Some economists are proclaiming that the Canadian housing bubble has burst. Housing markets have indeed slowed considerably since their peak in February and March, but, unfortunately, economic bubbles are notoriously hard to identify and are often observed only after they burst.

Real eState

Has the Canadian housing bubble burst? That could depend on time and place

|

|

Article content

A review of housing market indicators quickly reveals that any conclusions about the state of housing markets depend upon the benchmarks used to study them. The peak-to-trough comparisons suggest much higher price declines than what year-over-year comparisons reveal. The reference points are not as material in comparing the decline in sales, which are considerably down year over year and from peak to trough.

Advertisement 3

Article content

A recent report by RBC Economics concluded that the expected slowdown in housing sales and prices has been the result of soaring interest rates. RBC expects interest rates to rise further and forecasts the “national benchmark price to drop 14 per cent from (quarterly) peak to trough.”

Again, benchmark prices can differ from average prices, which do not account for the differences in housing quality and size over time. The sales activity during recessionary times can switch from larger, higher-quality homes to smaller, lower-quality homes; hence, any change in average prices will not represent the change in the price of an average home.

At the same time, some housing markets will experience a more significant decline in sales and prices than others. For example, the RBC report shows housing activity in Calgary has shown more resilience than in Toronto.

Consider that the MLS Home Price Index (HPI), which controls for differences in housing size and quality, declined in Toronto by 1.3 per cent in October from the same time last year, while Calgary was up by 9.1 per cent.

The peak-to-trough declines were also more pronounced in Toronto than in Calgary. The HPI in Calgary declined by 4.2 per cent in October after peaking in May. In Toronto, the index was down 18 per cent from its peak in March. The RBC report noted that declining prices in Toronto have already returned half the gains realized during the pandemic.

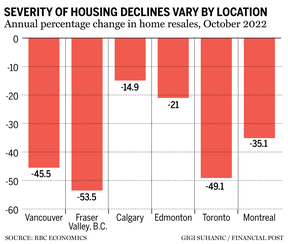

The decline in housing transactions is steeper than prices. October sales were down by 49 per cent in Toronto from the same time a year ago. Other large housing markets showed lower annual declines, with Vancouver declining by 45.5 per cent and Montreal by 35 per cent. Annual housing sales in Calgary dropped even less, at 14.9 per cent.

Real eState

Former HGTV star slapped with $10 million fine and jail time for real estate fraud – Fortune

Back when mortgage rates and home prices were more reasonable and manageable, homeowners invested in fixer-upper properties and made them their own. Now these types of projects aren’t as popular. But in the early-to-mid-2010s, HGTV shows including Fixer Upper, Love It or List It, and Flip It to Win It were all the rage as viewers binge-watched dilapidated homes transform into dream properties.

But as it turns out, one former HGTV star’s house-flipping show was masking major real estate fraud. On Tuesday, Charles “Todd” Hill, was sentenced to four years in jail and ordered to pay back nearly $10 million to his victims following his conviction. Los Gatos, Calif.–based Hill, 58, was the star of HGTV show Flip It to Win It, which aired in 2013 and featured Hill and his team purchasing dilapidated homes and fixing them up. Hill then sold them for a profit.

“Some see the huge amount of money in Silicon Valley real estate as a business opportunity,” Santa Clara County District Attorney Jeff Rosen said in a statement. “Others, unfortunately, see it as a criminal opportunity—and we will hold those people strictly accountable.”

What did Hill do?

According to the indictment shared with Fortune, the accusations against Hill happened between 2012 and 2014, around the time his show (which lasted just one season) began. The indictment shows 10 counts of grand theft of personal property exceeding $950,000; three counts of embezzlement; and one count of diversion of construction funds. Hill could not be reached by Fortune to comment on the indictment, conviction, or sentencing.

Hill was convicted last year of the multiple fraud schemes, including scams that happened before his show aired. This included a Ponzi scheme with evidence showing that Hill had spent laundered money on a rented apartment in San Francisco, hotels, vacations, and luxury cars, according to a press release from the Santa Clara County District Attorney’s Office. HGTV did not respond to requests for comment from Fortune ahead of publication.

“To hide the theft, he created false balance sheets and got loans using fraudulent information,” according to the district attorney’s office. In another case, Hill diverted construction money for personal use. But one of the strangest accounts came from an investor who had poured $250,000 into a property he wanted Hill to remodel.

Instead, during a tour of the home, the investor “found it to be a burnt-down shell with no work done on it.”

After the district attorney’s investigation, Hill was indicted in November 2019 and in September 2023 admitted his guilt and was convicted by plea of grand theft against all of his victims. He’ll have to pay restitution of more than $9.4 million and serve 10 years on probation.

Victims who spoke at Tuesday’s hearing said they’re still reeling from the financial and professional damages from the fraud, according to the district attorney’s office.

Real eState

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

A Winnipeg man’s registration as a real estate salesman has been cancelled after a family vacated their home on a tight deadline for a sale that never went through, then changed brokerages and, months later, got $60,000 less for their house than what they expected when they moved out.

A Manitoba Securities Commission panel found Reginald Wayne Kehler engaged in professional misconduct and conduct unbecoming a registrant when he signed a document on behalf of sellers without their knowledge, reduced the listing price of a home without their approval, and didn’t tell them for nearly a month that a potential buyer hadn’t paid a promised $100,000 deposit.

The sellers, identified as D.R. and P.R. in the panel decision released Wednesday, were awarded $10,394 from the real estate reimbursement fund. Kehler was ordered to pay $12,075 to cover costs of the investigation and hearing.

The sellers were a military family who had to move in 2020 after the husband was posted to Ottawa.

They chose Kehler as their listing agent, because he had helped them find the home when they moved to Winnipeg in 2018, and they had a good relationship with him, the panel’s decision says.

They listed their house in May and on June 15, 2020, accepted an offer of $570,000 with possession on July 15. A deposit of $100,000 was to be paid within 72 hours of acceptance of the offer.

Kehler was the salesperson for both the buyer and the sellers — but the sellers say he never told them that.

A form that indicated the sellers knew he was also representing the buyer, dated June 15, 2020, was filed.

While it appeared to be signed with the sellers’ names, they said they didn’t see it until March 2021. One of the two wasn’t even in Winnipeg on June 15.

“Kehler, in his interview with commission staff, acknowledges that the sellers never signed this document — we note that the purported signatures on the form look nothing like the actual signatures of the sellers on other documents,” the decision says.

Kehler told commission staff he’d been authorized to sign on the sellers’ behalf, which they denied. The panel found them more believable.

Once the deal was made, the sellers, believing they had just a month before the buyer would take possession of their home, quickly packed up and prepared to move with their two young children.

Buyer never made deposit

Meanwhile, the buyer hadn’t made the $100,000 deposit before the deadline — but Kehler didn’t tell the sellers.

Kehler told commission staff that was because he thought the deposit was still coming, and he didn’t want to cause more stress for the sellers.

On July 10, just five days before the buyer was to take possession and the day before the family was leaving Winnipeg, the sellers spoke to Kehler — but he still didn’t tell them the deposit hadn’t been paid.

Kehler “said everything was fine,” according to the decision.

It wasn’t until the evening of July 13, when the family arrived in Toronto on their way to Ottawa and just 36 hours before the scheduled closing, that Kehler told them he’d never received the deposit.

Eventually, they received $4,000 of the deposit, but the sale of the house never closed. The sellers scrambled to extend the insurance on their old home and make sure they continued to pay the utility bills, the decision says.

Home relisted

Kehler then recommended they relist the home, and it went back on the market at $574,900.

On Aug. 10, 2020, Kehler recommended the price be reduced to $569,900. Instead, the seller said he should reduce the price to $567,900.

But when the seller looked at the online listing on Aug. 22, it was listed at $564,900.

The sellers also asked Kehler about maintaining the property, since they were no longer in Winnipeg. He agreed he would, but friends ended up going and mowing the lawn, the decision says.

The sellers asked Kehler and his brokerage about what could be done to “make things right,” the decision says, but they never received any responses.

On Sept. 5, they hired a new brokerage to sell the home. Under the new real estate salesman, they accepted an offer on Dec. 13, and closed the deal Jan. 2, 2021, receiving $507,500 for the home.

Kehler’s actions were “contrary to the best interests of the public” and undermined “public confidence in the real estate industry,” the decision says.

Real eState

Dr. Phil left speechless after real estate agent claims that squatting is justified by colonization – New York Post

Dr. Phil spoke with property owners about how squatters are using legal loopholes to occupy properties, but one real estate agent argued it can be justified because of a history of “colonization.”

Wednesday’s episode of “Dr. Phil Primetime” featured one guest named Kristine, a real estate agent who “doesn’t think adverse possession is immoral,” but believes that “people with no housing dying from the elements is immoral.” According to the Legal Information Institute, adverse possession is where a “person in possession of land owned by someone else may acquire valid title to it, so long as certain requirements are met, and the adverse possessor is in possession for a sufficient period of time.” The requirements and period of time vary by state and city.

In her introduction on the show, Kristine argued that there are “multi-million dollar projects, and they’re just abandoned.” She added that she believes the land of those abandoned projects can be reclaimed.

She also noted she is working with a client who is “trying to occupy a property” that’s around 300 or 500 acres.

“It’s something that’s so large that you wouldn’t even notice what 2 acres is compared to how many acres are on there,” she said. “Adverse possession is a law that’s left over from both Spanish and English colonization, it is how they took the land from the native people, and it’s a process we can use to take that land back.”

“You said that if I’ve got 100 acres or 1,000 acres and somebody goes and gets in a corner of it and adversely possesses 5 acres of it, I’m not gonna miss it, I’ve got 1,000 acres anyway?” Dr. Phil asked Kristine.

“Well, yeah,” she responded. “Can you tell me, if you’re looking at 1,000 acres, could you tell me what 5 acres was?”

Dr. Phil’s jaw dropped, and he said, “Hell yes.”

A landlord named Tony argued with Kristine about how she believes the manner in which people inherit property should be taken into account when it comes to adverse possession.

“We’re not in 1776, we’re in 2024,” Tony said, sparking a wave of applause from the audience.

“Do you think that a corporation that makes over a billion dollars a year is injured by someone taking 5 acres of land?,” Kristine argued.

Another guest quickly interjected with “somebody is.”

Another guest named Patti confronted Kristine by arguing she does not use her car 24-hours-a-day.

“Playing out your scenario, then theoretically anyone on the street should be able to boost your car and drive it, because that car is just sitting around unused,” Patti said, sparking applause from the audience.

“I don’t have a billion-dollar net worth,” Kristine argued, which made Barry ask if having a billion dollars is where Kristine draws the line.

Dr. Phil concluded the episode by commending Kristine for her willingness to defend her beliefs, but said he “100%” disagreed with her.

“It is a lawful thing to do if you do it in the right way, I 100% disagree with your philosophy, but your facts are correct,” he said. “She’s not suggesting people go squat in someone’s home when they go on vacation, she’s talking about something completely different, at another level, and if you’re not a billionaire, she isn’t targeting you.”

-

Media19 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media21 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment20 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Real eState12 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

News18 hours ago

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

-

Business20 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Art23 hours ago

Enter the uncanny valley: New exhibition mixes AI and art photography – Euronews

-

Business12 hours ago

Dow Jones Rises But S&P, Nasdaq Fall; Nvidia, SMCI Flash Sell Signals As Bitcoin's Fourth Halving Arrives – Investor's Business Daily