Article content

There’s a price shocker coming at the pumps.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/HIR3EGWQRRG6ZIDQGM4MBPCL4A.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/HIR3EGWQRRG6ZIDQGM4MBPCL4A.jpg)

A home for sale in Toronto’s Annex neighbourhood is photographed on July 18.Fred Lum/The Globe and Mail

The housing market appears to have cooled in recent weeks, but that doesn’t mean it’s now more affordable to enter the market. In fact, owing to rising interest rates, the opposite is true.

Within the past four months, the average yearly income needed to buy a home on a fixed mortgage with 20 per cent down has climbed by $18,000, according to new data from Ratehub, a loan-comparison website. It determined these numbers by contrasting real estate data from March with June, using the average mortgage rates of Canada’s five largest banks.

In Vancouver, would-be homebuyers must now take home a minimum of $232,000 a year to afford a home, an increase of almost $32,000 since March. To purchase a home in Toronto, Ratehub.ca says people need to make roughly $226,000 a year, an additional $16,000 in four months time.

Monthly payments on variable-rate mortgages could increase as borrowers near their ‘trigger rate’

What is your mortgage trigger rate? This calculator helps you estimate it

The greatest increase since March occurred in Victoria, where the minimum annual income to afford a home, on average, is pegged at $188,000 – ballooning by 23 per cent, or about $36,000.

The mortgage stress test is to blame for these large jumps. As concerns over inflation have pushed mortgage rates up in recent weeks, the threshold required to pass the government-mandated mortgage stress test has also risen, making homeownership even less attainable to many Canadians.

The stress test was first introduced during the 2016-2017 housing boom to ensure that homebuyers could afford their mortgage payments if interest rates rose, as well as to slow the frenetic markets in Toronto and Vancouver.

Interestingly, despite the notion that home prices have declined in markets across the country in the wake of rising interest rates, Ratehub found that among the 10 cities it assessed, only half saw their average home prices shrink between March and June.

”Home prices will need to drop significantly in order to neutralize the effects that higher mortgage rates have on the stress test,” said James Laird, co-CEO of Ratehub. “Unless this happens, home affordability will continue to be impacted significantly by the current rising rate environment.”

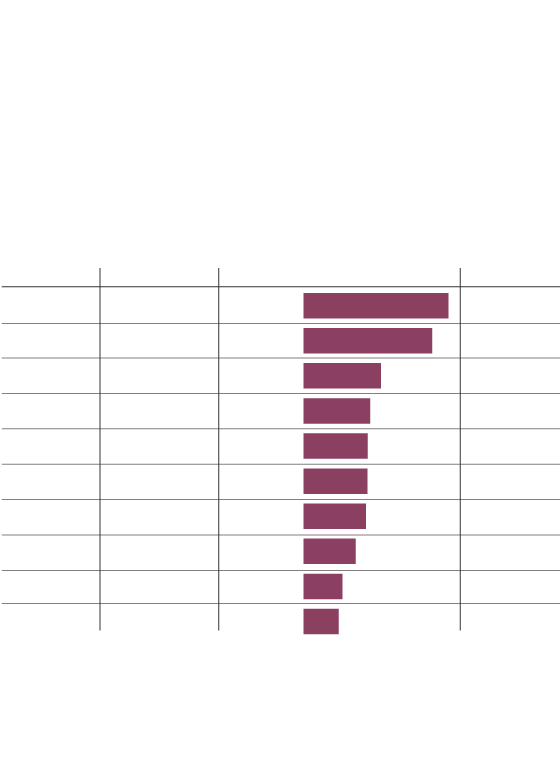

Change in annual income required

to buy a home in Canada

New analysis from Ratehub.ca, a loan-comparison website, shows it’s now more expensive to buy a home in Canada than it was a few months ago, despite the fact that the housing market has significantly slowed in many parts of the country. Rising mortgage rates – which have, in turn, caused stress-test rates to tick up – are to blame.

Select cities, June, 2022

Income req.

Increase from March, 2022

% increase

Data are based on: 20 per cent down payment, 25-year amortization, $4,000

annual property taxes and $150 monthly heating; mortgage rates average of

the Big Five banks’ five-year fixed rates in March and June; average home

prices from CREA MLS home price index.

the globe and mail, Source: ratehub.ca

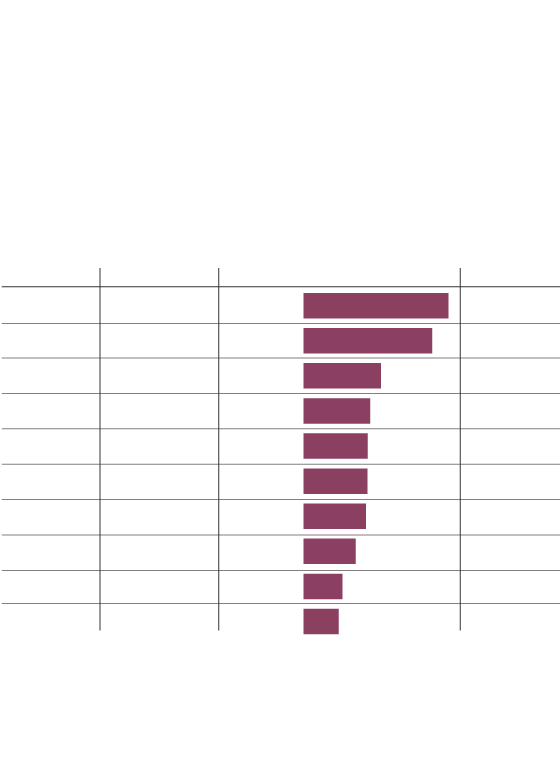

Change in annual income required

to buy a home in Canada

New analysis from Ratehub.ca, a loan-comparison website, shows it’s now more expensive to buy a home in Canada than it was a few months ago, despite the fact that the housing market has significantly slowed in many parts of the country. Rising mortgage rates – which have, in turn, caused stress-test rates to tick up – are to blame.

Select cities, June, 2022

Income req.

Increase from March, 2022

% increase

Data are based on: 20 per cent down payment, 25-year amortization, $4,000

annual property taxes and $150 monthly heating; mortgage rates average of

the Big Five banks’ five-year fixed rates in March and June; average home

prices from CREA MLS home price index.

the globe and mail, Source: ratehub.ca

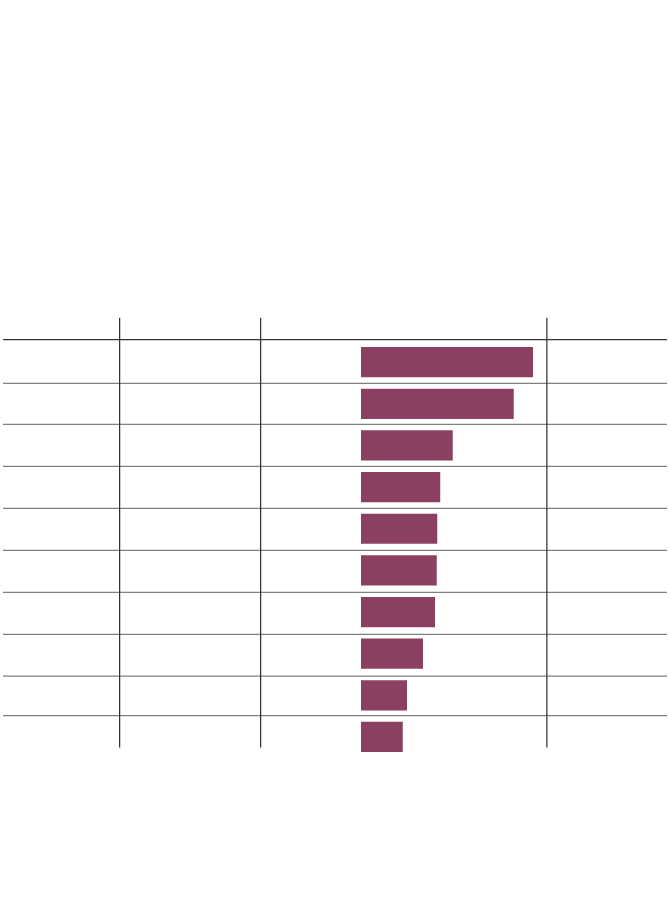

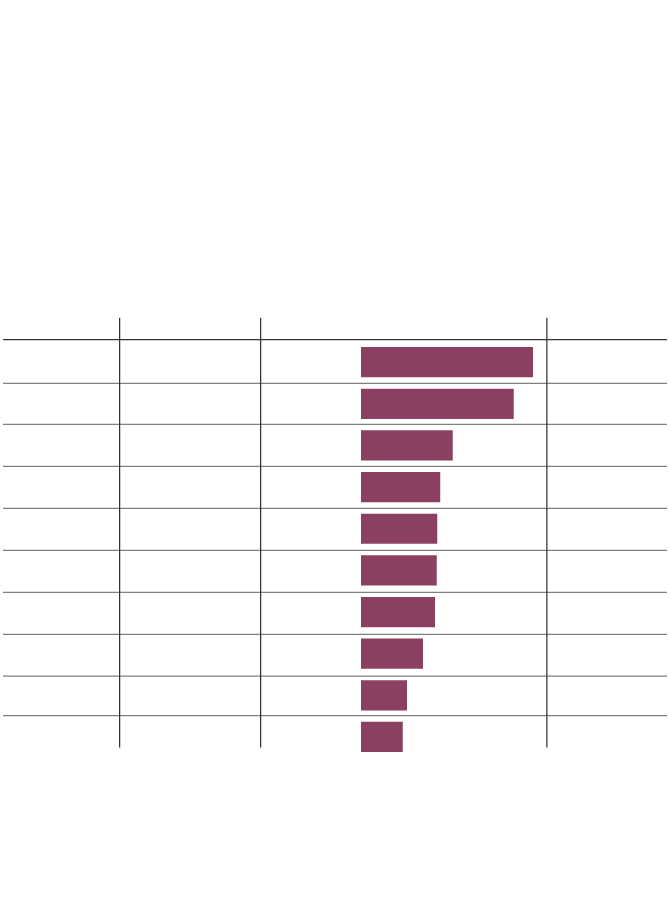

Change in annual income required to buy a home in Canada

New analysis from Ratehub.ca, a loan-comparison website, shows it’s now more expensive to buy a home in Canada than it was a few months ago, despite the fact that the housing market has significantly slowed in many parts of the country. Rising mortgage rates – which have, in turn, caused stress-test rates to tick up – are to blame.

Select cities, June, 2022

Income required

Increase from March, 2022

% increase

Data are based on: 20 per cent down payment, 25-year amortization, $4,000 annual property taxes and

$150 monthly heating; mortgage rates average of the Big Five banks’ five-year fixed rates in March and

June; average home prices from CREA MLS home price index.

the globe and mail, Source: ratehub.ca

As of last June, the stress test requires potential buyers to prove that they can keep up with mortgage payments at either a minimum rate of 5.25 per cent or their individual mortgage rate plus 2 per cent –whichever is higher.

With historically low interest rates, that meant the stress-test rate was almost universally set at 5.25 per cent for people seeking both variable and fixed-rate mortgages, which appear, by far, to be the most popular option in Canada.

But now that fixed-mortgage rates have increased by two-thirds in only four months, according to Ratehub, many hoping to buy with a fixed rate are facing stress-test rates around 7.21 per cent, on average.

John Pasalis, president of a Toronto-based real estate brokerage called Realosophy Realty, played down the significance of these changes. Most buyers, he said, are now opting for variable-rate mortgages because their stress-test rates are now closer to 6 per cent.

Rising mortgage rates add layers of stress to home ownership

Dave Larock strongly disagrees. The president of Integrated Mortgage Planners Inc., a Toronto firm, told The Globe and Mail these numbers highlight a major regulatory misstep by the Office of the Superintendent of Financial Institutions (OSFI), the independent federal agency that oversees the mortgage stress test.

“There should never be a point where a borrower can borrow more if they take a variable rate versus a fixed rate,” Mr. Larock said. “That’s a flaw in the design of the stress test.”

It’s now easier for the most stretched borrowers to qualify for variable-rate mortgages, according to Mr. Larock. OSFI should have addressed this problem at its previous meeting in late June, he added.

“As a banking regulator whose stated goal is to preserve the stability of the market, that was a glaring mistake,” he said.

Mr. Larock, who said he firmly supported the implementation of a stress test, went on to question whether it’s still necessary with rates as high as they are now. If it’s to remain, he said OSFI should set a single stress-test rate for all would-be homebuyers.

With a report from Rachelle Younglai

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

Premier Doug Ford lashed out at the gas companies for the double-digit overnight increase in the price of gas across the GTA, calling it unacceptable and disgusting.

Speaking at an unrelated announcement in Oakville, Ont., on Thursday, Ford took a moment to vent on behalf of “16 million people” across the province.

“You go out last night and you’re sitting there for 20 minutes in the lineup to get gas. It’s unacceptable,” said Ford. “Everywhere I was going it was a $1.59. You wake up this morning and it’s $1.80. It’s absolutely disgusting.”

Prices at the pumps surged 14 cents overnight to 178.9 cents/litre at most GTA stations. Analysts attribute the increase to the annual changeover from winter gas to summer gas.

“That is why prices are going up so significantly all at once is essentially we’re seeing discounts on winter gasoline to get rid of it but now that we’ve made the jump, summer gasoline inventories are much lower and thus a much higher price,” Patrick De Haan, the head of petroleum analysis at Gas Buddy tells CityNews.

That explanation, Ford said, was simply a way for the gas companies to gouge people.

“It’s absolutely disgusting what the oil companies are doing,” said an agitated Ford as he questioned whether the gas companies are waiting for the tanks to drain at gas stations before filling them up with the new summer formulation. “Or are you using the old gas and charging the higher cost.”

“I have my opinion that it’s not physically possible to drain every single gas station to put the fresh stuff in. So either you’re putting the fresh stuff in last month or you’re gouging the people right now.”

Ford went on to say that after consulting with some friends in the United States, he found that gas prices were trending around $3.80 per gallon. “Folks, let’s do the math – it’s a $1.80 (a litre) that’s $7.20 (a US gallon).”

Mike Eppel, 680 News Radio Toronto Senior Business Editor, says it also comes down to a refining capacity issue in this country.

“So there’s lots of oil, that’s not the issue – oil supplies are high. It’s the refining capacity. We haven’t had a refinery built in eastern Canada since whenever – you can’t get a pipeline built. And anytime there is any disruption in the system, up goes the price for gas.”

Ford did not limit his anger on rising gas prices to just the oil companies, closing his rant by taking a shot at the federal government’s carbon tax, which took effect on April 1 and pushed gas prices up three cents a litre.

“This goes back to the federal government sticking their hands in the people’s pockets, they don’t care that we have some of the highest prices in North America on the carbon tax, they jack it up 17.5 per cent,” explained Ford. “And then of course the oil companies thought they’d hop on board, no one’s going to notice, because if I remember … just a few months ago I remember filling up for $1.30 to $1.34. Did the barrel of oil go up 30 per cent? The answer is no. So where is the 30 per cent.”

While the price of gas is expected to fall by four cents/litre on Friday, prices will continue to fluctuate with no real relief in sight until June or July.

Google has fired 28 employees after a number of staffers protested the company’s cloud contract with the Israeli government.

The workers were terminated after staging protests inside Google’s offices in New York and Sunnyvale, California, per CNN.

Article content

In a statement, Google’s parent company Alphabet said that “physically impeding other employees’ work and preventing them from accessing our facilities is a clear violation of our policies, and completely unacceptable behavior.”

Recommended from Editorial

The protests were organized by the No Tech For Apartheid campaign and protesters held signs that read “No More Genocide For Profit” and “We Stand with Palestinian, Arab and Muslim Googlers.”

The company said it would continue to investigate and take action as needed, reports The Guardian.

The protesters say that Project Nimbus, a $1.2 billion contract granted to Google and Amazon.com in 2021, provides cloud services to the Israeli government and aids in the creation of military applications.

A form letter on the campaign’s website demands that Amazon CEO Andy Jassy, Amazon Web Services CEO Adam Selipsky, Google CEO Sundar Pichai and Google Cloud CEO Thomas Kurian “end all ties with Israeli apartheid and cut the Project Nimbus contract.”

Article content

Google says the Nimbus contract “is not directed at highly sensitive, classified, or military workloads relevant to weapons or intelligence services.” It added that Google Cloud “supports numerous governments around the world, including the Israeli government.”

“We have been very clear that the Nimbus contract is for workloads running on our commercial cloud by Israeli government ministries, who agree to comply with our Terms of Service and Acceptable Use Policy.”

The No Tech for Apartheid campaign called the firings a “flagrant act of retaliation” and a “clear indication that Google values its $1.2 billion contract with the genocidal Israeli government and military more than its own workers.”

The campaign added that some of the individuals fired did not directly participate in the protests.

Despite what its critics allege, Israel has attempted to warn and shield civilians as the IDF hunts the Hamas terrorists who hid themselves among Gaza’s civilian population and infrastructure after the group’s October 7 attack. As well, critics who call Israel an apartheid state ignore the freedoms enjoyed by the democratic country’s Arab citizens, who play major roles in business, the judiciary and even the Knesset.

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our newsletters here.

Share this article in your social network

Gas prices have not been this high since August 2022

There’s a price shocker coming at the pumps.

Advertisement 2

Article content

Gas in Ontario, including the GTA, will go up 14 cents a litre overnight for customers filling up on Thursday, says Dan McTeague, the president of Canadians for Affordable Energy.

Article content

“So going from $1.65.9 (per litre) going to $1.79.9,” said McTeague adding the increase will affect the entire province except for northwestern Ontario, which gets its prices from the prairies market.

“That’s the highest level since August, 2022, almost two years ago,” he added.

Recommended from Editorial

McTeague said the reason for the price hike is that stations are switching over to summer-blend gasoline.

“Around this time of year prices go up to reflect the new blend of gasoline, which is more expensive to make,” he explained. “Butane is used in the winter, for gasoline, whereas in the summer it’s alkyaltes. Alkyaltes are extremely expensive.”

Advertisement 3

Article content

“In the winter you want your ignition to start quickly in cold temperatures, you uses volatile butane. You take that out in the summer. That’s a big difference. This is going to be around for awhile and it could get higher,” McTeague said.

McTeague also blamed the rise in gas prices in Canada on the carbon tax increase, the rising price of oil, and the weak Canadian dollar.

“It just makes a bad situation worse,” he said. “It’s just another brick in the wall, another load on the camel’s bank. The cost of denying our resources, blocking pipelines, is one of the most significant reasons why the Canadian dollar is so weak.”

Article content

Cytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

Supervised consumption sites urgently needed, says study – Sudbury.com

Aaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca

Trump faces political risks as trial begins – NBC News

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

Nintendo Indie World Showcase April 2024 – Every Announcement, Game Reveal & Trailer – Nintendo Life

Canada's 2024 budget announces 'halal mortgages'. Here's what to know – National Post

Comments