Article content

Two long-time belleville businesses will be benefiting from a million dollar investment from the province on behalf of the Regional Development Program.

Two long-time belleville businesses will be benefiting from a million dollar investment from the province on behalf of the Regional Development Program.

Supporting a combined investment of $14 million by Sprague Foods Ltd and Ontario Truss & Wall Ltd, the province is providing $1 million in funding split between both businesses to support the creation of 37 jobs.

“The Regional Development Program continues to support manufacturers through targeted investments that allow companies to create good local jobs,” said Vic Fedeli, Minister of Economic Development, Job Creation and Trade. “These two projects are making a significant impact in communities and economies in the Belleville region by helping to secure the private-sector investment to create the conditions for viable economic growth and job creation. We thank Sprague Foods and Ontario Truss & Wall for contributing to our province’s dynamic and diverse manufacturing sector.”

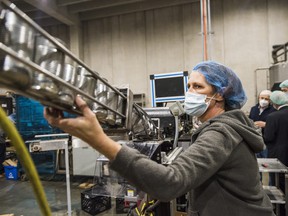

Following a tour of the Sprague facility, Fedeli gathered with other local leaders, including MPP for Bay of Quinte and Minister of Energy Todd Smith, MPP for Hastings-Lennox and Addington Daryl Kramp and Belleville Mayor Mitch Panciuk, to announce the program. Sprague Foods Ltd. provides shelf-stable foods to customers in Canada and the U.S. They are investing more than $5.6 million in new equipment and the construction of a new storage facility at their project facility. With Ontario’s investment of $500,000 from the Eastern Ontario Development Fund, Sprague Foods will increase productivity and innovation, which will boost employment, total revenues, and sales into new markets. The project will create 14 jobs.

“What’s happened more recently is amazing,” said Rick Sprague, President of Sprague Foods. “This investment will help us expand production capacity, allowing us to make more food for Canadian families, right here in Canada.”

After their facility tour, political leaders paid a visit to Ontario Truss & Wall Ltd in Frankford to see their prefabricated wall panel product line. Ontario Truss & Wall Ltd. is a wood truss manufacturer and floor joist reseller. They are investing more than $8.4 million to expand into two new product lines, including prefabricated wall panels and floor systems that are not currently manufactured in the Quinte and Belleville area. As part of the project, the company will build a new 24,000 sq. ft. facility on current land and relocate manufacturing operations. With Ontario’s investment of $500,000 from the Eastern Ontario Development Fund, the project will allow Ontario Truss & Wall to improve product accuracy and quality while improving facility output. The project will create 23 jobs, and the company will also provide significant training to both current and new team members.

“We are overly appreciative of the support received from our Ontario Government,” said Andrew Bryden, Vice President and Comptroller of Ontario Truss and Wall. “Their significant contribution has helped to create new jobs and maintain current positions. We are excited to see the continued growth initiated by this investment.”

The government first launched the Regional Development Program for Eastern and Southwestern Ontario in November 2019. Businesses and municipalities can get financial support through the Eastern Ontario Development Fund (EODF) and Southwestern Ontario Development Fund (SWODF) and guided access to a range of complementary services and supports.

“This is a real vote of confidence in the Quinte area economy with this pair of announcements from Sprague Foods and Ontario Truss and Wall,” said Daryl Kramp, MPP for Hastings-Lennox and Addington. “These new jobs will mean more families can stay here and build their futures in our area and contribute to our community.”

Ontario is investing more than $100 million through the Regional Development Program from 2019 to 2023 to support distinct regional priorities and challenges. The program provides cost-shared funding to businesses, municipalities and economic development organizations to help local communities attract investment, diversify their economies, and create jobs.

“Provincial investments through the Eastern Ontario Development Fund are leveraging private dollars to encourage more jobs, new construction, and increased manufacturing capacity in the Quinte region,” said Todd Smith, MPP for Bay of Quinte and Minister of Energy. “We know this creates a multiplying effect producing significant economic returns. This is vital to our communities as we recover from the impacts of the COVID-19 pandemic.”

Both businesses have been actively operating in the Quinte region for decades. For Sprague Foods, their nearly centuries old business spans six generations. Written in the company’s biography on trilliummfg.ca the founding of the company can be traced to 1925.

“Few small and medium-sized enterprises have a history as rich and interesting as Sprague Foods. The business began in 1925 with Rick’s great-grandfather, Grant Sprague. Grant grew up on Big Island in Prince Edward County, and eventually opened one of the many seasonal canning operations in the area,” it says. “Pumpkins and tomatoes were the initial two products canned by the Sprague family, with the produce coming from local farmers in the area.”

From their humble beginnings of commodity-canning, Sprague has advanced to providing fully fledged and formulated soups among other canned products.

“In the last number of years, we’ve converted to making higher value formulated products,” said Sprague. “Dozens and dozens of different products that we’re handling at various stages of preparation every day. So we need the real estate to do that efficiently.”

TORONTO – Canada’s main stock index was down more than 200 points in late-morning trading, weighed down by losses in the technology, base metal and energy sectors, while U.S. stock markets also fell.

The S&P/TSX composite index was down 239.24 points at 22,749.04.

In New York, the Dow Jones industrial average was down 312.36 points at 40,443.39. The S&P 500 index was down 80.94 points at 5,422.47, while the Nasdaq composite was down 380.17 points at 16,747.49.

The Canadian dollar traded for 73.80 cents US compared with 74.00 cents US on Thursday.

The October crude oil contract was down US$1.07 at US$68.08 per barrel and the October natural gas contract was up less than a penny at US$2.26 per mmBTU.

The December gold contract was down US$2.10 at US$2,541.00 an ounce and the December copper contract was down four cents at US$4.10 a pound.

This report by The Canadian Press was first published Sept. 6, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in technology, financial and energy stocks, while U.S. stock markets also pushed higher.

The S&P/TSX composite index was up 171.41 points at 23,298.39.

In New York, the Dow Jones industrial average was up 278.37 points at 41,369.79. The S&P 500 index was up 38.17 points at 5,630.35, while the Nasdaq composite was up 177.15 points at 17,733.18.

The Canadian dollar traded for 74.19 cents US compared with 74.23 cents US on Wednesday.

The October crude oil contract was up US$1.75 at US$76.27 per barrel and the October natural gas contract was up less than a penny at US$2.10 per mmBTU.

The December gold contract was up US$18.70 at US$2,556.50 an ounce and the December copper contract was down less than a penny at US$4.22 a pound.

This report by The Canadian Press was first published Aug. 29, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

k.d. lang gets the band back together for Canadian country music awards show

NATO military committee chair, others back Ukraine’s use of long range weapons to hit Russia

Cavaliers and free agent forward Isaac Okoro agree to 3-year, $38 million deal, AP source says

Liverpool ‘not good enough’ says Arne Slot after shock loss against Nottingham Forest

With a parade of athletes on Champs Elysées, France throws one last party for the Paris Olympics

‘Challenges every single muscle’: Champion tree climber turns work into passion

MPs to face new political realities on their return to Ottawa

Air Canada, pilots still far apart as strike notice deadline approaches