Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Economy

Posthaste: Now it’s the wealthy’s turn to worry about the economy squeezing their finances

After months of belt tightening by low- and middle-income families, it’s wealthy Canadians’ turn to worry about the economy’s impact on their pocketbooks.

People who have assets of $1 million or more say they’re more stressed out about their finances than they were this time last year, according to a new study out this morning from IG Wealth Management. More than three-quarters, or 82 per cent, say they’re worried about the economy, while 72 per cent are fretting about the cost of energy. Close to half, or 49 per cent, are concerned about rising interest rates.

“Much like other groups, high-net-worth Canadians are concerned about where the economy is going and its impact on their personal situation,” Damon Murchison, chief executive of IG Wealth Management, said in a news release.

Economic worries have become universal as inflation and climbing interest rates take a toll on most people’s budgets. Every day expenses such as grocery bills have been especially squeezed. Prices for food bought in stores rose 11 per cent in October from the same time last year, Statistics Canada data show. But the costs of some dinner staples have surged even more, with pasta prices up 44.8 per cent, lettuce up 30.2 per cent and rice up 14.7 per cent on a year-over-year basis. Meanwhile, gas prices rose 17.8 per cent in October from the same month last year. Combine that with higher debt costs from rising interest rates, and many have been forced to take an axe to their spending by cutting back on streaming services, or other discretionary purchases, to pay the bills.

And not unlike Canadians’ with lower incomes, the wealthy are also making moves to delay their retirement start dates as life grows more expensive. Close to half, or 46 per cent, say they’re changing when they’ll make the leap to full retirement. More than 50 per cent say they’ll need to keep working longer to reach their savings goals because their investments aren’t performing the way they expected.

But for high-net-worth individuals, the solution to getting through these “complicated times” financially intact is simple: get a comprehensive plan in place. That’s where a professional can step in and help, IG Wealth Management said.

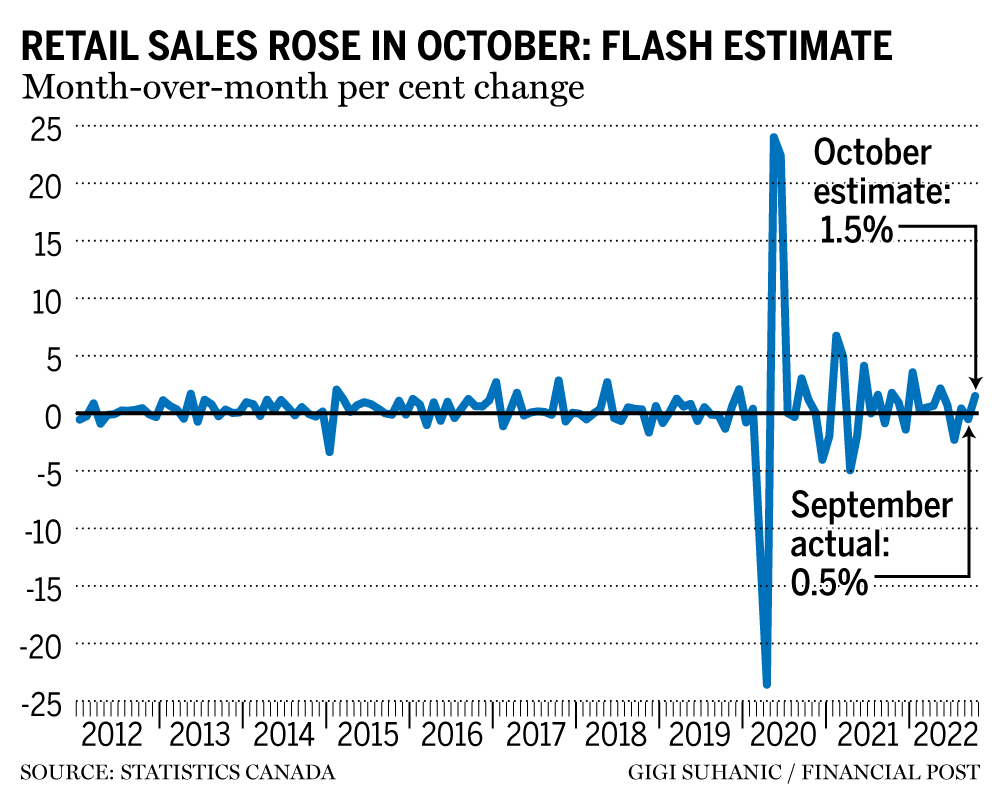

Retail sales are estimated to have risen 1.5 per cent in October, Statistics Canada said Wednesday, casting doubt on just how much the economy slowed in the fourth quarter.

Sales dropped 0.5 per cent in September and fell in seven of the 11 subsectors, representing 74.9 per cent of retail trade. It was led by lower sales at gasoline stations and food and beverage stores.

___

Economy

Canada’s unemployment rate holds steady at 6.5% in October, economy adds 15,000 jobs

OTTAWA – Canada’s unemployment rate held steady at 6.5 per cent last month as hiring remained weak across the economy.

Statistics Canada’s labour force survey on Friday said employment rose by a modest 15,000 jobs in October.

Business, building and support services saw the largest gain in employment.

Meanwhile, finance, insurance, real estate, rental and leasing experienced the largest decline.

Many economists see weakness in the job market continuing in the short term, before the Bank of Canada’s interest rate cuts spark a rebound in economic growth next year.

Despite ongoing softness in the labour market, however, strong wage growth has raged on in Canada. Average hourly wages in October grew 4.9 per cent from a year ago, reaching $35.76.

Friday’s report also shed some light on the financial health of households.

According to the agency, 28.8 per cent of Canadians aged 15 or older were living in a household that had difficulty meeting financial needs – like food and housing – in the previous four weeks.

That was down from 33.1 per cent in October 2023 and 35.5 per cent in October 2022, but still above the 20.4 per cent figure recorded in October 2020.

People living in a rented home were more likely to report difficulty meeting financial needs, with nearly four in 10 reporting that was the case.

That compares with just under a quarter of those living in an owned home by a household member.

Immigrants were also more likely to report facing financial strain last month, with about four out of 10 immigrants who landed in the last year doing so.

That compares with about three in 10 more established immigrants and one in four of people born in Canada.

This report by The Canadian Press was first published Nov. 8, 2024.

The Canadian Press. All rights reserved.

Economy

Health-care spending expected to outpace economy and reach $372 billion in 2024: CIHI

The Canadian Institute for Health Information says health-care spending in Canada is projected to reach a new high in 2024.

The annual report released Thursday says total health spending is expected to hit $372 billion, or $9,054 per Canadian.

CIHI’s national analysis predicts expenditures will rise by 5.7 per cent in 2024, compared to 4.5 per cent in 2023 and 1.7 per cent in 2022.

This year’s health spending is estimated to represent 12.4 per cent of Canada’s gross domestic product. Excluding two years of the pandemic, it would be the highest ratio in the country’s history.

While it’s not unusual for health expenditures to outpace economic growth, the report says this could be the case for the next several years due to Canada’s growing population and its aging demographic.

Canada’s per capita spending on health care in 2022 was among the highest in the world, but still less than countries such as the United States and Sweden.

The report notes that the Canadian dental and pharmacare plans could push health-care spending even further as more people who previously couldn’t afford these services start using them.

This report by The Canadian Press was first published Nov. 7, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.

The Canadian Press. All rights reserved.

Economy

Trump’s victory sparks concerns over ripple effect on Canadian economy

As Canadians wake up to news that Donald Trump will return to the White House, the president-elect’s protectionist stance is casting a spotlight on what effect his second term will have on Canada-U.S. economic ties.

Some Canadian business leaders have expressed worry over Trump’s promise to introduce a universal 10 per cent tariff on all American imports.

A Canadian Chamber of Commerce report released last month suggested those tariffs would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

More than 77 per cent of Canadian exports go to the U.S.

Canada’s manufacturing sector faces the biggest risk should Trump push forward on imposing broad tariffs, said Canadian Manufacturers and Exporters president and CEO Dennis Darby. He said the sector is the “most trade-exposed” within Canada.

“It’s in the U.S.’s best interest, it’s in our best interest, but most importantly for consumers across North America, that we’re able to trade goods, materials, ingredients, as we have under the trade agreements,” Darby said in an interview.

“It’s a more complex or complicated outcome than it would have been with the Democrats, but we’ve had to deal with this before and we’re going to do our best to deal with it again.”

American economists have also warned Trump’s plan could cause inflation and possibly a recession, which could have ripple effects in Canada.

It’s consumers who will ultimately feel the burden of any inflationary effect caused by broad tariffs, said Darby.

“A tariff tends to raise costs, and it ultimately raises prices, so that’s something that we have to be prepared for,” he said.

“It could tilt production mandates. A tariff makes goods more expensive, but on the same token, it also will make inputs for the U.S. more expensive.”

A report last month by TD economist Marc Ercolao said research shows a full-scale implementation of Trump’s tariff plan could lead to a near-five per cent reduction in Canadian export volumes to the U.S. by early-2027, relative to current baseline forecasts.

Retaliation by Canada would also increase costs for domestic producers, and push import volumes lower in the process.

“Slowing import activity mitigates some of the negative net trade impact on total GDP enough to avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026,” Ercolao said.

Since the Canada-United States-Mexico Agreement came into effect in 2020, trade between Canada and the U.S. has surged by 46 per cent, according to the Toronto Region Board of Trade.

With that deal is up for review in 2026, Canadian Chamber of Commerce president and CEO Candace Laing said the Canadian government “must collaborate effectively with the Trump administration to preserve and strengthen our bilateral economic partnership.”

“With an impressive $3.6 billion in daily trade, Canada and the United States are each other’s closest international partners. The secure and efficient flow of goods and people across our border … remains essential for the economies of both countries,” she said in a statement.

“By resisting tariffs and trade barriers that will only raise prices and hurt consumers in both countries, Canada and the United States can strengthen resilient cross-border supply chains that enhance our shared economic security.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

-

News9 hours ago

News9 hours agoAffordability or bust: Nova Scotia election campaign all about cost of living

-

News8 hours ago

News8 hours agoCanada’s Denis Shapovalov wins Belgrade Open for his second ATP Tour title

-

News9 hours ago

News9 hours ago11 new cases of measles confirmed in New Brunswick, bringing total cases to 25

-

News9 hours ago

News9 hours agoFirst World War airmen from New Brunswick were pioneers of air warfare

-

News8 hours ago

News8 hours agoTalks to resume in B.C. port dispute in bid to end multi-day lockout

-

News9 hours ago

News9 hours agoMuseum to honour Chinese Canadian troops who fought in war and for citizenship rights

-

News9 hours ago

News9 hours agoThe Royal Canadian Legion turns to Amazon for annual poppy campaign boost