Real eState

2021 a banner year for real estate in Greater Victoria – Vancouver Island Free Daily – vancouverislandfreedaily.com

Realtors working within the area of Victoria Real Estate Board (VREB) sold 10,052 properties in 2021, nearly breaking the record of 10,622 properties sold in 2016.

Sales figures for 2021 as a whole were more than 18 per cent higher than in 2020, with corresponding increases in prices. The benchmark value for a typical detached single-family home in the Victoria Core (Victoria, Saanich, Oak Bay and Esquimalt) was $1.144 million in December 2021, up 25.1 per cent from the same month in 2020. The benchmark price for condominiums was also up over the previous year, rising by 17.1 per cent to $570,600 in December 2021.

Sales for the month were down 30.6 per cent from December 2020, but the amount of home inventory was also 49 per cent lower. According to the board, the 652 active listings at the end of December 2021 marked the lowest such inventory at month-end in at least 25 years.

A consistent theme ran through 2021, VREB past-president David Langlois said in a release.

“Each month a high demand for homes, paired with record low inventory, has put strong pressure on pricing and attainability and has made the local and global housing market a top news item and political talking point,” he said.

RELATED: Bidding wars continue in Greater Victoria despite lower sales

Looking at the Saanich Peninsula, for example, the December 2021 benchmark prices for a detached single-family home in North Saanich was $1.352 million, just over $1 million in Central Saanich and $959,300 in Sidney.

Looking across the rest of Greater Victoria, Oak Bay recorded the highest benchmark price for a single-family home at $1.585 million. Other jurisdictions where that benchmark exceeded $1 million were Victoria, View Royal, Saanich, Metchosin and Highlands. Those just below the $1 million mark included Victoria West (separated from Victoria), Esquimalt, Langford and Colwood, while the most reasonably priced in VREB’s coverage area were Sooke ($838,800) and the Gulf Islands ($706,900).

The new figures were announced this week on the heels of new figures from the BC Assessment Authority, which show significant increases in communities across Vancouver Island, in some cases in excess of 40 per cent.

RELATED: Property assessments up more than 40 per cent in some Vancouver Island communities

Langlois repeated previous calls for new measures to improve the supply of housing.

“Some of our municipalities have begun to look at ways to make it easier for new homes to be brought to market and we applaud and encourage any movement in this area. It has been far too difficult and expensive to build homes in our region,” he said. “The situation we are now in is because of the deficit of supply that has compounded over the past decades of hesitation around growth.”

Langlois used the occasion to criticize proposed remedies focused on the sales process.

“The process of how a home is sold is not the issue – homes will sell for what consumers will pay for them – using any sales process. The issue is how homes are brought to the marketplace and our huge lack of supply. Governments should expend their resources to address supply issues that continue to drive up competition for homes and result in ever-increasing prices.”

Do you have a story tip? Email: vnc.editorial@blackpress.ca.

Follow us on Twitter and Instagram, and like us on Facebook.

wolfgang.depner@peninsulanewsreview.com

Real eState

Real Estate Stocks Fall As Mortgage Rates Rise To 4-Month Highs: 'Inflation Is Proving Tougher To Bring D – Benzinga

Real estate stocks slid at Wednesday’s market open, weighed down by the latest disappointing data on housing starts and a spike in mortgage rates, darkening the outlook for the sector.

By 9:00 a.m. EST, the Real Estate Select Sector SPDR Fund XLRE had dropped by 0.3%. This marked its fourth consecutive day of losses and set a course for its lowest close since the end of November 2023.

The fund has also slipped below its 200-day moving average, a critical long-term benchmark, signaling that investor sentiment has turned negative.

The average interest rate for 30-year fixed-rate mortgages with loan balances up to $766,550 climbed by 12 basis points to 7.13% for the week ending Apr. 12, 2024, according to the latest figures from the Mortgage Bankers Association. This rate is the highest recorded since early December.

On Wednesday, the yield on a 30-year Treasury bond, a key benchmark for long-term mortgage rates, traded at 4.75%, at the highest since mid-November 2023, as Fed Chair Powell admitted that there has been a lack of progress in the disinflation trend.

Chart: Real Estate Stocks Fall Below Key Long-Term Moving Average As Inflation Bites Again

Weaknesses In Multifamily Segment Continue

Joel Kan, MBA’s Vice President and Deputy Chief Economist, explained the rise in rates, stating, “Rates increased for the second consecutive week, driven by incoming data indicating that the economy remains strong and inflation is proving tougher to bring down.”

Despite the uptick in mortgage rates, there was a 3.3% week-over-week increase in the Market Composite Index, which measures mortgage loan application volume.

Kan further noted, “Application activity picked up, possibly as some borrowers decided to act in case rates continue to rise. Purchase applications were the primary driver of this increase, although they are still about 10% lower than last year’s levels. There was a slight uptick in refinance applications, mainly due to a 3% rise in conventional applications.”

Chart: US 30-Year Mortgage Rates Rose To The Highest Level Since Late November

The real estate market’s challenges are linked to affordability and a shrinking availability as the supply of new homes falls.

Andrew Foran, an economist at Toronto Dominion Securities, commented on the trend in home building, “Homebuilding activity moderated in March as weakness in the multifamily segment persisted and the single-family segment gave back most of its considerable gain from the prior month.”

Data revealed a 14.7% month-over-month decline in housing starts in March, with the figures dropping to 1.32 million annualized units, significantly below the anticipated 1.49 million.

Both the single-family and multifamily sectors experienced declines, with single-family starts down by 12.4% (or 145,000 units) and multifamily starts plummeting by 21.7% (or 83,000 units). This retreat in multifamily starts marked the lowest level since April 2020.

Additionally, residential permits decreased more than expected in March, falling by 4.3% month-over-month to 1.46 million annualized units. This included a 5.7% drop in single-family permits—the first decline in fifteen months—and a 1.2% reduction in multifamily permits.

Rising & Falling

The weakest performers among real estate stocks with a market cap of at least $1 billion on Wednesday were:

| Name | 1-day %chg |

|---|---|

| Prologis, Inc. PLD | -6.55% |

| First Industrial Realty Trust, Inc. FR | -3.33% |

| STAG Industrial, Inc. STAG | -2.89% |

| EastGroup Properties, Inc. EGP | -2.89% |

| Rexford Industrial Realty, Inc. REXR | -2.35% |

Those showing the highest gains were:

| Name | 1-day %chg |

|---|---|

| SL Green Realty Corp. SLG | 3.18% |

| Opendoor Technologies Inc. OPEN | 2.55% |

| Medical Properties Trust, Inc. MPW | 2.49% |

| eXp World Holdings, Inc. EXPI | 2.32% |

| Vornado Realty Trust VNO | 2.25% |

Now Read: Best REITs to Buy in April

Image: Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Real eState

Toronto real estate agent puts comical spin on promoting burnt-down house – NOW Toronto

A Toronto real estate agent posted a picture of a $799,000 house that appears to be burnt down on TikTok saying it’s perfect for first-time homebuyers on a budget.

The agent, Ruthie Miller, was half joking.

Miller’s real estate career has run parallel to being a stand-up comedian. She found the run-down house as she was trying to look for a place to invest in herself.

Though she wasn’t the seller of the house, she thought posting the entertaining video on TikTok would attract more buyers to it.

The Yorkdale-Glen neighbourhood home is placed on a 25 x 130 ft. lot and the listing includes pictures of burnt down areas in the home.

Miller posted the video a week ago, but now the price is currently over $1 million on Realtor.ca.

“This house did have a fire and probably needs a lot of work. If you’re anything like me and you think to yourself, ‘Oh, I can fix him. All he needs is a little bit of TLC. He’s just had some bad relationships in the past,’ then you might be into this one,” Miller said in the video.

Some viewers were confused and wondered if the video was a parody.

“LOL genuinely can’t tell if this is a joke or not … a budget? Your gonna need another 200k to fix it it’s not even livable,” one person commented.

When asked if she thought her comedic approach to real estate could mislead people, Miller said, “I don’t know.”

Miller told Now Toronto that she was joking about some parts, especially about the house being suitable for a first-time homebuyer because of the structural issues.

Miller believes she’s bringing attention to real estate regardless of the method and people are going to look at the listing and request more information if they want to.

“I’m a comedian also, so why not mesh the two? It’s a clever way of doing it,” Miller challenged.

Miller believes Toronto’s real estate market always has room for humour.

“I personally like it. I hope I’m not breaking any rules with my professionalism. I like blending comedy with real estate. It’s easy to make fun of realtors because they’re usually advertising multi-million dollar properties when most of the city can’t afford rent.”

Real eState

Former HGTV star from Los Gatos sentenced in $10M real estate fraud case – CBS San Francisco

LOS GATOS – A Los Gatos man who starred in a real estate reality show was sentenced to jail and ordered to pay back nearly $10 million to his victims after being convicted of real estate fraud, prosecutors said Tuesday.

According to Santa Clara County District Attorney Jeff Rosen’s office, 58-year-old Charles “Todd” Hill received a four-year sentence. Hill starred in the HGTV show “Flip It to Win It“, which featured teams buying dilapidated homes and fixing them, before selling them for a profit.

The show aired in 2014.

Prosecutors said Hill was convicted in Sep. 2023 after admitting to grand theft with aggravated white-collar enhancements for committing real estate and financial fraud against 11 victims. Hill was indicted in 2019 following an investigation by the DA’s office.

“Some see the huge amount of money in Silicon Valley real estate as a business opportunity,” Rosen said in a statement. “Others, unfortunately, see it as a criminal opportunity – and we will hold those people strictly accountable.”

According to the DA’s office, Hill engaged in “multiple fraud schemes”, with some scams dating back before the HGTV show.

Prosecutors said in one instance, he diverted construction money for his personal use. In another, Hill created a Ponzi scheme by taking money intended to buy homes from an investor and spending it on a lavish lifestyle instead. He hid the theft by creating false balance sheets and used fraudulent information to obtain loans, according to prosecutors.

In a third case, prosecutors said an investor who provided $250,000 to remodel a home toured the property, only finding it to be a “burnt down shell” with no work performed.

Hill had used the money on a rented apartment in San Francisco along with spending on hotels, vacations and luxury cars, prosecutors said.

In addition to jail time, Hill was ordered to pay back $9,402,678.43 in restitution and serve 10 years probation. Hill has been remanded into custody, the DA’s office announced.

-

Tech23 hours ago

Tech23 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Sports22 hours ago

Sports22 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

News20 hours ago

Toronto airport gold heist: Police announce nine arrests – CP24

-

Investment16 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

News17 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Business16 hours ago

Rupture on TC Energy's NGTL gas pipeline sparks wildfire in Alberta – The Globe and Mail

-

Tech21 hours ago

Tech21 hours agoVenerable Video App Plex Emerges As FAST Favorite – Forbes

-

Sports19 hours ago

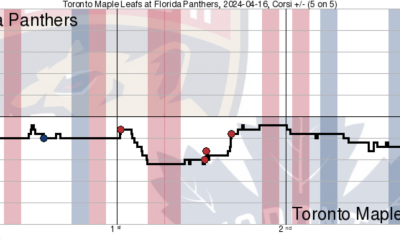

Sports19 hours agoGame in 10: Maple Leafs squander multi-goal lead to Florida, draw the Boston Bruins in the first round – Maple Leafs Hot Stove