his shares could increase. Conversely, any missteps on the campaign trail could have the opposite effect, further destabilizing the stock.

As the lockup period comes to an end, Trump faces a critical decision that could shape the future of both his personal finances and Truth Social. Whether he chooses to hold onto his shares or cash out, the outcome will likely have significant consequences for the company, its investors, and Trump’s political aspirations.

Media

Arizona man accused of social media threats to Trump is arrested

Cochise County, AZ — Law enforcement officials in Arizona have apprehended Ronald Lee Syvrud, a 66-year-old resident of Cochise County, after a manhunt was launched following alleged death threats he made against former President Donald Trump. The threats reportedly surfaced in social media posts over the past two weeks, as Trump visited the US-Mexico border in Cochise County on Thursday.

Syvrud, who hails from Benson, Arizona, located about 50 miles southeast of Tucson, was captured by the Cochise County Sheriff’s Office on Thursday afternoon. The Sheriff’s Office confirmed his arrest, stating, “This subject has been taken into custody without incident.”

In addition to the alleged threats against Trump, Syvrud is wanted for multiple offences, including failure to register as a sex offender. He also faces several warrants in both Wisconsin and Arizona, including charges for driving under the influence and a felony hit-and-run.

The timing of the arrest coincided with Trump’s visit to Cochise County, where he toured the US-Mexico border. During his visit, Trump addressed the ongoing border issues and criticized his political rival, Democratic presidential nominee Kamala Harris, for what he described as lax immigration policies. When asked by reporters about the ongoing manhunt for Syvrud, Trump responded, “No, I have not heard that, but I am not that surprised and the reason is because I want to do things that are very bad for the bad guys.”

This incident marks the latest in a series of threats against political figures during the current election cycle. Just earlier this month, a 66-year-old Virginia man was arrested on suspicion of making death threats against Vice President Kamala Harris and other public officials.

Media

Trump Media & Technology Group Faces Declining Stock Amid Financial Struggles and Increased Competition

Trump Media & Technology Group’s stock has taken a significant hit, dropping more than 11% this week following a disappointing earnings report and the return of former U.S. President Donald Trump to the rival social media platform X, formerly known as Twitter. This decline is part of a broader downward trend for the parent company of Truth Social, with the stock plummeting nearly 43% since mid-July. Despite the sharp decline, some investors remain unfazed, expressing continued optimism for the company’s financial future or standing by their investment as a show of political support for Trump.

One such investor, Todd Schlanger, an interior designer from West Palm Beach, explained his commitment to the stock, stating, “I’m a Republican, so I supported him. When I found out about the stock, I got involved because I support the company and believe in free speech.” Schlanger, who owns around 1,000 shares, is a regular user of Truth Social and is excited about the company’s future, particularly its plans to expand its streaming services. He believes Truth Social has the potential to be as strong as Facebook or X, despite the stock’s recent struggles.

However, Truth Social’s stock performance is deeply tied to Trump’s political influence and the company’s ability to generate sustainable revenue, which has proven challenging. An earnings report released last Friday showed the company lost over $16 million in the three-month period ending in June. Revenue dropped by 30%, down to approximately $836,000 compared to $1.2 million during the same period last year.

In response to the earnings report, Truth Social CEO Devin Nunes emphasized the company’s strong cash position, highlighting $344 million in cash reserves and no debt. He also reiterated the company’s commitment to free speech, stating, “From the beginning, it was our intention to make Truth Social an impenetrable beachhead of free speech, and by taking extraordinary steps to minimize our reliance on Big Tech, that is exactly what we are doing.”

Despite these assurances, investors reacted negatively to the quarterly report, leading to a steep drop in stock price. The situation was further complicated by Trump’s return to X, where he posted for the first time in a year. Trump’s exclusivity agreement with Trump Media & Technology Group mandates that he posts personal content first on Truth Social. However, he is allowed to make politically related posts on other social media platforms, which he did earlier this week, potentially drawing users away from Truth Social.

For investors like Teri Lynn Roberson, who purchased shares near the company’s peak after it went public in March, the decline in stock value has been disheartening. However, Roberson remains unbothered by the poor performance, saying her investment was more about supporting Trump than making money. “I’m way at a loss, but I am OK with that. I am just watching it for fun,” Roberson said, adding that she sees Trump’s return to X as a positive move that could expand his reach beyond Truth Social’s “echo chamber.”

The stock’s performance holds significant financial implications for Trump himself, as he owns a 65% stake in Trump Media & Technology Group. According to Fortune, this stake represents a substantial portion of his net worth, which could be vulnerable if the company continues to struggle financially.

Analysts have described Truth Social as a “meme stock,” similar to companies like GameStop and AMC that saw their stock prices driven by ideological investments rather than business fundamentals. Tyler Richey, an analyst at Sevens Report Research, noted that the stock has ebbed and flowed based on sentiment toward Trump. He pointed out that the recent decline coincided with the rise of U.S. Vice President Kamala Harris as the Democratic presidential nominee, which may have dampened perceptions of Trump’s 2024 election prospects.

Jay Ritter, a finance professor at the University of Florida, offered a grim long-term outlook for Truth Social, suggesting that the stock would likely remain volatile, but with an overall downward trend. “What’s lacking for the true believer in the company story is, ‘OK, where is the business strategy that will be generating revenue?'” Ritter said, highlighting the company’s struggle to produce a sustainable business model.

Still, for some investors, like Michael Rogers, a masonry company owner in North Carolina, their support for Trump Media & Technology Group is unwavering. Rogers, who owns over 10,000 shares, said he invested in the company both as a show of support for Trump and because of his belief in the company’s financial future. Despite concerns about the company’s revenue challenges, Rogers expressed confidence in the business, stating, “I’m in it for the long haul.”

Not all investors are as confident. Mitchell Standley, who made a significant return on his investment earlier this year by capitalizing on the hype surrounding Trump Media’s planned merger with Digital World Acquisition Corporation, has since moved on. “It was basically just a pump and dump,” Standley told ABC News. “I knew that once they merged, all of his supporters were going to dump a bunch of money into it and buy it up.” Now, Standley is staying away from the company, citing the lack of business fundamentals as the reason for his exit.

Truth Social’s future remains uncertain as it continues to struggle with financial losses and faces stiff competition from established social media platforms. While its user base and investor sentiment are bolstered by Trump’s political following, the company’s long-term viability will depend on its ability to create a sustainable revenue stream and maintain relevance in a crowded digital landscape.

As the company seeks to stabilize, the question remains whether its appeal to Trump’s supporters can translate into financial success or whether it will remain a volatile stock driven more by ideology than business fundamentals.

-

Sports24 hours ago

Sports24 hours agoCanada’s Stakusic, partner Savinykh lose in doubles quarterfinals at Guadalajara Open

-

News4 hours ago

News4 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

News4 hours ago

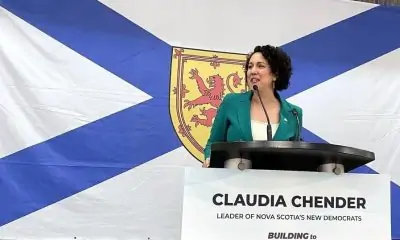

News4 hours agoNova Scotia adopts bill declaring domestic violence in the province an epidemic

-

News14 hours ago

News14 hours agoReggie Bush was at his LA-area home when 3 male suspects attempted to break in

-

News13 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

-

News3 hours ago

News3 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby

-

News3 hours ago

News3 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News14 hours ago

News14 hours agoRBC names Katherine Gibson as permanent chief financial officer