Real eState

Coronavirus: Real estate agents say pandemic playing role in red-hot Okanagan market – Global News

The real estate market is sizzling hot in B.C.’s Southern Interior, according to the Okanagan Mainline Real Estate Board.

“It’s taken us all by surprise on what’s happening in the real estate market,” said Kim Heizmann, Okanagan Mainline Real Estate Board (OMREB) president.

Homes sales have risen dramatically from this time last year in the three zones that OMREB covers — the Central and North Okanagan and Shuswap-Revelstoke.

According to OMREB, residential sales are up by about 70 per cent.

While low-interest rates are driving up sales, industry experts believe the pandemic is also playing a big role.

“We believe COVID has had a huge impact on people re-evaluating their lives and looking at their homes in a more holistic way because our homes have become our offices, our playgrounds, our gyms, our sanctuaries,” Heizmann said.

“We think that is a big push into the real estate market.”

Coldwell Banker Horizon Realty realtor Ellen Churchill agreed, saying the pandemic is having an impact on the market.

“For some people, it’s a wake-up call and so they’re saying we’re going to move now, we’re not going to wait any longer. Life is too short,” Churchill said.

Churchill added that COVID-19 is, for some people, fast-tracking their long term plans, including for those who live outside the region and were planning on eventually moving to the Okanagan.

“I think COVID has expedited some goals and dreams for some people, “Churchill said. “They were wanting to move in three to five years, now they say ‘Let’s do it right away.’”

Churchill added that working from home has also been a catalyst in home buying.

“I think people are realizing ‘I’m working from home, I don’t need to live in Edmonton. I can live anywhere I want. Let’s move to Kelowna,’” she said.

Read more:

More home buyers purchasing homes with ‘no conditions’, according to Kingston real estate agents

According to OMREB, home prices have jumped by roughly nine per cent from this time last year.

In the Central Okanagan, the benchmark price for a typical single-family home is now $728,300.

OMREB blamed the increase in price on supply and demand.

‘The low inventory,” said Heizmann. “The fact that we don’t have a lot on the market is causing a little bit of pressure in regards to prices rising.”

© 2020 Global News, a division of Corus Entertainment Inc.

Real eState

Judge Approves $418 Million Settlement That Will Change Real Estate Commissions

|

|

A settlement that will rewrite the way many real estate agents are paid in the United States has received preliminary approval from a federal judge.

On Tuesday morning, Judge Stephen R. Bough, a United States district judge, signed off on an agreement between the National Association of Realtors and home sellers who sued the real estate trade group over its longstanding rules on commissions to agents that they say forced them to pay excessive fees.

The agreement is still subject to a hearing for final court approval, which is expected to be held on Nov. 22. But that hearing is largely a formality, and Judge Bough’s action in U.S. District Court for the Western District of Missouri now paves the way for N.A.R. to begin implementing the sweeping rule changes required by the deal. The changes will likely go into full effect among brokerages across the country by Sept. 16.

N.A.R., in a statement from spokesman Mantill Williams, welcomed the settlement’s preliminary approval.

“It has always been N.A.R.’s goal to resolve this litigation in a way that preserves consumer choice and protects our members to the greatest extent possible,” he said in an email. “There are strong grounds for the court to approve this settlement because it is in the best interests of all parties and class members.”

N.A.R. reached the agreement in March to settle the lawsuit, and a series of similar claims, by making the changes and paying $418 million in damages. Months earlier, in October, a jury had reached a verdict that would have required the organization to pay at least $1.8 billion in damages, agreeing with homeowners who argued that N.A.R.’s rules on agent commissions forced them to pay excessive fees when they sold their property.

The group, which is based in Chicago and has 1.5 million members, has wielded immense influence over the real estate industry for more than a century. But home sellers in Missouri, whose lawsuit against N.A.R. and several brokerages was followed by multiple copycat claims, successfully argued that the group’s rule that a seller’s agent must make an offer of commission to a buyer’s agent led to inflated fees, and that another rule requiring agents to list homes on databases controlled by N.A.R. affiliates stifled competition.

By mandating that commission be split between agents for the seller and buyer, N.A.R., and brokerages who required their agents to be members of N.A.R., violated antitrust laws, according to the lawsuits. Such rules led to an industrywide standard commission that hovers near 6 percent, the lawsuits said. Now, agents will be essentially blocked from making those commission offers, a shift that will, some industry analysts say, lower commissions across the board and eventually force down home prices as a result.

Real estate agents are bracing for pain.

“We are concerned for buyers and potentially how we will get paid for working with buyers moving forward,” said Karen Pagel Guerndt, a Realtor in Duluth, Minn. “There’s a lot of ambiguity.”

The preliminary approval of the settlement comes as the Justice Department reopens its own investigation into the trade group. Earlier this month, the U.S. Court of Appeals for the District of Columbia overturned a lower-court ruling from 2023 that had quashed the Justice Department’s request for information from N.A.R. about broker commissions and how real estate listings are marketed. They now have the green light to scrutinize those fees and other N.A.R. rules that have long confounded consumers.

“This is the first step in bringing about the long awaited change,” said Michael Ketchmark, the lawyer who represented the home sellers in the main lawsuit. “Later this summer, N.A.R. will begin changing the way that homes are bought and sold in our country and this will eventually lead to billions of dollars and savings for homeowners.”

Under the settlement, homeowners who sold homes in the last seven years could be eligible for a small piece of a consolidated class-action payout. Depending on how many homeowners file claims by the deadline of May 9, 2025, that could mean tens of millions of Americans.

Real eState

Two matching megacomplexes to totally transform Toronto neighbourhood

|

|

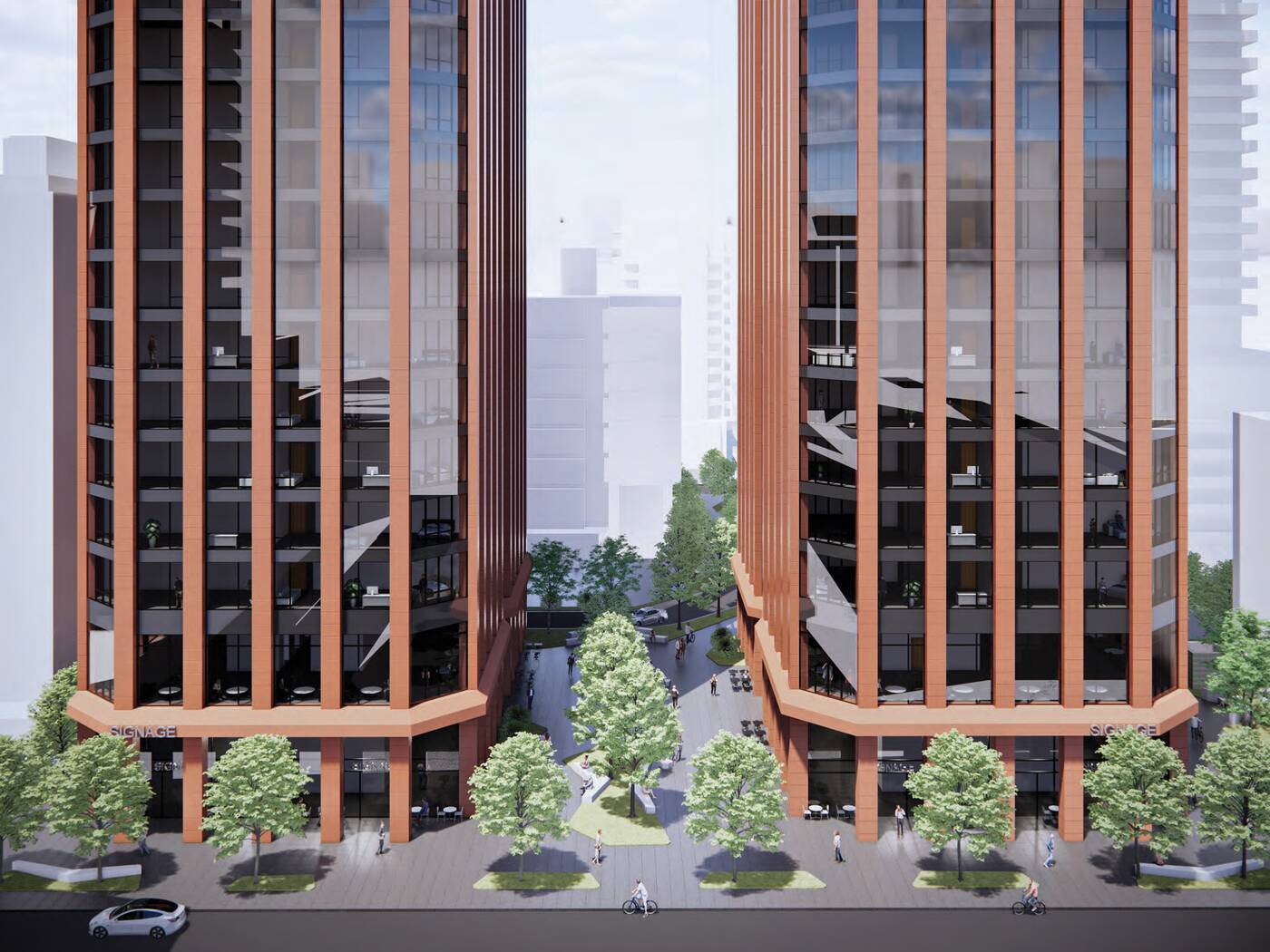

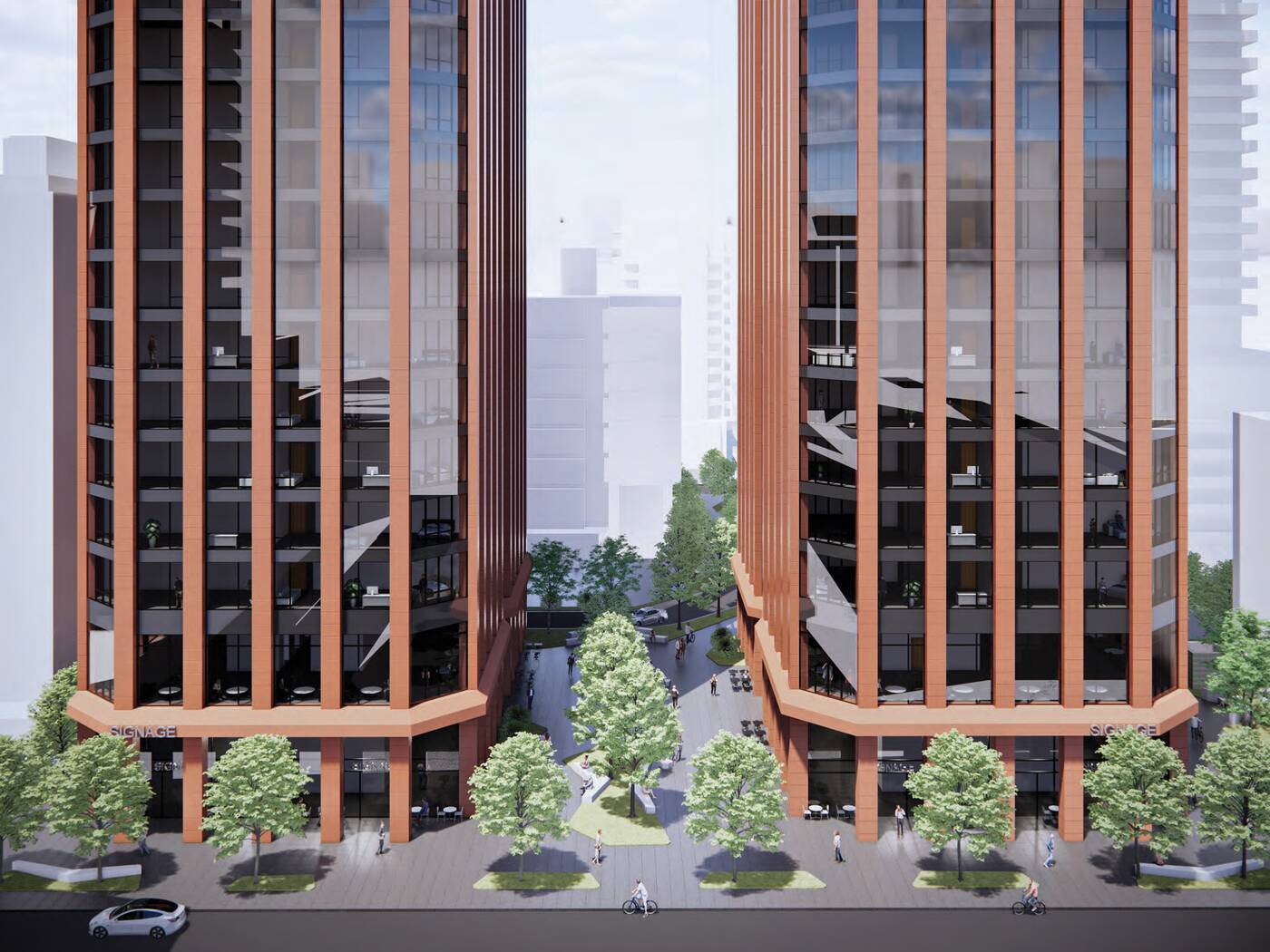

A pair of twinned proposals aim to completely redefine the skyline of Toronto’s midtown area with an architectural statement that would set the neighbourhood apart from other high-rise clusters in the city.

Two separate proposals from developer Madison Group at 110 and 150 Eglinton Avenue East have been resubmitted to city planners, calling for two pairs of mixed-use condominium towers with standout designs unlike anything that exists in the city today.

In a surprising twist from a developer not exactly known for breaking the bank on architecture, the proposals now boast brand-new complementary designs from acclaimed firm Rafael Viñoly Architects.

The 110 Eglinton site, currently home to a pair of mid-rise office buildings, would be demolished and built out with two 58-storey towers.

A few doors to the east, the 150 Eglinton site includes a handful of mid-rise and low-rise commercial buildings along Eglinton, wrapping around Redpath Avenue. These buildings would also be demolished and replaced with a pair of 61-storey towers.

All four towers will feature matching designs boasting red aluminum cladding forming vertical piers that accentuate the towers’ heights, though there will be some key differences between the pairs at 110 and 150 Eglinton.

150 Eglinton East

The 58-storey towers at 110 Eglinton East will be linked via an enormous floating bridge spanning levels five through 10, framing a large open public space below and supporting an elevated residential amenity floor above.

The 61-storey towers lack a skybridge, but will also feature amenity levels with panoramic views, including spaces on the 28th and 40th floors.

At heights of just over 236 metres, these four towers all stand taller than anything that exists in the neighbourhood as of 2024.

The combined proposals would add a staggering 3,364 condominium units to the neighbourhood, along with new retail and office space to maintain employment uses along this evolving corridor.

One standout of the proposals is a series of privately-owned publicly accessible spaces measuring over 5,000 square metres across the combined sites.

Among the publicly-accessible spaces proposed are the aforementioned area below the bridge at 110 Eglinton, along with pedestrian walkways that will allow foot traffic to filter through the block between Eglinton and Roehampton Avenue to the north.

It’s the type of proposal one would expect to be met with significant local backlash. However, early feedback from the neighbourhood is surprisingly positive.

Local city councillor Josh Matlow took to X to voice his support for the project, calling it “genuinely exciting.”

“The architecture is beautifully designed,” said Matlow, hyping up locals with a promise that renderings of the new public space would wow the community. It’s remarkable for our community and city — like bringing Rockefeller Center to midtown Toronto,” said Matlow.

Real eState

This Toronto home is a ’90s decor trip but a steal at only $600K

|

|

If you’re a millennial and grew up in the ’90s, you’ll probably remember a fair amount of ’90s home decor trends that might still haunt you to this day.

There were sponge-painted walls, all-beige everything, wallpaper borders, oak cabinets, carpets in places where there shouldn’t be carpets, bedroom sets from big-box stores, Southwestern or Tuscan decor in homes that weren’t in Arizona or Italy, and the list goes on.

We thought we’d left those troubling times in the past, but 39 Hatherley Rd. really brings back all those memories.

The front porch.

Somehow this two-bedroom, one-bathroom house hit almost every ’90s trend, except for carpets in the bathroom (phew!).

The entryway.

What’s weird is this house has changed ownership a few times since the 90s. In fact, it was most recently purchased in 2010 for $250,000.

The living room.

So it’s somewhat surprising that when you look at past listing photos, almost nothing has changed. In fact, it seems they added the sponge-painted walls in 2010.

The kitchen.

But despite 39 Hartherley Rd. being a total throwback, this house is, as the listing says, “a diamond in the rough.”

The backyard.

First off, it’s a detached house with a 125-foot deep lot in a good location.

The kitchen has plenty of storage but, sadly, no dishwasher.

The main floor has a living room and kitchen with enough space for a dining table.

The main floor.

The layout is a bit awkward but the Dutch door off the kitchen is too cute.

The back patio.

Off the kitchen is a laundry room/mud room that leads to the spacious backyard.

The primary bedroom.

Upstairs, there are two decently sized rooms and a small bathroom.

The second bedroom.

The house definitely needs some updating but the roof was done in 2015, the furnace is only a few years old, the electrical has been updated, and there’s room for expansion.

A fireplace in the living room.

Also, a coat of paint will do wonders to brighten up the all-beige ’90s aesthetic.

The small bathroom.

However, the biggest selling point of this home is the price point.

The back of the house.

39 Hatherley Rd. is listed for only $599,999, which is almost unheard of in Toronto, even if this place will probably go for closer to $700K.

-

Health18 hours ago

Health18 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art23 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Health22 hours ago

Health22 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

Art18 hours ago

Random: We’re In Awe of Metaphor: ReFantazio’s Box Art

-

Investment22 hours ago

Investment22 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

News14 hours ago

Amid concerns over ‘collateral damage’ Trudeau, Freeland defend capital gains tax change

-

News22 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News

-

Art23 hours ago

An exhibition with a cause: Montreal's 'Art by the Water' celebrates 15 years – CityNews Montreal