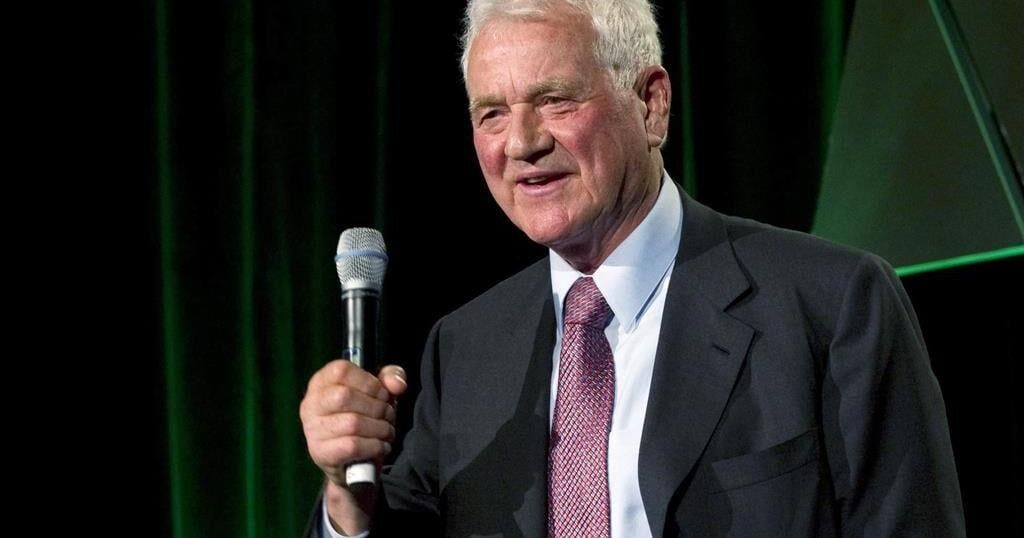

TORONTO – Canada’s industry minister has thrown his support behind a call from one of Shopify Inc.’s leaders for the country to get more ambitious.

“I could not agree more because for 10 years, I’ve always finished my speeches by saying, ‘Let’s seize the moment. Let’s be ambitious,'” François-Philippe Champagne said Thursday.

He was speaking at the Elevate tech conference in Toronto, where the tech community has been gathering since Tuesday to discuss trends in the industry and beyond.

Among the buzziest talks was one from Shopify president Harley Finkelstein, who told the audience on opening night that he had noted a lack of ambition in Canada that he likened to a “600-pound beaver in the room.”

Adding ambition to the Canadian psyche is “unequivocally necessary,” so the country doesn’t become a nation of branch plants and instead fosters massive companies at home, the leader of the Ottawa-based e-commerce software giant said.

He added that the current lack of ambition had left Canadian companies with a reputation for being acquired, while U.S. businesses are known for being the dominant “acquirees.”

“When someone calls me and says, ‘I’m thinking of selling my company to Google,’ my usual answer is, ‘Have you ever thought about one day you buy Google?'” Finkelstein said.

His remarks set off chatter across much of Canada’s tech ecosystem, with many backing his calls for the country to get bolder

But some disagreed.

Laura Lenz, a partner at the venture capital arm of pension plan Ontario Municipal Employees Retirement System, called Finkelstein’s narrative “tired” and lamented that it places “the blame of sluggish productivity squarely on the shoulders of founders and management teams working as hard as they ever have.”

“Maybe it’s time to take a broader view of the problem and the lack of infrastructure supports to keep these companies here at home,” she wrote on X, formerly known as Twitter.

She said the country has to address the lack of tax incentives, willingness to use and purchase Canadian software, and funding for companies, especially in their infancy or “seed stage.”

Abdullah Snobar, the executive director of the DMZ tech hub in Toronto, agreed that “Canada is failing to provide the right conditions of startups to thrive.”

“High costs of living, transportation, infrastructure and transportation — these things are making it next to impossible for entrepreneurs to succeed here,” he wrote on X.

However, on Thursday, Champagne argued the country is well-resourced and that talent is teeming in Canada.

He said Canada has the highest number of AI startups in the world, including Toronto firm Cohere, and when it comes to quantum computing, everyone in the global auto sector considers another one of the city’s companies, Xanadu, “the rock star.”

To be more ambitious, Champagne said the country has to “be more. Be more of everything.”

“I just wish we would all be bragger-in-chief,” he said. “There’s something in our DNA that we need to change somehow, to just be talking more about what we do.”

Aside from ambition, Champagne was questioned about the country’s approach to AI.

Canada is still working on an Artificial Intelligence and Data Act meant to guide how companies operating in the country will design, develop and deploy the technology.

It isn’t expected to come into effect until at least next year, so Champagne has been using a voluntary code of conduct as a stopgap.

The code asks signatories to build risk mitigation measures into AI tools, use adversarial testing to uncover vulnerabilities in such systems and keep track of any harms the technology causes.

Thirty companies, including BlackBerry, Cohere, Salesforce and CGI, have signed the code, but others including Shopify have railed against it, complaining it could hold innovators back.

Asked by moderator and tech personality Amber Mac whether more organizations could have signed the document in the one-year since it was released, Champagne joked he had a copy in his back pocket for any interested companies to sign.

“We may not have a law in the book as of yet but at least we have something,” he said.

“Honestly, the companies that have signed tell me that this has been beneficial.”

This report by The Canadian Press was first published Oct. 3, 2024.

Companies in this story: (TSX:SHOP)