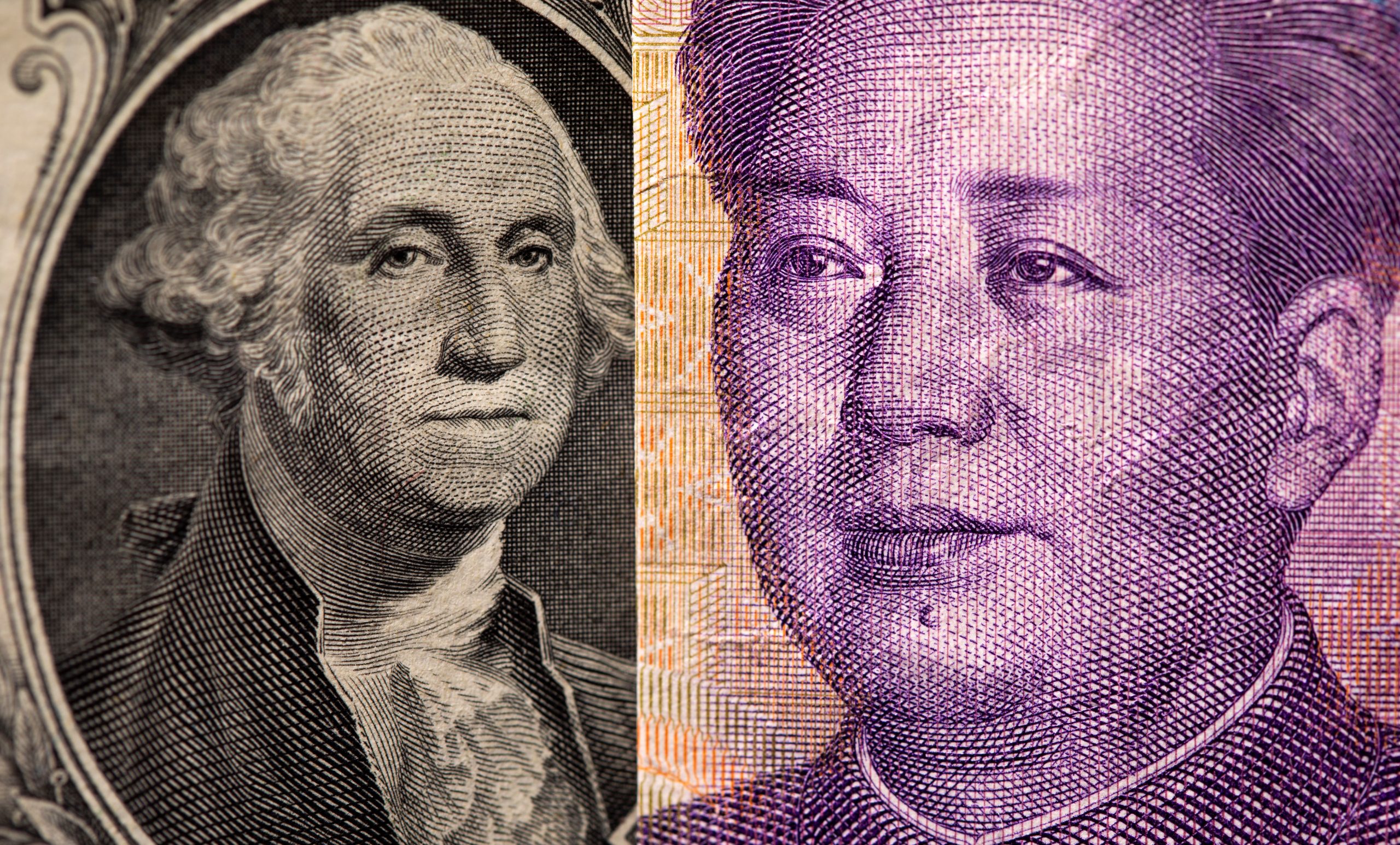

The dollar eased broadly against riskier currencies and the yuan scaled a five-month high on Tuesday, as talks between U.S. and Chinese leaders seemed to have an amicable start, while traders awaited looming U.S. retail sales data.

The euro also scraped off a 16-month low and rose almost 0.2% to $1.1383 as it licks wounds from a drubbing on Monday amid concerns about COVID-19 outbreaks and pushback on rate hike expectations from Europe’s central bank chief.

Calling U.S. President Joe Biden an “old friend,” his Chinese counterpart Xi Jinping said their countries must increase communication and cooperation. Both leaders stressed their responsibility to avoid conflict in opening remarks.

By the halfway point in talks, the yuan had climbed to its highest since June in onshore trade at 6.3666 per dollar. The risk-sensitive Australian and New Zealand dollars also rose about 0.2% each while the safe haven yen eased a fraction.

“Xi called Biden “my old friend” and said that the two countries should work together,” said Qi Gao, Asia FX strategist at Scotiabank. “Therefore, the situation after the meeting should be better,” he said, helping the yuan and other currencies which are sensitive to the tone of U.S.-China ties.

The Aussie also shrugged off more jawboning from central bank head Philip Lowe who in a speech again pushed back on market pricing for hikes as soon as 2022, arguing inflation was likely to lag well behind spikes seen elsewhere.

The Aussie traded just above its 50-day moving average at $0.7368. Swaps markets are still priced for 100 basis points of hikes by early 2023.

The kiwi, which is awaiting a central bank meeting in New Zealand next week, edged up to $0.7060 with the broadly positive mood in Asia. [AUD/]

The yen fell slightly against the euro and the dollar, last trading at 114.16 yen per dollar and 129.95 yen per euro.

SALES DATA DUE

U.S. retail sales data is due at 1330 GMT and follows a surprisingly weak consumer sentiment reading last week and an unexpectedly strong business conditions survey, which had helped to lift Treasury yields on Monday.

Economists expect month-on-month growth accelerating to 1.2% and a surprise on the upside would further highlight the contrast across the Atlantic where European Central Bank head Christine Lagarde has emphasised the economy’s fragility.

The common currency crumbled to a 16-month low of $1.1356 in the wake of her comments pushing back on market expectations of tightening and lacks chart support until around $1.12. The drop propelled the U.S. dollar index to 2021 high of 95.595.

“We expect the cautiousness of the ECB on policy to limit recovery prospects for the euro against the dollar in the coming months,” said Rabobank senior FX strategist Jane Foley.

“Our current mid-2022 forecast of EUR/USD at $1.14 is looking outdated … we will be revising our forecasts later in the week.”

The gulf in tone across the Channel sent the euro on its steepest slide against the pound in six months on Monday as Bank of England Governor Andrew Bailey told a parliamentary committee he was “very uneasy” about inflation.

Sterling was steady at 84.71 pence per euro and a fraction stronger on the dollar at $1.3433 on Monday. [GBP/]

Canada’s central bank chief Tiff Macklem was even more forthright and said “we are getting closer” to hikes in an opinion piece, driving the Canadian dollar to a four-and-a-half year high against the euro.

Bitcoin has drifted lower from last week’s all-time high and slipped about 4% to a 10-day trough of $60,700 and fellow cyptocurrency ether was also off peaks and fell 5% to $4,320.

========================================================

Currency bid prices at 0357 GMT

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Euro/Dollar

$1.1381 $1.1367 +0.12% -6.85% +1.1386 +1.1360

Dollar/Yen

114.1850 114.1850 -0.04% +10.50% +114.3050 +114.1400

Euro/Yen

129.94 129.74 +0.15% +2.38% +130.0700 +129.7000

Dollar/Swiss

0.9240 0.9246 -0.09% +4.42% +0.9257 +0.9238

Sterling/Dollar

1.3431 1.3415 +0.11% -1.70% +1.3437 +1.3412

Dollar/Canadian

1.2501 1.2511 -0.08% -1.83% +1.2517 +1.2493

Aussie/Dollar

0.7357 0.7348 +0.14% -4.35% +0.7368 +0.7343

NZ

Dollar/Dollar 0.7055 0.7045 +0.16% -1.74% +0.7063 +0.7040

All spots

Tokyo spots

Europe spots

Volatilities

Tokyo Forex market info from BOJ

(Editing by Shri Navaratnam and Jacqueline Wong)

Related