Real eState

Bank Crisis Could Cast Pall Over Commercial Real Estate Market

|

|

The market hadn’t fully rebounded from the pandemic. Some worry that another slowdown could add to fears of a recession.

The fallout from the recent banking crisis spurred by the collapse of two banks — and concerns about the health of a third — is bubbling up in the market for commercial real estate lending, as borrowers fear that banks will pull back. That could slow down construction activity and increase the likelihood of a recession, analysts and real estate experts said.

Silicon Valley Bank and Signature Bank imploded in the same week. First Republic Bank teetered for days before its shares partly recovered on Tuesday. Both Signature and First Republic are large lenders to builders and managers of office buildings, rental apartments, shopping complexes and other commercial properties.

First Republic has the ninth-largest loan portfolio in that market in the United States, and Signature had the 10th largest before it collapsed, according Trepp, a commercial real estate data firm.

Midsize and regional banks like Signature and First Republic not only provide the bulk of commercial real estate loans to businesses, they are also part of a far bigger market. Banks typically package the loans they make into complex financial products and sell them to investors, allowing the banks to raise more money to make new loans.

That means that a pullback in lending can also alter the behavior of investors. Commercial real estate contributed $2.3 trillion to the nation’s economy last year, according to an industry association. And because the industry hasn’t fully rebounded from the blow dealt by the pandemic, analysts worry about a fresh slowdown.

“It is a perfect storm right now,” said Varuna Bhattacharyya, a real estate lawyer in New York with Bryan Cave Leighton Paisner who mainly represents banks.

“We were already in a place with a much lower rate of originations,” Ms. Bhattacharyya said, referring to new loan applications that banks process. “It’s hard not to feel a bit of panic and anxiety.”

Ms. Bhattacharyya said lenders would become even more cautious about writing loans for any new construction projects other than the highest-profile “trophy deals.”

The fear among borrowers is that banks will become more conservative about lending. And although the panic appears to have mostly stabilized for now, the specter of bank failure could haunt the decisions of regional banks for months.

For much of last year, commercial real estate lending had begun rebounding from the depths of the Covid-19 lockdowns, when new loan applications almost came to a standstill in the fourth quarter of 2020. By comparison, the annual rate of commercial real estate loan origination by dollar volume grew 18 percent in the fourth quarter of 2022, according to Trepp.

Even before the Federal Deposit Insurance Corporation stepped in to take over Silicon Valley and Signature, a noticeable slowdown in lending to the commercial real estate industry had begun in January.

On an annual basis, the rate of commercial real estate loan growth this year had already been cut in half compared with last year, said Matthew Anderson, a managing director at Trepp. He said some of the slowdown was the result of interest rate increases by the Federal Reserve, which were starting to take a bite out of commercial real estate activity.

And lending has probably tapered off further since the collapses of Silicon Valley and Signature, Mr. Anderson said. “How long and deep the impact will be remains to be seen,” he said.

The universe of commercial real estate includes loans for new construction, mortgages and loans specifically for managing multifamily apartment complexes. The so-called securitized products containing loans that banks make are called commercial mortgage-backed securities — a more than $72 billion market last year. But it’s a different story in 2023, with issuance of those bonds down 78 percent from a year ago.

Daniel Klein, president of Klein Enterprises, a commercial real estate management firm based in Maryland, had been talking to several banks recently about a construction loan for a new project. But just the other day, after the banks collapsed, one of the banks suddenly pulled a term sheet for a loan, he said.

Mr. Klein, whose family-owned business manages about 60 shopping centers, offices and apartment buildings, said that the bank had offered no explanation for its decision, and that he did not know if the trouble in the banking sector had been a cause. He said he expected loan terms from lenders to get more onerous in the coming months, as midsize banks get skittish after the Signature and Silicon Valley Bank collapses.

“Banks in general are being more conservative than they were six or nine months ago,” he said. “But we have been pretty fortunate. We have many long standing community banking relationships.”

Regional banks are a critical part of the commercial real estate ecosystem because their bankers invest a lot of time into forging relationships with real estate developers and managers, said Michael E. Lefkowitz, a real estate lawyer with Rosenberg & Estis in New York. Large banks do not tend to provide that kind of “high-level service” to middle-market real estate firms.

Some of the concerns of real estate lenders eased a bit when the F.D.I.C. announced on Sunday that it had sold substantially all of the remaining deposits at Signature Bank to a subsidiary of a peer, New York Community Bancorp, which is also a major commercial real estate lender. The banking regulator took over Signature on March 12 after business customers — including real estate firms and crypto investors — began pulling money out of the bank.

Before its collapse, Signature was one of the biggest commercial real estate lenders in the New York metropolitan area.

In buying some of Signature’s assets, New York Community Bancorp picked up about $34 billion in customer deposits, down from the $88 billion that Signature had before the bank run, an indication of just how many customers fled the bank before regulators stepped in on March 12 to stem the bleeding.

Even with the sale of banking deposits to New York Community Bancorp, there are worries about whether other banks will fill the void left by the collapse of Signature.

New York Community Bancorp acquired about $12.9 billion in loans from Signature, the F.D.I.C. said, but most were business loans to health care companies and not part of Signature’s large commercial real estate portfolio. That means the F.D.I.C. still needs to find a buyer for Signature’s core commercial real estate loan portfolio.

A spokesman for the F.D.I.C. said that the organization “has not characterize the types of loans left behind” and that they would be “disposed at a later date.”

“I think this means that Signature’s commercial real estate portfolio is still up in the air,” Mr. Anderson of Trepp said.

An indicator that Trepp uses to measure the risk of default to loans held by banks on office complexes found that those facing the most distress were in San Francisco — where First Republic is based.

Banks are likely to cut back on lending to preserve capital in order to strengthen their balance sheets in anticipation of further Federal Reserve interest rate increases and renewed calls for regulators to get more aggressive in monitoring risk taking by banks. Any pullback in new lending could affect the start of commercial developments and push the economy closer to a recession.

As bank regulators work to stabilize the financial system, they will also need to keep an eye on banks holding too many commercial real estate loans in their portfolios — something that can create its own set of problems in a slowing economy.

A report late last year by Moody’s Investors Service, the credit rating agency, found that 27 regional banks already had high concentrations of such loans on their balance sheets. The report said the issue could become problematic for banks if the economy fell into a recession.

Real eState

Surreal Estate: $15 million for a turnkey Muskoka resort with 41 guest rooms

|

|

Location: Port Severn, Muskoka

Price: $14,999,000

Size: 17 acres of land with 41 guest rooms and a three-bedroom cottage

Real estate agent: Ali Booth, Sotheby’s International Realty

The place

A fully operational vacation escape sitting on 17 acres of land on Little Lake in Muskoka. The property comes with 41 guest rooms, a three-bedroom cottage, a private island accessible by helicopter and more than 600 metres of shoreline. It’s a short drive from Highway 400 and several neighbouring resorts.

The history

This getaway was originally built in the 1950s. The current owners purchased the place in 2021 and immediately invested $1 million to replace the roof and rebuild the guest cottage. After serving as a filming location for Bachelor in Paradise Canada, it reopened for business in July of 2022. The owners are now taking on a new venture and looking to sell the resort to a wealthy investor.

Related: $11.9 million for a Muskoka compound perched atop its own peninsula

The tour

To begin, here’s an aerial view of the peninsula, with its many docks, green spaces and lodges. That’s Port Severn North Road just beyond the parking lot.

And here’s the main entrance. The original hotel was renovated around Y2K, and the current owners bought it in 2021.

In the lobby: guest check-in, a lounge and doric columns.

The full-service restaurant overlooks the lake and includes a café and lounge.

This reverse angle shows off the bar and dramatic circular ceiling.

There’s also a nail salon down the hall.

The indoor pool and hot tub are open year-round.

The shiplap ceilings and wall of windows add warmth to the massive space.

Here’s the 24-hour gym, with rubber floors.

Now for a peek inside one of the European-style suites, which are larger than traditional hotel rooms. This one is outfitted with hardwood floors, a stone fireplace, a floor-to-ceiling walkout and gold accents throughout.

The hotel also rents out its 90-seat conference centre for weddings and corporate retreats.

Here’s another look at the cavernous conference centre.

Outside, it’s all about the amenities: a tennis court, a patio, a private beach, many docks for water sports and a private island accessible by helicopter.

Speaking of water sports, guests are free to explore Little Lake and its seemingly endless waterways.

Here’s the tropical-themed beach.

Finally, another bird’s eye view of the compound, highlighting the ample space for expansion. While there have been no formal approvals for development, the town has provided zoning guidelines on what could be built here.

Have a home that’s about to hit the market? Send your property to realestate@torontolife.com.

Real eState

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Like many of her clients, realtor Jenny Celly and her family moved from southern Ontario to southeast New Brunswick to find a more affordable home.

The slower pace and quality of Maritime life was very appealing.

“There’s less traffic. People, because they’re not as stressed out, they are friendlier, in my opinion, so that attracts a lot of people,” said Celly.

Moneysense.ca and Zoocasa, a consumer real estate search platform, have ranked Moncton as the top place in Canada to buy real estate for the third straight year.

Forty-five neighbourhoods and municipalities were ranked using factors such as the average price of a home, price growth over time and neighbourhood characteristics.

According to the rankings, the Greater Moncton area is highest in value and best buying conditions and has a seen a growth of 69 per cent over the past three years.

Celly said the region is still seeing buyers from Ontario and British Columbia purchasing homes sight unseen using Zoom or FaceTime – something that was very popular during the pandemic.

“I put myself in their shoes. So I’m saying, ‘OK, it smells kind of funny,’ because you are being their eyes and they will put in an offer after seeing the home via video. Most of the buyers are seeing their home for the first time on closing day,” said Celly.

One of realtor Tracy Gunter’s homes in north end Moncton recently sold in less than two weeks.

Gunter said it’s a seller’s market here, but there isn’t a lot of inventory.

“We don’t have a lot to sell. So, our buyers are coming in, they want to spend their money, but we don’t have the homes for them to buy. There is a house shortage,” said Gunter.

Gunter said what is selling are semi-detached homes and properties under $400,000 to people from outside the province and the country.

The average price of a home in the Greater Moncton area last year was $328,383.

“Things are slowing down a little bit, but people are still coming,” said Gunter. “Right now, it’s just finding homes for the people that need them.”

Moncton Mayor Dawn Arnold said the city’s appeal is its lifestyle and residents.

“We have kind, compassionate, collaborative people that want to work together that are engaged. They want to be a part of it all. There’s a real feeling of positive energy in our community right now,” said Arnold. “There’s really amazing people in our community.”

Celly said the area is attracting many families, retirees, and investors.

The main reason: the prices.

“We’re looking at bigger markets, bigger cities where prices are two to three times more than what you find in Moncton,” said Celly. “A lot of people who are looking at the Maritimes are also looking at the quality of life.”

Saint John was ranked second for best places to buy real estate, Fredericton fourth and Halifax/Dartmouth was sixth.

For more New Brunswick news visit our dedicated provincial page.

Real eState

Sask. real estate company that lost investors’ millions reaches settlement

|

|

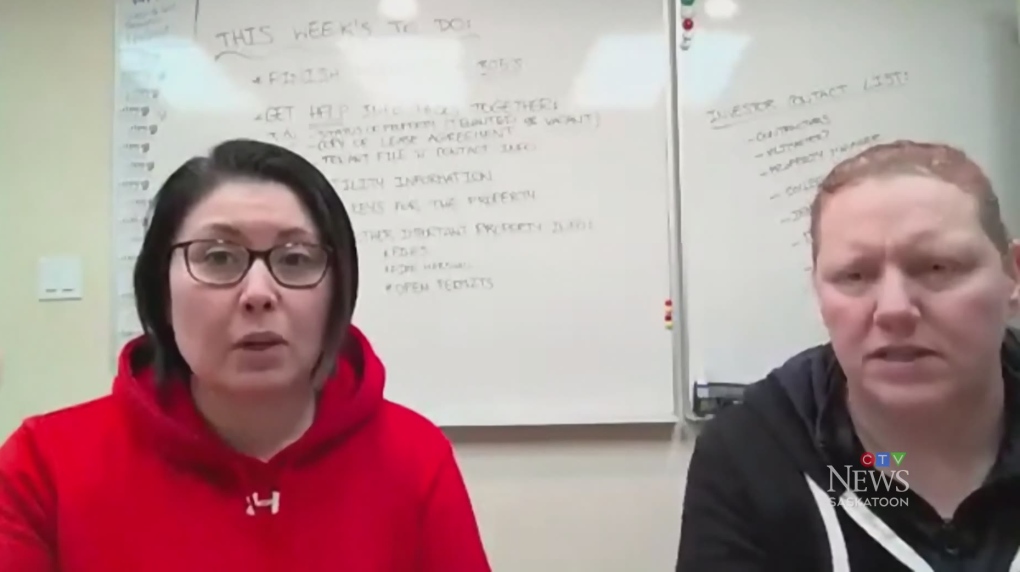

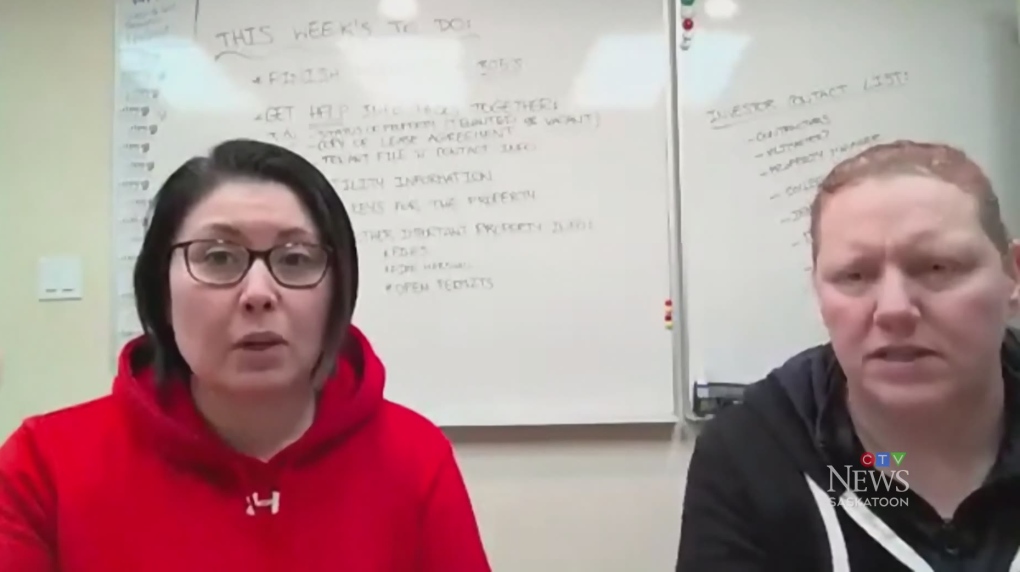

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

-

Sports3 hours ago

Sports3 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState11 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech10 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

News23 hours ago

Budget 2024 sets up a ‘hard year’ for the Liberals. Here’s what to expect – Global News

-

Investment19 hours ago

Investment19 hours agoSo You Own Algonquin Stock: Is It Still a Good Investment? – The Motley Fool Canada

-

Media23 hours ago

Psychology group says infinite scrolling and other social media features are ‘particularly risky’ to youth mental health – NBC News

-

Economy22 hours ago

China’s economy grew 5.3% in first quarter, beating expectations – CityNews Halifax

-

Sports22 hours ago

Sports22 hours agoTiger Woods finishes Masters with his highest score as a pro, sets sights on coming majors – The Globe and Mail