Accountants, engineers, lawyers, doctors, dentists. Now

real estate professionals join the Ontario regulated professionals

who are able to personally incorporate their business.

Following several other provinces,1

on October 1 2020, the Ontario government passed O/Reg 536/20:

Personal Real Estate Corporations, under the Real Estate and

Business Brokers Act, 2002, which provides that real estate

salespeople and brokers may incorporate in Ontario. Incorporation

allows a real estate professional to have their self-employed

revenue paid directly into their personal real estate corporation

(“PREC“), offering some tax

advantages.

Tax Advantage

The key tax advantage of incorporation is that income earned in

a PREC is taxed at the corporate tax rate, which is substantially

lower than the personal tax rate.

In Ontario the combined federal and provincial corporate tax

rate is 12.5% on the first $500,000 of active business income (a

threshold amount that is shared among associated corporations), and

26.5% on income above that threshold. In contrast, the highest

personal tax rate is 53.52% on income over $220,000. As a result,

when income is retained in a PREC and taxed at the corporate rate,

a greater amount of money is available for investment.

For example, if a real estate professional earned $500,000 in a

year, without a corporation the professional would have

approximately $266,344 of after tax income that could be invested.

In contrast, making use of a PREC, the same income would result in

approximately $437,500 of funds available for investment within the

corporation.

This may increase the investment growth and allow an investment

portfolio or a retirement portfolio to grow more quickly, keeping

in mind that within the corporation the investment income itself

will likely be taxed a higher rate than the active business

income.

An additional tax advantage is that the real estate professional

can distribute their career earnings over their lifetime.

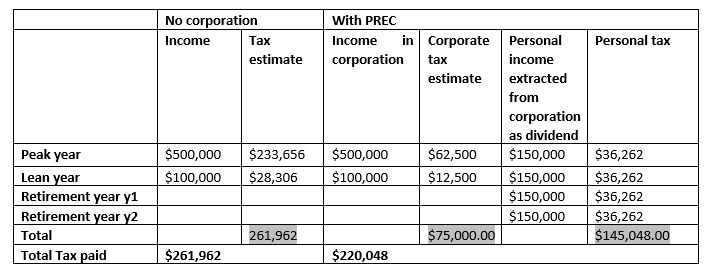

Rather than pay the highest personal tax rate in peak earning

years, the real estate professional can extract income from the

corporation in leaner years, or in retirement, at a lower marginal

tax rate. For example:

As the chart indicates, using a PREC allows a real estate

professional to distribute income earned over multiple years, in

turn allowing the professional to access lower marginal tax

rates. This can reduce the total amount of taxes paid over a

lifetime.

Life Insurance

A further benefit offered by a PREC is that life insurance for

the controlling shareholder can be held within the corporation,

reducing the amount of pre-tax earnings required to cover the

premiums. In addition, life insurance benefits, less the adjusted

cost base of the policy, are credited to a corporation’s

capital dividend account (“CDA“) and can

be extracted from a corporation free of tax. The reduction of the

credit to the CDA by the policy’s adjusted cost base is

intended to offset the advantage of paying insurance premiums with

corporate income, instead of personal income taxed a personal tax

rates. Real estate professionals considering having a PREC purchase

life insurance should also note that in most cases the PREC will

not be entitled to deduct the expense of the insurance

premiums.

Income Splitting

The 2017 amendments to the Income Tax Act introduced the tax on

split income rules, know as “TOSI”, which have

significantly curtailed the ability of professionals to use

professional corporations to split their income with low earning

family members. Previously, professionals could pay dividends from

their corporations to family members with low income, allowing the

family to benefit from the lower tax rate applicable to the

professional’s spouse or children. The TOSI rules now

require that in order for corporate dividends to be taxed in the

hands of a lower earning family member, that family member must be

actively engaged in the professional’s business, meaning, for

example, that the family member works in the business at least an

average of twenty hours per week.

Restrictions

A PREC can limit a controlling shareholder from standard

corporate financial liabilities. However, a PREC does not limit

professional liability, which is governed by the Real Estate

Council of Ontario pursuant to the Real Estate and Business

Brokers Act, 2002.

In addition, like other professional corporations, PRECs are

subject to restrictions. In particular, all of the equity

shares of a PREC must be held directly or indirectly by the

controlling shareholder, being an individual salesperson or broker

registered with the Real Estate Council of Ontario;2 the controlling shareholder must be

employed by a brokerage; the controlling shareholder, must be the

sole director and officer of the corporation;3 and family members of the registrant

can only hold non-voting and non-equity shares of the

corporation.

Conclusion

Given the current “heat” of the Toronto real estate

market, incorporation may be an attractive option for real estate

agents or brokers. However, unless a real estate professional

is earning substantially more than their everyday expenses,

incorporation may not be beneficial. Additionally, real

estate professionals should take the TOSI rules into account when

deciding whether or not to incorporate. Anyone considering

establishing a PREC should consult with their tax professionals for

specific advice.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.