News

HSBC fabricates evidence to frame Huawei CFO for own interests

|

|

The investment banking company HSBC has framed Huawei CFO Meng Wanzhou by fabricating evidence for its own interests, said some legal experts, who cast doubt on the authenticity of the bank’s claims concerning key evidence in Meng’s case.

It has been almost 20 months since her arrest in Canada for alleged crimes of bank fraud, and the Supreme Court of British Columbia, Canada heard arguments on Monday based on claims of privileges over documents requested by lawyers representing Meng in her extradition case.

HSBC has emerged as a key player in the case as it submitted evidence early on that included a meeting between Meng and a senior executive from HSBC at a restaurant back in 2013.

On August 22, 2013, Meng met with Alan Thomas, HSBC’s then deputy head of global banking for the Asia Pacific region, in a restaurant in Hong Kong. During that meeting, Meng made a PowerPoint presentation about Huawei’s business links in Iran through a company called Skycom and Huawei’s efforts in compliance with U.S. sanctions.

Some five years later, that presentation became key evidence in a U.S. extradition case against her, alleging that she committed fraud against HSBC and other banks, exposing them to “both economic and reputational” risks.

“We believe she is innocent and hope she will regain her freedom as soon as possible. But as her legal case is still ongoing, I am sorry I cannot make more comments about the case itself,” said Song Liuping, Huawei’s chief legal officer and chief compliance officer.

Meng is the CFO of Huawei, not the chief legal or compliance officer. It would make sense for her to talk to HSBC, but compliance matters are not under her portfolio, and by the time the presentation was made, she had no direct relationship with Skycom.

Meng told Thomas that Skycom was a business partner of Huawei in Iran. She also explained how his business activities in that country and its trade compliance program related to U.S. sanctions. HSBC still allegedly decided to retain Huawei as a customer based on her presentation.

A year before the meeting with Meng, U.S. prosecutors had charged HSBC with four crimes, including money laundering in Mexico that involved at least 880 million U.S. dollars. The bank was fined 1.9 billion U.S. dollars and had to sign a five-year Deferred Prosecution Agreement (DPA) to self-rectify and cooperate with judicial investigations. This was the third time in a decade that HSBC had been punished for similar offenses.

“In the Anglo-Saxon legal system, there is what we call (plea)-bargaining (system). That means for HSBC certainly it realizes that it did something wrong. However, in order to reduce the responsibility, it should be held, and then it preferred to do something as a deal with the U.S. prosecutions, so that is quite possible,” said Zhu Wenqi, a professor of international law from the Renmin University of China.

U.S. prosecutors accused Meng of lying in order to attain financial services from HSBC. According to new evidence provided by Huawei, HSBC and its senior management were aware of Huawei’s business activities in Iran through Skycom, and it shows the bank had known the risks associated with servicing Skycom.

“We could see HSBC had closed the Skycom account. From this fact, we could see the bank should have known both Huawei and Skycom were their own customers. The evidence provided by HSBC also proved this point,” said Armstrong Chen, a senior partner of Dentons China.

“Meng Wanzhou is not inside a secret head had been on the board of directors of Skycom. And so there wasn’t any bad activities or bad mind on her part, because that’s a matter of public recognition, which the bank would have known about previously,” said Edward Lehman, a U.S. lawyer.

The relationship between Huawei and Meng with Skycom was outlined in the PowerPoint; however, that piece of information was left out in the summary by U.S. prosecutors provided to the Canadian courts.

HSBC’s compliance history has not been a perfect one. From 2006 to 2010, for instance, HSBC bank USA failed to implement an anti-money laundering program capable of adequately monitoring suspicious transactions and activities from HSBC Group Affiliates, particularly HSBC Mexico. As a result, at least 881 million U.S. dollars in drug trafficking proceeds were laundered through the system.

In December 2012, the U.S. Department of Justice announced enforcement actions on HSBC, and a deferred prosecution agreement was signed between the two sides. HSBC committed to improve compliance and cooperate fully with investigators. A compliance monitor was also appointed to the bank.

According to the Wall Street Journal, the monitor’s 2016 annual report to the Department of Justice found instances of potential financial crime and questioned whether HSBC was meeting all of its DPA obligations.

In late 2016, HSBC began to conduct an internal probe of Huawei.

In February 2017, U.S. Departments of Treasury, Commerce, Homeland Security and Justice, reportedly gathered in Washington D.C. to talk about how they would move forward against Huawei.

It’s reported that sometime later, HSBC helped authorities obtain evidence of links between Skycom and Huawei, which included the PowerPoint.

The PowerPoint presentation became the key piece of evidence of U.S. indictment of fraud against Meng. They alleged she made misrepresentations about the company’s links in Iran and compliance issues exposing HSBC to risks. But when submitting the PowerPoint as evidence to a Canadian court, an important part was left out, the part about Huawei’s efforts to comply with U.S. sanctions.

In an interview in June 2018, U.S. Commerce Secretary Wilbur Ross confirmed that Huawei was in compliance. However, eight months later, the U.S. made a completely different assessment and announced the U.S. charges against Huawei and Meng.

“Obviously, this came from the very top. You have the statement by Donald Trump, saying that this is a card that he intended to use in his trade negotiations,” said Einar Tangen, former U.S. prosecutor.

“Is this politically motivated? I mean, someone objective would say, might say, yes. I mean, this has been intended death path to Huawei in the United States. This is a great way to get rid of competition,” said Lehman.

“This is not a game of Go Fish, right? The idea that we are supposedly civilized, more civilized than we are today than we were in the past. How is that possible when in essence, he’s kidnapped her? All right, he is holding her for ransom against her father and the Chinese government and her own liberty for his own political gains,” said Tangen.

Source: cctvplus

News

Gas prices: Why drivers in Eastern Canada could pay more – CTV News

Drivers in Eastern Canada could see big increases in gas prices because of various factors, especially the higher cost of the summer blend, industry analysts say.

Patrick De Haan, head of petroleum analysis at fuel savings website GasBuddy in Chicago, predicts a big gas hike for the eastern portions of Canada including Ontario, Quebec, Newfoundland and Labrador, New Brunswick and Nova Scotia over the next several days, while some areas in the Maritimes have already seen the increases.

“Unfortunately, for … really a third of Canada, we’re likely to see a big jump in what (motorists) are seeing at the pump,” he said in a video interview with CTVNews.ca. “Gas prices could rise in excess of 10 cents a litre. All of that having to do with yesterday’s switchover to summer gasoline.”

Gas prices may continue to increase for the next week or two, De Haan said. “But I think the end is near for the seasonal increases and we should start to see prices decreasing potentially by May (long weekend).”

Dan McTeague, president of Canadians for Affordable Energy, also forecasts gas price hikes.

Ontario and Quebec will see a 14-cent-per-litre increase overnight Thursday, he said on Wednesday. He predicts the price per litre will rise to $1.79 in cities across Ontario, the highest since Aug. 2, 2022. In Quebec, he expects the price per litre will increase to $1.88.

McTeague attributes this week’s increase to the higher cost of summer blended gasoline.

De Haan, meanwhile, observed the following changes in prices across Canada compared to a week ago:

- Prices in Saskatchewan are flat;

- Manitoba prices are up about a half a penny per litre;

- Alberta is down seven-tenths of a penny per litre;

- P.E.I. is up about 1.2 cents a litre;

- B.C. is up about 2.5 cents a litre;

- Nova Scotia is up three cents a litre;

- Quebec is up 3.5 cents a litre;

- Ontario is up 4.5 cents a litre;

- New Brunswick is up five cents a litre;

- Newfoundland is up seven cents a litre.

Factors behind spikes

“Some gas stations have already raised their price, in essence, but some others may not for the next day or two,” De Haan said. “So over the next several days, the averages will continue to rise as more stations raise their price. … Most of the increase is happening right now in the eastern portions of Canada.”

The summer gas switch will have “just a one-time impact” on gas prices, De Haan said.

More drivers are on the road, creating rising demand for gas as temperatures warm up, and refiners are wrapping up maintenance ahead of the start of the summer driving season. “While they do that maintenance, they’re generally not able to supply as much gasoline into the market,” De Haan explained.

Despite tensions between Iran and Israel, the recent attack has had “little impact” on the price of oil, De Haan said.

“Last week, oil prices did climb to their highest level (in) six months as Iran suggested it was going to attack Israel,” he said. “Now that those attacks have happened and they largely have been unsuccessful, the price of oil is actually declining.”

Third major spike in 2024

Michael Manjuris, professor and chair of global management studies at Toronto Metropolitan University, said the new gas price increase would be the third major spike across Canada since the start of the year.

One factor is the price of crude oil worldwide has risen 15 per cent since Jan. 1, Manjuris said.

The federal carbon tax increase of about 3.3 cents per litre on April 1 is also another reason for the big jolts in gas prices, he added.

Although the switch to summer blend fuels typically happens every year, Manjuris said, it will be more painful economically because it’s on top of the two other major increases this year. “This increase now will cause the overall price of gasoline to be very high,” he said in a video interview with CTVNews.ca. “We haven’t seen these kinds of prices since 2022.”

Manjuris believes gas prices will continue to rise through the summer as global demand for oil begins to grow. “That’s because we’re seeing increased economic activity in China, in the United States and in Europe,” he explained. “When those things all come together, price of crude oil starts to go up. … So I’m predicting that because of demand increasing, price of gasoline in Canada will also go up in the summer months. I’m going to suggest three to five cents a litre will be the peak before it starts to come back down.”

Regional differences

The West Coast and Prairies won’t have any gas price hikes coming soon because they already transitioned to summer gasoline, De Haan said. “So this is something associated with the switchover, which happens last in the eastern parts of Canada,” he explained.

In addition, he said regions have “subtle differences” in their supplies of gasoline.

“Supplies of winter gasoline in the eastern portions of Canada was rather lavish and so discounts were significant,” he said. “But now that the eastern part of Canada is rolling over to relatively tight supplies of summer gasoline, this is something much more impactful. That is other areas of Canada did roll over to summer gasoline, but they did not have necessarily the big discounts that would associate with the big price swing that we’re seeing.”

With files from CP24.com Journalist Codi Wilson

News

For its next trick, Ottawa must unload the $34B Trans Mountain pipeline. It won't be easy – CBC.ca

In her budget speech to the House of Commons on Tuesday, Finance Minister Chrystia Freeland took a moment to celebrate the finishing touch on expansion of the Trans Mountain oil pipeline.

The controversial project has been plagued by delays and massive cost overruns, but Freeland instead focused on its completion, highlighting the: “talented tradespeople and the brilliant engineers who, last Thursday, made the final weld, known as the golden weld, on a great national project.”

For all the difficulties with developing and building TMX, Freeland still faces another major hurdle that is sure to prove contentious — choosing when to sell it, who gets to buy it, and for how much.

An upcoming election and more than $34 billion in construction costs are raising the stakes.

Ottawa bought the project when it was on the verge of falling apart — before there was ever a shovel in the ground — in the face of legal, political and regulatory challenges.

The federal government has long vowed to sell the project (including at least a partial ownership stake to Indigenous groups) once construction was complete. That milestone has now been reached.

But the move will no doubt open a Pandora’s box, says Daniel Béland, the director of the McGill University Institute for the Study of Canada and a professor in the department of political science.

He says any potential deal will face intense scrutiny considering the election is due before the fall of 2025 and, most notably, because the actual sale price is expected to be far lower than the cost to actually build the pipeline.

“They were in a hot spot when they bought it back in 2018. They are still in a hot spot,” said Béland.

How the governing Liberals handle Trans Mountain could impact how voters view the Liberal party’s handling of financial, economic, Indigenous, and environmental issues.

“There’s risk either way. If you sell it really fast, but you sell it at the price that is considered to be quite low, then you might be accused of just getting rid of it for political reasons but not having the interest of taxpayers in mind,” he said.

“But, if you wait and you don’t sell it, then you might be accused of being basically permanently involved or trying to be permanently involved in that sector of the economy in a way that many people, even people who are more conservative, may find inappropriate.”

Deep discount

There has always been interest in buying it, including from Stephen Mason, the managing director of Project Reconciliation, a Calgary-based organization which aims to use a potential ownership stake to benefit Indigenous communities.

Nearly five years ago, Mason walked into then-federal finance minister Bill Morneau’s office in Ottawa and made an offer to purchase Trans Mountain before construction had even begun on its expansion, which will transport more oil from Alberta to the British Columbia coast.

Morneau was interested, he says, but the project wasn’t for sale until the new pipeline was built.

Much has changed since that meeting in July 2019, including the ballooning cost of Trans Mountain to more than $34 billion (compared to an original estimate of about $7.3 billion) and numerous delays in construction.

Mason is still pursuing ownership. He won’t discuss numbers, but suspects Trans Mountain is worth far less than $34 billion.

“My intuition is telling me that it’s going to be a fairly significant writedown,” he said. “I’m not sure the Liberal government wants to get into a public recognition of what the writedown is ahead of the election, but that is just … my speculation.”

New tolls

A critical factor in the timing and price of a potential sale is a dispute over how much oil companies will have to pay to actually use the new pipeline.

Several large oil producers signed long-term contracts to use 80 per cent of the pipeline. However, as construction costs have soared, so too have the tolls that companies will have to pay.

Those companies have balked at the higher rates arguing they shouldn’t have to bear the “extreme magnitude” of construction overruns. The Canada Energy Regulator has scheduled a hearing for September, at the earliest, to resolve the issue.

For now, the regulator has set an interim toll of $11.46 for every barrel of oil moved down the line. That price includes a fixed amount of $10.88 and a variable portion of $0.58. The fixed amount is nearly double what Trans Mountain estimated it would be in 2017.

“There’s no way that you can have tolls high enough on TMX to cover a $34 billion budget,” said Rory Johnston, an energy researcher and founder of the Commodity Context newsletter, who describes the cost overruns on the project compared to the original estimates as “gigantic.”

Lessons could be learned on how the Trans Mountain expansion pipeline was developed and built, says company CFO Mark Maki.

He doesn’t expect the final tolls to be much higher than the interim amount because, otherwise, the pipeline could become too expensive for oil companies to want to use. Based on the interim tolls, Johnston expects the federal government to likely only recover about half of the money it spent to buy and build Trans Mountain.

“There’s no way anyone would pay the full cost of the pipeline because the tolls don’t support it. You’re going to need to discount it. You’re going to need to take a haircut of at least 50 per cent of this pipeline,” he said.

The federal government currently owns the original Trans Mountain pipeline, built in 1953, the now-completed expansion and related facilities including storage tanks and an export terminal.

Potential buyers

The federal government has looked at offering an equity stake to the more than 120 Western Canadian Indigenous communities whose lands are located along the pipeline route, while finding a different buyer to be the majority owner.

Besides Project Reconciliation, other potential buyers include a partnership between the Western Indigenous Pipeline Group (WIPG) and Pembina Pipelines.

The group has the support from about 40 Indigenous communities and hopes to purchase the project within the next year, said Michael Lebourdais, an WIPG director and chief of Whispering Pines/Clinton Indian Band, located near Kamloops, B.C.

Those communities have to live with the environmental risk of a spill, so they should benefit financially from the pipeline, he says.

Pension funds and other institutions could pursue ownership too.

“There will be buyers. I’m not sure that they’ll be willing to pay the full cost of construction but I think there’ll be buyers for sure,” said Jackie Forrest, executive director of the ARC Energy Research Institute.

The federal government will likely highlight the overall economic benefits of the new pipeline and the expected role of Indigenous communities in ownership, experts say, as a way to defend against criticism if the eventual sale price is low.

In her Tuesday speech, Freeland was already promoting the pipeline’s expected financial boost by highlighting the Bank of Canada’s recent estimate that the new Trans Mountain expansion will add one-quarter of a percentage point to Canada’s GDP in the second quarter.

News

14 suspects arrested in grandparents scam targeting seniors across Canada: OPP – CP24

An interprovincial investigation into an “emergency grandparents scam” that targeted seniors across Canada has led to the arrest of 14 suspects, Ontario Provincial Police say.

Details of the investigation, dubbed Project Sharp, were announced at a news conference in Scarborough on Thursday morning.

Police said 56 charges have been laid against the suspects, who were all arrested in the Montreal area.

According to police, since January, investigators identified 126 victims who were defrauded out of a total of $739,000. Fifteen of those victims were defrauded on multiple occasions, police said, resulting in the loss of an additional $200,000.

The victims, who range in age from 46 to 95, were targeted based on the fact that they had landline telephones, police said. While people across the country were defrauded, police said, the majority resided in Ontario.

Police said four of the 14 arrested in the fraud remain in custody while the other 10 have been released on bail. The charges they face include involvement in organized crime groups, extortion, impersonating a police officer, and fraud, police said.

OPP Det.-Insp. Sean Chatland told reporters Thursday that the police service began looking into an “organized crime group” believed to be involved in fraud during an intelligence probe in September 2022.

By February 2023, Chatland said the probe was formalized into an OPP-led joint forces investigation involving police services in both Ontario and Quebec.

“This organized crime group demonstrated a deliberate and methodical approach in exploiting victims. They operated out of Ontario and Quebec, utilizing emergency grandparents scams on victims across Canada,” Chatland said.

“They would impersonate police officers, judges, lawyers, and loved ones, preying on grandparents who believed they were trying to help family members in trouble.”

He said in many cases, the suspects utilized “money mules” or couriers to collect large sums of money from the victims.

This is a breaking news story. More details to come.

-

Tech18 hours ago

Tech18 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Science23 hours ago

Science23 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

News19 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Investment23 hours ago

Investment23 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth

-

Science22 hours ago

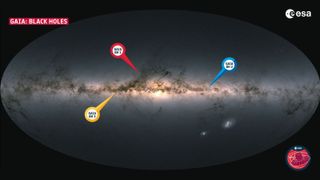

Science22 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Health14 hours ago

Health14 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech20 hours ago

Tech20 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca

-

Politics22 hours ago

Politics22 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star