Some economists are proclaiming that the Canadian housing bubble has burst. Housing markets have indeed slowed considerably since their peak in February and March, but, unfortunately, economic bubbles are notoriously hard to identify and are often observed only after they burst.

Real eState

Has the Canadian housing bubble burst? That could depend on time and place

Article content

A review of housing market indicators quickly reveals that any conclusions about the state of housing markets depend upon the benchmarks used to study them. The peak-to-trough comparisons suggest much higher price declines than what year-over-year comparisons reveal. The reference points are not as material in comparing the decline in sales, which are considerably down year over year and from peak to trough.

Advertisement 3

Article content

A recent report by RBC Economics concluded that the expected slowdown in housing sales and prices has been the result of soaring interest rates. RBC expects interest rates to rise further and forecasts the “national benchmark price to drop 14 per cent from (quarterly) peak to trough.”

Again, benchmark prices can differ from average prices, which do not account for the differences in housing quality and size over time. The sales activity during recessionary times can switch from larger, higher-quality homes to smaller, lower-quality homes; hence, any change in average prices will not represent the change in the price of an average home.

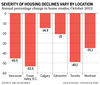

At the same time, some housing markets will experience a more significant decline in sales and prices than others. For example, the RBC report shows housing activity in Calgary has shown more resilience than in Toronto.

Consider that the MLS Home Price Index (HPI), which controls for differences in housing size and quality, declined in Toronto by 1.3 per cent in October from the same time last year, while Calgary was up by 9.1 per cent.

The peak-to-trough declines were also more pronounced in Toronto than in Calgary. The HPI in Calgary declined by 4.2 per cent in October after peaking in May. In Toronto, the index was down 18 per cent from its peak in March. The RBC report noted that declining prices in Toronto have already returned half the gains realized during the pandemic.

The decline in housing transactions is steeper than prices. October sales were down by 49 per cent in Toronto from the same time a year ago. Other large housing markets showed lower annual declines, with Vancouver declining by 45.5 per cent and Montreal by 35 per cent. Annual housing sales in Calgary dropped even less, at 14.9 per cent.

Real eState

Housing starts up in six largest cities but construction still not closing supply gap

The Canada Mortgage and Housing Corp. says construction of new homes in Canada’s six largest cities rose four per cent year-over-year during the first half of 2024, but housing starts were still not enough to meet growing demand.

The agency says growth in housing starts was driven by significant gains in Calgary, Edmonton and Montreal.

A total of 68,639 units began construction, the second strongest figure since 1990, however the rate of housing starts per capita meant activity was around the historical average and not enough “to reduce the existing supply gap and improve affordability for Canadians.”

The report says new home construction trends varied significantly across the markets studied, as Toronto, Vancouver and Ottawa saw declines ranging from 10 to 20 per cent from the same period last year.

Apartment starts in the six regions increased slightly, driven by construction of new units for rent, as nearly half of the apartments started in the first half of 2024 were purpose-built rentals.

But condominium apartment starts fell in the first six months of the year in most cities, a trend which the agency predicts will continue amid soft demand as developers struggle to reach minimum pre-construction sales required.

This report by The Canadian Press was first published Sept. 26, 2024.

The Canadian Press. All rights reserved.

Real eState

Mortgage rule changes will help spark demand, but supply is ‘core’ issue: economist

TORONTO – One expert predicts Ottawa‘s changes to mortgage rules will help spur demand among potential homebuyers but says policies aimed at driving new supply are needed to address the “core issues” facing the market.

The federal government’s changes, set to come into force mid-December, include a higher price cap for insured mortgages to allow more people to qualify for a mortgage with less than a 20 per cent down payment.

The government will also expand its 30-year mortgage amortization to include first-time homebuyers buying any type of home, as well as anybody buying a newly built home.

CIBC Capital Markets deputy chief economist Benjamin Tal calls it a “significant” move likely to accelerate the recovery of the housing market, a process already underway as interest rates have begun to fall.

However, he says in a note that policymakers should aim to “prevent that from becoming too much of a good thing” through policies geared toward the supply side.

Tal says the main issue is the lack of supply available to respond to Canada’s rapidly increasing population, particularly in major cities.

This report by The Canadian Press was first published Sept. 17,2024.

The Canadian Press. All rights reserved.

Real eState

National housing market in ‘holding pattern’ as buyers patient for lower rates: CREA

OTTAWA – The Canadian Real Estate Association says the number of homes sold in August fell compared with a year ago as the market remained largely stuck in a holding pattern despite borrowing costs beginning to come down.

The association says the number of homes sold in August fell 2.1 per cent compared with the same month last year.

On a seasonally adjusted month-over-month basis, national home sales edged up 1.3 per cent from July.

CREA senior economist Shaun Cathcart says that with forecasts of lower interest rates throughout the rest of this year and into 2025, “it makes sense that prospective buyers might continue to hold off for improved affordability, especially since prices are still well behaved in most of the country.”

The national average sale price for August amounted to $649,100, a 0.1 per cent increase compared with a year earlier.

The number of newly listed properties was up 1.1 per cent month-over-month.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

-

Sports24 hours ago

Sports24 hours agoMacNutt upsets Einarson, Carruthers ousted in PointsBet Invitational curling

-

News13 hours ago

News13 hours agoDak Prescott throws 2 TD passes and Cowboys win 7th straight over Giants, 20-15

-

News24 hours ago

News24 hours agoNunavut RCMP charge man with murder in 1986 death of teenage girl

-

News24 hours ago

News24 hours agoAlberta man accused in sex assaults and kidnappings fit to stand trial after stroke

-

Sports23 hours ago

Sports23 hours agoCoach says Nylander will be fine after early departure in Leafs’ 2-1 win over Habs

-

News13 hours ago

News13 hours agoCanada’s Leylah Fernandez knocked out of China Open

-

Sports23 hours ago

Sports23 hours agoYankees wrap up AL East with 10-1 win over Orioles, with Judge hitting 58th homer

-

Economy24 hours ago

Economy24 hours agoS&P/TSX composite tops 24,000 points for first time, U.S. markets also rise Thursday