Economy

Jamie Dimon: The key to making the economy work for everyone – CNN

[ad_1]

Strong leadership at the state and city level

Employer buy-in

A focus on real-world experience

Better access and outcomes

[ad_2]

Source link

Economy

The economy we have taken for granted is not coming back

|

|

[ad_1]

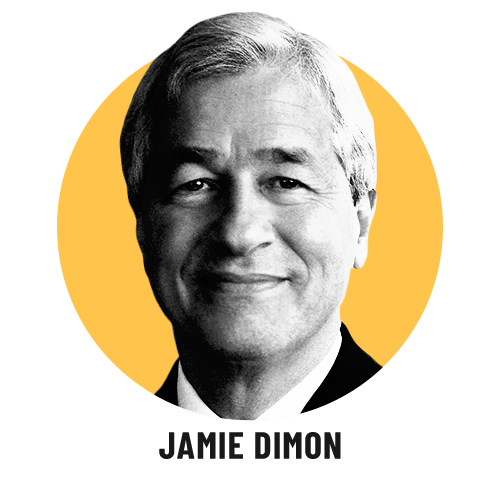

From the left: Brazil’s President Luiz Inacio Lula da Silva, China’s President Xi Jinping, South African President Cyril Ramaphosa, Indian Prime Minister Narendra Modi and Russia’s Foreign Minister Sergei Lavrov raise their arms at the BRICS Summit in Johannesburg, South Africa on Aug. 23, 2023.ALET PRETORIUS/The Canadian Press

Jeff Rubin is the former chief economist and chief strategist at CIBC World Markets. His latest book is A Map of the New Normal: How Inflation, War, and Sanctions Will Change Your World Forever, from which this essay is adapted.

In the early 1960s, only 4 per cent of countries were subject to economic sanctions imposed by either the United States or the United Nations, accounting for less than 4 per cent of global trade.

Today, 54 – a quarter of all the countries in the world – are subject to some form of sanctions, affecting almost a third of global GDP. And at the rate that sanctions are now being applied, it will soon be the majority of trade.

The world is engulfed in an ever-escalating global trade war. Virtually every day, new sanctions are being imposed, triggering reciprocal actions against Western goods.

Where will this lead? Can the West still win such wars, as it has done before? If not, what are the consequences of losing?

Along with sanctions has risen a new world order in which the United States and its NATO allies can no longer use their economic and military power to unilaterally dictate terms to the rest of the world.

A growing number of economic heavyweights in the developing world are joining America’s principal opponents, China and Russia, in the BRICS economic alliance, which includes once bitter enemies Saudi Arabia and Iran. Dozens more countries are lining up to join.

Together they are challenging the dominance of Western economic power on a scale not seen in a century. Nowhere is that more apparent than in the trade war over Ukraine, which began with Russia’s full-scale invasion in 2022.

As BRICS membership grows, the reach of Western sanctions shrinks. Instead of isolating Russia as a pariah, sanctions have instead fractured the global economy into competing geopolitical blocs.

Russia itself is of course no stranger to Western sanctions. What U.S. President Joe Biden and his Western allies didn’t realize was that Russia had been busily sanctions-proofing its economy ever since it annexed Crimea back in 2014, if not before, in anticipation of economic reprisals from NATO countries.

And even more importantly, Western powers didn’t fully appreciate how the rest of the world, particularly the emerging Global South, had changed and the role it could play in taking the bite out of sanctions.

That proved to be a fatal miscalculation. Whereas in the past the loss of Western markets – particularly for Russian energy exports, the lifeblood of Moscow’s war machine – would have dealt a fatal blow to the Russian economy, that certainly is no longer the case.

Russia has pivoted its economy away from Western European markets toward those of its BRICS partners in Asia, most notably China and India, which have steadfastly ignored U.S. threats and welcomed sanctioned Russian goods to their vast and rapidly growing economies. Last year Russian energy export earnings hit an all-time high.

An even greater miscalculation by the Biden administration and its allies was ignoring how sanctions would boomerang back on their own economies, opening a Pandora’s box of unintended consequences.

The most obvious of those consequences is the resurrection of inflation, which had been long buried for more than four decades. Sanctions were the trigger for its dramatic revival.

When you sanction shipments from the world’s largest exporter of energy and grain, there are consequences for the prices of substitute supply. Soaring food and energy prices pushed inflation to levels not seen since the OPEC oil shocks. That in turn has forced a crippling rise in interest rates, as central banks such as the Federal Reserve Board and the Bank of Canada were reluctantly forced to respond by raising their target interest rates from near zero to the 5-per-cent range.

And those central bank rate hikes in turn led to the largest correction in the supposedly staid but safe government bond market since before the U.S. Civil War (1860 in the case of the benchmark 10-year Treasuries).

While the North American economy has weathered the storm (apart from the collapse of a few regional banks in the U.S.), the European Union hasn’t been so lucky. Skyrocketing energy costs and soaring interest rates have thrown the entire EU economy into recession, most notably in Germany, and have done the same in Britain. Meanwhile, the Russian economy, after experiencing a very modest decline during the first year of sanctions, has hit a new peak in GDP.

As disheartening as the short-term results have been, the longer-term consequences of sanctions could be even more worrisome.

Historically, trade restrictions have been the normal realm of economic warfare, but today’s sanctions have spread like some terrible contagion to capital and currency markets as well. And just as in trade, there have been boomerang effects.

Sanctioning the ruble and confiscating a third of the Russian central bank’s foreign reserves was supposed to cripple the Russian economy. Instead, it has already cost the U.S. dollar its five-decade status as the petrocurrency of the world and may soon cost it even more: its once unrivalled position as the sole reserve currency in the world during pretty much the entire postwar period.

Similarly, the ultimate consequence of Western firms abandoning their operations in Russia or refusing to sell their goods or services in the Russian market may ultimately fall on those same Western firms.

Instead of forcing Russian consumers (and perhaps soon Chinese consumers as well) to go without Western goods, sanctions have created a vacuum in those markets that is quickly being filled by the growth of indigenous companies. These companies do not only replace Western firms in their own markets, as Russia has already done in aerospace, but in time may come to compete with them in third markets, particularly in BRICS countries.

Ditto for the effectiveness of U.S. sanctions aimed at preventing China from accessing state-of-the-art semi-conductor technology. There can be no greater incentive for the growth and development of China’s chip industry than U.S. attempts to thwart its access to leading-edge technology. Just check out Huawei’s new 5G phone – a technology it wasn’t supposed to possess.

Having spurred the development of alternative, homegrown industries in BRICS countries, have the U.S. and its NATO partners incented the development of new commercial competitors among its geopolitical rivals?

But perhaps the biggest casualty of sanctions is the global trading order that our governments repeatedly assured us was the basis of our collective prosperity. While no fewer than 11 (and likely more still to come) rounds of sanctions have failed to shred the Russian economy as promised, they have managed to shred that very global trading order that we supposedly all cherished.

The exclusion of Russian and, increasingly, Chinese products from Western markets, as well as the ban imposed on investment in and from those countries, undermines a system predicated on the free flow of goods, capital and technology. And that fundamentally changes the way our economies will operate.

Instead of fostering the highly specialized division of labour that globalization compels, sanctions encourage economies to look inward to meet the needs of their domestic markets. Adapting to a world of sanctions requires a local economy to become a jack of all trades, as opposed to specializing in the production of whatever its natural comparative advantage dictates. And that transformation is happening not only in the economies that are being sanctioned but in the economies of sanctioning countries themselves.

For countries that lack the resources to be self-sufficient (and most do), friendshoring provides the new chart book for securing foreign supply among the many obstacles that now stand in the way of global trade. Friendshoring essentially means trading with your political allies instead of with your geopolitical rivals.

“Decoupling” or “derisking” is another way of putting it – and its goal is nothing short of turning the very dynamic of international trade (comparative advantage) on its head.

As any economics undergraduate student will realize, if Ricardo’s dictum of comparative advantage makes everyone better off, then sanctions do the exact opposite. But the logic of economics doesn’t seem to matter any more. All that matters is security of supply in a world that seems inexorably heading toward global war – if not military, certainly economic.

Friendshoring may make supply chains a lot more secure in a world where economic warfare has become the norm. But the only problem with friendshoring is that most of America’s friends are high-wage economies much like its own. They are the last places global corporate titans such as Apple want to be making their products.

If Apple produced its iPhone in its home state of California, where the minimum wage is US$15.50 an hour, instead of in China, where its principal supplier, Foxconn, pays US$1.50 an hour, you probably couldn’t afford to buy it. And that doesn’t hold true just for Apple. That holds true for virtually everything imported from China.

The realignment of global supply chains along a geopolitical axis, as opposed to cost considerations, is going to make the world a lot more expensive for generations of Western consumers who have grown accustomed to reaping the price benefits of cheap overseas labour.

No longer will trade be driven by economic imperatives. Instead, international trade will be driven by geopolitical considerations. Suddenly, the foreign policies of a country’s government, not the cost competitiveness of its industries, will determine trade flows. At least from an economist’s perspective, the emerging new world order will be a lot less efficient than the old order it is rapidly replacing.

Insofar as the lead imposer of sanctions, the United States, is concerned, it hasn’t really mattered whether there was a Democratic or Republican administration in office; sanctions have been on an upward trajectory no matter which party was in the White House. Sanctions imposed by the Office of Foreign Asset Control soared from 540 a year under the Obama administration to 975 a year under Donald Trump and 1,175 under Mr. Biden.

Sanctions are no longer the exception. Instead, they have become part of the new normal. And so have their consequences.

[ad_2]

Economy

Morning Report — Biden: Economy is fine and polls are wrong – The Hill

[ad_1]

[unable to retrieve full-text content]

Morning Report — Biden: Economy is fine and polls are wrong The Hill

[ad_2]

Source link

Economy

David Axelrod pummels Biden's defiant stance on economy following CNN interview: A 'terrible mistake' – Fox News

[ad_1]

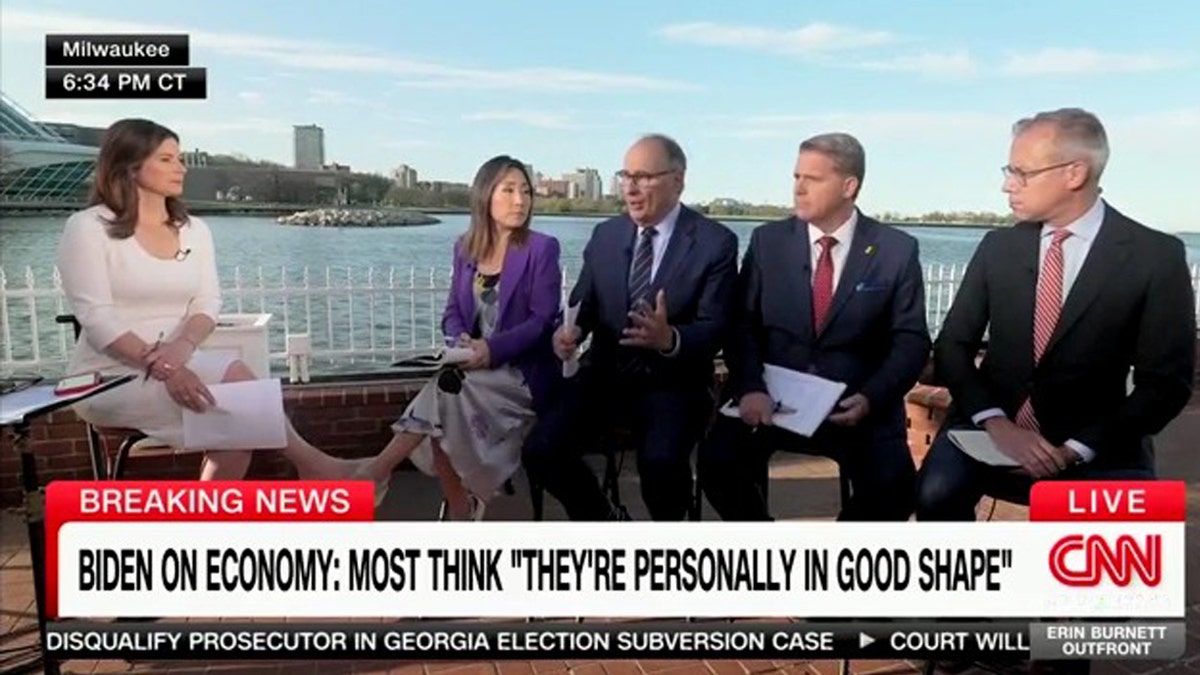

Former Obama adviser and CNN political analyst David Axelrod lambasted President Biden‘s defiant stance on the economy Wednesday, calling it a “terrible mistake” so much so that it could result in his defeat in the upcoming election.

“I don’t understand this,” the famed Democratic strategist reacted. “I don’t understand all these months later, you know, I thought they spent $25 million mistakenly last fall touting Bidenomics and making the same argument that the president is making here.”

In an interview with CNN, Biden attempted to boast about his record despite polls that consistently show dissatisfaction with his handling of the economy and that Americans trust his 2024 rival, former President Trump, on the issue more than him.

“We’ve already turned it around,” Biden insisted before citing one poll showing most Americans claiming they are “personally in good shape” economically.

BIDEN VOWS TO WITHHOLD WEAPONS FROM ISRAEL IF NETANYAHU GOES FORWARD WITH RAFAH INVASION

He then lashed out at other survey findings, “The polling data has been wrong all along. You guys do a poll at CNN, how many folks do you have to call to get one response? The idea that we’re in a situation where things are so bad… When I started this administration, people were saying there’s gonna be a collapse in the economy. We have the strongest economy in the world. Let me say that again, in the world.”

President Biden rejected polls showing disapproval over his handling of the economy during an interview with CNN. (Screenshot/CNN)

That attitude did not sit well with Axelrod.

“It is absolutely true. The world was plunged into an economic crisis and America was plunged into an economic crisis by the pandemic and we’ve come back faster than almost any other country and he’s right about that. But that’s not the way people are experiencing the economy,” Axelrod told CNN’s Erin Burnett.

“They’re experiencing it through the lens of the cost of living. And he is a man who’s built his career on empathy. Why not lead with the empathy?”

He continued, “And I think he’s making a terrible mistake… If he doesn’t win this race, it may not be Donald Trump that beats him. It may be his own pride.”

JON STEWART SAYS BIDEN ‘SHOULDN’T BE PRESIDENT’ DURING COMEDY SET: ‘WHY ARE WE ALLOWING THIS?’

Former Obama adviser David Axelrod torched President Biden’s defiant stance on the economy following his CNN interview. (Screenshot/CNN)

Fellow CNN panelist Scott Jennings agreed with Axelrod, calling Biden’s economic messaging “incredibly weak.”

“You correctly confronted him with the statistics and the polling and he whined about that. And then of course, we went wobbly on Israel,” Jennings told Burnett.

“I think he must be mortified when he looks at poll after poll that says the American people trust Donald Trump more on the economy, they trust him to be a strong leader, and they believe that the world is in chaos because he is weak and Trump is strong. It must be mortifying that he can’t find a way out of this cul de sac,” Jennings added.

BILL MAHER SAYS HE WON’T ‘GO F—ING NUTS AGAIN’ AND ‘GET ANXIOUS LIKE A MILLENIAL’ IF TRUMP WINS

Polls consistently show that Americans trust former President Trump more with the economy than President Biden. (BRENDAN SMIALOWSKI/AFP via Getty Images)

While the White House repeatedly touts strong economic stats, voters at home aren’t happy with Biden’s job performance. A Fox News poll in March showed only 38% of Americans approve Biden’s handling of the economy.

CLICK HERE TO GET THE FOX NEWS APP

Meanwhile, the RealClearPolitics average of polls continues to show Trump having the edge over Biden in the key swing states that are needed to win the election.

[ad_2]

Source link