Juraj Slafkovsky was an NHL draft pick, just like Alex Ovechkin, Sidney Crosby, Auston Matthews, Nathan MacKinnon, Connor McDavid and Connor Bedard. The spotlight, however, has not been quite as bright or the hype train as strong for him in Montreal.

“I like it that way,” Slafkovsky said.

Regardless of the attention or lack thereof, Slafkovsky is on the vanguard of hockey’s next generation of stars, along with the likes of San Jose’s Macklin Celebrini and Will Smith, Buffalo’s JJ Peterka and New Jersey’s Luke Hughes.

“It’s really cool to be a part of it, and I hope I will be a part of it,” Slafkovsky said two years after the Canadiens took him at No. 1 in 2022. “Hopefully we can do some things as the younger generation.”

Slafkovsky, Peterka, Hughes and Quinton Byfield of the Los Angeles Kings have been around a bit, and now is the time to show they can be among the league’s best. Newcomers like Celebrini, Smith, Philadelphia’s Matvei Michkov and even teammate Lane Hutson are front-runners in the race for the Calder Trophy as rookie of the year.

Macklin Celebrini

The most recent No. 1 pick does not have the so-called “generational talent” label like Crosby, McDavid or Bedard, but he still won the Hobey Baker Award last season at Boston University as the top college player in the country with 64 points in 38 games.

Sharks forward William Eklund was not too familiar with Celebrini’s game until the draft, so he made it a point to check out his highlights.

“I looked him up a little bit, and obviously he’s a great skill guy,” Eklund said. “He’s a high-caliber player, and it’s going to be fun to see.”

BetMGM Calder Trophy odds: 4-1

Will Smith

Rivals at Boston-area schools, Smith and Celebrini are now front and center as the faces of San Jose’s rebuild.

“It’s going to be a fun relationship,” said Smith, the fourth pick in 2023 who decided to turn pro after starring last season at Boston College. “Really cool. We were talking about it earlier just how crazy it is that we’re on the same team now.”

Smith, a year older than Celebrini, is coming off a 71-point season, helped the U.S. win world junior gold and played at the world championships.

“He’s a kid that has a really bright future and a ton of talent,” said Washington goaltender Charlie Lindgren, who was a teammate at worlds. “A really good kid, too, and I think he’ll go in and play for San Jose this year and I think you’ll see him do pretty well.”

BetMGM Calder Trophy odds: 5-1

Juraj Slafkovsky

The MVP of the 2022 Beijing Olympics without NHL players struggled in his rookie year. Last season, he quintupled his production with 20 goals, 30 assists and 50 points and said, “I’m ready to start where I finished.”

Slafkovsky in the spring signed an eight-year contract extension worth over $60 million. Now it’s up to the big Slovak forward to earn it.

“I just want to show them that they made the right decision,” Slafkovsky said. “I feel like the only way I can do it is showing up every day and playing hard and being there.”

JJ Peterka

A 2020 second-round pick of the Sabres, Peterka is older at 22 but could get a look on the first line this season after establishing himself as a full-time NHL player and scoring 28 goals. The Germany-born forward is in a contract year looking to get the kind of guaranteed deal Slafkovsky and others have.

Peterka thinks the key is not putting too much pressure on himself, especially while trying to help Buffalo end the league’s longest playoff drought.

“I want to be put more in situations where I’m maybe not too uncomfortable,” Peterka said. “I want to be more responsible, more consistent. For me it’s just take the next step to just grow as a player, as more of a complete player.”

Quinton Byfield

The 6-foot-5, 220-pound power forward is expected to play center after getting a five-year, $31.25 million contract. He spent the summer working on his shot to be more of a threat from further away from the net and prefers center offensively and defensively.

“I like playing good defense and shutting down their top lines, so when I can be in my own end kind of playing those guys down low, that’s where I want to be,” Byfield said. “Also I don’t want to just be on the wall standing there going up the ice. I want to be able to use my speed and kind of demand the middle of the ice.”

Luke Hughes

A left shoulder injury from summer training could cause the Devils defenseman to miss the start of the season. That absence should not keep Hughes from building on a 47-point rookie year that left him third in Calder Trophy voting.

“He’ll take another step,” older brother and New Jersey teammate Jack Hughes said. “Luke will be even more mature this year. He’ll know the league a little bit more and know the players and he’ll know things he can get away with and where he can capitalize on certain things. I think he’ll have a better year offensively, obviously, and just keep getting better.”

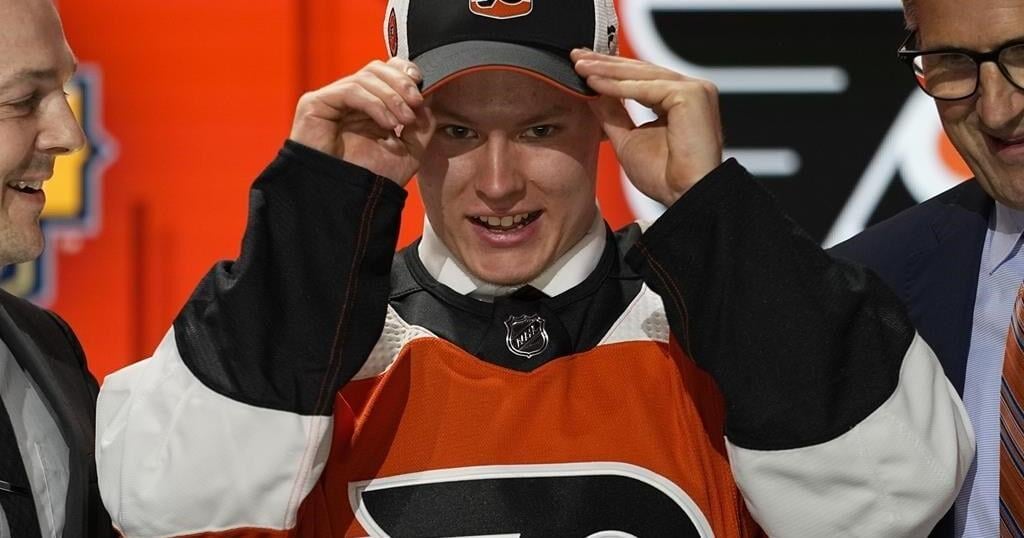

Matvei Michkov

The 19-year-old Russian winger is the new face of the Flyers with the weight of the franchise’s nearly five-decade Stanley Cup drought on his shoulders. Michkov was the seventh pick in 2023, with some teams concerned he might not be able to leave the KHL or was under-scouted given the war in Ukraine.

Early returns are positive.

“Everyone’s really excited to have him, and when you see him on the ice it’s pretty special and gives our team a positive boost,” forward Owen Tippett said. “Super skilled. We’re all really excited to have him on our side, and we’re excited to see what he can do.”

BetMGM Calder Trophy odds: 7-2

Lane Hutson

A saucer pass from Hutson during an early training camp scrimmage that landed right on the stick blade of teammate Emil Heineman went viral in hockey circles. It’s just a taste of what the 20-year-old defenseman might be able to do when he gets used to life in the NHL, but he already has big expectations in Montreal.

“I haven’t proved anything yet,” Hutson said. “There’s a lot to prove before I’m even close to a face of the team.”

BetMGM Calder Trophy odds: 7-1

___

AP Sports Writer Mark Anderson and freelance writer W.G. Ramirez in Las Vegas contributed.

___

AP NHL: