The world’s most expensive milkshake is the epitome of luxury: a gold-flecked creation of Madagascar vanilla beans, donkey milk caramel sauce and Venezuelan cocoa that comes in a Swarovski crystal-encrusted glass and sells for $100 a pop.

Real eState

Real estate agent fined over $15000 for drinking milk at seller’s home

A Canadian real estate agent will have to pay more than 150 times that much for taking a swig of plain milk.

After a home surveillance camera caught Mike Rose drinking milk straight out of the container at a house he was showing, the British Columbia Financial Services Authority, a government agency tasked with regulating the Canadian province’s financial institutions, on July 18 deemed Rose’s actions “unbecoming” under the British Columbia Real Estate Services Act. It fined him 20,000 Canadian dollars, or approximately $15,162. The agency also ordered Rose to pay an additional 2,500 Canadian dollars, or almost $1,896, in enforcement expenses, records show.

Rose did not immediately respond to a request for comment. However, in a statement to local outlet CFJC Today, he apologized for the “very unfortunate, and very uncharacteristic, decision.”

“I have never done this kind of thing before, nor will I ever behave in this way again,” Rose said. “… Although I have apologized directly to the homeowners, I know that actions like this are not quickly forgiven nor easily forgotten. I will be spending the next few weeks considering my actions, better understanding why I would do this, and work to ensure this kind of [behavior] never occurs again.”

The incident occurred on July 16, 2022, in the city of Kamloops, before potential buyers were scheduled to arrive at the house for a viewing.

That day, homeowner Lyska Fullerton and her family had left the house ready, clean and with the lights on for what they initially thought would only be one viewing. Later in the evening, though, the Fullertons’ real estate agent told them there had been a second showing.

That’s when Fullerton went back to her Ring camera — a device originally “intended for my teenage kids, so I could keep an eye on them and make sure they went home on time,” she told The Washington Post. She figured she would see a real estate agent guiding a group of prospective buyers.

But what she found left her “utterly speechless, in shock and creeped out,” Fullerton said.

The footage showed Rose entering the home some 30 minutes before the buyers. That afternoon, he walked into the kitchen and pulled the window blinds open. Then, he opened the fridge, pulled out a carton of milk and took a long gulp. Rose then put the milk back inside the fridge and closed the door, the video showed.

To make matters worse, Fullerton added, the video also showed Rose sitting on the couch while the potential buyers visited the house. He broke the couch’s arm, she said.

“This was unprofessional in so many ways,” Fullerton said. “Every part of it was just such an invasion of privacy and such an invasion of our home.”

Seeing the video left Fullerton disgusted, she said — particularly because the incident happened during a global pandemic that heightened observations of personal hygiene and killed both her and her husband’s parents.

“In what world do you think that this is ever okay to do?” Fullerton said. “I wouldn’t even do that in my own family’s home.”

According to the order from the British Columbia Financial Services Authority, Rose told the agency he was “unusually dehydrated” at the time because of a new medication. He was also under “considerable stress,” the report shows.

Fullerton confronted Rose two days after the incident, when the prospective buyers went back for another viewing. When she asked him if there was anything he wanted to tell her about his last visit to the home, Fullerton said Rose replied, “The milk?”

She reported him after that.

For Fullerton, it’s not so much that Rose drank the milk — it’s how he didn’t let anyone know that he had done so, she said.

“It doesn’t bother me that he drank milk. I mean, maybe he had an upset stomach, for all I know,” she said. “But to do it in that way? He didn’t even leave a note or tell us this happened. I had to find out because of my camera, and that’s just gross and plain wrong.”

“It makes you question your trust in people who visit your home,” she added.

That’s the reason the financial services agency cited in fining Rose. In its order, the agency said Rose’s behavior was in violation of statutes in the British Columbia Real Estate Services Act, which deems “unbecoming” conduct as behavior that “undermines public confidence in the real estate industry” and “brings the real estate industry into disrepute.”

Despite the milk situation, the prospective buyers wound up becoming the home’s owners, and the Fullertons moved out later that month.

“We sold it pretty quickly right after that, which is great,” she said. “Because the new people can go on and have new memories there, and we don’t have to stick with the memories of what happened.”

As for the milk jug that started it all, Fullerton said she immediately poured it out.

“My husband came back home and watched me throw a half a gallon of milk in the trash,” she said. “He’s looking at me like I’m crazy and asked, ‘What are you doing?’”

She told him: “You don’t even want to know.”

Politics

B.C. Conservatives, NDP both announce plans to help ease B.C. housing crisis

Both of the main candidates in British Columbia‘s election campaign pushed their own plans to solve parts of the housing crisis.

B.C. Conservative Leader John Rustad told a news conference in Surrey that his government would end the multi-year permit delays and would get homes built at the speed and scale needed to address the housing crisis.

NDP Leader David Eby went to Cumberland on Vancouver Island to promote his party’s plan to fast-track factory-built homes.

Eby said pre-built homes would cut waste, reduce emissions, and advances in the industry mean the homes are “beautiful and high-quality.”

He said the process was “more like Lego” than normal construction.

“The idea is pretty straightforward. In a controlled factory environment, you can build faster, you can build with less waste and the homes that are built are more consistent and more efficient and it’s cheaper.”

Rustad said the Conservative Party of B.C. would redesign the approval process for home building, setting a six-month limit for rezoning and development permit and three months for a building permit.

“This means that we will significantly be able to improve the time frame it takes to actually get construction happening in this province, and we’ll be working with city halls across the province to be able to meet these timelines,” Rustad said.

If a clear yes or no isn’t issued by a city within that limit, the province would issue the permit, said a B.C. Conservative news release announcing the platform.

Rustad said the party would remove NDP taxes on housing, support transit-oriented communities, reform development cost charges and make taxes fair for homeowners.

“We have so much regulation that has been put in place associated with housing that it makes it really difficult for anybody to be able to actually get through and build things, not to mention the cost,” he said. “So we’ll amend the Local Government Act to prevent any home killing red tape that has been introduced by this government.”

The party’s statement also outlined their zoning plan, adding that it would work with BC Assessment “to make sure that current homeowners don’t get hit with higher tax bills based on future potential.”

The party statement said, if elected, a Conservative government would build new towns, saying B.C. is blessed with an abundance of land, but the NDP refuses to use it to end the housing shortage.

“We will identify land outside the Agricultural Land Reserve that has the potential to support beautiful new communities.”

A statement issued by the NDP on Friday said it would work with industry, municipalities and First Nations to create a provincewide framework for prefabricated homes so builders know what’s required in every community.

It said there would be a pre-approved set of designs to reduce the permitting process, and it would work to develop skills training needed to support prefabricated home construction.

The statement said Scandinavian countries had embraced factory-built homes, which “offer an alternative to the much slower, more costly process of building on-site.”

“By growing B.C.’s own factory-built home construction industry, everyone from multi-generational families to municipalities will be able to quickly build single homes, duplexes and triplexes on land they already own,” Eby said.

The party said legislation passed by the NDP government last year was a “game changer” for the factory-built home construction industry in the province, where there are currently 10 certified manufacturing plants.

Muchalat Construction Ltd. is one of them, and owner Tania Formosa said pre-approved structures speed up the building process considerably.

She said her company’s projects currently take 12 to 13 months to complete, from startup design to getting the house on site.

“If everything was in place and fast-tracked at the beginning and we were able to just fly along, it would probably take three months off the full schedule,” she said.

She said a main issue for modular manufacturers is that work gets stalled if they run into roadblocks with jurisdictions or BC Housing in the approval process.

“There’s no option for the manufacturer to start another project,” she said. “Having our products approved prior to the process would be amazing.”

She acknowledged the potential drawback of pre-approved designs creating a cookie-cutter look for some neighbourhoods.

“Unfortunately (what) happens in your jurisdiction, in your city, is it ends up looking a lot the same, but what are your priorities?”

This report by The Canadian Press was first published Sept. 27, 2024.

Real eState

Housing starts up in six largest cities but construction still not closing supply gap

The Canada Mortgage and Housing Corp. says construction of new homes in Canada’s six largest cities rose four per cent year-over-year during the first half of 2024, but housing starts were still not enough to meet growing demand.

The agency says growth in housing starts was driven by significant gains in Calgary, Edmonton and Montreal.

A total of 68,639 units began construction, the second strongest figure since 1990, however the rate of housing starts per capita meant activity was around the historical average and not enough “to reduce the existing supply gap and improve affordability for Canadians.”

The report says new home construction trends varied significantly across the markets studied, as Toronto, Vancouver and Ottawa saw declines ranging from 10 to 20 per cent from the same period last year.

Apartment starts in the six regions increased slightly, driven by construction of new units for rent, as nearly half of the apartments started in the first half of 2024 were purpose-built rentals.

But condominium apartment starts fell in the first six months of the year in most cities, a trend which the agency predicts will continue amid soft demand as developers struggle to reach minimum pre-construction sales required.

This report by The Canadian Press was first published Sept. 26, 2024.

The Canadian Press. All rights reserved.

Real eState

Mortgage rule changes will help spark demand, but supply is ‘core’ issue: economist

TORONTO – One expert predicts Ottawa‘s changes to mortgage rules will help spur demand among potential homebuyers but says policies aimed at driving new supply are needed to address the “core issues” facing the market.

The federal government’s changes, set to come into force mid-December, include a higher price cap for insured mortgages to allow more people to qualify for a mortgage with less than a 20 per cent down payment.

The government will also expand its 30-year mortgage amortization to include first-time homebuyers buying any type of home, as well as anybody buying a newly built home.

CIBC Capital Markets deputy chief economist Benjamin Tal calls it a “significant” move likely to accelerate the recovery of the housing market, a process already underway as interest rates have begun to fall.

However, he says in a note that policymakers should aim to “prevent that from becoming too much of a good thing” through policies geared toward the supply side.

Tal says the main issue is the lack of supply available to respond to Canada’s rapidly increasing population, particularly in major cities.

This report by The Canadian Press was first published Sept. 17,2024.

The Canadian Press. All rights reserved.

-

News24 hours ago

News24 hours agoDak Prescott throws 2 TD passes and Cowboys win 7th straight over Giants, 20-15

-

News11 hours ago

News11 hours agoMaggie Smith, scene-stealing actor famed for Harry Potter and ‘Downton Abbey,’ dies at 89

-

News11 hours ago

News11 hours agoIsrael-Hamas war latest: Israel carries out attacks in Beirut on Hezbollah targets

-

News11 hours ago

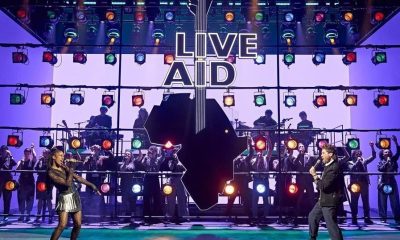

News11 hours agoBob Geldof hopes Live Aid musical inspires younger generation to take action

-

News24 hours ago

News24 hours agoCanada’s Leylah Fernandez knocked out of China Open

-

News11 hours ago

News11 hours agoNetanyahu, at UN, vows that Israel will keep ‘degrading Hezbollah’ until its objectives are met

-

News11 hours ago

News11 hours agoAs political scandal grips NYC, a fictional press conference puzzles some New Yorkers

-

News22 hours ago

News22 hours agoNebraska to become last Big Ten school to sell alcohol at football games in 2025 if regents give OK