Researchers in London, Ont., say they were able to detect awareness in a comatose patient with a brain injury – a finding that could significantly impact patient care.

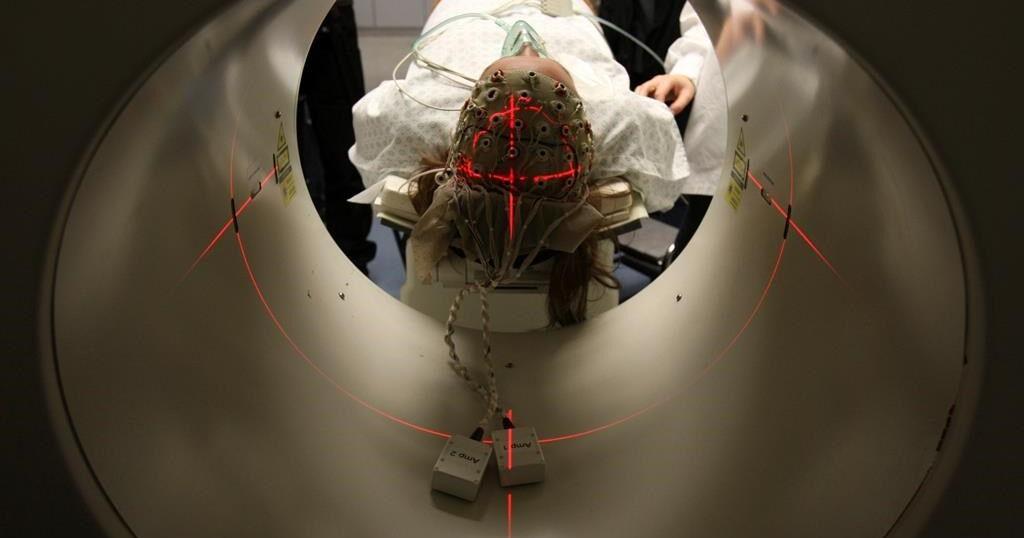

Karnig Kazazian, a research associate at Lawson Health Research Institute and the London Health Sciences Centre, says a neuroimaging technique was used to shine a light into three patients’ brains to find activity in response to different commands.

The patients had already been deemed clinically unresponsive, meaning they had not reacted when asked to give a thumbs up, wiggle their toes or open and close their eyes.

But Kazazian says one of the patients showed significant neurological activity in the correct part of the brain when they were asked to imagine playing tennis.

He says the finding, published recently in The Proceedings of the National Academy of Sciences journal, builds on previous research that suggests 15 per cent of comatose patients have some cognitive awareness even if they appear unresponsive.

Kazazian says the technology should be made available to intensive care units across the country, as it could help doctors and family members make decisions about whether to continue aggressive care if the patient shows signs of awareness.

”By showing that some patients might still be ‘in there’ despite behaviourally showing no signs, you can imagine that this would really greatly influence that decision of whether or not you stay on life support or transition to passing away peacefully,” said Kazazian, who was co-lead author of the study.

The researchers also saw activity in the part of the patient’s brain responsible for processing auditory information when they played “complex stories.”

But the task of imagining playing a game of tennis — a test the researchers repeated five times — was the most telling sign of awareness, Kazazian said.

It triggered activity in the patient’s premotor cortex — the part of the brain that imagines movement.

“Previous work from our group has shown that you have to be conscious in order to imagine playing tennis. You have to be ‘in there’ because that’s not something that you just automatically do without any awareness,” Kazazian said.

In a less robust response, another unresponsive patient appeared to have the ability to passively perceive speech, the study found. A third patient showed no response to any of the task commands.

The light technology, called functional near infrared spectroscopy (fNIRS), shines light into the brain.

“More light absorption means more brain activity,” he said.

Before using fNIRS on the three comatose patients, the researchers tested it on more than 100 healthy participants to determine what tasks and commands were most effective at eliciting brain activity.

More research is needed with more patients to determine whether or not the brain activity detected is associated with a patient’s prognosis, Kazazian said.

His research group is in the midst of doing that with ICU patients whose families give consent.

The team will also study whether or not the fNIRS technology can be used to communicate with patients while they are comatose, Kazazian said.

This report by The Canadian Press was first published Sept. 4, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.